Oil Stocks Have Risen. Don’t Go After The Rebound.

July 21, 2023

Energy equities have risen dramatically in the last week or so. If you want to play, go in with your eyes wide open.

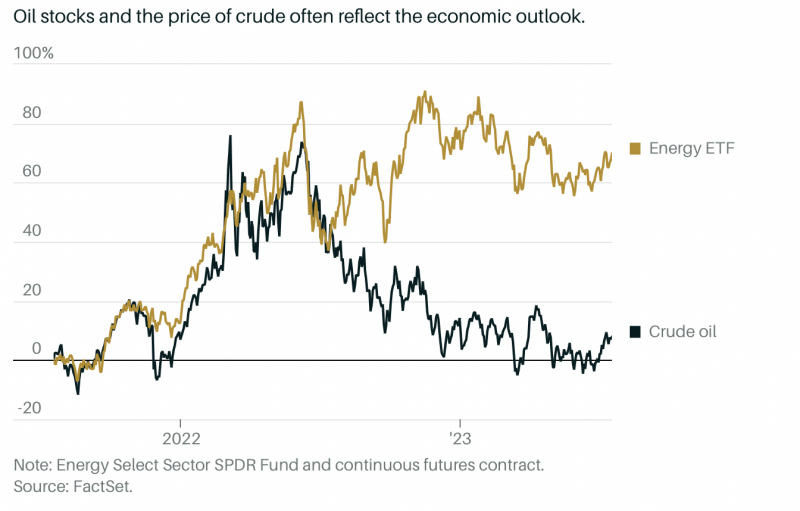

The sketch is simple to grasp. After all, the Energy Select Sector SPDR Fund (XLE), whose top holdings include Chevron (CVX) and Exxon Mobil (XOM), more than quadrupled from its Covid-era low to its peak last year — from $25 to $93. A drop aided gains in global oil supplies.

And the fund has kept its pricing around the high $60s to low $70s over the past year. One major reason is that purchasers understand the Federal Reserve is gradually lowering inflation, which more than likely suggests the end – or at least a meaningful halt – in rate rises is on the way.

According to the hypothesis, a healthy economy promotes oil prices and oil stocks. Even optimism about the future leads to rises. The benchmark for the US market, West Texas Intermediate, has risen to $76 a barrel from around $67.50 in late June. This 12% increase has pushed the fund up approximately 5%, from $79 to roughly $83.

But don’t expect the profits to keep coming in. Because of the long-term effect of the Fed’s increased rates on economic demand. The futures market predicts a price reduction to the mid-$60s by 2025.

This bearish forecast is dragging on oil stocks. Investors just do not want to bid up stock prices to reflect a long-term high oil price. Normally, stock prices climb quicker than crude prices because higher prices increase oil sales, which leads to better profits due to producers’ fixed expenses.

The equities have now traded with enough weakness that their technical patterns appear concerning.

According to FactSet, the fund has been trading below its 200-day moving average of $84.50 since early May. To say it another way, stock prices aren’t keeping up with their long-run norms, implying that investors are losing faith.

The reduced prices offer a purchasing opportunity for anyone bullish on the price of oil. However, the drop in oil stocks implies that expectations for cheaper crude must adjust.

And if the cloud over oil prices does not lift, the stock market has only begun to deteriorate. A fair dose of skepticism makes even more sense.