What is De-Dollarization? Explaining US Dollar Collapse

Jun 5, 2024

The American dollar has been the driving force for a long time, and de-dollarization is something that represents an important shift away from it. Since World War II, it has generated an unmatched power over financial institutions.

To be less dependent, nations and central banks are strategically reevaluating, as seen by the increasing de-dollarization movement. The rise of digital currencies, particularly stablecoins, has sparked this change since they are now regarded as respectable substitutes for fiat money when transacting internationally.

What happens if the US dollar collapses? The effects would be felt by every aspect of the world financial system, impacting everything from the financial transactions that support international trade to the stability of global foreign exchange reserves. Understanding the wide-ranging effects of this shift and the factors that can propel a move away from the dollar’s hegemony is crucial as we go deeper into de-dollarization.

Key Takeaways

- De-dollarization is the term used to describe the transition from the US dollar’s hegemony on a worldwide scale.

- The US dollar has served as the primary reserve currency globally since World War II, but new markets and advancements in technology are posing a threat to this status.

- A hypothetical collapse of the US dollar would result in changes in geopolitical and economic alliances, affecting global trade, inflation rates, and economic stability.

- Stablecoin integration into the financial system to lessen the impact of currency fluctuations, financial reserve diversification, and economic reforms might be preventive measures for preserving the dollar’s dominance.

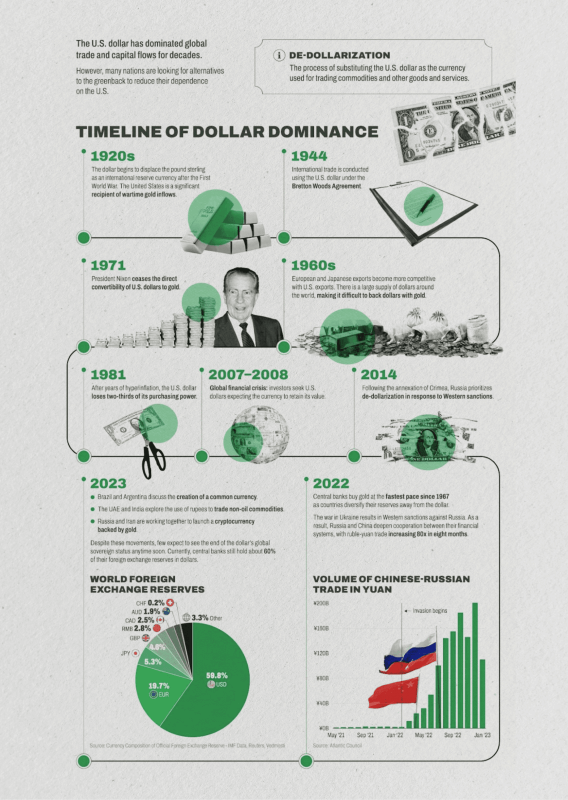

Historical Dominance of the U.S. Dollar

After World War II, the US dollar reached a level of significance never seen before, taking the lead as the world’s primary reserve currency. At the 1944 Bretton Woods Conference, nations decided to lock their currencies to the dollar, which was then convertible into gold at a predetermined rate, formalizing this position. This agreement created a solid foundation that promoted post-war economic recovery and global trade.

Until 1971, when the United States suspended the dollar’s convertibility into gold due to growing economic pressure, the Bretton Woods System was the foundation for the dollar’s dominance. The Nixon Shock signaled the end of the gold standard and the beginning of the fiat currency system.

The 1970s saw the creation of the petrodollar system, which further increased the dollar’s power. This system resulted from agreements by oil-exporting nations to value their oil sales in US dollars, solidifying the dollar’s position in the world’s energy markets.

Because of its importance in international trade, the U.S. dollar has an impact that goes well beyond national boundaries and affects financial stability and global economic policies. The dollar plays a crucial role in the global monetary system, enables most international transactions, and is a substantial store of value in foreign exchange reserves.

The dollar is the world’s reserve currency. Its strength and stability impact global economic conditions, exchange rates, and interest rates. Because of its status as a reserve currency, the United States has significant economic and geopolitical clout and can better finance spending without inducing inflation.

The dollar’s stability continues to significantly impact the global economy since central banks worldwide hold large quantities of US dollars.

However, emerging markets and significant developing nations are threatening the dollar’s hegemony by looking into alternate currencies and ways to undertake financial operations that can lessen their dependency on the US currency.

Such changes to the global financial system may result in a reassessment of the dollar’s standing, which would affect international trade, reserve assets, and corporate operations.

The Rise of Digital Currencies and the Dynamics of De-Dollarization

The process by which nations reduce their reliance on the US dollar in financial transactions, international trade, and worldwide foreign exchange reserves is known as “de-dollarization.” This transition frequently entails tactics like building regional alliances, encouraging the use of local currencies, and exchanging currencies to enable trade and financial operations without depending on the US dollar.

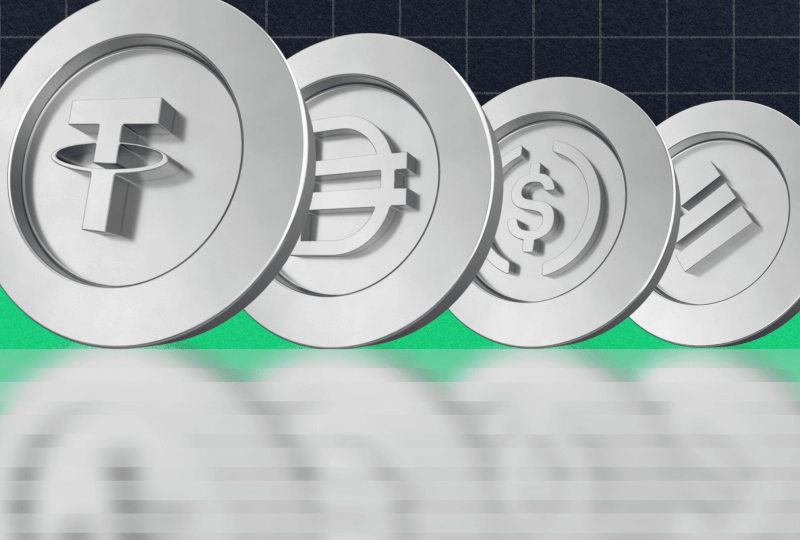

Parallel to this, de-dollarization initiatives have become increasingly dependent on the growth of digital currencies, especially stablecoins. Stablecoins are virtual currencies whose value is stabilized against the usual volatility of other digital currencies by being linked to stable assets such as gold, the US dollar, or other currencies.

Because these digital assets make cross-border exchanges easier and remove the need for traditional reserve currencies, they are increasingly used in international transactions and financial operations.

Stablecoin integration has significant benefits for international economics. It improves the effectiveness of cross-border transactions, lessens dependency on a single national currency, and diversifies world currency reserves.

The importance of the US dollar as the primary currency is threatened by new developments as nations and central banks investigate these digital alternatives. This change may affect the standing of the US dollar in international trade and finance by creating a more balanced and distributed global monetary system.

What May Cause the U.S. Dollar Collapse

The US dollar’s position as the world’s reserve currency is declining for several reasons. Its dominance is being challenged by geopolitical upheavals, such as the economic rise of regions like China and the European Union. These areas are growing and promoting their currencies to become more important in global trade and finance.

The United States economic sanctions have also forced other nations to look for ways to transact international commerce without using the US dollar. The necessity to prevent the direct effects of US policy on foreign economies is what spurred this change.

Consequently, to lessen their dependency on the US dollar, these nations explore and occasionally create bilateral trade deals in their own currencies or other agreed-upon currencies.

Stablecoins present an attractive option, particularly for nations subject to economic sanctions or during periods of currency volatility. Stablecoins offer a more dependable method of conducting financial transactions since they are correlated with stable assets and are less volatile than conventional cryptocurrencies.

They eliminate the need for the volatile exchange rates brought on by the dollar’s declining value, enabling nations and companies to conduct international trade while protecting their capital. This capacity is becoming more widely acknowledged as a benefit for preserving monetary sovereignty and enabling more seamless trade in a global economy less reliant on one country’s currency.

What Happens If The Dollar Collapses

The collapse of the US dollar would have a worldwide impact on international trade, inflation rates, and the stability of the world economy as a whole. The dollar is the foundation for a wide range of cross-border financial operations, including trade invoices, central bank reserves, and international markets.

A currency collapse would upset these systems, resulting in high exchange rate volatility, higher import costs, and higher interest rates on debts denominated in foreign currencies.

Significant changes in economic and geopolitical power dynamics could occur. Nations with strong dollar dependence may experience sudden financial crises and have to realign their economic strategies and renegotiate their foreign reserves.

Major economies such as the European Union, China, and emerging markets can try to make a stronger statement by positioning their currencies as substitutes for the US dollar in global trade and banking.

Various nations’ responses would probably vary depending on their current foreign reserves and economic configurations. Relative to countries highly invested in U.S. dollars, those with diversified reserves—which include currencies like the euro, Japanese yen, or Chinese renminbi—may encounter less immediate unrest.

De-dollarizing economies may quicken their pace, boosting the usage of non-traditional and alternative reserve currencies in international trade and financial assets. This change may also strengthen the influence of the Belt and Road Initiative and other regional and economic blocs like BRICS (Brazil, Russia, India, China, and South Africa) on the development of new global monetary policies.

In addition, when the dollar declines, central banks and global markets may reconsider the reserve currency position of the dollar, leading to a more multipolar currency environment.

In this scenario, entities would likely seek to stabilize their economies in the face of a new monetary system, which would likely result in a rise in borrowing rates and financial sanctions. The international community’s response would be crucial to managing the transition and maintaining a degree of financial sovereignty and economic stability.

Fast Fact

Congress enacted the Mint Act on April 2, 1792, after the ratification of the United States Constitution. This Act created the nation’s coinage system, designating the dollar as the primary unit of currency, making the United States the first nation in the world to implement a decimal currency system.

Can Stablecoins Be a Protective Measure?

Digital currencies called stablecoins, including Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), are linked to reliable assets like gold, the US dollar, or other national currencies. These digital assets offer an alternative to US dollars for conducting trade and storing value, stabilizing economies moving away from the currency. Stablecoins, in contrast to conventional cryptocurrencies, are characterized by their consistent value, supported by their ties to established assets.

Stablecoins play a critical role in aiding de-dollarization initiatives. They offer a technologically advanced alternative to the US dollar as nations and regions seek ways to strengthen their monetary sovereignty and lessen their reliance on the world reserve currency.

By removing the requirement for interbank payments in US dollars, they enable international commercial transactions, reducing costs and boosting efficiency. Because stablecoins can be held alongside conventional foreign currencies by central banks and financial institutions, this functionality helps to diversify the world’s foreign exchange reserves.

Nevertheless, numerous regulatory obstacles hinder stablecoin adoption. Regulators worldwide are closely examining them to ascertain how they will affect monetary policy, financial stability, and the current global financial system.

Risks related to credit, liquidity, and operating procedures are among the issues raised, along with the possibility of usage in illegal activity. Because of this, the road to their incorporation into the mainstream of the financial system entails negotiating intricate regulatory frameworks in several jurisdictions.

Stablecoins need well-defined regulatory frameworks that guarantee their safety, dependability, and legal compliance if they are to contribute meaningfully to global markets and play a significant role in the scenario of the collapse of the dollar.

Stablecoins will be able to offer a solid basis for financial transactions in a world where the power of existing currencies like the US dollar may wane thanks to these frameworks that will assist in managing risks and promoting user trust.

Future Prospects and Preventative Strategies

The future of the U.S. dollar as an international reserve currency is being examined more and more as the financial scene changes. The United States and other countries may need to employ a number of measures to reduce the likelihood of an American dollar collapse and preserve its role as a reserve currency.

These include expanding diplomatic ties to promote global economic cooperation, diversifying monetary reserves to encompass a wider range of currencies and assets, and implementing economic reforms to improve fiscal stability.

Simultaneously, stablecoins’ importance is growing. These organizations are investigating stablecoin integration into national and international economic frameworks. This integration may offer a more decentralized method of executing international transactions and a buffer against the volatility of traditional fiat currencies.

The emergence of stablecoins offers the US dollar both advantages and disadvantages. The increasing popularity of these digital assets may lessen the influence of established currencies, such as the US dollar, in international trade and finance.

The IMF and other international financial institutions are responsible for maintaining monetary stability. They monitor stablecoin adoption and changes in other currency use to prevent the destabilization of the world economy. They also provide standards for financial operations and oversee worldwide economic policy.

The United States may need to adjust its financial tactics to accommodate a more multipolar currency environment while preserving economic interests and global power. These adjustments may be essential to maintaining the dollar’s standing in an economy and avoiding its collapse.

Final Thoughts

The article emphasizes stablecoins’ possible growing significance in the de-dollarization process and their capacity to support financial transactions without relying on conventional reserve currencies like the US dollar. Stablecoins add to a diversification that might reshape global monetary processes as they become more widely accepted for use in reserve holdings and international trade.

When one considers the many changes that may occur in global finances, creative economic solutions will be essential. These regulations must change to reflect the growing significance of virtual currencies and the potential realignment of the US currency.

Understanding what happens when the dollar collapses is vital to finding effective tactics that guarantee stability and durability inside the international economy. This adjustment will open the door for a fair and welcoming financial system while also reducing the likelihood of future economic disruptions.

FAQ

What will happen if the dollar collapses?

To name a few, import costs will increase. The government will find it difficult to borrow money at the current rates, resulting in a budget deficit that needs to be filled by either raising taxes or expanding the money supply.

What steps is the US taking to de-dollarize?

Approximately forty nations are now subject to US sanctions. This has sparked de-dollarization efforts, motivated by concerns about the sanctions’ potential future targets. Since the end of World War II, US dollars have dominated international trade.

Does the US Dollar face threats?

A dollar collapse is regarded as unlikely. Rising inflation is the only possibility that seems likely to set off such a collapse. Some exporting countries are reluctant to see the dollar sink because of the U.S.’s importance as a trading partner.