War, Inflation, Rising Interest Rates: 6 Stocks For Tumultuous Times

Feb 27, 2022

Equity markets in the United States entered a correction zone this week. Growth stocks fared worse, entering the bear market territory. Investors are concerned about increasing interest rates and inflation. And Now, European peace is threatened by war.v

The natural impulse may be to give up, sell shares, and wait out the volatility, but doing so may result in losing out on good deals on quality stocks.

"What I don't want to see is people selling after we've had such a share fall after we've finally entered a correction," comments Liz Young, head of investing strategy at SoFi Technologies. The market may be turbulent right now, but investors can still hunt for attractive deals amid the chaos, researching some fresh ideas that can withstand the present climate.

According to RBC multi-industry strategist Deane Dray, investors should choose high-quality businesses. Firms with efficient management teams, profit margins, and cash flow are good examples of this.

Earnings are also important. "You want a firm with a high E in its P/E ratio," Young explains. Constantly rising revenues compensate for any compression in price/earnings ratios caused by inflation or geopolitical turmoil.

As tensions escalate in Europe, investors might look for firms having greater exposure to the United States. This may help to consider the possibility that things may take longer than expected to resolve the situation on the other side of the Atlantic.

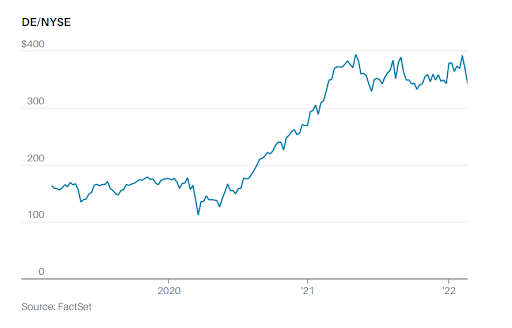

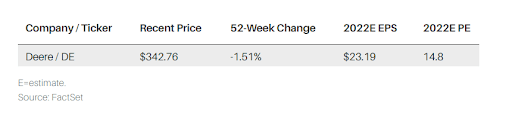

"Geopolitical turbulence provides a chance to obtain exposure to favorable longer-term trends," notes Mig Dobre, a Baird machinery analyst. "Deere is an excellent example." Deere stock has fallen nearly 15% since mid-February, probably since Russia accounts for about 6% of the firm's revenues.

Businesses that can thrive in a wide range of situations have an edge. CarMax's five-year goal is to sell two million automobiles per year, up from 1.2 million vehicles in the fiscal year 2021. One of the reasons Baird economist Craig Kennison included CarMax shares on his list of top ideas for 2022 is the corporation's volume target.

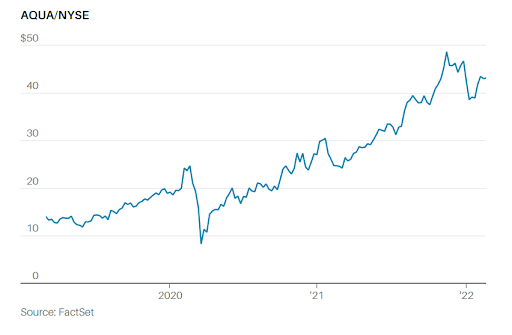

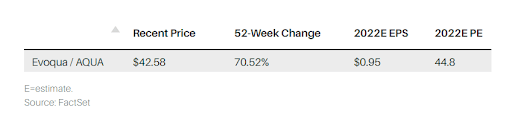

Evoqua Water Technologies

The water and wastewater treatment services offered by Evoqua Water Technologies meet the needs of residents, businesses, and industries. According to RBC multi-industry analyst Deane Dray, around 80% of revenues are produced in the United States, and the corporation is less dependent on capital investment than other companies. As a result, if business budgets tighten as the world's economy becomes more unpredictable, Pittsburgh-based Evoqua will be less vulnerable. And, regardless of what happens elsewhere, everyone in the United States will still need water. Dray's price target is $50, or around 50 times projected profits for the calendar year 2022. This is not inexpensive, but investors benefit from sustainable growth. Earnings are predicted to more than double in the following three years.

Deere

"The moment water utilities perform badly, or simply have a bad time, we begin to work," states Jay Rhame, CEO and portfolio manager at Reaves Asset Management, a business that invests in infrastructure and utility equities. "They are so dependable and steady that getting a cheaper value is rare."

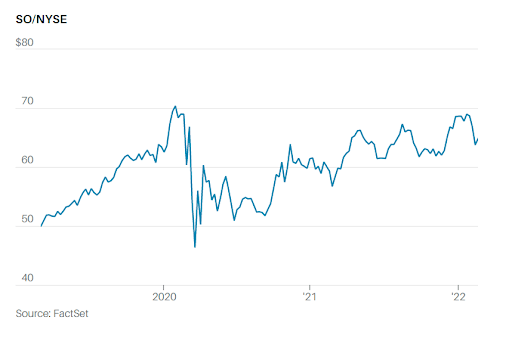

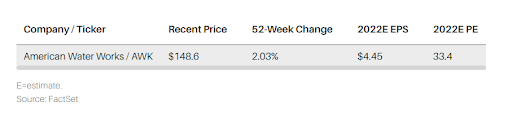

American Water Works stock has lost more than 20% since the beginning of this year, and it currently trades for around 33 times expected 2022 profits. That may seem expensive, but profits have risen steadily for years and are predicted to rise at a rate of 8% to 9% per year for the near future. For the last decade, the firm has increased its dividend by around 10% every year on average.

The Southern Co.

"The moment water utilities perform badly, or simply have a bad time, we begin to work," states Jay Rhame, CEO and portfolio manager at Reaves Asset Management, a business that invests in infrastructure and utility equities. "They are so dependable and steady that getting a cheaper value is rare."

American Water Works stock has lost more than 20% since the beginning of this year, and it currently trades for around 33 times expected 2022 profits. That may seem expensive, but profits have risen steadily for years and are predicted to rise at a rate of 8% to 9% per year for the near future. For the last decade, the firm has increased its dividend by around 10% every year on average.

The Southern Co.

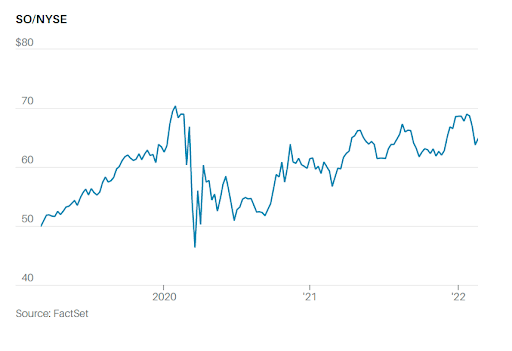

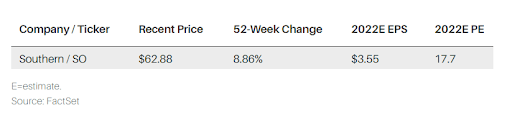

Southern Co., based in Atlanta, has protective and high-quality traits. For the previous decade, its dividend has increased at a rate of roughly 3% per year on average, and stock presently yields 4.3%. The multistate electric and gas utility is trading at nearly 17 times its expected 2022 profits of $3.55 per share. According to Rhame of Reaves Asset Management, Southern shares held their own throughout the market's 38% decline in 2008. The shares dropped over 10% this year, partly owing to the company's decision to postpone the start-up of new nuclear-power producing plants in Georgia by three to six months. Two additional units are now scheduled to be operational by the end of 2023.

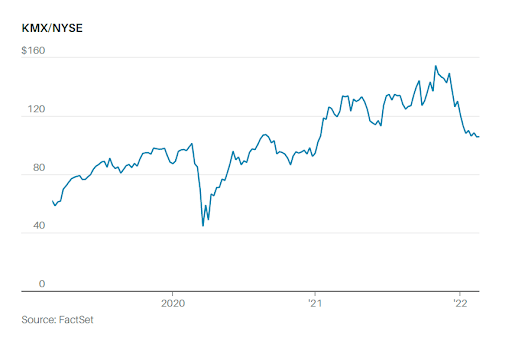

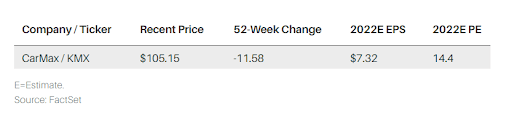

CarMax

Auto dealers, according to Benchmark strategist Mike Ward, are profitable companies. "Expenses are variable, inventory is mostly funded by car manufacturers, and parts and service income covers around 75% of fixed costs," he explains. CarMax, the biggest used-car dealership in the country, is down nearly 20% this year and trades for around 14 times expected calendar-year 2022 profits. Used cars are at an all-time high, owing to limited inventories and limited new-car output. Falling used-vehicle prices are a danger, but Baird analyst Craig Kennison advises investors to concentrate on dealers that can boost volumes so that profitability may expand even if automobile price goes down.

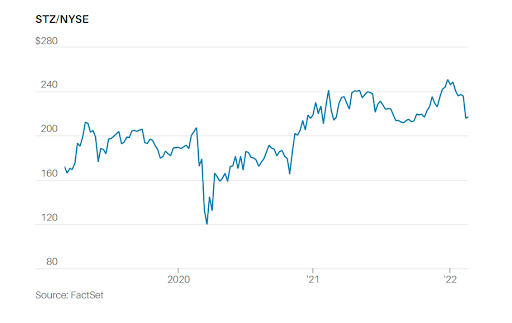

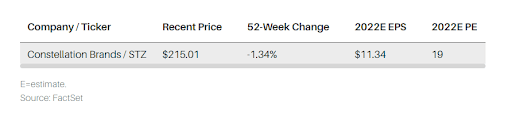

Constellation Brands

According to J.P. Morgan analyst Andrea Teixeira, before COVID-19, Constellation Brands was among the fastest-growing large-cap beverage companies. Volume growth is increasing at COVID as the beverages distributor in the United States keeps investing in brand names, such as Corona beer. In 2022, the stock is down around 15%. Investors are concerned that profit margins may suffer when the business ramps up additional production. Teixeira, on the other hand, adds that additional capacity will lead to increased volume and improved profit margins. Stock is currently trading at around 19 times the projected calendar-year 2022 profits per share of about $11.34. Earnings growth is predicted to average about 13% each year over the next three years.