The Economy May Not Actually Crash. However, a “No Landing” Scenario Might Still Be Troublesome.

Feb 16, 2023

There is a new position in the hard/soft landing debate - no landing at all. Just don't expect this to be good news for the stock market.

Recent headlines continue to focus on whether the Federal Reserve will be able to engineer a gradual slowdown in the economy in an attempt to moderate inflation or whether it will be forced to trigger a recession to get the Consumer Price Index growth rate back to its 2% target. However, a third option is also possible, in which it will not touch the ground at all.

In this "no landing" scenario, the economy continues its upward trajectory, but inflation refuses to be tamed. And this scenario is becoming increasingly likely. January's payroll data made the term "sustainable" seem downplayed, and strength indicators in the services sector remain robust. There are even signs of life in the manufacturing and housing data, where previously they seemed to have gone into a downward spiral. Inflation has even slowed, and collectively, the combination of lower price growth and a resilient economy has helped the S&P 500 rise in 2023.

"Markets have been rallying this year as hopes of a soft (or no) landing have been building, specifically because inflation continues to come back down, despite the labor market's resilience," notes Independent Advisor Alliance's Chief Investment Officer Chris Zaccarelli.

So what's not to like about a scenario where Americans can find jobs in a booming economy while the cost of living slowly retreats from its highs? Lots of things. That's because more jobs mean Americans can keep spending, as evidenced by the latest retail sales data, which rose in January. And that, in turn, will keep prices high and rising at a time when inflation, which is still cooling but already at a slower pace, is well ahead of the Fed's 2% target and not falling as fast as the central bank would like, forcing it to keep raising rates.

Or, as BofA Global Research Investment Strategist Michael Hartnett pithily puts it: "No landing means no Fed pausing."

Indeed, while the "turnaround" used to be a bull call, it is now increasingly at odds with a situation where the Fed has no incentive to stop, let alone roll back, its interest rate hike campaign. Deutsche Bank now expects U.S. Fed rates to peak at 5.6%, up from the previous forecast of 5.1%. Money market futures are not far behind, suggesting a final rate of 5.3%, a precipitous increase from 4.8% at the beginning of the month.

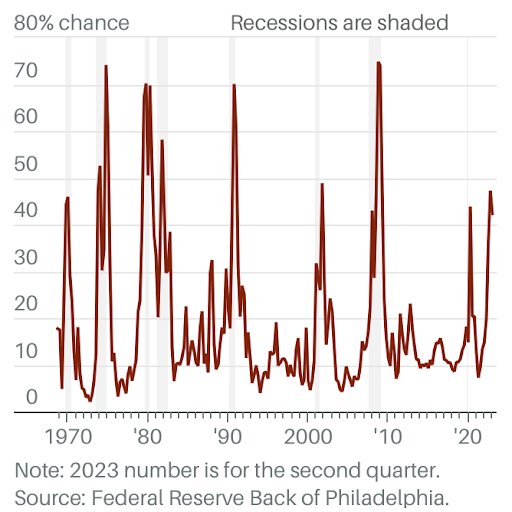

The likelihood of a decline in real GDP is an indicator of recession for forecasters. It has become known as the Anxious Index.

Even more bullish economists are beginning to worry about increasing prices remaining sticky. Ed Yardeni, the chief financial strategist at Yardeni Research, sees problems if inflation does not continue its downward path despite continuing to forecast a soft landing and a healthy stock market. "Fed officials likely would conclude that the only way to bring inflation down is by causing a recession," he writes. "In other words, the inflationary no-landing scenario may turn out to be the long way to a hard landing."

You don't have to go back very far to see how the narrative finishes. The bear market of last year was a reaction to fears about an ever-increasing terminal Fed funds rate at the price of economic development. "Bottom line, a no landing would not be a sustainable gain since it only ultimately…delays, but does not eliminate, the hard vs. soft landing issue," argues Tom Essaye, founder of Sevens Report Research.

"[The] Fed will keep raising rates until it feels confident that growth is slowing and that it won't put upward pressure on inflation."

Remember, you can't fight the Fed.