Is Tesla’s Ride a Blueprint for Emotional Investing?

May 15, 2024

In the world of finance, emotions often play a significant role in investment decisions. Investors can be swayed by feelings of fear, greed, excitement, or even admiration for charismatic leaders like Elon Musk. Tesla, the electric vehicle pioneer led by Musk, provides a compelling case study in emotional investing.

Tesla has captured the imagination of investors and the public alike with its groundbreaking electric vehicles, ambitious goals for sustainable energy, and the visionary leadership of Elon Musk. Musk’s larger-than-life persona, along with his bold promises and audacious projects, has cultivated a devoted following among investors.

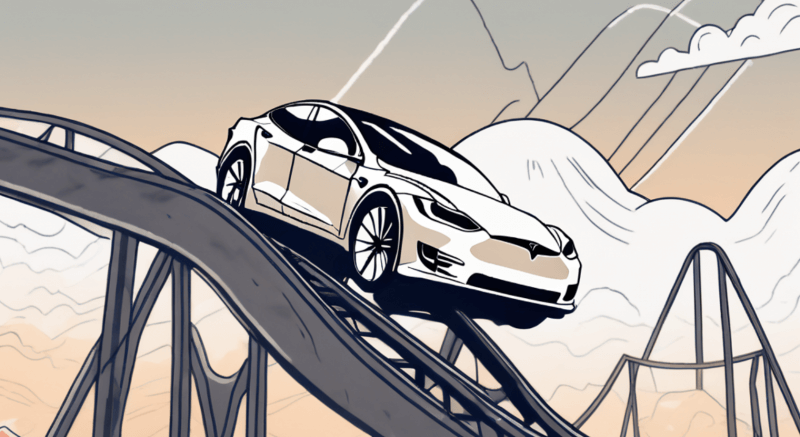

Tesla’s stock price has experienced extreme volatility, reflecting the swings in investor sentiment. The rollercoaster ride of Tesla’s stock is a testament to the power of emotions in financial markets. Investors have often reacted impulsively to Musk’s tweets, product announcements, or news about the company, driving sharp movements in the stock price.

Understanding Emotional Investing

Emotional investing is characterized by making investment decisions based on feelings rather than sound financial analysis. It is a departure from rational investing, where decisions are driven by objective data, market trends, and fundamental analysis. Emotional investing can be fueled by fear, excitement, greed, or other intense emotions that override logical thinking.

Investors who fall prey to emotional investing often find themselves buying high and selling low, a detrimental cycle that can erode wealth over time. The allure of quick profits or the fear of missing out on a hot trend can cloud judgment and lead to impulsive actions that are not in line with a well-thought-out investment strategy.

The Psychology Behind Emotional Investing

Emotional investing is deeply rooted in human psychology. Our evolutionary instincts, coupled with cognitive biases, contribute to this behaviour. Fear of missing out (FOMO) and the herd mentality are common psychological drivers that cause investors to make impulsive decisions without thoroughly evaluating the risks and rewards.

Furthermore, the emotional rollercoaster of investing can be exacerbated by external factors such as media hype, social influence, and the constant noise of the financial markets. These external stimuli can amplify emotional responses and lead to irrational decision-making, creating a feedback loop that reinforces emotional investing tendencies.

Emotional vs Rational Investing: Key Differences

There are several key differences between emotional and rational investing. Emotional investors tend to make decisions based on short-term market fluctuations and noise, while rational investors focus on long-term goals and the intrinsic value of a company. Emotional investors may also be more prone to panic-selling during market downturns, while rational investors see such periods as opportunities to buy undervalued assets.

Rational investors often follow a disciplined approach to investing, conducting thorough research, diversifying their portfolios, and sticking to a well-defined investment plan. They understand the importance of staying focused on long-term objectives and not being swayed by short-term market volatility or emotional impulses. By maintaining a rational mindset and avoiding emotional pitfalls, investors can increase their chances of achieving their financial goals over time.

Tesla’s Journey: A Case of Emotional Investing?

Tesla’s market performance over the years provides a compelling case study for emotional investing. The company’s stock price has experienced wild swings, often detached from traditional financial metrics. Retail investors, in particular, have shown immense enthusiasm for Tesla, driven by their belief in the potential of electric vehicles and the charismatic leadership of Elon Musk.

The sentiment surrounding Tesla’s stock has often been driven by emotions rather than traditional valuation factors. Hype generated by social media, Elon Musk’s influential tweets, and the aspirational image of Tesla as a pioneer in sustainable transportation have all contributed to the company’s stock price being influenced by investor sentiment to an exceptional degree.

Musk’s Impact: How His Actions Move Markets

Musk’s Tweets

Musk’s tweets have had a significant impact on Tesla’s stock price. For instance, in August 2018, when he tweeted about potentially taking Tesla private and claimed funding was secured, the stock price surged. However, it later emerged that funding was not secured, leading to volatility.

Product Announcements

Product unveilings, like the Cybertruck in November 2019, have also affected Tesla’s stock price. Musk’s presentation and bold claims about the truck’s capabilities led to a spike in stock price.

Legal and Regulatory Issues

Musk’s legal battles, such as the SEC settlement over his tweets about taking Tesla private, have caused fluctuations in the stock price due to uncertainty about their impact on Tesla’s leadership and operations.

Production Milestones and Delivery Numbers

Tesla’s quarterly production and delivery updates influence investor sentiment. Positive news tends to boost confidence, while setbacks can lead to downward pressure on the stock.

Personal Actions

Musk’s personal actions, like selling billions of dollars worth of Tesla shares in 2021, have sparked speculation about his confidence in the company’s future and contributed to short-term volatility.

Risks and Rewards of Emotional Investing

While emotional investing in Tesla can yield significant rewards, it also carries inherent risks. Understanding these risks is essential for investors considering this investment approach. Emotional investing can lead to impulsive decision-making and increased portfolio volatility. Investors may find themselves buying at inflated prices during periods of exuberance and selling at discounted levels when fear takes hold. Lack of disciplined risk management can result in substantial financial losses.

On the flip side, emotional investing can lead to substantial gains when investors accurately anticipate market sentiment and ride the wave of positive emotions. However, it should be noted that this approach requires careful timing, thorough research, and a willingness to accept the possibility of significant losses.

Conclusion: Finding Balance in the Tesla Story

Tesla’s journey serves as a blueprint for understanding the intersection of innovation, emotion, and investment. As investors navigate the highs and lows of Tesla’s stock price, they must heed the lessons of emotional investing and strive for a balanced approach. By marrying passion with prudence, investors can harness the excitement surrounding Tesla while safeguarding against the pitfalls of emotional decision-making. In doing so, they can chart a course that not only captures the thrill of innovation but also steers toward sustainable long-term growth.