Homebuyer Sentiment Plummets To Lowest Level Since May 2020

Feb 07, 2022

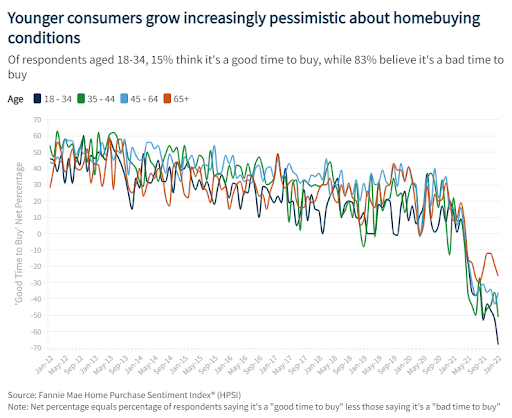

According to recent numbers assessing homebuyers' confidence, a record low proportion of Americans say that now is a good time to acquire a house, as affordability constraints limit options for young purchasers.

Only one out of every four survey participants on Fannie Mae's Home Purchase Sentiment Score, issued Monday, said it's a great time to buy a house, with the total index sliding 2.4 points to 71.8 in January. This is the weakest figure since May 2020, and it is down 5.9 points from the comparable period of 2021.

The precipitous dip in January indicates rising worries among both sellers and buyers, especially among younger individuals. Generally, four of the six index components fell, with the house sale and purchase circumstances, employment instability worries, and mortgage rate forecast falling the most.

"Younger customers, more than any other group, anticipate house prices to climb even more, and they also indicated a larger feeling of economic hopelessness," stated Doug Duncan, Fannie Mae's chief analyst. "While younger interviewees are normally the most hopeful about their future money, their feeling of confidence about their own financial condition has decreased in January."

Housing sentiment drifted lower among younger respondents, as many feel the pressure of tightening affordability and rising mortgage rates.

Buyers have ample right to be concerned. Mortgage rates are currently growing as more than 45 million younger generations approach their peak first-time house purchasing ages of 26 to 35, on top of soaring property prices and restricted property supply, which have been putting pressure on house accessibility for some time.

"All of this leads back to the present scarcity of cheap property securities," Duncan noted, "since millennials seem to be experiencing it very intensely and, without an increase in supply, their property ownership ambitions may be postponed."

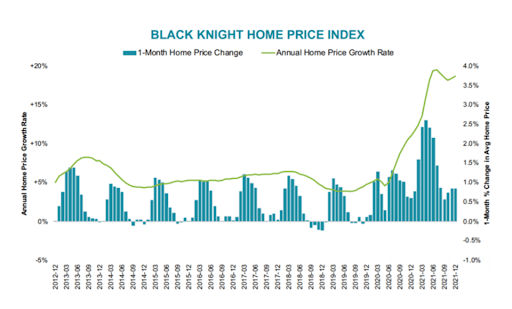

As Black Knight data showed, buyers of houses are experiencing serious housing scarcity, with the United States seeing a shortfall of between 500,000 and 750,000 active listings contrasted to December 2017-2019 inventory levels.

Furthermore, low inventory levels spurred house price increase in late 2021 and early 2021, with the average house price climbing by an unprecedented 0.84% in January.

This has increased the monthly housing costs for first-time purchasers. For example, the monthly principal and interest payment to buy the average house with 20% down hit a record peak of $1,454, according to Black Knight, up to $350 or 32% from a year earlier.

According to Black Knight, it currently takes 25.8% of the typical family wage to pay on a 30-year mortgage, up from 22.4% at the end of Q3 2021.

"Interest rate increases over the last week have swiftly driven us above the long-term, pre-Great Recession average payment-to-income ratio of 25%," remarked Ben Graboske, Black Knight's data, and analytics president. "Right to the lowest levels of availability since 2008."

According to Optimal Blue's rate lock data, homeowners are spending more in points to counteract current rate increases, further narrowing accessibility for prospective homebuyers, said Graboske.

Mortgage rates recently stopped after hitting a 22-month peak in January. Even though the 30-year fixed mortgage rate stayed unchanged last week at 3.55%, this may not last long.

Unexpectedly outstanding job numbers released on Friday revealed almost 500,000 new payroll positions in January, indicating that the central bank may speed preparations to increase interest rates to fight inflation, which is at a 40-year peak.

Consequently, the 10-year Treasury yield, which is often used to follow fixed mortgage rates, increased.

"The 10-year Treasury bond yield is at its greatest level since the outbreak, at 1.9%," noted Lawrence Yun, chief economist for the National Association of Realtors. "Mortgage rates will rise in lockstep with inflation."