The Liquidity of Bitcoin and the Factors That Affect It

Oct 21, 2024

As the dominant coin of the crypto market, Bitcoin not only sets trends but also directly impacts the global financial system. Its influence is so profound that it’s leading to a transformation of the classical economic foundations and principles underlying the world crypto-money practice.

BTC has a high demand and high liquidity, which often leads to a high degree of volatility of this coin in the context of its trading on different markets. But what is Bitcoin’s liquidity, and what factors affect it?

This article will explain the liquidity of the first coin on the crypto market, what factors affect it, and how it differs from the liquidity of other financial assets.

Key Takeaways:

- Bitcoin liquidity refers to how easily a trader or investor can buy or sell an asset without affecting its price.

- Although BTC and other cryptocurrencies trade 24/7 worldwide, they are generally less liquid than traditional asset classes.

- Converting Bitcoin to cash or conducting transactions can involve additional costs and potential time delays.

What is the Liquidity of Bitcoin?

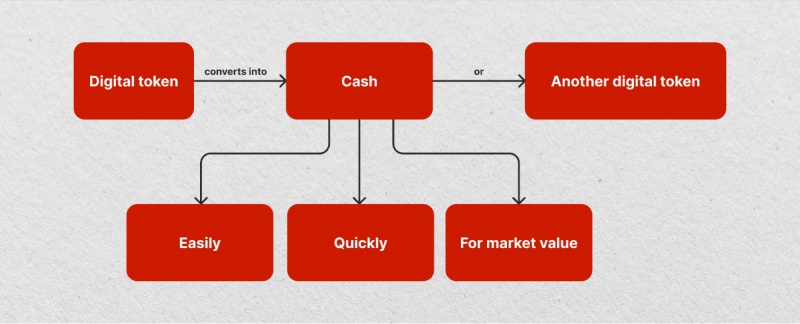

Bitcoin liquidity refers to the ease with which BTC can be bought or sold in the market without causing a significant impact on its price. Liquidity is a measure of how quickly and efficiently a trader can convert Bitcoin into cash or other assets, or vice versa, without experiencing major price fluctuations. A liquid market is characterized by high trading volumes and narrow bid-ask spreads, making transactions more efficient and less costly.

In the context of Bitcoin, liquidity is defined by the availability of buyers and sellers in the market. A highly liquid Bitcoin market has ample participants ready to trade at any given time, which allows large orders to be executed with minimal slippage — where the actual execution price differs from the intended price due to a lack of available liquidity.

Conversely, a less liquid market will have wider bid-ask spreads and may experience more volatile price movements due to the scarcity of participants and trading volume.

Key Factors Affecting BTC Liquidity

Bitcoin liquidity is influenced by several key factors that determine how easily and efficiently it can be traded without significantly impacting its price. Understanding these factors is crucial for traders, investors, and market participants, as they directly affect trading conditions, price stability, and market accessibility. Here are the main of them:

Trading Volume

The impact on liquidity is significant, as higher trading volumes typically result in increased liquidity. In markets with substantial trading volume, there are more buy and sell orders, making it easier to execute large trades without causing significant price movements.

It’s important to note that BTC is traded 24/7 globally, and as a result, crypto liquidity levels can fluctuate based on time zones, regional demand, and market activity. Generally, peak trading hours provide better liquidity due to increased trading activity, particularly when significant exchanges overlap.

Market Participants

The presence of institutional investors, such as hedge funds, financial firms, and professional traders, has a substantial impact on the liquidity of Bitcoin. Institutional investors typically engage in high-volume trading, which deepens the market and promotes price stability.

On the other hand, retail traders contribute to the liquidity of crypto, but their influence is more scattered and can be driven by market sentiment or speculative behavior. While retail investors can enhance liquidity, their participation may also lead to temporary increases in volatility.

Additionally, market makers play a crucial role in maintaining continuous liquidity by providing buy and sell prices. Their presence ensures that there are always counterparties available for trades, which helps minimize price gaps and enhances overall trading conditions.

Exchange Availability

When comparing centralized and decentralized exchanges, it’s important to note that CEXs such as Binance, Coinbase, and Kraken dominate Bitcoin trading due to their high liquidity and fast execution times. On the other hand, DEXs are gaining traction but often suffer from lower liquidity due to lower trading volumes.

It’s also worth considering the number of exchanges that list BTC. While a higher number of exchanges can provide more trading options and increase overall liquidity, it’s indispensable to remember that liquidity can become fragmented across these exchanges. This means a larger number of smaller exchanges may not always translate to deeper liquidity.

Regulation

The liquidity of Bitcoin can be significantly influenced by regulatory changes. When regulations are transparent and favorable, they attract both institutional and retail investors, thereby enhancing liquidity. Conversely, ambiguous or restrictive regulatory conditions can stifle market activity and reduce liquidity.

More investors are likely to trade Bitcoin in jurisdictions with supportive regulations, leading to a more robust market. In contrast, in countries where Bitcoin is prohibited or subject to severe restrictions, liquidity is constrained due to limited accessibility.

Market Sentiment

Market sentiment plays a crucial role in influencing liquidity. Positive developments, such as increased institutional adoption, technological advancements, or regulatory endorsements, can attract more market participants, thereby enhancing liquidity. On the other hand, negative occurrences, such as security breaches, regulatory interventions, or significant market downturns, can lead to a decrease in liquidity as traders exercise greater caution.

Additionally, the influence of social media platforms like Twitter, Reddit, and traditional news sources cannot be overlooked. These platforms can magnify market sentiment, resulting in sudden surges or declines in liquidity as traders respond to the latest news and updates.

Transaction Fees and Network Congestion

The impact of transaction fees on the Bitcoin network is significant. High fees can discourage frequent trading, leading to a reduction in liquidity. This is particularly evident during periods of network congestion when fees spike, causing traders to delay transactions or seek alternative assets to trade, further diminishing liquidity.

Furthermore, the efficiency and scalability of the BTC network directly influence liquidity. Ongoing efforts to enhance the network, such as implementing the Lightning Network, aim to reduce fees and transaction times. These improvements have the potential to significantly enhance liquidity by making trading faster and more cost-effective.

Security and Stability of the Network

The perceived security of the BTC network plays a crucial role in sustaining market liquidity. Any high-profile hacks, network vulnerabilities, or doubts about Bitcoin’s security can result in decreased participation in the market, ultimately impacting liquidity levels.

Furthermore, significant alterations to the BTC protocol, including hard forks, have the potential to cause a temporary reduction in liquidity as traders may prefer to adopt a cautious approach. This uncertainty during such periods can lead to decreased trading activity, as evidenced by the impact of events like the Bitcoin Cash fork.

Adoption and Institutional Infrastructure

As more institutions adopt Bitcoin, they bring additional liquidity into the market. Institutional involvement has increased with the introduction of BTC futures, exchange-traded funds (ETFs), and secure custody solutions, providing regulated avenues for institutional investors to engage with Bitcoin.

Furthermore, the expansion of derivative markets, including futures and options, has significantly boosted liquidity. These derivative instruments allow traders to hedge their positions, manage risk, and employ more diverse trading strategies, increasing market liquidity.

Global Macroeconomic Conditions

BTC is frequently viewed as a safeguard against traditional financial systems during economic instability or market downturns. This perception leads to a surge in demand for Bitcoin and subsequently enhances its liquidity.

Additionally, alterations in monetary policy, particularly in influential economies such as the U.S. or EU, can significantly impact Bitcoin’s liquidity. For instance, an accommodating monetary policy may bolster demand for Bitcoin as a reliable store of value, thereby boosting its liquidity.

Fast Fact:

BTC liquidity is a metric that reflects the general mood of crypto market participants and determines the balance of supply and demand for the coin.

Liquidity of Bitcoin in Comparison to Traditional Assets

BTC liquidity differs significantly from traditional asset classes like stocks, bonds, and fiat currencies. While Bitcoin’s liquidity has improved dramatically in recent years, largely due to increased adoption and the growth of cryptocurrency exchanges, it still faces challenges when compared to more established financial assets.

Below is a detailed explanation comparing the liquidity of Bitcoin with traditional assets:

Trading Volume and Market Depth

Bitcoin’s trading volume has grown significantly since its inception, with daily volumes often reaching billions of dollars. This makes it one of the most actively traded digital assets. However, liquidity can vary across different exchanges and regions, and during times of extreme volatility, BTC liquidity can drop as traders hesitate to execute large orders.

Although liquidity has improved, Bitcoin’s market depth — the volume of buy and sell orders at various price levels — can still be shallow compared to traditional assets. This makes it more prone to large price movements in response to significant trades.

Traditional assets like stocks, especially those of blue-chip companies, have significantly higher liquidity. Large stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, handle trillions of dollars in trading volume daily, ensuring deep liquidity and minimal price impact even for large orders.

Bonds, particularly government bonds like U.S. Treasuries, have some of the deepest markets in the world. High liquidity allows institutional investors to move large amounts of capital with minimal slippage or impact on the asset’s price.

The Forex market, where fiat currencies like the U.S. dollar, euro, and yen are traded, is the most liquid globally, with a daily trading volume of over $6 trillion. This market’s sheer size and depth make it far more liquid than BTC. Traders can execute huge orders with little price impact due to the constant availability of buyers and sellers.

Market Infrastructure

The infrastructure supporting BTC liquidity is relatively young. While major CEXs like Binance, Coinbase, and Kraken offer significant liquidity, liquidity can still be fragmented across different platforms. DEXs also provide trading opportunities but tend to have lower liquidity than their centralized counterparts.

Market fragmentation and limited integration between exchanges mean that a large trade on one platform could cause a temporary price spike or dip if liquidity is insufficient.

Traditional asset classes benefit from highly developed market infrastructure. Stock exchanges are well-established and regulated, with market makers ensuring liquidity for most listed securities. Clearing houses, custodians, and brokers contribute to smooth trading and deep liquidity.

For Forex, numerous large interbank liquidity providers ensure deep liquidity pools, while banks and financial institutions play a significant role in market stability.

Regulation and Institutional Participation

Bitcoin operates in a more loosely regulated environment than traditional assets, historically impacting its liquidity. While increasing regulatory clarity has encouraged more institutional participation, a lack of uniform global regulation still deters some large financial institutions from fully engaging in the Bitcoin market.

However, introducing Bitcoin futures, ETFs, and custodial solutions has helped improve liquidity by offering institutional investors more familiar and regulated products.

Stocks, bonds, and fiat currencies are subject to strict regulations worldwide, fostering trust and encouraging institutional investors’ participation. Regulated exchanges, such as the NYSE and the London Stock Exchange, ensure transparency, liquidity, and protection for market participants.

Institutional investors, including pension, hedge, and mutual funds, are active participants in traditional asset markets. Their involvement provides consistent liquidity and market depth.

Volatility and Its Impact on Liquidity

Bitcoin is known for its high volatility, which can significantly impact liquidity. During periods of extreme price fluctuations, liquidity can dry up as traders become reluctant to execute orders, fearing large slippage or unfavorable pricing. For example, during major market sell-offs or rallies, exchanges may experience wider bid-ask spreads and decreased liquidity as volatility spikes.

The relatively lower liquidity than traditional assets means that large trades can disproportionately affect Bitcoin’s price, leading to further volatility.

Traditional assets like blue-chip stocks or government bonds tend to be less volatile and enjoy more stable liquidity, even during market stress. While liquidity can be affected during financial crises, markets like Forex or highly traded stocks still maintain sufficient depth to handle large trades with minimal price disruption.

Fiat currencies, especially major ones like the U.S. dollar or euro, have very low volatility compared to Bitcoin, contributing to their stable liquidity.

Market Maturity and Accessibility

Bitcoin is still a nascent market, having been around for over a decade. As a result, its liquidity can fluctuate significantly depending on market conditions, regulatory changes, and market sentiment.

However, Bitcoin’s 24/7 trading availability and accessibility across global markets make it unique compared to traditional assets, typically bound by market hours.

Traditional asset markets have existed for centuries, with well-established systems ensuring robust liquidity. These markets benefit from a vast network of market participants, retail traders to institutional investors, and decades of regulatory frameworks that foster trust.

Accessibility is high, but traditional assets typically have limited trading hours (e.g., stock markets operate on weekdays and within specific hours), unlike Bitcoin’s round-the-clock trading.

Improving Bitcoin Liquidity: Key Factors

Bitcoin liquidity has grown significantly over the years, but there are still areas where it can improve. Liquidity is vital in reducing volatility, improving price stability, and allowing traders to execute large orders with minimal price impact. Several strategies, including increased institutional participation, exchange innovation, and enhanced market infrastructure, can help boost Bitcoin’s liquidity.

Institutional Participation

Large financial institutions, such as hedge funds and pension funds, can boost Bitcoin liquidity by increasing trading volumes. Clear regulations, Bitcoin financial products like ETFs and futures, and secure custodial services can attract more institutional investors, stabilizing the market and reducing volatility.

Exchange Innovation

Cryptocurrency exchanges play a crucial role in liquidity. Liquidity aggregation, advanced trading platforms, and cross-exchange networks improve market depth and ease large trades without significant price impacts. Innovations in the DeFi sector and DEXs further enhance liquidity by creating additional liquidity channels.

Improved Infrastructure

Scalability solutions like the Lightning Network help make Bitcoin transactions faster and cheaper, increasing trading activity and liquidity. Institutional-grade infrastructure with low-latency execution platforms and risk management tools also attracts more prominent players, enhancing liquidity.

Stablecoins

Like USDT and USDC, they provide a stable bridge between Bitcoin and fiat currencies. They help traders move quickly between assets, reduce volatility, and expand market participation, especially in regions with limited access to traditional banking services.

Derivative Markets

Bitcoin derivatives such as futures, options, and perpetual swaps enhance liquidity by allowing traders to hedge risks, speculate on price movements, and contribute to efficient price discovery. This attracts both institutional and speculative traders, increasing market liquidity.

Conclusion

The liquidity of Bitcoin is essential for its growth, supporting efficient trading, stable prices, and reduced volatility. Key factors influencing liquidity include institutional participation, exchange innovations, improved infrastructure, stablecoins, and the growth of derivative markets.

Boosting liquidity requires continued progress in these areas, such as clearer regulations, advanced trading platforms, scalability solutions, and more financial products for hedging and speculation. As Bitcoin evolves, enhanced liquidity will increase market stability, driving broader adoption in the global financial system.

FAQs:

What is Bitcoin liquidity?

Bitcoin liquidity refers to how easily Bitcoin can be bought or sold without significantly affecting its price.

Why is liquidity important for Bitcoin?

Liquidity is crucial for the smooth operation of any market, including Bitcoin. It enhances price stability, reduces volatility, and allows for more efficient trading.

How does Bitcoin liquidity compare to traditional assets?

Bitcoin generally has lower liquidity due to its relatively smaller market size and higher volatility than traditional assets like stocks or fiat currencies.

Why does Bitcoin liquidity vary across exchanges?

Bitcoin liquidity can vary between exchanges due to differences in trading volumes, user bases, and liquidity sources.