Even Though It Sounds Absurd, The Stock Market Is in a Rally Mood.

Feb 06, 2023

What a difference a little sentence can make.

The stock market soared after Federal Reserve Chairman Jerome Powell said that "the disinflationary process has started" during a news conference on Wednesday. Investors had already priced in a lower peak for the federal funds rate and higher chances of rate reduction in the second half of 2023. The rise was unaffected even by Big Tech companies' underwhelming earnings results and a strong employment report released on Friday.

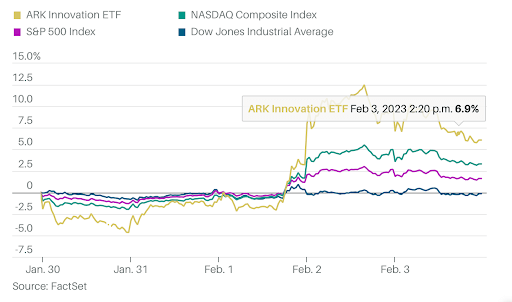

The S&P 500 (SPX) gained 1.6% for the week, while the Dow Jones Industrial Average (DJIA) lost 0.2%. However, the Nasdaq Composite (COMP) outperformed them all with a 3.3% gain. With a growth of about 20% since its low on December 28, it is about to enter a bull market.

The jobs figures proved that, no matter how hard you squint, it's difficult to see a recession. The data on Friday morning revealed that the United States gained 517,000 seasonally adjusted nonfarm payrolls in January, more than double the employment growth predicted by economists. The unemployment rate is at a nearly 54-year low of 3.4%. Despite this, average hourly salaries climbed by 4.4% year on year, a slower rate than the 4.8% growth seen through December. That's an encouraging indicator that salary growth may halt without causing widespread job losses — or a recession.

There is still a significant disconnect in the market's rationale. If the job market and the economy remain stable, the Fed is unlikely to decrease interest rates in the second half of 2023, as futures pricing suggests. It may take a significant worsening in economic indicators to compel the central bank to intervene. In other words, it's difficult to envisage a scenario other than higher rates for longer, raising bond yields and putting pressure on stock valuations, or growth falling short, pulling down earnings.

Don't tell that to the market. All it sees now is softening financial conditions, an economy in good shape, and moderate inflation. So much so that the rally throughout the year has been driven solely by optimism in the form of rising valuation multiples. The S&P 500 price/earnings ratio is up 8% this year, even though earnings expectations are down 1%. The mood is clearly risky, and then some: Small-cap stocks are outperforming large-cap stocks, and growth is outpacing value. The ARK Innovation Exchange-traded fund (ARKK) is up 42% in 2023.

Market Snapshot

Evan Brown, head of multi-asset strategies at UBS Asset Management, advises investors to become more selective. He predicts that the world economy is more likely to barely keep afloat than to grow quickly. He predicts there will be no recession in 2023, citing an active U.S. labor market, improved economic conditions in China and Europe, and the fact that American consumers and companies are less sensitive to interest rates than they were a decade ago.

In the coming months, Brown predicts the Fed will stop raising rates and hold them higher for longer. This should limit the P/E ratio for the S&P 500 and favor value-oriented stocks. Brown's overall assessment is neither completely bullish nor pessimistic, at least as far as the index level is concerned. "You're better off picking your spots," he says. Anywhere they might be.