Inflation is Here to Stay. What the Fed’s Preference Indicator Is Likely to Show.

May 26, 2023

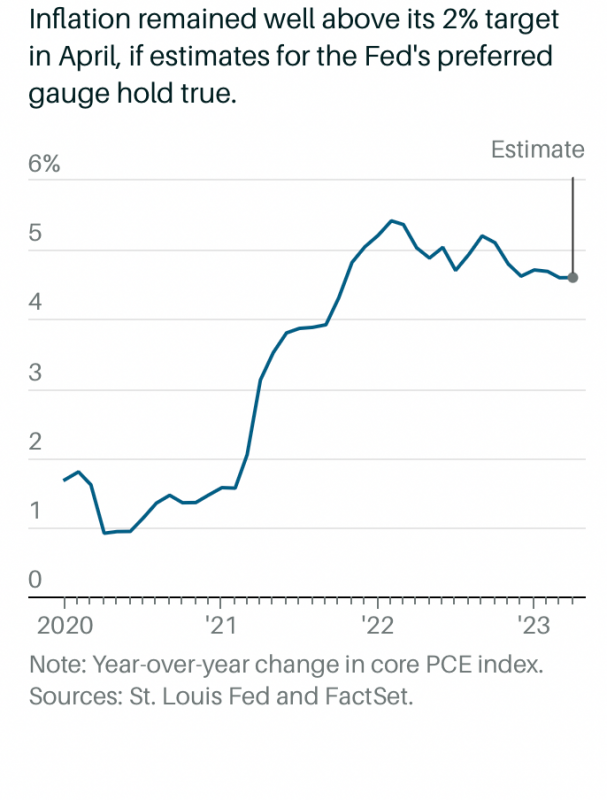

The Federal Reserve’s favored inflation gauge likely indicates that prices rose 0.3% month on month in April.

According to experts polled by FactSet, the government’s personal consumption expenditures price index, which is set to be announced Friday morning, inflation increased on an annual basis as well, climbing to 4.3% from 4.2% in March.

Economists estimate that core PCE, which includes the more volatile food and energy sectors, would rise 0.3% from March to April but remain flat annually at 4.6%. Core statistics are regarded to offer a more accurate view of inflation’s path.

If economists’ projections are true, April’s PCE measure will bring little meaningful respite to Fed officials, who agreed that inflation is persistent “too high,” according to the minutes of the Fed’s May 2-3 policy meeting, which were released Wednesday.

Several officials expressed concern that the central bank’s progress in restoring inflation to the Fed’s 2% annual objective might be “unacceptably slow.” This signals that at least some Federal Open Market Committee members may advocate for more rate rises during their meeting on June 13-14.

However, committee members are divided on how much additional policy tightening “may be appropriate” as the Fed weighs reining in inflation against recent financial turmoil and weaker economic growth.

The Bureau of Economic Analysis updated the first-quarter GDP growth rate upward, stating that GDP rose at an annual rate of 1.3% in the period. This is lower than what experts consider the optimal GDP growth rate of 2% to 3% but greater than analysts’ projections of 1.1% growth.

“Growth is slowing as the drag from higher interest rates continues to accumulate,” wrote Gus Faucher, PNC’s chief economist.

Rising mortgage rates have already caused a considerable contraction in the housing sector, while declining corporate earnings are a drag on company investment, according to Faucher. Nonetheless, the labor market is healthy, which has aided consumer spending growth.

Although headline and core PCE are likely to stay relatively stable, the previously published consumer price index fell for the 10th month in a row in April, despite increased gas costs. However, similar to PCE estimates, April’s CPI indicated somewhat greater inflation, with headline prices rising 0.4%, up from 0.1% in March. In April, the core CPI increased by 0.4% month on month.

Fed policymakers favor the Bureau of Labor Statistics’ PCE inflation gauge, which measures direct and indirect purchases by all U.S. families and charities since it has proven to be more constant over time than CPI. The CPI gathers information from urban consumers.

Furthermore, the CPI places a greater emphasis on shelter expenses, such as rent and the owner’s equivalent rent, which has led to higher inflation readings in recent months due to rising housing costs.

Economists anticipate that Friday’s PCE data will play a substantial role in the Fed’s decision on whether to stop or continue rate rises. “What happens next will be determined by data and events such as inflation, jobs, the debt ceiling showdown, and the state of the banking sector and its impact on credit flow,” writes James Knightley, ING’s senior international economist.

The PCE’s “super core” statistics, computed by deducting housing rentals from the core PCE, will most likely be emphasized. In March, it increased by only 0.24% month on month.

But, as Clayton Allison, portfolio manager at Prime Capital Investment Advisors, points out, that supercore rating isn’t perfect. “When housing rents are removed, the gauge is left with more volatile components like airfare and hotel prices, which may have seen growth over the past month due to resilient consumer spending and a still robust labor market,” Allison explained, adding that stickier areas with rising costs, such as healthcare services, are also given higher weights.

At the June FOMC meeting, authorities are expected to “skip” an interest-rate rise, according to Knightley. Currently, tougher lending conditions are regarded to be doing the Fed’s job for it, and more rate hikes aren’t required, according to Knightley. However, he highlighted that some Fed officials want to see concrete proof that inflation would return to 2%.

“The Fed has repeatedly said they will be data dependent when making their decisions, so if the data come in hot on Friday, I’d expect committee members to continue their hawkish rhetoric and the odds of a pause to decline,” Allison said.

The PCE figures for April will be announced on Friday at 8:30 a.m.