Angi Could Be the Next Uber. Its Stock Looks Too Cheap

Jan 16, 2022

Technology has succeeded in displacing business travel, gym visits, and in-person purchasing. However, for everyone who has ever battled with a dripping faucet or an overgrown tree, the Covid period served as another reminder: Good help is scarce.

Angi (ANGI) has spent the last quarter-century attempting to resolve the issue. The firm spent the majority of that time matching homeowners with prescreened plumbers, carpenters, and landscapers via internet advertisements. It was a respectable business, but the model came to a grinding halt during the epidemic. Contractors that are overworked and facing an excessive demand have had no need to spend on advertising.

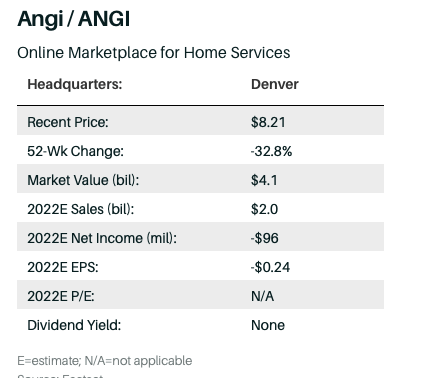

Angi's advertisements and leads business, wxhich accounts for almost three-quarters of total income, remained steady in the previous quarter, despite an increase in demand for contractors. The company's stock has fallen 33% in the last year. However, Angi is working on a remedy, and the stock suddenly appears to be a bargain in a world of expensive internet stocks.

Angi, which was formed by the merging of Angie's List and HomeAdvisor in 2017, has taken a more proactive role in the connection between homeowners and contractors. Historically, the corporation has withdrawn from the scene following an introduction, but its new Angi Services sector acts as a soup-to-nuts marketplace. Angi's platform handles all communication, scheduling, and invoicing between homeowner and contractor. Angi receives an unstated commission on each assignment.

Over 500 different services are accessible, including plumbing, landscaping, painting, roofing, renovation, housecleaning, and pest treatment. Contractors gain from assured employment at fixed prices, with Angi collecting payments. Meanwhile, homeowners may simply schedule visits online or using a smartphone application.

If this sounds like hailing an Uber or reserving a holiday rental on Airbnb, it is part of the goal.

"Owning a property is difficult," admits Angi CEO Oisin Hanrahan. "We want to meet every homeowner's need and alleviate some of their stress, while also altering the economics" for home-service providers.

While the Angi Services division is still tiny, it is already demonstrating exceptional growth, with sales increasing 160 percent year over year to $117 million in the third quarter.

There is much upward potential from there. Annually, Americans spend about $600 billion on home services. Less than 20% of those careers begin online, a percentage that is expected to grow rapidly as a new generation of digital natives joins the housing market.

Analysts estimate Angi to record revenue of $1.68 billion in 2021, a modest 15% increase over the preceding year. This trend should continue to accelerate as Angi Services gains market share and the legacy company resumes growing.

Cory Carpenter of J.P. Morgan anticipates Angi Services to account for more than 40% of the company's overall sales by 2025. He anticipates it to increase by more than 50% by 2022, compared to the advertisements and leads business's single-digit growth.

"From an investor's perspective, it checks a lot of boxes: a sizable total addressable market, low online penetration, and market leadership," says Carpenter, who rates Angi stock as a Buy.

Investors have been oblivious thus far. Angi stock is now trading at less than 1.8 times the $2.29 billion in sales that Wall Street anticipates the business will produce in 2023. This compared to an average of more than five times year-ahead revenue for Angi during the last five years. The average multiple for leading online marketplaces such as Airbnb (ABNB), Etsy (ETSY), and Uber Technologies (UBER) is 6.1.

A portion of Angi's discount is reasonable, considering the company's slower forecasted growth rate compared to rivals. In the following years, the firm intends to grow at a rate of 15% to 20% every year.

Profitability is also not foreseeable. The continuous rebranding to Angi demands significant expenditure, as does expanding Angi Services into more categories and locations. Angi is expected to lose $66 million in 2023 before making a profit in 2024. Hanrahan indicates that he is fine operating the firm at break-even for several years, putting long-term growth ahead of short-term earnings. The good news is that Angi has a low debt load and positive cash flow, implying that it should be able to self-fund expansion.

IAC/InterActiveCorp (IAC), the technological start-up holding firm managed by Barry Diller, holds about 85 percent of Angi shares.

"We believe there is an incredible chance to grow this firm into an 800-pound giant in the home services area," says Lori Keith, portfolio manager of the $8.3 billion Parnassus Mid Cap fund (PARMX), Angi's largest non-IAC stakeholder. "They must adopt a long-term view as they invest...to acquire larger scale and then see the [profit] margin inflection point down the track."

Angi does not require an Airbnb-like multiple to generate meaningful profits.

Carpenter projects a price objective of $13 on Angi shares, a 58 percent increase from the previous $8.21.

Booking home services, like numerous other aspects of the twenty-first-century business, will progressively go online. Investors must exercise patience with Angi. However, they now have a chance to enter on the bottom floor.