The Power Of Liquidity For Crypto Exchanges

June 28, 2023

As of today, nearly 600 cryptocurrency exchanges stand ready, inviting investors to trade thousands of different cryptocurrencies and gain financial profits.

While these exchanges differ in many ways, from the types of assets they offer to their pricing structures, they all rely on one crucial element to run smoothly – it is liquidity. Just as the heart keeps the body alive by pumping blood, liquidity keeps the crypto exchanges up and running.

But what does liquidity really mean for the crypto exchange, and how do they get it?

Key Takeaways

- Crypto exchanges are platforms for trading cryptocurrencies, and liquidity ensures their smooth operation.

- Liquidity refers to the ease of buying or selling assets without impacting prices significantly.

- Liquidity is crucial for crypto exchanges, enabling fair prices, market stability, quick transactions, and accurate analysis.

- Top crypto liquidity providers like B2Broker, Cumberland, and Empirica enhance exchange liquidity and efficiency.

Definition Of Crypto Exchanges

If you’ve ever traded stocks, you’re probably familiar with stock exchanges. Crypto exchanges work similarly but are all about digital assets or cryptocurrencies. These platforms serve as bridges, connecting buyers and sellers in the digital world, facilitating transactions, and making trading possible. Just as money changes hands in a bustling market, cryptos change hands on these digital exchanges, allowing their prices to be set and stable.

Types of Crypto Exchanges

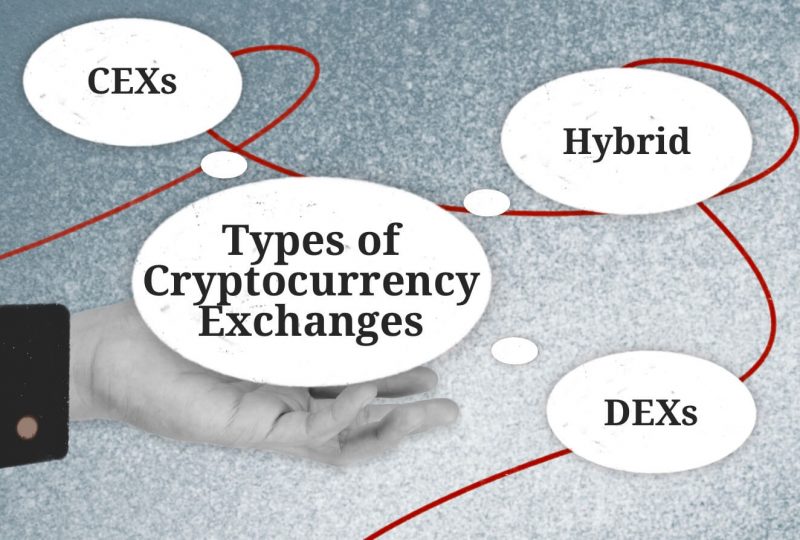

There are primarily three types of cryptocurrency exchanges, each with its unique way of operating.

Centralized Exchanges (CEXs)

These are the most common types of crypto exchanges. Profit-oriented companies run centralized exchanges that derive revenue from their platform’s fees. Users on these platforms cannot access the private keys of their exchange account’s wallets, meaning that while users can trade on these platforms, they do not have complete control of their assets. Examples of centralized exchanges include Binance and Coinbase.

Decentralized Exchanges (DEXs)

Unlike centralized exchanges, decentralized platforms are not controlled by any single entity. They run on blockchain and use smart contracts to automate the trading process, allowing users to maintain control over their assets. These platforms offer a higher degree of privacy than their centralized counterparts but can also be more challenging to use. Examples of decentralized exchanges include Uniswap and SushiSwap.

Hybrid Exchanges

As the name suggests, hybrid exchanges combine elements of both centralized and decentralized exchanges. They aim to provide the security of centralized exchanges with the privacy and control benefits of decentralized exchanges. An example of a hybrid exchange is Poloniex, which combines traditional centralized systems’ reliability and speed with decentralized networks’ transparency.

The Concept Of Liquidity In Crypto

The financial world is teeming with slang, but if there’s one term that you really need to get your head around, it’s liquidity. In simple terms, liquidity refers to how quickly and easily an asset can be bought or sold in the market without impacting its price. The quicker and easier the sale, the more liquid the asset is.

In the crypto world, liquidity plays a similar role. It’s about how fast and straightforward a cryptocurrency can be bought or sold at a stable price. High liquidity in a crypto exchange means that transactions can happen rapidly, and large volumes of crypto can be bought or sold without drastically affecting the price.

What Is A Crypto Liquidity Pool?

In traditional markets, liquidity is usually provided by market makers. However, crypto has its own unique solution – liquidity pools. Liquidity pools are essentially smart contracts that contain funds. In a liquidity pool, there are two tokens, and each transaction must involve an exchange between these two tokens.

Think of a liquidity pool as a big pot of money used to facilitate trades. The users who put their money into the pool are known as liquidity providers. For providing this service, they receive a fee. This structure helps create a more stable and predictable trading environment.

For instance, in a decentralized exchange like Uniswap, if you want to swap your Ethereum for DAI, you don’t need to find someone who wants to trade DAI for Ethereum. Instead, you just interact with the liquidity pool.

How Is Liquidity Measured In Crypto?

The concept of liquidity is quite straightforward, but how do we measure it? In crypto, there are a few different ways to measure the liquidity of an asset or an exchange.

Trading Volume

This is perhaps the most straightforward measure of liquidity. High trading volumes suggest significant assets are being bought and sold, indicating a high degree of liquidity.

Market Size

The size of the market is another essential factor when considering liquidity. A larger market often implies greater liquidity because more potential buyers and sellers exist. A cryptocurrency with a large market capitalization will typically be more liquid than a small market cap.

Order Book Depth

This is the tally of buy and sell orders that traders have placed but are not yet fulfilled. A deep order book (one with many orders) implies high liquidity.

Bid-Ask Spread

This is the gap between the highest price a buyer is prepared to pay for an asset and the lowest price a seller is willing to accept. A narrow bid-ask spread usually suggests high liquidity because buyers and sellers closely agree on the price.

Importance Of Liquidity For Crypto Exchange Firms

Liquidity holds significant importance for crypto exchange firms, especially during financial crises. Therefore, liquidity providers are crucial in stabilizing markets when they face stress or uncertainty. Their liquidity provision, whether through injecting capital or investing in digital assets, acts as a safeguard against the complete breakdown of the market. By preventing excessive price drops, liquidity providers ensure market stability and facilitate the return to normalcy.

Here are several advantages that liquidity providers bring to crypto exchanges.

Better and Fair Prices

High liquidity levels ensure more consistent and fair pricing in the marketplace. Large transactions won’t have a disproportionate impact on the overall market prices when there’s a substantial number of buyers and sellers. For instance, in a highly liquid market, a $1 million trade on Bitcoin won’t cause its price to plummet or skyrocket. Instead, the market absorbs the transaction with minimal impact on the price, providing better and fairer prices for everyone involved.

Market Stability

Greater liquidity leads to more stable markets. The market becomes resilient against drastic price swings with plenty of active participants. For example, a highly liquid exchange won’t experience a 20% price drop due to a single large sell order. The multitude of buyers and sellers helps to cushion such moves, contributing to overall market stability.

Quick Transaction Time

In a liquid market, orders can be filled almost instantly. This is vital in the volatile crypto world, where prices can shift rapidly within seconds. A trader in a highly liquid market could sell thousands of Ethereum tokens in mere moments, ensuring they capitalize on the current market price.

More Accuracy for Technical Analysis

A liquid market provides a more accurate reflection of market sentiment, which, in turn, enhances the reliability of the technical analysis. For example, a technical analyst looking at the price pattern of a highly liquid crypto like Bitcoin can be more confident that the patterns they see represent a consensus view among a broad base of traders.

Attractiveness to New Traders

Highly liquid exchanges can attract more participants, especially new traders who may feel more secure entering a market where they can readily execute trades. If an exchange can boast a daily trading volume of $2 billion, it sends a solid signal to new traders about its vibrant activity level and liquidity.

Reduced Slippage

Slippage is a trader’s nightmare, occurring when a trade is executed at a different price than expected. In a highly liquid market, such as an exchange with a daily trading volume of billions of dollars, slippage is less likely to occur, helping traders execute trades at their desired prices.

Improved Market Efficiency

In a liquid market, price adjustments to new information happen swiftly. For instance, if a company announces a new blockchain partnership, the associated token’s price on a liquid market will adjust quickly to this news, reflecting the market’s consensus on its impact.

Increased Investor Confidence

A liquid market reassures investors, knowing they can easily enter and exit positions. This confidence, in turn, draws more participants, creating a positive cycle of increasing liquidity. For example, an investor looking to put $500,000 into Bitcoin would likely feel more comfortable doing so on an exchange with high liquidity.

Mitigation of Market Manipulation

In highly liquid markets, it becomes much harder for any single entity to manipulate prices, making the market safer for all participants. For instance, attempting to artificially inflate the price of a coin in a market with a trading volume of $5 billion daily would be an exceedingly difficult and costly endeavor.

Promoted Innovation and Competition

Lastly, high liquidity can spur innovation and competition among exchanges. An exchange in a highly liquid environment will continuously seek to improve its platform, features, and services to attract traders. The desire to capture a piece of the liquidity pie drives innovation, leading to better trading platforms and services.

Who Are Crypto Liquidity Providers?

Crypto liquidity providers are crucial in addressing the liquidity challenges cryptocurrency exchanges face. These providers maintain a stock of crypto assets in their own accounts and assist brokers and other organizations in fulfilling client orders. Their primary objective is to ensure the availability of sufficient liquidity on the exchange. An exchange’s lack of liquidity can lead to a liquidity crisis, hindering smooth trading operations.

Liquidity providers offer their services to both buyers and sellers, effectively acting as intermediaries between the broker and the market. They are responsible for maintaining the liquidity of assets, ensuring enough supply to meet demand.

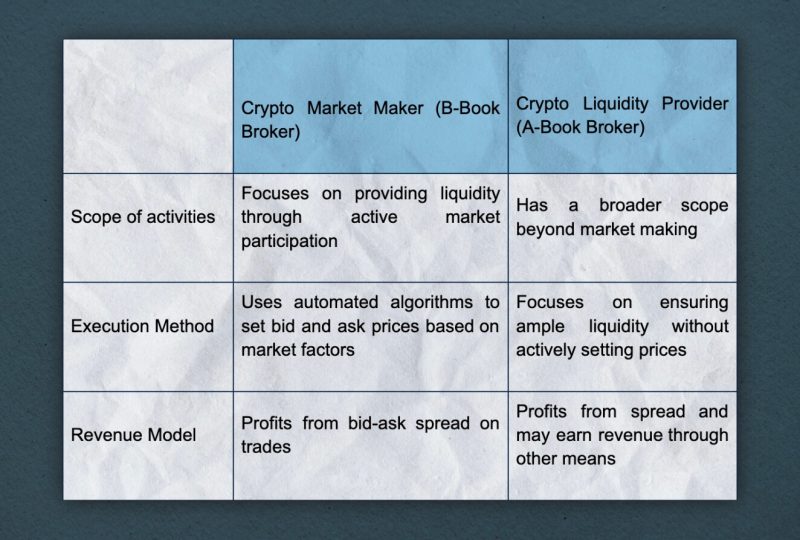

Although liquidity providers are often referred to as market makers, it’s important to note that they differ from the traditional concept of market makers. Market makers typically include banks, funds, and other institutions actively participating in “making the market.”

On the other hand, liquidity providers facilitate the connection between the broker and the market maker, sometimes utilizing automated market maker technology.

The effectiveness of liquidity providers significantly influences the functioning of exchanges. With the increasing popularity of crypto trading and the growing number of crypto exchanges, liquidity providers have become an indispensable element for the smooth operation of these platforms. Liquidity in the crypto market arises from a high level of trading activity, indicated by substantial volumes of buy and sell orders and pending orders in the order book.

To ensure compliance with international standards, local regulations, and other requirements, most crypto liquidity providers are subject to regulatory oversight by state authorities.

How to Choose a Crypto Liquidity Provider in 2023

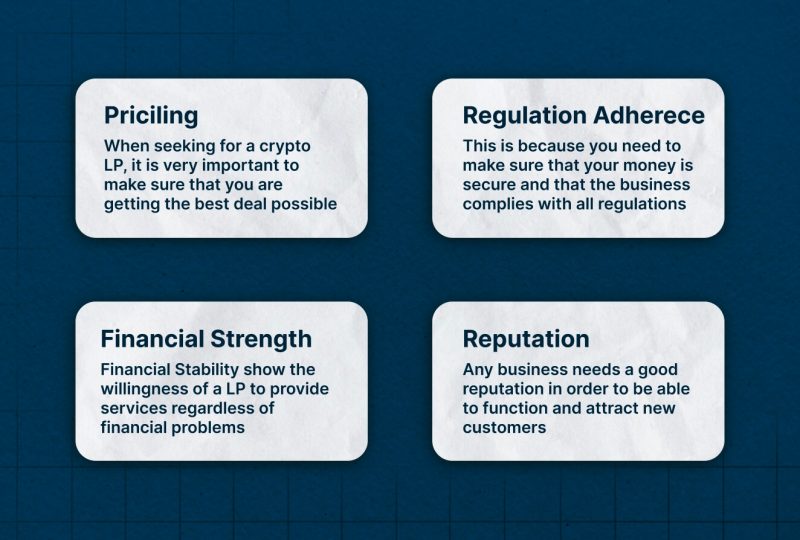

Selecting the right crypto liquidity provider in 2023 requires carefully evaluating the following factors:

Reputation and Track Record

Look for established providers with a strong reputation for reliability, security, and integrity in the crypto industry. Check reviews, testimonials, and references from other users or businesses that have used their services to assess their track records.

Regulatory Compliance

Ensure the liquidity provider complies with relevant regulations and holds the necessary licenses and certifications. Regulatory compliance helps mitigate risks and ensures the provider operates within the legal framework.

The Depth and Asset Coverage

A good liquidity provider should offer access to many cryptocurrencies, including major tokens and popular altcoins. Sufficient depth ensures enough trading volume and tight bid-ask spreads for smooth transactions.

Costs and Fee Structure

Compare the spreads, commissions, and transaction fees charged by different providers to ensure they align with your requirements. Look for transparent pricing models and avoid providers with excessive or hidden fees.

Scalability and Flexibility

Consider your future growth plans and assess whether the liquidity provider can scale their services to accommodate your evolving needs. Look for providers that can handle increased trading volumes and adapt to changing market conditions.

Top Cryptocurrency Liquidity Provider Firms

Three notable companies stand out when considering the top crypto liquidity providers for crypto firms: B2Broker, Cumberland, and Empirica.

1. B2Broker

Founded in 2014, B2Broker is a pioneering crypto liquidity service available in over 40 countries, catering to more than 500 clients. The company has gained recognition for its award-winning tactics and strategies that have helped clients achieve remarkable milestones.

B2Broker creates a liquid market through various distribution systems, granting investors and brokers access to deep institutional liquidity pools. The company offers settlement options in USD, EUR, and GBP, as well as significant cryptocurrencies and stablecoins. Notably, B2Broker holds licenses from esteemed financial regulatory bodies, including FCA AEMI, CySec, and FSA.

2. Cumberland

Established in 2014, Cumberland operates as a subsidiary of DRW, a well-established diversified trading firm based in Chicago with over 30 years of experience. This global cryptocurrency liquidity provider delivers round-the-clock responsiveness to ensure a world-class trading experience.

Cumberland offers multiple trading options, including traditional voice markets and their electronic trading solution, which provides real-time, two-way pricing. They specialize in spot cryptocurrency liquidity services, enabling trading without pre-funding and utilizing time-weighted average price (TWAP) execution methods.

3. Empirica

Originally established in 2010 as a trading software company, Empirica has evolved into a reputable crypto liquidity provider using its proprietary software. With a significant market presence, Empirica is a market maker responsible for executing 20-30% of the daily volume on designated exchanges. The company boasts a 40-60% turnover across over 50 tokens on multiple exchanges.

Empirica offers comprehensive solutions, enabling token projects to become liquid within 6-12 months and facilitating listings on tier 1 exchanges. With over 12 years of experience, Empirica has demonstrated expertise in addressing common challenges token issuers face.

Final Takeaway

Liquidity plays a crucial role in cryptocurrency trading, to the advantage of both exchanges and market participants. Better pricing, more stable markets, quicker transactions, and more precise technical analysis are benefits of a high liquidity trading environment.

Notably, market liquidity can be affected by various external factors, making liquidity providers’ services indispensable. These service providers ensure that assets may move freely within the market without major price swings and help maintain a healthy market environment while connecting buyers and sellers.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

Why is a liquidity pool important for crypto?

A liquidity pool is crucial in crypto because it consolidates funds from multiple users, creating a deep liquidity pool. It ensures ample assets are available for trading, enhancing market efficiency and reducing price volatility.

What does liquidity mean in a crypto exchange?

Liquidity in a crypto exchange refers to the ease of buying or selling assets without significant price impact. It demonstrates the presence of active buyers and sellers, enabling smooth and efficient trading.

Is high liquidity good in crypto?

Yes, high liquidity is beneficial in crypto. It offers advantages like better pricing, increased market stability, faster transactions, and improved technical analysis accuracy. High liquidity fosters a favorable trading environment.

Why is low liquidity bad in crypto?

Low liquidity can be problematic in crypto as it leads to wider bid-ask spreads, making trading more expensive. It also increases the risk of price manipulation and slippage, where trades occur at different prices than expected.

What affects crypto liquidity?

Market demand, trading volume, regulatory changes, news events, and market sentiment can influence crypto liquidity. The characteristics of a cryptocurrency, like market capitalization and available trading pairs, also impact liquidity levels.