What is a Bull Flag? How Does it Differ from a Bear Flag?

Jan 04, 2025

The bull flag figure is a central component of chart analysis and a favorite among investment professionals because it signals trend prolongations.

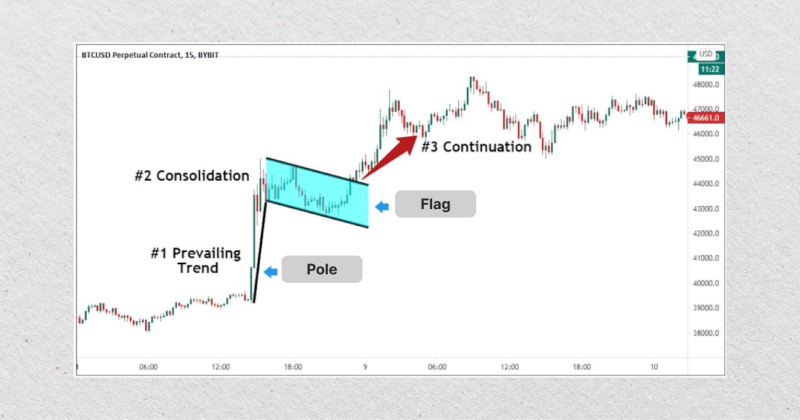

Found within strong directional trends, this figure combines a rapid price correction (the flagpole) with a brief aggregation moment (the flag), offering traders an opportunity to capitalize on the next breakout.

Whether you are a trading beginner or a seasoned market participant, grasping the bull flag figure is indispensable for recognizing high-probability trading options and enhancing your entry strategies in ever-changing market scenarios.

This guide delves into the nuances of the bull flag, its variations, and how traders can conveniently integrate it into their schemes for consistent success.

Key Takeaways:

- In chart analysis, a flag figure is a chart formation distinguished by a drastic price jump followed by a brief countertrend aggregation moment.

- A bullish flag resembles an arched flag on a price chart. The flagpole represents the current buying trend, and the flag is a rectangular aggregation pattern.

- The tighter and more compact the bull flag, the harder and more reliable the trading sign is taken into account.

What Does the Bull Flag Figure Stand for?

The bull flag pattern is a common chart research chart formation that signals a potential prolongation of an uptrend shift in capital markets.

Resembling a flag on a pole, this pattern is used by financial professionals to discern potential ways to join a huge bullish price action after a brief aggregation moment.

The bull flag pattern is a widely recognized extension pattern in chart analysis. Its reliability makes it a favored choice among traders. The pattern reflects natural market behavior: a strong forward price spike (flagpole) is topped by a temporary aggregation moment (flag) before continuing the bullish tendency.

This pause in price action allows new traders to enter the market and existing participants to increase their positions, enhancing the strength of the subsequent breakout.

At its core, the bull flag represents a balance between market participants. After a rapid rally, sellers step in to take profits, causing a slight pullback or sideways movement.

Simultaneously, buyers who believe in continuing the trend accumulate positions during this pause, creating the characteristic flag formation. This interplay of buying and selling pressure makes the bull flag a reliable precursor to another upward spike.

Fast Fact:

In a bearish triangle pattern, volume often remains steady following a correction, driven by investor fear and anxiety over falling prices.

Types of Bull Flag Figures

While fundamentally a prolongation formation, the bull flag pattern can manifest in various forms depending on the market dynamics. Understanding these variations helps traders identify the most suitable opportunities and adapt their strategies to different market dynamics.

Below are the primary types of bull flag patterns:

Classic Bull Flag

The classic bull flag is the standard version of this pattern. It consists of a strong, steep flagpole capped by a rectangular aggregation moment where the price surges sideways or slightly downward within parallel trendlines.

The aggregation moment is relatively shallow, with a 38–50% retracement of the flagpole’s height. This pattern frequently resolves with a break-out before the flag’s resistance line. It is commonly observed in strongly trending markets where bullish momentum temporarily pauses before resuming.

Ascending Bull Flag

The ascending bull flag features an upward-sloping aggregation moment, indicating a more aggressive stance by buyers during the pause. The flag’s trendlines are upward-sloping and parallel, reflecting sustained buying pressure.

The break-out occurs when the price surpasses the flag’s supporting trajectory. This pattern is frequently seen in highly bullish markets, where buyers maintain control even as the price appreciates.

Descending Bullish Flag

The descending bull flag has an aggregation moment that slopes slightly downward, forming a gentle correction against the prevailing uptrend. The flag’s trendlines are downward-sloping and parallel, which suggests mild profit-taking or a temporary increase in supply.

A break-out occurs when the price passes directly above the upper pattern line of the descending flag. This variation is common in volatile markets, where minor corrections happen during strong uptrends.

Wedge-Shaped Bull Flag

The wedge-shaped bull flag differs from the classic form in that its aggregation moment constitutes a wedge. The flag’s boundaries converge as the price consolidates, and the wedge may have a slight upward or downward slope.

Volume often contracts during the wedge formation and expands at the break-out. This pattern is typical when price aggregation narrows due to reduced volatility, usually leading to an explosive breakout.

Mini Bull Flag

The mini bull flag is a smaller and quicker version of the classic bull flag. It occurs over a shorter timeframe and features a less pronounced flagpole. The aggregation moment is brief and tight, often lasting only a few candles on lower timeframes.

The break-out from this pattern is typically sharp and rapid. Mini bull flags are commonly found in highly liquid and fast-moving markets, such as Forex or cryptocurrency, where short-term traders are active.

Complex Bull Flag

The complex bull flag consists of multiple aggregations or miniature flags within the primary pattern. It reflects prolonged indecision before the trend extends. The flag often shows multiple retracements or overlapping price actions.

Breakouts from this pattern can be more significant due to the extended build-up of momentum. Complex bull flags are usually seen in markets experiencing intermittent volatility or during news-driven events that extend aggregation moments.

How to Detect a Bull Flag?

Identifying a bull flag pattern involves analyzing the price action and looking for specific nuances that define this prolongation pattern. Here’s a step-by-step guide to recognizing a bull flag:

Look for a Strong Flagpole

The first component of a bull flag is a steep and sharp price increase, referred to as the flagpole. This upward tendency is typically driven by strong buying momentum, often complemented by high trading traffic. The flagpole illustrates the earliest bullish surge and sets the foundation for the pattern.

Spot the aggregation Moment (Flag)

After hitting the flagpole, the price triggers an aggregation moment, moving sideways or modestly decreasing. This phase forms the flag portion of the pattern and is characterized by two parallel trendlines that slope downwards, upwards, or remain horizontal.

The aggregation is relatively shallow, often retracing 38–50% of the flagpole’s height. Deeper retracements may signal a weakening trend.

Analyse Volume Patterns

Volume often decreases due to the flag’s aggregation moment, indicating reduced trading activity and a temporary pause in the trend. A spike in volume prior to the break-out confirms the rebound of the upmarket trend and validates the pattern.

Check the Flag’s Shape

The flag can take different forms, such as a rectangle, wedge, or slightly sloping channel. Ensure the aggregation moment does not invalidate the bullish scenario by breaking below critical support levels.

Monitor the Breakout

A bull flag is endorsed when the price breaks out over the flag’s resistance zone or upper trend level. The break-out should be preceded by increased volume, signifying renewed buying pressure.

Measure the Price Target

Once the break-out is confirmed, the expected price target can be estimated by adding the flagpole width to the break-out point. This projection helps traders set realistic profit targets to prolong the trade.

Bullish Flag vs. Bear Flag Pattern — Comparative Analysis

The bullish flag and bear flag patterns are essential appliances in chart analysis, representing prolongation patterns in bullish and bearish trends, respectively. While they share structural similarities, they occur in opposite market trends and signify different trading perspectives.

Here is a brief comparison between those two patterns, which you can notice in trading practice:

Trend Direction

The bull flag occurs over an uptrend and represents the retention of bullish sentiment after a pause or aggregation. In reverse, the bear flag forms a downtrend, indicating that downward momentum will likely endure after a brief aggregation.

Structure and Appearance

The bull flag comprises a sharp upward decline, cognized as the flagpole, topped by a gathering moment where the price rebounds slightly downward, sideways, or within a channel.

On the other hand, the bear flag starts with a steep downward move, forming the flagpole, and transitions into a moment where the price drifts slightly higher, sideways, or within a channel.

Break-Out Direction

A bull flag frequently breaks out upward over its resistance, signaling the prolongation of the bullish wave. Conversely, a bear flag breaks down below its support, signaling the prolongation of the bearish trend.

Volume Structure

In a bullish flag pattern, trading traffic is high ahead of the flagpole figure, decreases during the aggregation moment, and increases again ahead of the breakout. For a bear flag, volume is high immediately after the sudden decline, drops throughout the recovery, and rises sharply right before the breakdown.

Trader Actions

Traders use the bull flag figure to issue long orders upon a break-out over the flag’s resistance line, targeting further positive price growth.

Conversely, the bear flag sequence is adopted by market players to enter short deals upon a breakdown below the flag’s support line, aiming to capitalize on continued downtrend price development.

Concluding Considerations

The bullish flag figure is a powerful prolongation signal, blending simplicity with effectiveness in trend-following strategies. Its consistent ability to predict bullish breakouts makes it a go-to tool for investors in various markets, from stocks and FX to crypto.

Mastering the art of identifying and leveraging this pattern, along with sound risk allocation and proper trade execution, can significantly enhance trading outcomes. Staying attuned to figures like the bull flag equips traders with the insights needed to navigate market dynamics confidently and seize profitable prospects as markets evolve.

FAQ:

What does a bullish flag structure stand for?

A bull flag is a charting figure that resembles the prolongation of an upward streak after a rapid aggregation, featuring a sharp boost (flagpole) preceded by a flag-shaped pause.

How do you determine a bull flag figure?

A bull flag is identified by a prominent lateral move followed by an aggregation moment within concentric trend lines, confirmed by a sudden spike over the flag with rising volume.

How do traders use the bull flag figure?

Traders set up long stakes after a break-out over the flag, targeting a price equal to the flagpole’s height while managing risk with stop-loss orders.