Stocks Finish Higher, Bonds Extend Fed-Driven Selloff

Apr 07, 2022

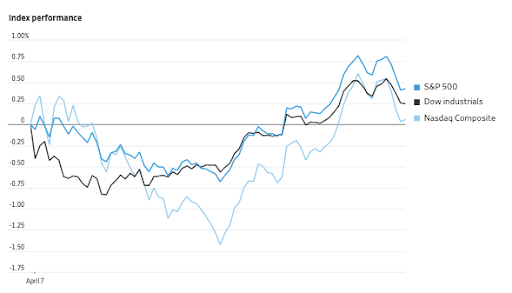

S&P 500 Recovers Early Losses; Nasdaq, Dow Industrials also Rally.

As investors absorbed the likelihood of more aggressive monetary tightening by the Federal Reserve, U.S. equities surged and the yield on the 10-year U.S. Treasury note reached a three-year high.

Stocks, which had dipped earlier in the week, rebounded Thursday afternoon after falling earlier in the day. The Dow Jones Industrial Average jumped 87.06 points, or 0.25 percent, to 34583.57, the S&P 500 gained 19.06 points, or 0.4 percent, to 4500.21, and the Nasdaq Composite increased 8.48 points, or 0.1 percent, to 13897.30.

The yield on the 10-year U.S. Treasury note traded at 2.654 percent in Treasury markets, up from 2.606 percent on Wednesday. This is the highest it has been since March 6, 2019. As prices decrease, yields climb.

According to Asbury Research analyst John Kosar, the afternoon rise was "tactical," rather than sparked by particular news. He pointed out that the S&P 500 and the CBOE's Volatility Index both reached crucial technical levels after noon and reversed at the same time.

"Sometimes the money moves first, the market changes second, and then the headline," Mr. Kosar explained. What happens in the next few days will tell investors if this was a true reversal or just a temporary reprieve, he added.

The surge on Thursday ended a two-day selloff fueled by fears over Fed policies. On Tuesday, Fed governor Lael Brainard — a vocal opponent of prematurely withdrawing stimulus last year — shook markets by saying the central bank was committed to taking actions to decrease inflation this year.

After a long debate, it was decided to raise interest rates by half a percentage point rather than a quarter point on Wednesday.

Federal Reserve Bank of St. Louis President James Bullard said he and his colleagues must act boldly and decisively to raise rates to a level that can handle and stop rising prices.The president shared his views with reporters Thursday.

According to specialists, individuals who were the last to sell their assets in recent days, realized that the Federal Reserve is changing its actions and policies, which certainly did not play into their hands.

"It's almost as if the market got a sudden insight that the Fed is tightening," said Barry Bannister, equity strategist at Stifel.

Prior to this week, the US stock market had been on a tear, helping indices recoup many of the losses suffered in 2022. The recovery, which began in mid-March, appeared to resist obstacles such as the Ukraine crisis, growing Covid-19 cases in China, and soaring inflation, which threatens to exacerbate supply-chain snarls. Even after dropping 2.2 percent in the previous two sessions, the S&P 500 was down only 6 percent for 2022, according to Wednesday's closing prices, a significant improvement from its more than 12 percent loss at the year's low.

Some investors just did not trust the Fed would act forcefully, according to Thomas Kee, editor of the Stock Traders Daily newsletter. "It was the similar type of thinking from previously that [the Fed] will never affect the market," he explained.

However, he added that he didn't think the selloff would go much lower and that markets will recover. "Markets forget quickly," he remarked.

According to analysts, the recent stabilization of some commodity prices has supported the stock market. Crude oil in the United States declined 0.2 percent to $96.03 a barrel on Thursday. This is somewhat higher than before Russia's invasion of Ukraine, but it is still much lower than the almost $130 price achieved last month.

Based on new data released this week, claims for people out of work fell to their lowest level in nearly 55 years.

Despite experts who said there would be 199,000+ new claims the previous week which is an indication of layoffs, there were almost 167,000, which is incomparably considered a good number.

Beginning next week there will be a string of reports for the first four months. Many experts believe the event will have a big impact on the stock market as a whole.The S&P 500 earnings are projected to rise 4.5 percent for the year.

Individual stocks soared 15 percent, or $5.15, to $40.06 after Berkshire Hathaway said Wednesday it now owns more than 11 percent of the computer and computer supplies company.

Banks are especially susceptible to inflation and monetary policy; on Thursday, financials were among the S&P 500's early losses, but rebounded late. The KBW Nasdaq Bank Index fell 0.7 percent for the seventh consecutive day, marking its worst losing streak since 2018. Bank of America declined for the ninth time in a row.

Twitter slumped 5.4 percent, or $2.74, to $48.03 as investors digested the ramifications of Tesla CEO Elon Musk's ownership in the social-media business and nomination to its board.

The pan-European Stoxx Europe 600 index fell 0.2 percent in Europe. The DAX index in Germany fell 0.5 percent.

Indexes in Asia declined too. The Hang Seng Index in Hong Kong plummeted 1.2 percent, while the Shanghai Composite Index in mainland China fell 1.4 percent. The Nikkei 225 in Japan fell 1.7 percent.