What Is SWIFT Banking System?

July 13, 2023

If you’ve ever received or dispatched funds to a destination beyond your home country’s borders, you’ve likely encountered the SWIFT banking system. This quiet workhorse in the background of international finance plays a vital role in your ability to smoothly transfer money around the globe, often within a matter of hours.

So, what is SWIFT exactly, and how does its magic work?

Key Takeaways

- SWIFT is a messaging system that facilitates global secure communication and money transfer between member banks and financial institutions.

- SWIFT carries payment information between sender and recipient banks, ensuring funds are transferred according to instructions.

- SWIFT is widely used in the global financial industry, with over 11,000 member institutions in 200+ countries handling millions of messages daily.

- SWIFT faces challenges that can be improved with blockchain technology, which has the potential to enhance security, efficiency, and cost-effectiveness in the banking system.

Understanding SWIFT, The Backbone Of International Payments

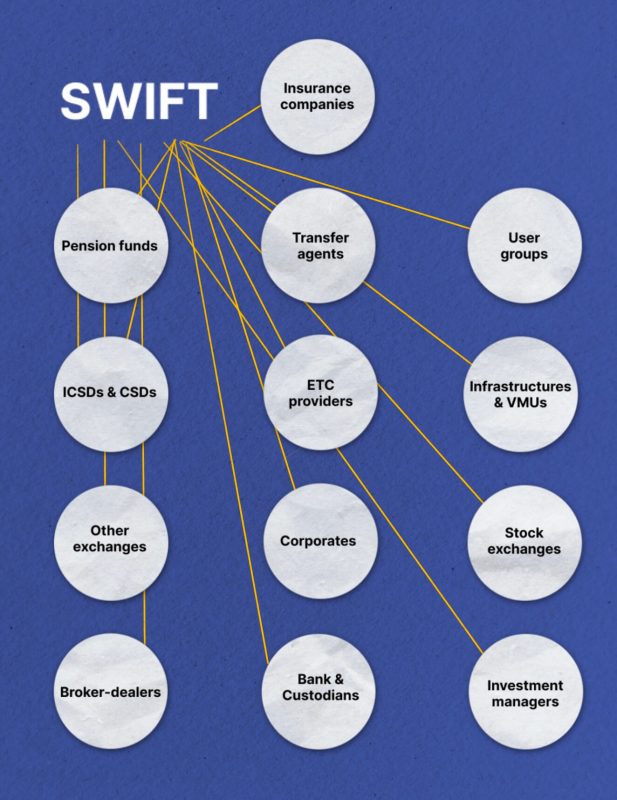

SWIFT, an acronym for the Society for Worldwide Interbank Financial Telecommunication, may initially strike you as a banking system or a financial institution, but that’s not the case. In reality, SWIFT is not directly involved in transferring money but is a pivotal conduit for financial messages.

We can look at society for worldwide interbank, or, SWIFT as a facilitator or a liaison that governs the logistics of money transfers between its member banks and financial institutions. It operates a global messaging network, a means of communication that sets the stage for the actual movement of funds.

This essentially creates an international payment network enabling individuals and businesses to make or receive payments electronically or via card, irrespective of the financial institutions the payor and the payee are affiliated with. Upon joining, members must pay an initial fee along with ongoing annual charges, determined by their classification within the network.

Regarding its scale and reach, SWIFT’s influence on the global financial infrastructure cannot be overstated. The statistics from 2022 alone paint a vivid picture: more than 11,000 SWIFT members worldwide exchanged an astounding average of 35 million messages daily through this network.

Who Owns SWIFT?

In terms of ownership, SWIFT doesn’t belong to a single entity or organization. Instead, it operates as a cooperative collectively owned by its members, with shareholders counting approximately 3,500 member institutions worldwide.

Headquartered in the town of La Hulpe in Belgium, SWIFT’s operations are subject to oversight from a prestigious group of financial authorities – the central banks of the G10 countries, the European Central Bank, and the National Bank of Belgium.

The SWIFT cooperative is guided by a democratically elected board of directors of 25 members chosen by its shareholders. This board is vested with crucial responsibilities that ensure the smooth functioning of the SWIFT system.

SWIFT History And The World Before It

The genesis of SWIFT can be traced back to when the international finance world grappled with Telex, an early messaging system for financial institutions that left much to be desired. Known for being clunky, slow, and prone to errors, Telex was considered far from ideal for the rapid pace of the financial sector.

Responding to this need for a more efficient and reliable system, SWIFT was brought to life in Brussels in 1973. Initially, the cooperative was formed with 239 financial institutions spanning 15 countries, a testament to the immediate recognition of its potential. Within four years, this number nearly doubled, with 518 institutions from 22 countries becoming part of the SWIFT network.

Fast forward to the present, SWIFT boasts a network of over 11,000 banking institutions spread across more than 200 countries, and facilitates $150 trillion in transactions per year.

How Does The SWIFT Messaging System Work?

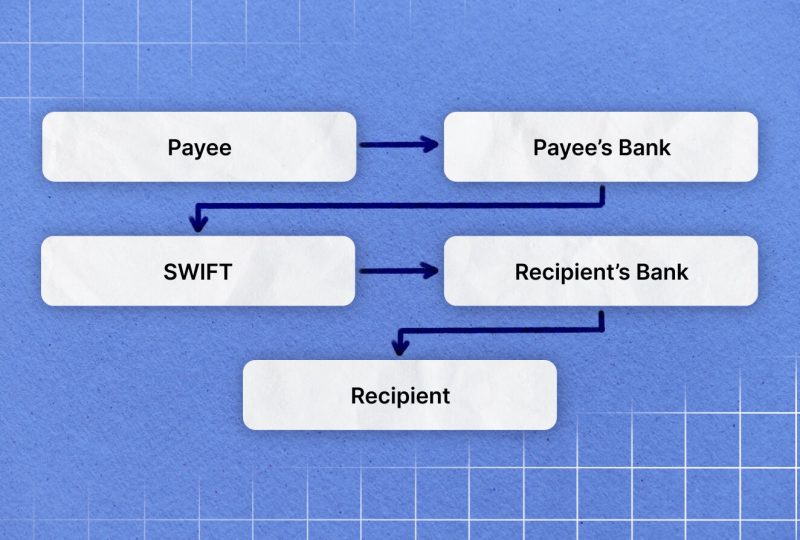

The essence of a SWIFT transfer lies in transmitting important payment information from the sender’s bank to the beneficiary’s bank. It acts as an international intermediary, streamlining bank communication across borders.

This process’s mechanics involve using nostro or vostro accounts, acting as a record-keeping ledger for transaction details. This arrangement allows transactions to be efficiently processed, even when the customer and vendor are affiliated with different banks.

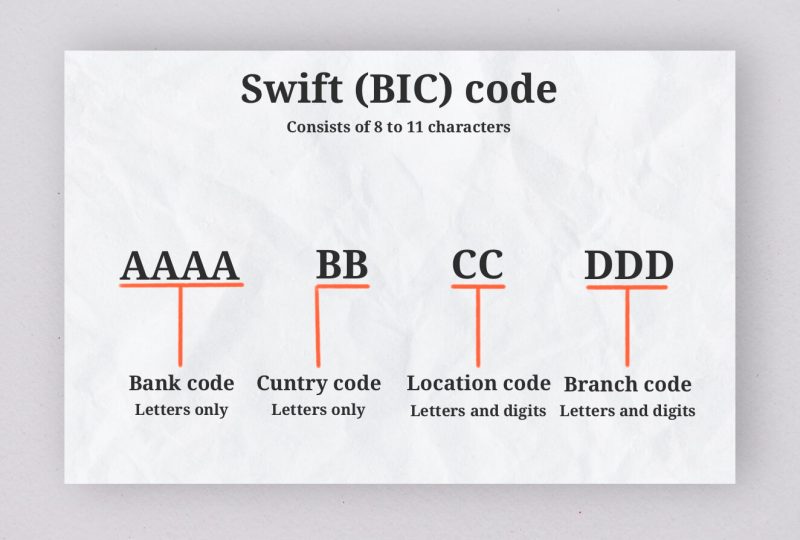

SWIFT assigns each member institution a unique identifier known as a Bank Identifier Code (BIC), comprising either eight or 11 characters. Sometimes referred to as a SWIFT code, or SWIFT ID, the BIC provides a standardized identification of the bank.

This systematic coding method ensures precise and efficient identification of financial institutions within the SWIFT network, facilitating smooth international transactions.

SWIFT Services Overview

The SWIFT system facilitates various services designed to ensure efficient and accurate business transactions. Here is a list of some of the primary SWIFT services.

Messaging, Connectivity, and Software Solutions

At its core, SWIFT’s primary business is providing a secure, reliable, and scalable network to exchange financial messages seamlessly. To this end, it offers a broad range of products and services, including various messaging hubs, software, and network connections, all aimed at enabling clients to send and receive transactional messages effectively.

These tools form the backbone of SWIFT’s operation, easening global financial communications with unparalleled efficiency and reliability.

Applications

SWIFT’s network opens access to many applications for different transactional needs. These include real-time matching for instructions related to treasury and Forex transactions, banking market infrastructure that processes interbank payment instructions, and a securities market infrastructure designed for the execution of clearing and settlement instructions concerning payments, securities, foreign exchange, and derivatives transactions.

Business Intelligence

In recent years, SWIFT has further enriched its service portfolio by introducing business intelligence dashboards and reporting tools. These features provide clients with a dynamic and real-time monitoring perspective, letting them closely watch messaging activity and gain detailed reports. Clients can customize these reports based on specific criteria such as region, country, or message type, allowing for more focused analysis and insights.

Compliance Services

SWIFT provides various services in this area, recognizing the critical importance of financial crime compliance. These services include utilities and reporting tools for ‘Know Your Customer’ (KYC) procedures, sanctions, and anti-money laundering (AML) measures. These services are fundamental in maintaining the integrity and legality of transactions through the SWIFT network.

How To Send Money With SWIFT

If you ever need to send money internationally, perhaps to support family or friends abroad, make a vacation rental payment, cover tuition fees, or procure goods or services, SWIFT is your go-to system. Essentially, sending money through SWIFT means making a wire transfer, and here’s a step-by-step guide on how to do it.

Initially, make sure you have all the necessary details at hand:

- The name, address, country, and routing code of the recipient’s bank or financial institution.

- The full legal name, current address, and recipient account number.

- The SWIFT Code of the recipient’s bank account.

- Your government-issued identification.

- The specific purpose of sending the funds.

- Any additional documentation or information stipulated by your bank.

Once you’ve collated all the necessary information, visit your bank physically or log into your bank’s online system to initiate an international wire transfer. Before proceeding, ensure you clearly understand all the fees and limits associated with sending money overseas.

During the process, you’ll likely be asked to specify the destination country, the currency you wish to use for the transaction, and other information collected in the initial step.

Once all details are filled in and confirmed, send the money via SWIFT from your bank. Always remember to maintain a record of the transaction for future reference.

If you are receiving a SWIFT transaction, ensure that you provide your bank’s SWIFT number to the sender. Please note that the specific SWIFT number you’ll need to provide may vary depending on whether you receive funds in US dollars or a foreign currency.

Understanding SWIFT’s Business Model

So far, we’ve discussed the workings and functionality of SWIFT and its role in facilitating the seamless movement of money globally. But you might wonder, how does SWIFT generate revenue?

As a cooperative organization, SWIFT is owned by its members, which predominantly include banks, brokerage firms, foreign exchange services, and other financial institutions. These members must pay an annual membership fee to be part of the SWIFT network.

In addition to the annual fees, SWIFT also charges for the secure messages it carries to facilitate financial transactions. The pricing for these messages varies, depending on factors like the type and length of the message, as well as the nature of SWIFT’s relationship with the sending institution.

As a customer, if your bank is a member of the SWIFT network, you can use it to securely convey payment instructions and move your money from one location to another. However, the costs associated with using SWIFT are typically passed down to you, the consumer. This is usually reflected in the fees applied when you conduct an international transfer.

SWIFT’s Payment Fees

When making a SWIFT payment, you should anticipate two categories of fees.

Firstly, there are transaction fees. A SWIFT message does not always follow a direct route from the sender’s bank to the recipient’s bank. It may sometimes pass through intermediary banks before finally reaching its destination, and each of these banks could impose a handling fee for their services. Your bank might levy a fixed rate or opt for a variable fee to accommodate these fees. As the SWIFT payment network operates internationally, there isn’t a standardized table of fees. Thus, it’s wise to inquire about these costs beforehand.

Secondly, there are foreign exchange fees. A foreign exchange fee will be applied if your transfer necessitates a currency exchange. This fee depends on the interbank rate (the rate banks use when exchanging currencies among themselves) and the FX fees the bank imposes on its customers. Banks can charge up to 5% of the transaction amount as FX fees, so it’s crucial to investigate your bank’s fees before transferring. There could be a more economical method to send your money.

When executing international financial transactions, it’s essential to understand how these fees are assigned to ensure that your recipient receives the correct amount. Banks offer options to designate whether these fees are borne by the sender, the recipient, or shared between both parties. You and your recipient should agree on the best method to handle these fees before initiating the payment.

What Challenges Does SWIFT Face?

Despite its crucial role in global finance, SWIFT faces several important problems. Let’s discuss them below.

Online Security Risks

SWIFT manages sensitive data and money, making it a big target for online criminals. One main weakness is in the process of checking who is using the system. If an online criminal gets the login details of a bank worker, they can make transactions that benefit them because there are no extra checks in the system.

A case from 2018 shows this issue. Some lower-level workers at Punjab National Bank in India started using SWIFT to send messages that weren’t tracked by the bank’s system. Over several years, this activity went unnoticed, leading to a huge loss of $1.8 billion. In other cases, criminals have stolen millions of dollars through SWIFT from banks in Russia and Bangladesh.

SWIFT itself doesn’t take the blame for these problems. It focuses on keeping its own systems secure and says that the banks themselves should control who has access to the system. In 2017, SWIFT made a list of security rules that banks should follow, but the banks themselves have to say whether or not they wish to follow.

Not Enough Automation

As the world of finance gets more complicated, customers want more automated processes to handle large numbers of transactions. But SWIFT, built over many years and uses a lot of older technology, finds it difficult to add more automation. This change would be expensive and could make the system even more complicated.

Problems With Connections

Although SWIFT almost always ensures messages get through, the customer is responsible for setting up a secure connection between their systems and the SWIFT network. This process can take a lot of time, money, and effort. Also, every connection is unique because each business, country, and bank has different needs and rules. This means that if one part of the connection to SWIFT stops working, the whole connection can fail.

Given these difficulties, is it time for a new system?

Will Blockchain Replace SWIFT?

The challenges faced by SWIFT have sparked a search for innovative solutions, and blockchain technology has appeared as a promising solution for many. Back in 2017, SWIFT started exploring blockchain, but we haven’t heard much about their progress since then.

However, other players in the financial industry, like JP Morgan, have been actively looking into blockchain-based solutions. Despite Ripple’s legal issues, they’ve provided distributed ledger services to various financial institutions.

Blockchain brings some exciting possibilities. One key advantage is cutting out the middleman. Instead of relying on a single company like SWIFT, blockchain allows banks to communicate directly with each other. This approach boosts security by removing potential vulnerabilities. Instead, the network relies on a decentralized system of nodes, making it more resilient.

Another significant benefit of blockchain is improved visibility and efficiency. With a blockchain ledger, organizations can track the progress of their international transactions and communications in real time. This transparency streamlines processes and builds trust between the parties involved.

Additionally, maintaining multiple ledgers is costly and complex for banks. A shared ledger across all banks would reduce costs and make it easier to comply with regulations like Anti-Money Laundering and Know Your Customer requirements. It’s a win-win situation for everyone.

Final Takeaway

Since its formation, SWIFT has been instrumental in the smooth operation of worldwide interbank financial telecommunications. The introduction of blockchain technology, however, opened up novel opportunities. While blockchain may not be able to replace SWIFT completely, it has the potential to improve significantly and revolutionize the current financial system.

The journey ahead promises greater efficiency, enhanced security, and cost-effectiveness in banking operations. We are on the verge of an exciting era in which blockchain technology could set new standards in the world of finance; therefore, it is crucial that we stay informed and engaged.