Metals Will Be The Oil Of The Future

The energy transition is in full swing, with electric vehicles supplanting gas guzzlers, and solar panels and wind turbines replacing coal and oil as the world’s leading energy sources. Scientists have cautioned that limiting temperature rises to 1.5 degrees Celsius will necessitate a 45 percent reduction in global emissions by 2030 and a total reduction of zero by mid-century. Nations have pledged to cease deforestation, reduce CO2 and methane emissions, and limit public investment in coal power at the present COP26 climate meeting.

The next commodities supercycle is being driven by the energy transition, with enormous opportunities for technology makers, energy traders, and investors. Indeed, BloombergNEF, a new energy research firm, forecasts that the worldwide transformation would cost $173 trillion in energy supply and infrastructure expenditure over the next three decades, with renewable energy estimated to provide 85% of our energy demands by 2050.

The metals business, on the other hand, has a promising future.

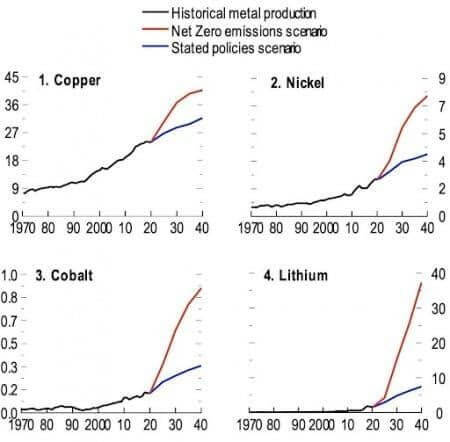

Metals are required in greater quantities in clean energy systems than in fossil fuel-based technology. According to a recent Eurasia Review analysis, in a net-zero emissions scenario, prices for copper, nickel, cobalt, and lithium could reach historical peaks for an unprecedented, sustained period, with the total value of production rising more than four-fold for the period 2021-2040, and even rivaling crude oil production.

Electric and fuel cell cars are expected to displace 21 million barrels of oil per day in demand by 2050, according to BNEF.

Source: Eurasia Review

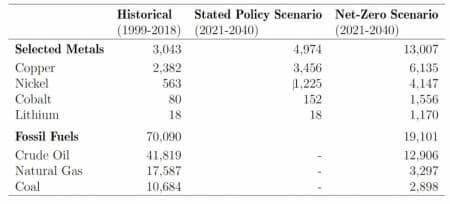

The metals demand surge might result in a more than fourfold rise in the value of metals output in the net-zero emissions scenario, totalling $13 trillion accumulated over the next two decades for the four metals alone. This might be comparable to the anticipated value of oil production in a net-zero emissions scenario over the same time span, making the four metals macro-relevant in terms of inflation, trade, and output, as well as offering huge windfalls to commodity producers.

Global output of selected energy transition metals estimated cumulative real revenue, 2021-40 (billions of 2020 US dollars)

Source: Eurasia Review

Here are the long-term outlooks for key commodities and clean energy sectors as per BNEF.

1. Solar Panels

KEY METALS AND MATERIALS: Steel, Aluminum, Polysilicon, Copper, Silver

TOP ETF: Invesco Solar Portfolio ETF (NYSEARCA:TAN)

Solar panels with a 1GW capacity require 10,252 tons of aluminum, 3,380 tons of polysilicon, and 18.5 tons of silver, according to BNEF. The solar sector is predicted to become a big user of these commodities over the next decade, with global installed solar capacity expected to double by 2025 and quadruple to 3,000 GW by 2030.

An unexpected boost in demand for solar panels from late 2020, owing to the Biden administration's and China's revised carbon obligations, has caused a spike in the price of polysilicon, disrupting the decade-long downward trend in solar installation prices. According to new research from the Solar Energy Industries Association and Wood Mackenzie, the U.S. solar sector has been plagued by supply chain bottlenecks and rising raw materials costs, with solar prices growing Q/Q and Y/Y in Q2 across all market segments. Since Wood Mackenzie began tracking prices in 2014, this is the first time that residential, commercial, and utility solar costs have all climbed at the same time. The most severe cost constraints were caused by increased raw material costs, such as steel and aluminum.

Several new polysilicon factories are now under construction, largely in China, and are projected to fill a portion of the supply shortfall. However, the existing gap is a strong indication that, as the decarbonization and electrification push continues, much more has to be done.

Fortunately, according to BNEF analyst Yali Jiang, basic polysilicon shortages are unlikely to become a long-term issue because pricing usually drives greater capacity. Since these metals are exposed to the larger commodities market, BNEF is more worried about other auxiliary materials used in solar panel manufacture and installation that involve silver, aluminum, and steel, among other metals.

2. Wind Turbines

KEY METALS AND MATERIALS: Concrete, Steel, Glass Fiber Reinforced Plastic, Electronic Scrap, Copper, Aluminum, Carbon Fiber Reinforced Polymers

TOP ETF: First Trust Global Wind Energy ETF (NYSEARCA:FAN)

According to BNEF estimates, it takes 154,352 tons of steel, 2,866 tons of copper, and 387 tons of aluminum to build a gigawatt of wind turbines and infrastructure. According to the Global Wind Energy Outlook (GWEO), installed wind capacity will reach 2,110GW by 2030, indicating an 185 percent increase in that span.

According to the Global Wind Energy Council, mounting cost constraints are beginning to significantly effect the rollout of wind projects, which, along with the expiration of key subsidies in China, is projected to result in record capacity additions plummeting.

Indeed, Vestas Wind Systems A/S (OTCPK:VWDRY), one of the world's largest turbine manufacturers with a 31% market share, recently lowered its projection for the remainder of 2021, citing increased raw material prices and supply chain disruptions as reasons. Vestas cut its full-year sales guide to €15.5 billion to €16.5 billion in August, down from €16 billion to €17 billion before, and its targeted EBIT margin to 5% -7 percent from 6 percent -8 percent previously.

Steel prices have risen in the United States this year and have also grown in China and Europe, accounting for a large portion of the growing expenses.

However, the long-term picture is positive, with BNEF predicting that capacity additions would rebound and reach a rate of 129 gigawatts per year by 2030.

"Commodity inflation has arrived. Beyond the next 12 months, the focus now shifts to determining if the projects can and will be built, as well as the cost.” Vestas Wind's CEO, Henrik Andersen, has posed.

3. Lithium-Ion Batteries

KEY METALS AND MATERIALS: Copper, Aluminum, Lithium (LCE), Nickel, Cobalt, Manganese

TOP ETF: Global X Lithium & Battery Tech ETF (NYSEARCA:LIT)

The forecast for lithium-ion batteries is arguably the most optimistic of all.

This is due to the fast adoption of electric vehicles (EVs), as well as utilities' increased investment in utility-scale battery storage units (one megawatt (MW) or higher power capacity) as battery costs continue to plummet. According to a recent Pew Research Center poll, 7% of individuals in the United States own an electric or hybrid car, and 39% say they are "very likely" or "somewhat likely" to seriously consider buying one when they next shop for a vehicle.

Between 2010 and 2020, lithium-ion battery pack prices dropped 89 percent, with the volume-weighted average reaching $137/kWh—$100/KWh is considered the Holy Grail for EVs to attain cost parity with ICEs.

NextEra Energy (NYSE:NEE) announced intentions to develop a 409-MW energy storage facility in Florida fueled by utility-scale solar in 2019.

In the state of Colorado, Xcel Energy (NASDAQ: XEL) aims to replace its Comanche coal units with a $2.5 billion investment in renewables and battery storage, comprising 707 megawatts (MW) of solar PV, 1,131 MW of wind, and 275 MW of battery storage.

Duke Energy (NYSE: DUK) announced intentions to create an energy storage project at the Anderson Civic Center in Anderson, South Carolina, involving $500 million in battery storage installations with a 300 MW capacity.

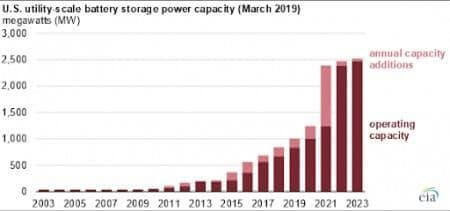

From 2014 (214 MW) to March 2019 (899 MW), operating utility-scale battery storage power capacity in the United States more than tripled, according to the EIA. According to the group, utility-scale battery storage power capacity may reach 2,500 MW by 2023, an increase of 180 percent, provided that presently planned additions are completed and no current running capacity is decommissioned.

According to UBS, the energy storage industry in the United States might rise to $426 billion in the next decade.

As the clean energy movement gathers traction, a number of energy specialists, including UBS, BloombergNEF, S&P Market Intelligence, and Wood Mackenzie, are exceedingly optimistic about the battery storage industry's prospects, both in the short and long term.

Source: EIA

1GWh Li-ion batteries require 1,731 tons of copper, 1,202 tons of aluminum, and 729 tons of lithium, according to BNEF.

According to BNEF's June study, lithium supply will likely remain tight until 2022 as demand from the battery sector grows. However, unlike solar and wind, where critical shortages are projected to be more fleeting, BNEF predicts that lithium hydroxide, the ingredient used in premium Li-ion batteries, would be in limited supply by 2027.

To make matters worse, the battery industry's capacity to keep up with the EV surge is already being jeopardized by the scarcity of other battery materials. All main battery metals have witnessed price rises since mid-2020, with lithium chemistry and copper foil, in particular, being a source of worry.

Battery components nickel and manganese, according to Kwasi Ampofo, head of metals and mining at BNEF, might face some of the most severe shortages later this decade due to a lack of capacity to convert those metals into specialty chemicals.

According to Lei Zhang, CEO of Envision Group, the battery supply chain, particularly on the raw material side, requires additional investment, including in new lithium and nickel mines.

Price fluctuations are a key source of worry in the battery industry, since increased costs may deter EV adoption.

4. EV Chargers

KEY METALS AND MATERIALS: Copper

TOP ETF: Global X Autonomous & Electric Vehicles ETF (NYSEARCA: DRIV)

Rising demand for EV fast-charging infrastructure, government initiatives to drive the adoption of EVs and associated infrastructure, increasing deployment of EVs by shared mobility operators, and rising prevalence of range anxiety are all contributing to the overall growth of the EV charging stations market.

According to BloombergNEF estimates, a single rapid public electric car charger requires 25 kilograms of copper, whereas a smaller charger for use at home requires roughly 2 kilos. That may not sound like much, but considering that worldwide charge points are predicted to grow from 1.3 million units in 2020 to 30.8 million units by 2027, a CAGR of over 50%, it might be considerable.

President Biden of the United States has vowed to install 500,000 additional charging stations around the country by 2030. China, which has the majority of the world's public chargers, is rapidly expanding its network, while companies like Tesla Inc. (NASDAQ: TSLA) and BP Plc (NYSE: BP) have made significant investments.

Last year, the number of public charging stations installed along roads, in fleet depots, and in grocery store parking lots increased by more than a third, bringing the global total to 1.36 million. According to BNEF, charger installations will significantly increase, reaching 309 million connections by 2040, when the sector's annual expenditure would exceed $590 billion.

Tritium, the world's second-largest manufacturer of fast charging equipment, claims that charging stations are already underpricing challenges due to increased copper costs.

Raw material shortages are a major concern for EV charging infrastructure, and growing material costs might stymie rollouts.