What Are Liquidity Pools? Definition, Types, and Benefits

Jul 23, 2024

Liquidity is a well-defined term in the financial world, and many describe it as the backbone of trading and organizations’ economic health. In traditional markets, financial liquidity refers to the ease at which assets can be converted into cash, which is an excellent indicator of financial markets’ efficiency.

In decentralized markets, the term carries the same meaning but works differently, highlighting the notion of decentralization: shared control and permissionless.

Meet liquidity pools, the cornerstone of decentralized exchanges and DeFi ecosystems. Crypto liquidity pools facilitate the faster acquisition of virtual coins and tokens and allow liquidity providers (LPs) to earn using a sophisticated revenue model. Let’s dive deeper into this concept and explain how you can use it to improve the operations of your exchange.

Key Takeaways

- Liquidity pools are reserves for digital assets and cryptocurrencies, providing liquidity to crypto exchanges.

- Participants who deposit their funds in DeFi pools receive interest or a proportion of the collected fees.

- Pools can be single- or multi-asset, depending on the type of coins deposited, whether one currency or crypto pairs.

- Liquidity pools allow anyone to invest their crypto holdings to generate passive returns, minimizing the entry barriers, unlike centralized liquidity models.

Understanding Liquidity Pools

Liquidity pools are collections of cryptocurrencies and tokens locked in a smart contract that is triggered when certain conditions are met. These pools supply crypto exchange platforms with liquidity to offer to trade and swap across the virtual coins and tokens existing within the pool.

Decentralized exchanges integrate various DeFi pools to increase the liquidity of their platforms and ensure the timely execution of trade requests.

Security is vital in these virtual reserves, as any breach or hack can dry out investors’ funds and damage the liquidity provision to connected platforms.

These pools emphasize DeFi’s shared control characteristic, as anyone can become a liquidity provider by locking in a certain amount and type of cryptocurrencies in return for an LP token. Moreover, it highlights the permissionless requirements as smart contracts are self-executing protocols deployed once particular criteria are met.

They are also called automated market makers, referring to the automatic function of smart contracts.

Examples of a Liquidity Pool

Uniswap is a popular liquidity pool that maintains the balance between two ERC-20 coins or tokens. Each Uniswap smart contract contains two tokens minted on the ETH network supplied by public users.

For example, if a user wants to exchange ETH for USDC in a DEX, the platform must scan the liquidity pools it is integrated with and locate the pairs in an ETH//USDC pool to execute the exchange request.

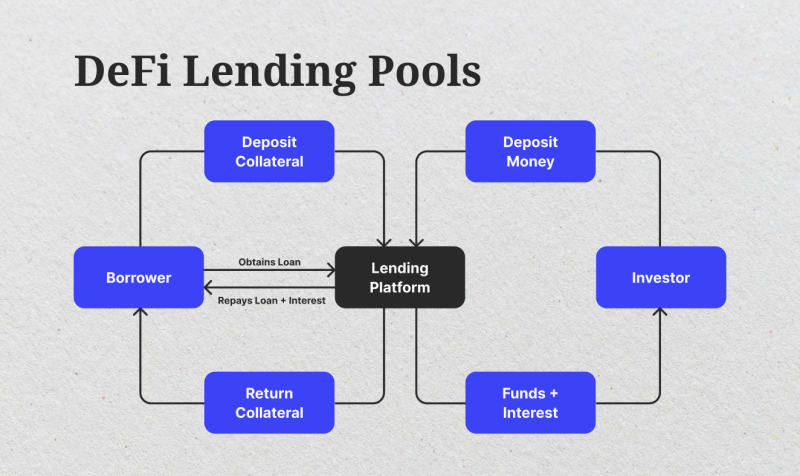

Aave is another liquidity pool that matches lenders with borrowers. Lenders are LPs who add their cryptocurrencies to pools for interest rates, while borrowers get loans financed by LPs and pay interest.

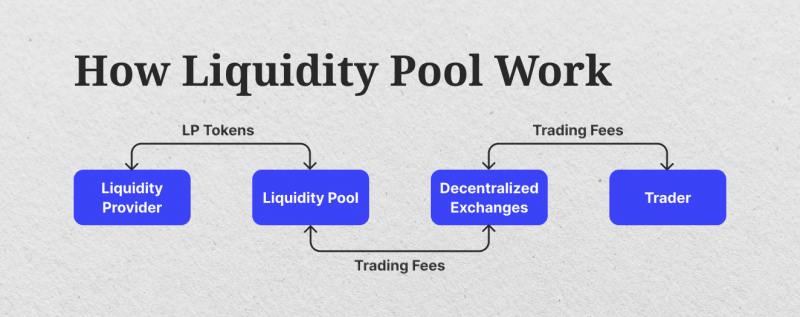

How Do Liquidity Pools Work

In centralized exchanges, a market maker constantly buys and sells securities to make them more available to other participants. Thus, there is always a counterpart to every trade, and liquidity levels are increased.

However, in decentralized finance, automated market makers perform this task much faster and more efficiently. Liquidity pools allow decentralized exchanges and crypto trading platforms to find counterpart assets and tokens and execute trades without intermediaries.

In traditional trading, liquidity providers are considerable financial firms that harness significant capital and funds to make markets more efficient and liquid. In exchange, market makers earn from the price difference between buying and selling, as they buy low-price assets and sell them at higher prices to make a profit.

On the other hand, anyone can participate in DeFi pools and become a liquidity provider by locking a pair of cryptocurrencies denoted by the pool. In exchange, LPs receive special tokens representing their shares from the total awards and fee allocations as more trades are processed using these pools.

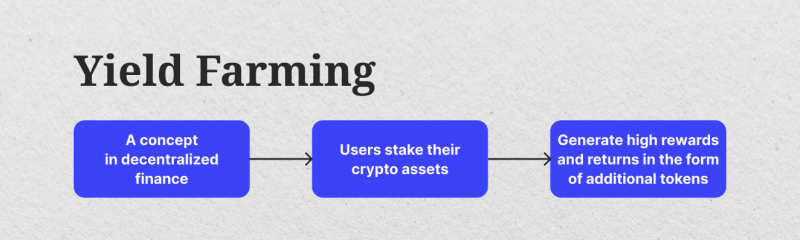

DeFi LPs can redeem their tokens to receive rewards or withdraw from pools. Additionally, they can use these tokens to participate in other crypto pools. This strategy is called “yield farming”.

Depositing

The first step in participating in a DeFi liquidity pool is depositing two coins or tokens of equal value. The type of cryptocurrencies is more likely to be determined by the pool platform or issuer, which maintains the ratio of tokens quantity and value to ensure a seamless pool operation.

Some pools have particular rules about depositing, such as the minimum amount of each token, the lock-up period, and penalties if an LP wants to withdraw early from the reserve.

Smart contracts govern these pools to ensure the right balance and smooth execution of requests.

Minting

Pool participants receive LP tokens in exchange for their deposited funds. These tokens are minted based on the associated blockchain’s protocols and reflect the value of the deposited assets.

The LP tokens act as proof of participation and represent the investor’s proportional share from the collective fees. Users can redeem the tokens to receive their rewards or withdraw from the pool.

When users leave the pool, they return their tokens, which are burned by the issuing platform. Some LP tokens give additional rights to holders, such as voting rights or additional rewards.

Earning

Participants receive regards and income from trading and operating fees conducted using their pool. Every time a decentralized exchange uses that particular pool to find matching crypto pairs or process transactions, some charges are deducted from the transaction and allocated to the pool.

Then, LPs receive these proportions based on their contribution. These amounts might seem tiny. However, a continuous stream will add up to provide a passive income.

The larger and more secure the pool is, the more likely it will be used to execute requests. Therefore, investors seek the most sophisticated DeFi pools to join and earn over time.

Additional Features

LP tokens allow holders to participate in other investing activities that generate additional income. Yield farming entails depositing crypto tokens in Web 3.0 platforms and DeFi pools to earn interest-bearing returns.

These invested tokens increase the liquidity at the selected platform, and users earn more money as more transactions and operations take place on the designated platform.

Additionally, LP tokens can be invested in crypto staking, which involves locking up a given amount of cryptocurrencies to power validating nodes at a selected blockchain. At the end of the lock-up period, stakers receive rewards and returns in addition to getting back their initially invested tokens.

Types of Crypto Liquidity Pools

Crypto liquidity pools, regardless of their types, provide a passive source of income, which can be tiny or significant depending on the amount the participant invests and the type of pool.

Single-asset

Single-asset liquidity pools are more straightforward. They entail depositing one type of crypto coin or tokens. Lending pools use single assets, where fund borrowers take loans in the denominated currency and pay interest. At the same time, liquidity providers earn interest paid by borrowers.

These pools are easier to comprehend and manage as they involve only one crypto asset. Investing in single-asset DeFi pools entails less risk because investors are concerned with one asset class and can track its price action more simply.

Fast Fact

The total value locked (TVL) in lending pools exceeded $30 billion by June 2024, a massive increase from $13 billion in June 2023. The all-time high record was in April 2022, as TVL reached over $50 billion.

Multi-asset

In multi-asset pools, users deposit two cryptocurrencies as a pair with an equal ratio to maintain a value balance. Decentralized exchanges (DEXs) use these pools to facilitate token swaps and exchanges relating to the underlying assets.

The fees resulting from any trade operation associated with this pool are distributed proportionally among participants. These pools are designed to maintain a value balance by depositing and tracking two assets simultaneously.

Hybrid Pools

Hybrid pools are more flexible, allowing the creation of single-asset and multi-asset liquidity pools at different ratios.

This type can be more challenging to understand and manage but can provide higher returns. Investors can deposit two different currencies at different ratios and customize their liquidity provision strategies according to their unique needs.

Staking Pools

Staking pools are the most common DeFi investments, where participants lock in a specific type and amount of cryptocurrencies determined by the campaign issuer.

These tokens are locked for a specific period. They are used to power validating nodes and blockchain security protocols, especially in chains that use proof-of-stake and delegated proof-of-stake.

In exchange for locking their tokens, investors receive returns denoted as annual percentage yield (APY), which varies based on the total pool amount and number of participants. Investors also receive additional rewards or tokens at the end of the staking campaign in addition to regaining their initially invested assets.

The Benefits of Liquidity Pools in DeFi

Are liquidity pools only beneficial for investors and liquidity providers? How do these pools aid decentralized exchanges, and why are they so popular?

Just as central banks and financial institutions are vital for traditional brokerage firms, decentralized pools of liquidity are crucial for crypto exchanges for the following reasons.

Better Liquidity

Cryptocurrency liquidity pools emphasize the concept of shared control by allowing anyone to participate in making the decentralized ecosystem better and more efficient.

Liquidity pools aggregate crypto coins, tokens, and other assets from a broad range of users, communities, and investors. These collectives equip exchange platforms with high liquidity, facilitating fast execution and low slippage chances.

This feature is crucial for cryptocurrencies because the market is so volatile, and any delay can cause considerable price changes that affect investors’ strategies and returns. When the coin supply is low, trade requests and swaps are delayed “slippage,” where the executed price slightly differs from the market price.

Generating Passive Income

Lending pools and staking are equally crucial for offering flexible DeFi investment opportunities to make passive income. Investors and crypto users can leverage their idle digital assets to generate returns, whether from loan returns, trading fees, or rewards from powering blockchain mechanisms.

The rate of returns between these pools differs based on the denoted digital currency, the number of participants, and the security protocol behind the pool. These features can make the pool more valuable for exchange platforms, garnering more returns for investors.

However, returns are not guaranteed and are inconsistent because the market is volatile.

Decentralized Ecosystem

The decentralized world is inevitable, and the recent developments in crypto regulations and the increased adoption of blockchain currencies prove that the DeFi ecosystem is integrating into more use cases.

Liquidity pools are vital for the smooth operation of the decentralized world. They enable the timely and efficient execution of exchange platforms, currency swaps, trade requests, and other operations.

Building solid DeFi infrastructures is necessary for the future development of blockchain practices, increasing investor confidence and trust among authorities and centralized institutions.

Risk Management

The proper functioning of decentralized pools minimizes the reliance on centralized liquidity sources, such as traditional banks, hedge funds, and investment institutions. Traders can create a combined portfolio of centralized and decentralized assets to minimize risks.

Additionally, traditional finance relies on the liquidity provided by large market players and whales whose decisions can flip the market. However, users have the upper hand in decentralized control, and their collective investments and actions dictate the market.

Advantages and Disadvantages of Liquidity Pools

Are there any dangers associated with crypto liquidity pools? Well, as a premature ecosystem, blockchain entails some challenges. Let’s explore and compare the benefits and drawbacks of DeFi liquidity pools.

Pros

- DeFi crypto pools increase the liquidity of DEXs and facilitate a smooth order execution and token swap.

- There are low entry barriers as anyone can invest in liquidity pools and invest their crypto assets.

- Investing in liquidity pools entails income generation from aggregated, staking, or lending pools, which provide passive income without active engagement.

- Liquidity pools are less exposed to investors’ risk as they aggregate assets from a large number of participants and do not rely on a few providers, unlike centralized liquidity provisions.

- Centralized institutions and authorities increasingly regulate and adopt crypto assets, leading to further infrastructure improvement.

Cons

- Market volatility is a considerable risk for liquidity pools, significantly when prices change after investors deposit a massive amount of crypto assets.

- Any glitches or errors in developing smart contracts can lead to significant damages, including loss of funds and compromised security.

- Cryptocurrency fluctuations can affect the value of returns investors expect from their crypto investments.

How to Use Liquidity Pools for Your Crypto Exchange

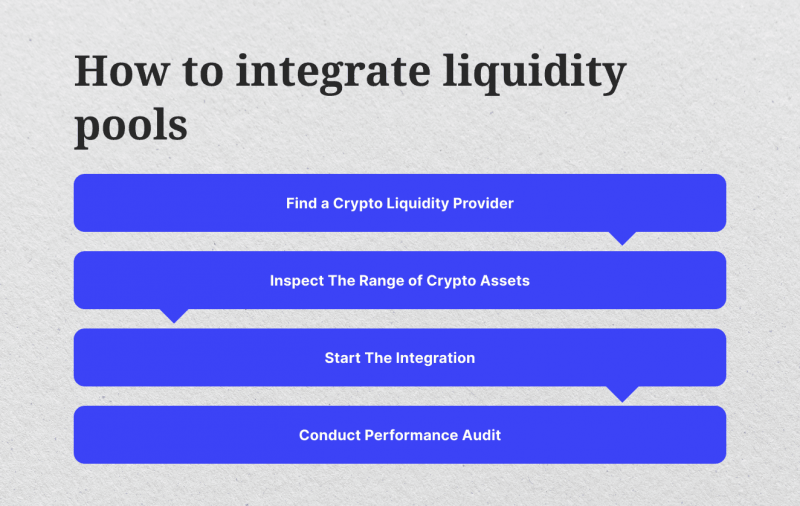

If you are launching a crypto exchange or a decentralized token swap platform, then integrating a reliable liquidity source is essential for the proper functioning of your business. Here’s what you need to do.

- Find a Crypto Liquidity Provider: Look for a source of crypto liquidity that aggregates digital coins and tokens to facilitate trading on your platform. Ensure the provider’s legality and reputation.

- Inspect The Range of Crypto Assets: Review the quantity of digital assets and securities offered and ensure you get the broadest range of cryptocurrencies to provide your customers more flexibility.

- Start The Integration: Set up technical meetings to work on service integrations and API connectivity with the crypto LP.

- Conduct Performance Audit: Continuously observe the functioning of the liquidity bridge and ensure a stable flow.

Conclusion

Liquidity pools are collectives of crypto tokens and coins that investors deposit to supply sufficient liquidity to decentralized exchanges and brokerage firms. These sources ensure quick order execution of trades submitted on crypto brokerage platforms.

Any users can participate in these pools to contribute to the well-being of a decentralized ecosystem. In exchange, liquidity providers receive LP tokens representing their shares in the pool, which can be redeemed to receive rewards and generate passive income.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

Are liquidity pools profitable?

Yes. DeFi pools can be profitable, but several factors affect their profitability, such as impairment losses, market volatility, and pool security.

How do liquidity pools generate income?

Providers who participate in liquidity pools receive LP tokens representing their shares. LPs share the pool’s rewards and collected fees proportionally to their investment.

How do liquidity pools maintain asset balance?

Crypto liquidity pools use the automated market-making (AMM) protocol that conducts price changes to maintain a 1:1 ratio between the deposited crypto pairs.

What’s the difference between staking and liquidity pools?

Crypto staking involves investing and locking cryptocurrencies to activate validating nodes and promote blockchain utilization, while liquidity pools supply liquidity to DEXs to boost their order execution method.