What Are Ethereum Futures ETFs? How To Invest in These Assets?

Jun 24, 2024

The cryptocurrency industry has reached a crucial turning point. The recent approval of spot Bitcoin ETFs (Exchange Traded Funds) in January 2024 has already brought in a staggering $12 billion net inflows. And now, the U.S. Securities and Exchange Commission (SEC) has given the green light for Ether ETFs creation. Many analysts believe this represents a significant shift in regulatory attitudes towards crypto investing and signals a new era for the entire cryptocurrency market.

Currently, spot Ether ETFs are not yet available for investors, as the issuers must first submit their S-1 registration statements. However, in the meantime, traders can invest in ETH futures ETFs that are currently on the market. In this article, we’ll delve into what exactly an Ethereum futures ETF is and how they differ from the spot ones.

Key Takeaways

- A significant value and great attention to Ethereum have led to the development of instruments like ETH futures contracts and Ether futures ETFs.

- Ether futures ETFs provide investors with a regulated, secure, and easy way to gain exposure to Ethereum price movements.

- Despite the advantages, these ETFs may not always track Ethereum’s spot price perfectly and are subject to high market volatility and liquidity concerns.

- Spot ETFs present an alternative investment option with direct exposure to Ether.

Ethereum and Its Ecosystem

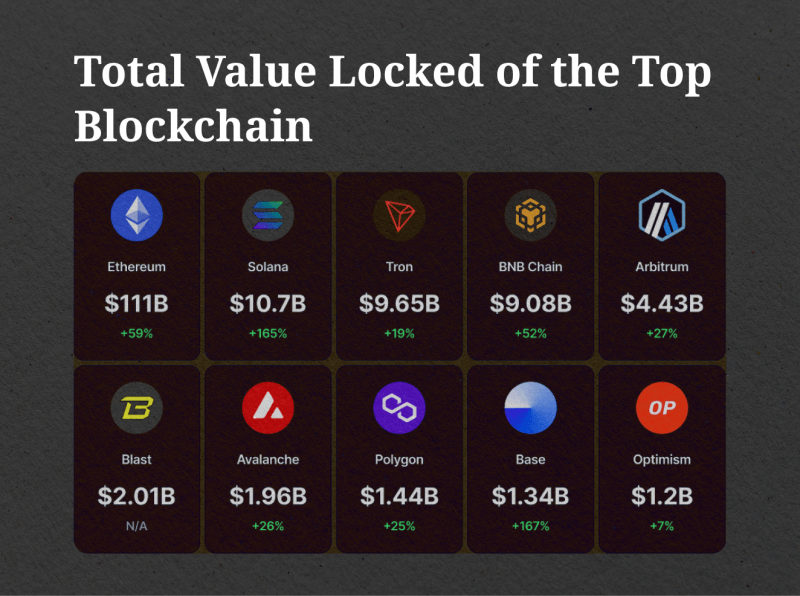

Ethereum, often referred to as the “world computer”, is a decentralized, open-source blockchain platform that allows for the creation of smart contracts and decentralized applications (dApps).

Launched in 2015 by Vitalik Buterin, Ethereum was designed to be a programmable blockchain – meaning developers could build on top of it instead of just using it as a digital currency like Bitcoin. This has resulted in a diverse ecosystem of projects, including decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and more.

What Is Ether Crypto?

The native cryptocurrency of the Ethereum network is Ether (ETH). It serves multiple functions within the ecosystem – facilitating transactions, paying for computational services, and incentivizing network participants through proof-of-stake (PoS) consensus.

Today, ETH has become one of the most valuable cryptocurrencies in the market, just the second after Bitcoin, with a capitalization of over $450 billion and a price of $3,770 as of June 2024.

Its value has experienced significant volatility throughout its history, reaching an all-time high of over $4,100 in November 2021 before dropping to around $1,100 in July 2022. This volatility makes it an attractive asset for traders and investors to speculate on and potentially capitalize on its price movements.

Ether Futures Contracts

Alongside the growth of the Ethereum network, the demand for financial instruments that allow investors to benefit from Ether’s price movements has also increased. As a result, Ether futures contracts have been developed.

Future contracts, or simply “futures”, are agreements to buy or sell an underlying asset – in this case, Ether – at a predetermined price (also known as the strike price) on a specific date in the future. These contracts can be traded on regulated exchanges and are settled in cash upon expiration.

Investing in futures allows traders to speculate on the future price of an asset without actually owning it. This characteristic makes futures contracts particularly appealing for those who are interested in short-term, high-risk strategies and those looking to hedge their positions against price volatility.

Besides this, futures provide several other advantages over spot trading (trading the underlying asset directly), including:

- trading with leverage, which can amplify profits (but also losses);

- short trading, i.e., betting on the price to fall.

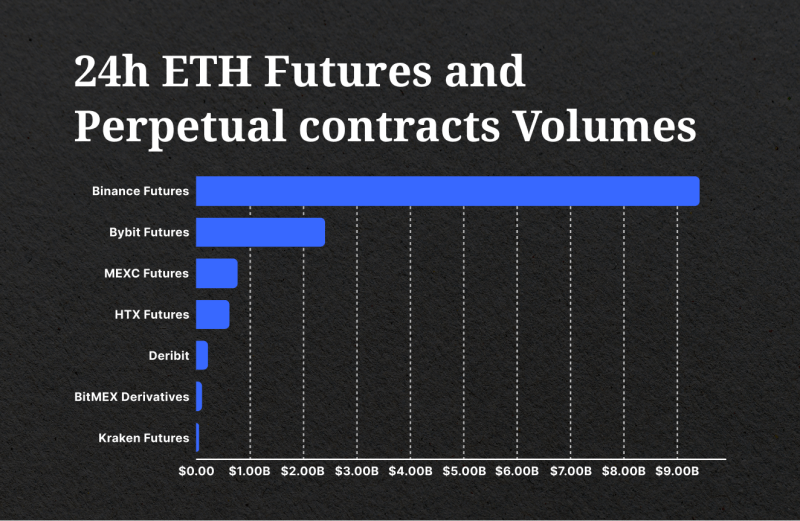

You can trade ETH futures on every major cryptocurrency exchange and many traditional financial platforms. Some of the most popular exchanges offering futures contracts include Binance, OKX, ByBit, KuCoin, CME Group, and others.

Many exchanges offer perpetual contracts for Ethereum. These are similar to regular futures in terms of trading mechanisms but differ in that they have no expiration date.

Fast Fact

The daily trading volume of cryptocurrency futures on Binance and other major platforms typically exceeds that of spot trading by several times.

Introducing Ethereum Futures ETFs

Now, let’s talk about the main topic of this article – what is Ethereum ETF?

ETFs, or exchange-traded funds, are investment vehicles that track the performance of a particular asset or group of assets. They are traded on stock exchanges, providing investors with a simple and convenient way to diversify their portfolios.

An Ether ETF holds a portfolio of Ether futures contracts. It provides investors with exposure to Ether’s price movements without directly owning and managing cryptocurrency wallets and exchanges. These products are structured similarly to traditional ETFs, with shares traded on exchanges and managed by professional fund managers.

Some of the most popular ETH futures ETF funds include:

- VanEck Ethereum Strategy ETF (EFUT)

- ProShares Ether Strategy ETF (EETH)

- Bitwise Ethereum Strategy ETF (AETH)

- VanEck Ethereum Strategy ETF (EFUT)

- ARK 21Shares Active Ethereum Futures Strategy ETF (ARKZ)

Key Benefits of Ether Futures ETFs

Ether futures ETFs offer several distinct advantages that make them appealing to retail investors:

Compliance with Regulations

Unlike direct investments in cryptocurrencies through crypto exchanges, Ether ETF funds are subject to the oversight and regulations of traditional financial markets by organizations such as the SEC. Investors can have peace of mind knowing that they are investing in a regulated and secure environment.

Ease of Access

Investing in ETH futures ETFs is as simple as buying any other stock or ETF through a traditional brokerage account. Those not familiar with the complexities of cryptocurrency wallets and exchanges can easily gain exposure to Ether’s price movements without worrying about technicalities. Moreover, ETFs allow investors to easily diversify their portfolios by investing in a basket of assets.

Cost-efficiency

Purchasing and managing Ethereum futures contracts can be overwhelming for many investors. Ether ETFs eliminate these complexities, as professional fund managers handle all the responsibilities. This passive management style reduces operational costs, making it a relatively affordable investment option.

Potential Drawbacks and Risks of Ether Futures ETFs

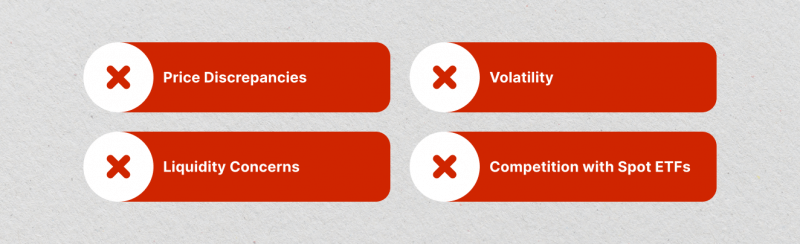

While Ether futures ETFs provide a more regulated and accessible way to invest in the Ethereum ecosystem, they also come with their own set of risks and drawbacks:

Price Discrepancies

Ether futures ETFs may not always perfectly track Ether’s spot price, as they rely on the performance of the underlying futures contracts, which can be affected by factors such as contango (a situation where futures prices exceed the spot price).

Volatility

The crypto market, including Ether, is known for its high volatility. This volatility is inherently reflected in the performance of ETH ETFs, making them riskier investments compared to traditional asset classes. These instruments may not be suitable for risk-averse investors and long-term holders.

Liquidity Concerns

Ether futures ETFs may have lower trading volumes than their Bitcoin counterparts, potentially leading to challenges in buying or selling shares at desired prices, especially in large quantities. Most ETH futures ETF funds lack liquidity due to the relatively young Ethereum market.

Competition with Spot ETFs

Given that Ethereum spot ETFs have recently gained approval, futures ETFs could prove less attractive to investors. Spot ETFs would allow for direct ownership of Ether, potentially making them a more desirable option for those looking to invest in the underlying asset.

How to Invest in Ether Futures ETFs

If you’re interested in gaining exposure to the Ethereum ecosystem through ETFs, here’s a step-by-step guide to help you get started:

1. Open a Brokerage Account

The first step is to open a brokerage account with a financial institution allowing ETFs trading. Popular options include Fidelity, Robinhood, Vanguard, and Charles Schwab. Note that KYC verification is required to trade with any brokerage firm.

2. Research and Select the Necessary Asset

Investigate the available ETH ETFs among the brokerage’s offerings. Review the fund’s prospectus, holdings, fees, and risk profile to determine the best fit for your investment goals and risk tolerance.

3. Place Your Order

Once you’ve selected the ETF that you want to invest in, place a buy order through your brokerage account, just as you would with any other instrument. Depending on your investment strategy, you can choose between a market order or a limit order.

4. Monitor and Manage Your Investment

Monitor your investment’s performance regularly. The fund’s share price may not always perfectly track the spot price of Ether due to factors like contango and the fund’s management fees. Adjust your position as needed based on your investment objectives and market conditions.

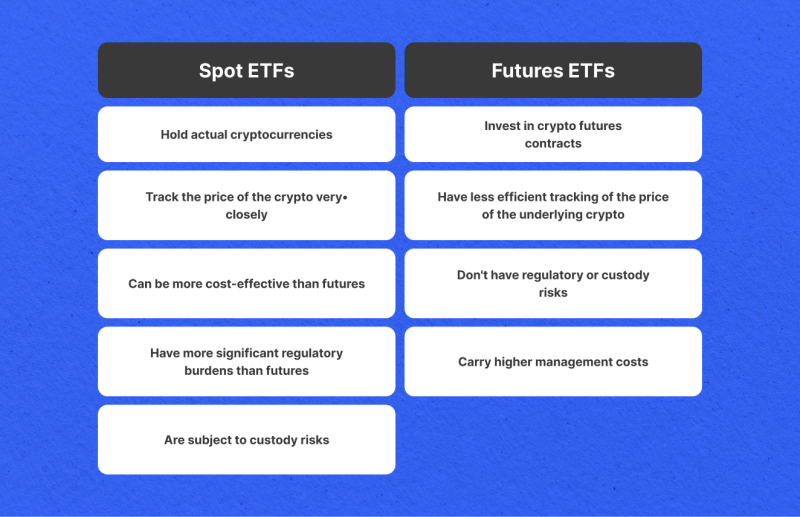

Futures ETFs vs. Spot ETFs

While futures ETFs provide investors with regulated exposure to Ethereum, another option for gaining direct exposure to Ether is through spot ETFs. These funds hold the underlying Ether tokens and track the cryptocurrency’s spot price, offering a more direct and potentially lower-cost way to invest in Ether.

However, spot ETFs also come with their own set of risks. Due to the direct ownership of tokens, they are subject to custody risks – the potential for theft or loss due to hacking or technical failures. This risk is mitigated in futures ETFs as they trade futures contracts instead of holding the actual cryptocurrency.

Additionally, spot ETFs face more significant regulatory hurdles as they require approval from regulators. Futures funds, on the other hand, do not have to go through such stringent regulations. However, they do carry higher management fees due to the active trading of futures contracts.

The Regulatory Status of ETFs

The regulatory environment surrounding cryptocurrencies and related financial products, including Ether futures ETFs, is an important consideration. In the United States, the SEC and the Commodity Futures Trading Commission (CFTC) share oversight responsibilities for these products.

The SEC has authority over registering and approving ETFs, while the CFTC regulates the derivatives markets. The regulatory landscape has been evolving, with the SEC approving the first Bitcoin futures ETFs in 2021 and the first spot Bitcoin ETFs in 2024.

However, the regulatory environment remains fluid, and any changes in laws or regulations could have significant implications for Ether futures ETFs and their investors. Staying informed about the latest regulatory developments and their potential impact on these investment products is crucial for making informed investment decisions.

The Tax Implications of Ether Futures ETFs

The tax treatment of Ether futures ETFs is a complex and crucial aspect for investors, as it can significantly affect their overall returns.

One notable advantage of certain Ether futures ETFs, such as those structured as C-Corporations (C-Corps), is their potential for enhanced tax efficiency. Unlike traditional regulated investment companies (RICs), C-Corps are not subject to pass-through taxation rules. This allows them to carry forward losses and potentially offset future gains.

Moreover, payouts from C-Corp Ether futures ETFs may be taxed at the lower long-term capital gains rate rather than the higher ordinary income tax rate, further enhancing after-tax returns for long-term investors. Note that the VanEck Ethereum Strategy ETF (EFUT) is the only Ethereum futures ETF structured as a C-Corp as of today.

Given these nuances, consult with a tax professional to understand the specific tax implications of their Ether futures ETF investments. Tax treatment can vary based on the fund’s structure, your individual circumstances, and any changes in tax laws.

The Future of Ether Futures ETFs

As the Ethereum network continues to expand, Ether futures ETFs are poised to play an increasingly pivotal role in the investment landscape. These financial instruments provide a regulated and accessible means for investors to participate in the global adoption of Ethereum, potentially reaping the rewards from the ongoing adoption and development of decentralized applications, DeFi, and other Ethereum-based innovations.

Nevertheless, the future of Ether futures ETFs is not without its uncertainties. The approval of spot Ether ETFs, which offer more direct exposure to the underlying cryptocurrency, could pose challenges to the long-term viability of its futures counterparts.

Final Thoughts

Ether futures ETFs afford a regulated and accessible avenue for investors to engage with the second popular blockchain and its native cryptocurrency, Ether. These investment products offer several advantages, including regulatory compliance and ease of access, while also presenting distinct risks that investors must carefully evaluate.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Investing in cryptocurrencies, including Ether, involves a substantial risk of loss and is not suitable for all investors.

FAQ

What is the best ETF for Ethereum?

The best ETF for Ethereum would depend on individual investment goals and risk tolerance. Researching different ETFs and comparing their features, holdings, fees, and risk profiles is recommended to determine the best fit for your specific needs. Some popular options include the VanEck Ethereum Strategy ETF (EFUT) and the ProShares Ether Strategy ETF (EETH).

How do futures ETFs and spot ETFs differ?

A futures ETF trades in futures contracts, while a spot ETF holds the underlying asset. Since spot ETFs hold actual assets, they are subject to custody risks. On the other hand, futures ETFs trade in regulated markets and are not backed by the underlying asset, reducing custody risks but potentially carrying higher management fees.

Are Ethereum futures ETFs worth investing in?

Ethereum futures ETFs offer potential benefits such as diversification, low-risk investments, and the ability to profit in a downward market. However, these ETFs have generated less interest than their Bitcoin counterparts. Also, before investing in any Ethereum futures ETF, make sure you do your research to avoid overconcentration and potential losses.