What is Berachain? An In-Depth Guide to the Proof of Liquidity Consensus

Oct 28, 2024

Blockchain technology continuously evolves, pushing the boundaries of decentralized finance (DeFi) and crypto ecosystems. One of the emerging blockchain platforms that has attracted attention is Berachain.

Known for its innovative approach to liquidity provisioning and its integration of a unique consensus mechanism, Berachain offers a novel framework that addresses some of the critical challenges in the current blockchain space.

This article explains what Berachain is, its ecosystem, and how it contributes to the DeFi landscape by providing value for liquidity providers (LPs), developers, and the wider cryptocurrency community.

Key Takeaways

- Berachain is an EVM-compatible Layer-1 blockchain that addresses liquidity and security issues through its innovative Proof of Liquidity (PoL) consensus mechanism.

- The platform’s unique approach rewards liquidity providers with $BGT governance tokens, aligning incentives for network participants and enhancing overall security.

- Berachain’s core DApps – BEX, Bend, and Berps – leverage PoL to create a robust ecosystem for decentralized trading, lending, and perpetual futures.

- With its modular framework BeaconKit and Cosmos SDK integration, Berachain offers developers flexibility and scalability while maintaining EVM compatibility.

So, What is Berachain?

The story of Berachain began with an intriguing twist. Originally conceived as the Bong Bears NFT project, the team behind Berachain identified critical issues in existing blockchain networks, particularly the misalignment of liquidity and security at the chain level.

This realization led to the evolution of Bong Bears into a full-fledged Layer-1 blockchain, integrating seamlessly with the Ethereum Virtual Machine (EVM).

Berachain has become synonymous with innovation in liquidity and consensus mechanisms. Built on the Cosmos SDK, it introduces the Proof of Liquidity (PoL) consensus model, allowing LPs to participate in network security and governance while earning rewards through the native governance token (BGT).

One of Berachain’s standout features is its EVM compatibility. This means that developers familiar with Ethereum can easily deploy their decentralized applications (DApps) and smart contracts on Berachain without any modifications. The platform achieves this through BeaconKit, a modular framework built on the EVM that leverages Cosmos SDK.

BeaconKit provides the flexibility needed for Berachain to scale efficiently while maintaining a user-friendly environment for developers. This modular approach allows Berachain to adopt Ethereum upgrades quickly, ensuring that the platform remains up-to-date with the latest advancements in blockchain technology.

Built with a focus on high performance, scalability, and user-friendliness, Berachain stands out with its unique features:

- Proof-of-Liquidity (PoL) Consensus Mechanism

- Modular Framework

- EVM Compatibility

- Network Security

The Core of Berachain: Proof of Liquidity (PoL) Consensus

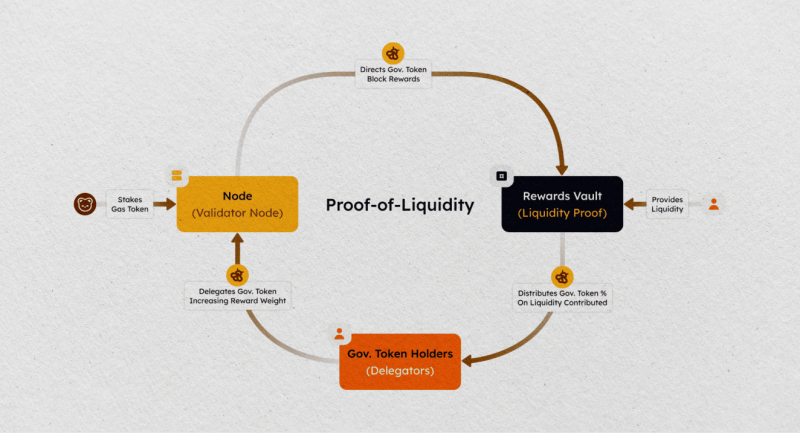

At the heart of Berachain’s innovation lies its Proof of Liquidity consensus mechanism. Unlike traditional blockchains that rely on Proof of Stake (PoS) or Proof of Work (PoW), Berachain incentivizes liquidity providers to secure the network.

By providing liquidity, users help maintain network security and contribute to the consensus layer, effectively solving problems like liquidity fragmentation and price volatility.

The liquidity consensus mechanism is crucial in aligning the interests of LPs with those of the network participants, enabling a more inclusive and decentralized environment. Liquidity providers can stake their assets in liquidity pools and, in return, earn BGT rewards, which enhances user engagement and creates an economically sound ecosystem.

How PoL Works

In a PoL system, validators not only stake tokens but also actively contribute to liquidity pools and decentralized exchanges. This dual role means that the tokens used for network security are also working to make the Berachain ecosystem more efficient and liquid.

For example, a validator on Berachain might stake tokens and supply liquidity to a decentralized exchange (DEX). By facilitating trades, they earn both validator rewards and trading fees. This model creates a more collaborative and inclusive environment where all participants – from individual users to large protocols – are incentivized to contribute to the network’s growth and security.

Benefits of PoL

- By tying liquidity provision to network security, PoL makes attacking the network more difficult and expensive.

- All participants are motivated to contribute positively to the ecosystem, fostering a more cohesive and cooperative environment.

- The PoL mechanism naturally encourages higher liquidity across the platform, benefiting all users.

- Rewards are distributed based on actual contributions to the network rather than just token ownership.

Berachain Ecosystem: A Haven for Developers and Users

Berachain is built on a modular framework, making it highly adaptable and scalable for various DeFi applications. The Berachain ecosystem enables developers to create customized smart contracts and build decentralized applications (dApps) tailored to meet specific use cases. This flexibility makes Berachain attractive to both developers and investors, as it ensures the platform’s growth potential is not limited by its initial design.

At the heart of this ecosystem is the Ethereum Virtual Machine (EVM) runtime layer, which allows for EVM compatibility. This feature is crucial for developers as it simplifies the process of porting dApps from Ethereum to Berachain without rewriting the underlying code. The Cosmos SDK also allows developers to create custom modules, which enhance the functionality of the blockchain, enabling the creation of novel DeFi applications and crypto assets.

Berachain’s ecosystem is built around three core decentralized applications (DApps) that leverage the PoL mechanism to create a robust and interconnected platform:

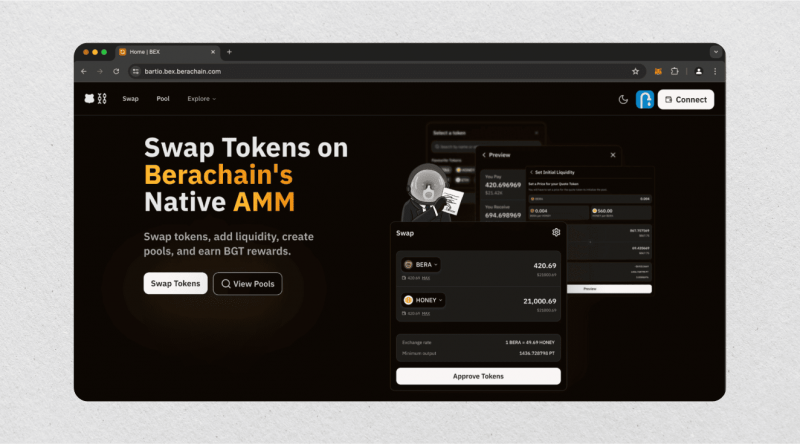

BEX: Decentralized Exchange

BEX is Berachain’s native decentralized exchange, allowing users to trade various crypto assets without intermediaries. Key features include:

- Automated trading through smart contracts

- Liquidity providers earn trading fees and $BGT governance tokens

- Seamless integration with PoL, enhancing network security

Bend: Lending Protocol

Like popular DeFi lending platforms like Aave or Compound, Bend enables users to lend and borrow crypto assets. Its unique features include:

- Collateralized lending and borrowing

- Interest earnings for lenders

- Additional $BGT rewards for liquidity providers

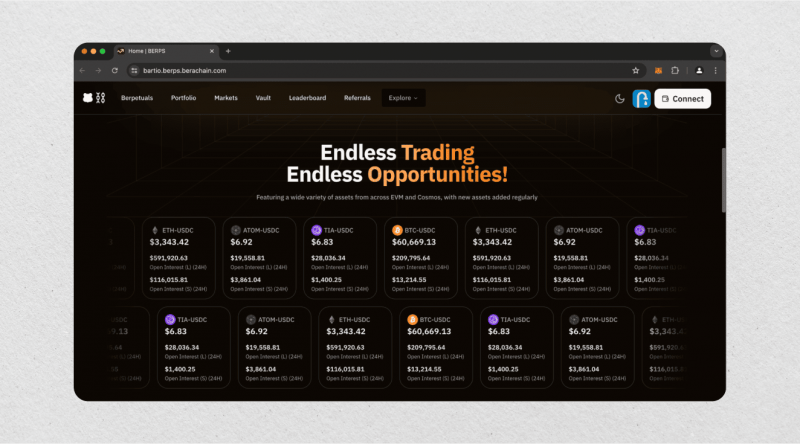

Berps: Perpetual Futures

Berps introduces perpetual futures trading to the Berachain ecosystem, allowing users to speculate on price movements without owning the underlying assets. Key aspects include:

- Leveraged trading positions

- Liquidity providers earn trading fees and $BGT rewards

- Enhanced engagement and liquidity for the network

These core DApps work harmoniously to create a comprehensive DeFi ecosystem on Berachain, each contributing to the platform’s liquidity, security, and overall utility.

The Berachain ecosystem is designed to foster a vibrant and inclusive environment for all participants. Its team comprises experienced developers and blockchain enthusiasts dedicated to building a future-proof platform. Their commitment to innovation and a strong community focus drive the continuous development and growth of the overall ecosystem.

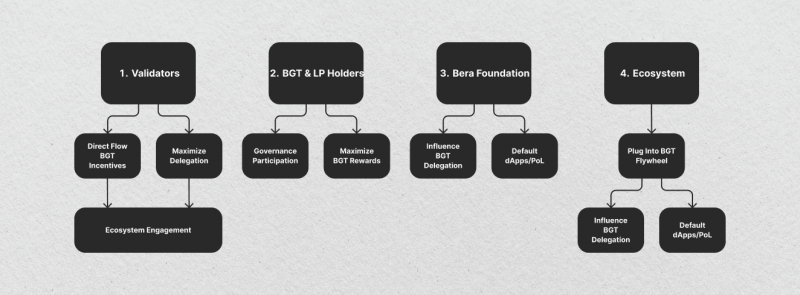

Governance and Decentralisation: The Role of BGT Tokens

One of the most compelling aspects of Berachain is its approach to governance and network security. The platform’s governance token system allows users to vote on changes and upgrades to the network, ensuring that decisions are made democratically.

Governance is decentralized through the use of governance tokens known as BGT. Network participants can stake these tokens to influence governance proposals, shaping the platform’s future direction. This decentralized approach ensures that all stakeholders, from liquidity providers to developers, have a say in critical decisions, fostering an inclusive environment.

Key aspects of $BGT include:

- Proposal Creation: Any $BGT holder can submit proposals for network improvements or changes.

- Voting Power: The amount of $BGT held determines voting weight in governance decisions.

- Delegation: Holders can delegate their voting power to other community members.

- Reward Distribution: $BGT is earned by liquidity providers and active network participants.

Additionally, soulbound governance tokens play a vital role in securing the network. These tokens cannot be transferred or sold, making them valuable assets in governance decisions. BGT emissions also reward participants who contribute to the network’s growth through liquidity provision or active participation in governance processes.

The security is further enhanced by the Proof of Liquidity consensus model, which reduces the risks associated with stake centralization and liquidity fragmentation.

Additionally, the Berachain team has implemented a series of safety protocols to reduce price volatility and promote price stability in its tokenomics model. This ensures that the value of native tokens remains relatively stable, offering a more secure investment environment for users.

$BERA: The Gas Token

The $BERA token is essential to the Berachain network, serving as both a transaction fee (gas token) and a staking asset for validator nodes. When users conduct transactions on the blockchain platform, they pay a fee in $BERA. Additionally, nodes that validate transactions on the network must stake $BERA to participate.

The total value of staked $BERA contributes to the network’s security, forming the foundation upon which the $BGT token builds for enhanced protection. Important note: The $BERA token and the mainnet are currently not live. Any claims suggesting otherwise are fraudulent.

$HONEY: Berachain’s Stablecoin

Honey ($HONEY) is a stablecoin pegged to the US dollar. This means its value is designed to remain consistently close to one US dollar. Unlike cryptocurrencies like Bitcoin, which can fluctuate wildly in price, $HONEY aims to provide a stable store of value.

Various crypto assets back it. This means that to mint $HONEY, users must deposit other cryptocurrencies, such as Bitcoin or Ethereum, into a designated vault. These deposited assets serve as collateral, ensuring the stability of $HONEY.

To mint $HONEY, users deposit eligible collateral into a vault. The specific assets accepted as collateral can change over time, as determined by governance. Once the collateral is deposited, the user receives $HONEY tokens in return.

The minting rates are determined by governance. This means the community sets the exchange rate between the deposited collateral and $HONEY through voting. This allows for flexibility in adjusting the minting rates based on market conditions. $HONEY can also be acquired through trading on the Berachain Bex. In addition to minting, users can buy $HONEY from other users on the Berachain Bex exchange.

$HONEY has various uses within the Berachain ecosystem. It can be used for payments, remittances, and hedging against market volatility. It also plays a crucial role in several DeFi applications, such as lending, borrowing, and perpetual futures.

Collateral assets are governed. The decision of which assets can be used as collateral for $HONEY is made by the community through governance. This ensures that the backing of $HONEY remains strong and reliable. Fees collected from minting and redeeming $HONEY are distributed to $BGT holders.

Earning Rewards with Berachain

As mentioned above, Berachain’s economic model is built around incentivizing liquidity provision and user participation. Liquidity providers who stake assets in liquidity pools are rewarded with BGT tokens as part of the block rewards. The more liquidity one provides, the higher the rewards, which in turn increases network security and liquidity depth.

Aside from staking, users can also earn BGT rewards by engaging in the ecosystem through governance participation, contributing to the platform’s network growth. The Berachain documentation outlines several strategies for maximizing rewards, including staking assets in different pools and engaging in governance proposals to drive the platform’s development.

Fast Fact

To get Berachain bArtio testnet tokens, set up a web3 wallet like MetaMask, connect to the bArtio network, and use the official faucet. These tokens are crucial for testing smart contracts, exploring features, and participating in potential airdrop rewards on Berachain’s EVM-compatible blockchain.

Berachain Testnet and Future Developments

As of October 2024, Berachain is in its testnet phase, with the mainnet launch anticipated by the end of the year. The crypto community eagerly awaits this launch, given the platform’s innovative approach to solving longstanding issues in the blockchain space.

Framework Ventures and other prominent backers have shown confidence in the platform’s future, with investment rounds led by industry experts aiming to support the Berachain blockchain. As more users and liquidity providers join the Berachain community, the platform’s potential for growth is enormous.

Impact on the Crypto Landscape

Berachain can potentially revolutionize the cryptocurrency landscape by addressing key challenges existing blockchain platforms face. Its innovative features and focus on user experience make it a promising contender in the DeFi space. Here are some potential impacts:

- Berachain’s modular framework and PoL consensus mechanism can significantly improve network scalability, enabling it to handle more transactions and dApps.

- The PoL consensus mechanism provides a more secure and robust network than traditional PoW and PoS. Berachain can deter malicious attacks and maintain network stability by incentivizing liquidity providers.

- Berachain could reduce liquidity fragmentation across DeFi platforms by incentivizing liquidity provision at the protocol level.

- The PoL consensus mechanism eliminates the need for miners, reduces transaction fees, and makes Berachain more accessible to a wider range of users.

- Berachain’s focus on user-friendliness and seamless interface can attract more mainstream users to cryptocurrency.

Conclusion

Berachain represents a bold step forward in blockchain technology, addressing critical issues of liquidity and security through its innovative Proof of Liquidity consensus mechanism. By aligning the incentives of all network participants and creating a robust DeFi ecosystem, Berachain has the potential to revolutionize how we think about and interact with blockchain networks.

As the platform moves towards its mainnet launch, the crypto community watches with anticipation. If successful, Berachain could pave the way for a new generation of blockchain networks that prioritize liquidity, security, and user engagement equally.

For developers, traders, and DeFi enthusiasts, Berachain offers an exciting new frontier to explore. Whether it will become the next big player in the Layer-1 space remains to be seen, but its unique approach certainly makes it a project worth watching closely in the coming months and years.

FAQ

How was created Berachain?

The project was originally an NFT project called Bit Bears, which the Berachain website says was simply started for a bit of fun. It saw great success, however, leading to a “massive cult community.” This was when the founders saw the vision for what Berachain has become today.

How to provide liquidity in Berachain?

To provide liquidity, the Liquidity Provider receives a receipt token. Ex: $HONEY-WBERA. The Liquidity Provider stakes the receipt token with the Reward Vault, making them eligible to receive $BGT based on their contribution.

Has Berachain been launched?

Berachain is currently in its public testnet phase, and an airdrop of its native token, BERA, is expected to occur when the mainnet launches in 2024.

How much did Berachain raise?

It has raised a total funding of $142M over three rounds.