The Fed Could Have Another Dilemma With Today’s Inflation Report

Mar 14, 2023

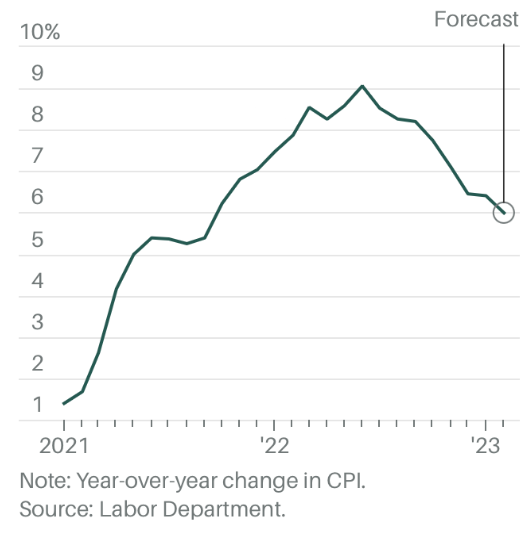

According to economists surveyed by FactSet, the CPI will rise by 6% year over year in February, down from 6.4% in January, and prices will expand by 0.4% over the prior month as opposed to 0.5% in January.

An analyst at broker XM named Charalampos Pissouros claimed that a significant decline in the headline CPI rate is out of the ordinary given the continued decline in oil prices year over year.

Core CPI, which does not include volatile food and energy prices, probably decreased from 5.6% in January to 5.5% last month.

Pissouros stated that market players might feel more confident about the most recent adjustment in their Fed bets should the core rate decrease by more than anticipated.

Economists expectations for the next rate action by the U.S. central bank are represented by those bets. In contrast to a 50-basis-point hike in December and numerous 75-basis-point increases last year, the Fed increased rates by 25 basis points in February. (One-hundredth of a basis point is a percentage point.)

A significant stock market selloff that started in February after equities rose in January was aided by the increase in interest rates during the previous 12 months.

Traders' predictions for the next rate decision were divided before last Friday's failure of Silicon Valley Bank and regulatory actions to guarantee depositors and launch a new lending facility for banks. Some predicted a 50 basis point increase, while others thought it would be 25 basis points.

It is still unclear if the Fed would raise rates at all or announce a halt to its monthly quantitative tightening program, according to Quincy Krosby, the chief global strategist at LPL Financial. She said the Fed might take both actions.

According to the CME FedWatch Tool, the futures market was pricing in a 35% likelihood that the Fed will not adjust interest rates next week and a 65% chance that it will rise by 25 basis points. A half-point increase in interest rates is ruled out.

The recent rapid spike in interest rates has left Silicon Valley Bank with significant unrealized losses on its bond portfolio, which includes mortgage-backed securities. Depositors fled when the bank was compelled to liquidate part of its holdings, resulting in a $1.8 billion loss.

As James Reid, a strategist at Deutsche Bank, the environment ahead of tomorrow's CPI is intriguing. That's an understatement for sure.