Everything You Need to Know About Nvidia’s Recent 10-for-1 Stock Split

Jul 15, 2024

The field of AI investing has broadened significantly in the last two years. Ever since OpenAI released its first NLP-based ChatGPT, the AI investment industry has established itself as a frontrunner in terms of growth and yearly returns. Arguably, Nvidia has benefitted from the AI emergence, unlike any other company, by making hardware solutions for AI startups across the globe.

Today, Nvidia has a staggering valuation of $3.04 trillion and climbs the market capitalization rankings each quarter. To sustain their nearly unprecedented growth, Nvidia’s founders have decided to execute a 10-for-1 share split. In this piece, we will explain Nvidia’s stock decision and analyze its effects on the market and your investments!

Key Takeaways:

- Nvidia has recently conducted its 10-for-1 share split.

- Stock splits were conducted to increase liquidity and prepare for the future appreciation of singular stock assets.

- Nvidia’s stock split decision underscores the company’s confidence in its long-term future growth.

Understanding the Basics of a Stock Split

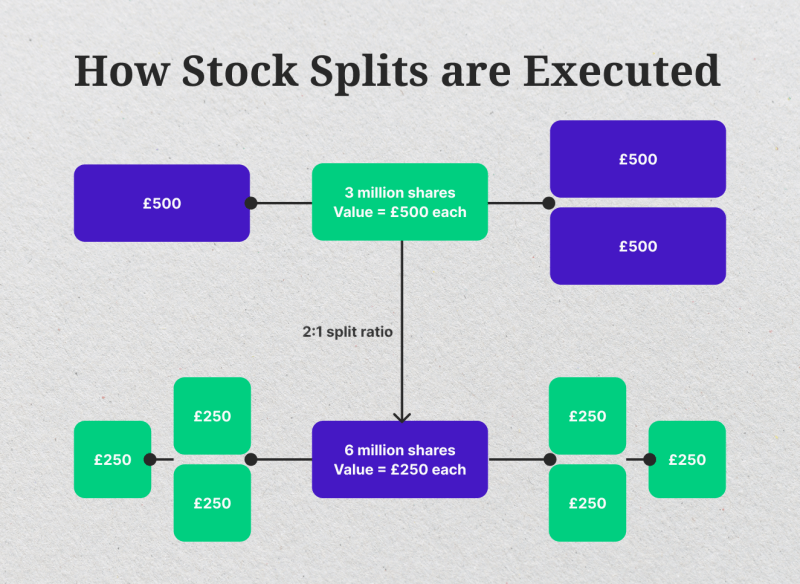

Imagine you own a delicious pie, and you decide to share it with more friends. A stock split is like cutting that pie into more slices. In the financial world, a stock split is a corporate action where a company divides its existing outstanding shares into a multiple number of new shares.

There’s a key point to remember here: the total value of the pie (the company’s market cap) remains exactly the same. It’s simply being divided among a larger number of slices (shares). Let’s say a company has a stock price of $100 per share and decides on a 2-for-1 split. After the split, each shareholder will receive two new shares for every share they previously owned.

The price of each individual share will then adjust to $50 to reflect the increased number of shares. This doesn’t change the company’s overall value; it just makes the stock more accessible to retail investors by lowering the price per share.

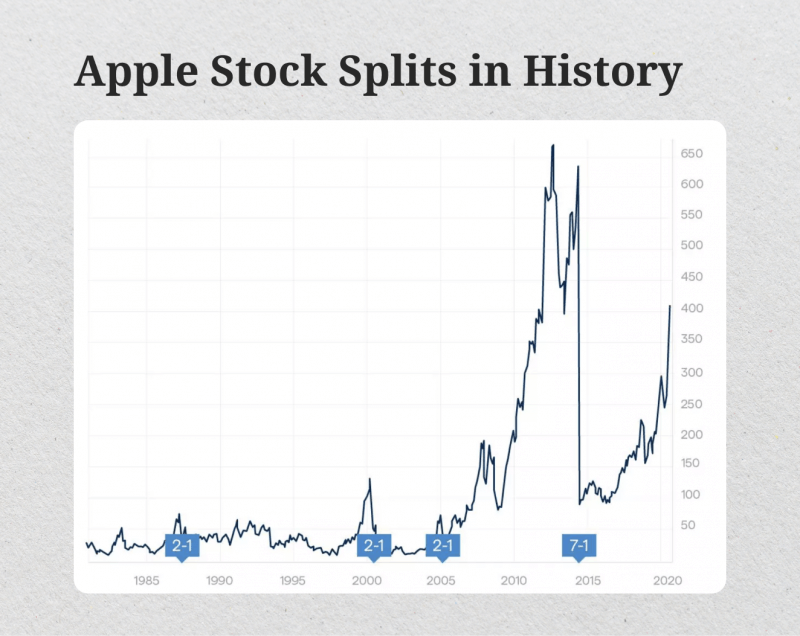

Stock Splits in History

Stock splits are a well-established practice dating back to the early 1900s. Companies like Apple and Google have utilized splits throughout their histories to keep their share prices within a range that is attractive to a broader investor base. Historically, stock splits haven’t necessarily guaranteed a surge in stock prices, although they can lead to increased trading volume and liquidity. So, companies split stock for two major reasons – acquiring more liquidity and setting themselves up for long-term growth.

While some investors might view splits as a bullish signal due to the perceived ease of entry, it’s crucial to remember that past performance is not indicative of future results. Focus on the company’s fundamentals, such as its financial health, product roadmap, and competitive landscape, to make informed long-term investment decisions. Stock splits are a financial maneuver, and a company’s long-term prospects are what truly drive sustainable share price growth.

Breaking Down Nvidia’s 10-for-1 Split

In Nvidia’s case, they’ve conducted a 10-for-1 stock split. This means investors received ten new shares for every single share they owned after Nvidia’s stock split was executed.

The total value of investments in Nvidia has remained exactly the same, but investors now own ten times the number of shares. This has made the stock more appealing to individual investors who might have been hesitant to invest due to the higher pre-split price point.

The Reasons Behind Nvidia Stock Split Decision

There can be several factors influencing a company’s decision to enact a stock split. A high share price can sometimes create a psychological barrier for individual investors. By making the stock more affordable through a split, Nvidia might aim to attract a wider range of investors and increase trading activity.

This broader investor base can potentially lead to a more stable and liquid stock, which can benefit the company in the long run. Additionally, a split can enhance the stock’s liquidity, making it easier for investors to buy stock or sell their owned shares. This increased liquidity can also make the stock more attractive to institutional investors who manage large portfolios.

Does the Split Change the Fundamentals?

It’s critical to understand that a stock split does not change the underlying value or financial health of the company. The total value of all outstanding shares remains constant. The split simply increases the number of shares and adjusts the price per share proportionately.

There’s no dilution of stock ownership or company assets. Think again about the pie analogy – while you have more slices now, the overall size and deliciousness of the pie remain the same.

Short-Term vs. Long-Term Impact on Investors

In the short term, a stock split can sometimes lead to a temporary increase in trading volume due to heightened investor interest surrounding the event.

However, the long-term impact on the stock price depends on the company’s overall performance and future prospects. Investors should focus on factors like Nvidia’s financial health, product roadmap, and market position to make informed investment decisions.

A strong track record of innovation, a healthy balance sheet, and a dominant position in a growing market are all indicators that can influence a stock’s long-term trajectory. The split itself is a financial tool and shouldn’t be the sole reason for an investment decision.

What Happened After the Split for the Nvidia Stocks?

After the split, Nvidia stock is traded under a new ticker symbol with a “D” appended to it, indicating a post-split stock. The trading price per share has been adjusted, reflecting the 10-for-1 ratio. For instance, if the pre-split price were $200, the post-split price would be around $20.

The stock has then resumed regular trading on the stock exchange. Investors should be aware of this change in the ticker symbol to avoid any confusion when monitoring their holdings or placing trades.

Final Thoughts: A Split is a Tool, Not a Guarantee

Nvidia stock split has been a strategic move aimed at making the stock more accessible to a wider range of investors and potentially increasing liquidity. While the Nvidia split itself doesn’t affect the company’s underlying value or end-of-day prices for the foreseeable future, it can be a signal of management’s confidence in the company’s future prospects.

However, investors should remember that a stock split is a financial tool, not a guarantee of future stock price growth. Focus on the company’s fundamentals, industry trends, and your own investment goals to make informed decisions about buying, selling, or holding Nvidia stock. Alternatively, you can obtain stock advisor service to receive premier insights regarding Nvidia and other stocks mentioned in the top ranks for DOW.