Explaining The Role of Smart Contracts in Today’s Digital Landscape

Jul 29, 2024

Distributed ledger technology has transformed the way we store and manage data, resulting in the emergence of smart contracts. Across a range of industries, this advanced technology is reshaping the landscape by eliminating intermediaries and enhancing efficiency.

These non-negotiable contracts promote transparency, security, and confidence among all participants, even without regular communication. Smart contracts are experiencing rapid growth and significant changes in markets worldwide.

This article aims to answer the question, “What is a smart contract?” and explore its possibilities in today’s digital world.

Key Takeaways

- Smart contracts are computer programs that automatically execute as parties fulfill their agreements’ terms, based on blockchain technology.

- Cryptocontracts were first introduced in 1994.

- Smart contracts can be employed in multiple industries, such as DeFi, real estate, healthcare, and others.

- Smart contract adoption requires continuous research, development, and collaboration with specialized companies and legal frameworks.

Smart Contracts Explained

Smart contracts (crypto contracts) are blockchain-based self-executing computer programs that automatically run as parties fulfill their agreements’ terms. The term “smart” in smart contracts refers to executing the agreement through computer programming code rather than paper or other forms. Smart contracts have multiple parts and can be governed by terms such as timing, expiration date, and voidability circumstances.

So, what are smart contracts in simple terms? They are digital instructions that automate specific tasks, ensuring timely and accurate execution. With the advent of blockchain technology, this concept has become a practical reality, making contracts not just written and signed but programmed, automated, and self-executed. This digital upgrade has marked a significant leap in handling agreements in the digital age.

Smart contracts are crucial for blockchain-based ecosystems, particularly in application-focused blockchains like Ethereum. These trustless, autonomous, decentralized, and transparent digital contracts reduce the need for intermediaries and contract enforcement in transactions. They are irreversible and unmodifiable once deployed, making them the building blocks of decentralized applications (dApps). Thousands of dApps across various blockchain networks utilize smart contracts in various ways, including trading, investing, lending, borrowing, gaming, healthcare, real estate, and corporate structures.

A smart contract is a distributed, decentralized, and autonomous system that ensures that all nodes connected to the network have a copy of the contract’s conditions. It is determined and immutable, meaning the final outcome remains unchanged regardless of who executes it. All nodes maintain and execute the contract, removing any controlling power from any one party. It is trustless, as third parties are not required to verify the process’s integrity.

The Bitcoin network was the first to use smart contracts for value transfers, employing basic conditions like checking if the amount of value is available in the sender account. Ethereum emerged later and became more powerful due to its ability to create custom contracts in a Turing-complete language. Common smart contract platforms include Ethereum, Solana, Polkadot, and Hyperledger Fabric, with Ethereum smart contracts being the most popular.

A Brief Overlook of Smart Contracts History

The term “smart contract” was first introduced by Nick Szabo, a US-born computer scientist and cryptographer, in 1994. Szabo defined them as digital transaction mechanisms that implement a contract’s terms and claimed that digital contracts are more functional than their paper-based counterparts, as they are digitally specified and include protocols for parties to perform on these promises.

Szabo took the vending machine as a prime example of how smart contracts work, as it automatically honors the terms of an unwritten agreement after a purchaser has satisfied the conditions.

Smart contracts also have origins in Ricardian Contracts, a concept published in 1996 by Ian Grigg and Gary Howland. Ricardian Contracts are a bridge between text contracts and code, with parameters such as being easily readable, parsable, digitally signed, carrying keys and server information, and allied with a unique and secure identifier.

The emergence of cutting-edge technologies, such as Ethereum, has spurred the rise of smart contracts, making them more accessible and prevalent platforms today.

Types of Smart Contracts

Today, several types of blockchain-based smart contracts exist.

Smart Legal Contract

Smart legal contracts, based on blockchain technology, are legally guaranteed and offer greater transparency than traditional contracts. They adhere to the “if… then…” structure, with parties executing contracts with digital signatures. Autonomous execution is possible if certain prerequisites are met, but failure could result in severe legal consequences.

Application Logic Contracts (ALCs)

ALCs are application-based codes that sync with other blockchain contracts, enabling interactions between devices like IoT and blockchain integration, and not between individuals or organisations.

Decentralized Autonomous Organisations (DAOs)

DAOs are democratic groups governed by smart contracts, serving as blockchain-governed organizations with shared objectives. They lack an executive or president, and their functions and fund allocation are regulated by blockchain-based tenets. VitaDAO is an example of this type of smart contract.

How Do Smart Contracts Work?

Smart contracts are digital contracts that follow a set of “if/when…then…” statements on a blockchain. These contracts execute actions when predetermined conditions are met, such as releasing funds, registering vehicles, sending notifications, or issuing tickets.

The blockchain is updated when the transaction is completed, ensuring only authorized parties can see the results. Participants must agree on transaction representation, rules, exceptions, and dispute resolution frameworks.

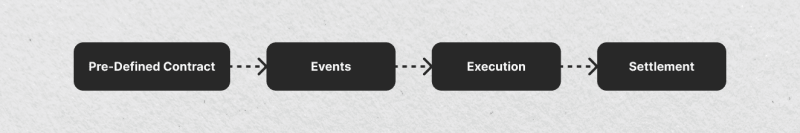

The process involves three steps:

1. Agreement

The parties must agree on the terms and conditions of the arrangement, including the criteria for fulfillment of the contract and whether it will execute automatically.

2. Contract creation

The parties have multiple options for creating smart contracts, ranging from coding them themselves to working with a smart contract developer. The smart contract’s security is crucial, and it must be fully verified during this step.

3. Deployment

The contract is broadcast to the blockchain, with the smart contract’s code included in the transaction’s data field. The contract is live on the blockchain once the transaction is confirmed and cannot be revoked or changed. The blockchain network stores the completed smart contract for review at any time.

Smart contracts are autonomous, relying on predefined rules, automating trust, and ensuring every party receives what they are promised.

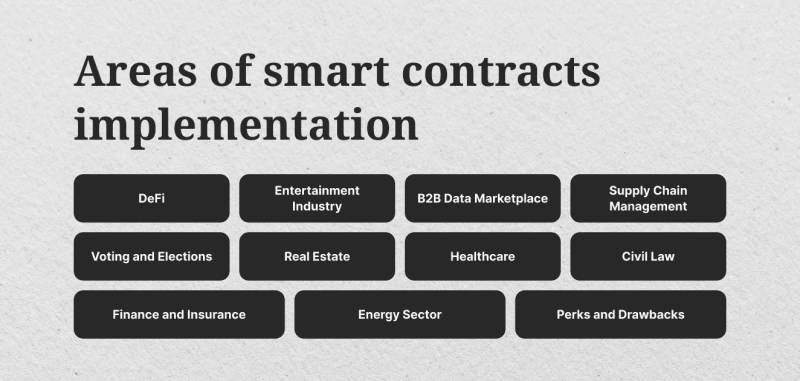

Areas of Smart Contracts Implementation

Smart contracts have a wide range of applications across various industries.

DeFi

DeFi apps utilize cryptocurrencies and smart contracts to provide financial services without intermediaries, enabling complex processes like borrowing, lending, and derivative transactions.

Entertainment Industry

The streaming industry is leveraging smart contract apps to streamline royalty payments for artists and record companies, potentially resolving ownership disputes and crediting royalties for commercial use.

B2B Data Marketplace

A data marketplace is a platform for users to buy and sell diverse datasets or streams. It is facilitated by smart contracts that enable automated, secure transactions without human intervention.

Supply Chain Management

Smart contracts can be created for the entire supply chain, ensuring smooth execution and escalation measures for delays. Blockchain applications in management streamline late or deferred decisions, making them transparent and accessible. They enable seamless product tracking, authentication, shipment monitoring, and automated payments. Blockchain mitigates fraud and loss risks by providing a secure digital version.

Voting and Elections

Smart contracts provide a secure, ledger-protected voting environment, reducing voter manipulation and increasing turnout. They eliminate the need for physical polling locations, promoting efficiency. Blockchain’s ability to log votes makes it difficult to decrypt voter addresses, increasing confidence in preventing ill practices. Online voting, using smart contracts, can increase the number of participants.

Real Estate

Smart contracts in real estate can streamline property transactions by autonomously creating and executing contracts based on blockchain payment records. They reduce middleman fees and distribute ownership between the parties involved. These contracts offer cheaper, faster, and safer mortgage transactions, allowing buyers to access properties earlier and update records automatically. They could also revolutionize real estate by transitioning from automated title transfers to transparent rent agreements.

Healthcare

Smart contracts in healthcare improve efficiency, promote clinical trials, and ensure accurate patient records. They automate healthcare payment processes, prevent fraud, and enable medication traceability, cold chain management, health passport management, and clinical research. Blockchain securely stores patient health records with a private key, ensuring privacy. Smart contracts can conduct confidential research and share hospital receipts with insurance companies. The ledger can be used for supply management, drug supervision, and regulation compliance.

Civil Law

Smart contracts are gaining popularity in the legal industry, enabling the creation of legally binding business and social contracts, with some North American regions allowing digitised agreements like marriage and birth certificates.

Finance and Insurance

Digital currencies are revolutionizing financial sectors like stock trading, loans, and insurance with automated smart contracts. These contracts improve speed, transparency, and efficiency in loan approvals and insurance claims verifications. They also enhance bookkeeping tools, prevent accounting record infiltration, and facilitate trade clearing. The insurance industry can benefit from smart contracts, streamlining processes and reducing paperwork.

Energy Sector

Smart contracts can effectively manage decentralized energy distribution, ensuring fair pricing and efficient energy transfers as renewable energy sources gain popularity.

Perks and Drawbacks

Though smart contracts can benefit many sectors, they have superior traits and some drawbacks that should also be considered. Let’s discuss them, starting with the pros.

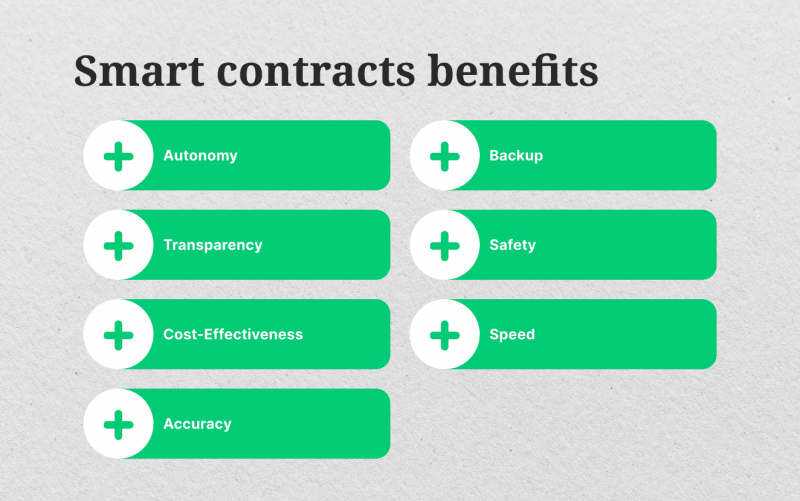

Pros

Smart contract usage has numerous positive aspects. Here are some of them:

Autonomy

Smart contracts offer autonomy and cost savings and facilitate direct, transparent relationships with customers by eliminating the need for intermediaries, thereby reducing the risk of third-party manipulation and promoting direct dealings between parties.

Backup

Contracts store transactional details indefinitely, making retrieving these properties easy in case of data loss.

Transparency

A smart contract ensures transaction transparency by allowing all parties involved to view its terms, conditions, and outcomes.

Safety

Encrypted smart contracts offer enhanced protection against fraud, hacks, and unauthorized modifications in decentralized blockchain-based systems. These contracts are replicated in all nodes, preventing loss. Also, blockchain can be modified computationally, allowing network nodes to detect and invalidate violation attempts.

Cost-Effectiveness

Smart contracts can significantly reduce expenses or fees by eliminating intermediaries like banks, notaries, or legal services.

Speed

Smart contracts use computer protocols to automate tasks, saving hours in business processes and eliminating paperwork and approvals.

Accuracy

Smart contracts enhance accuracy by eliminating errors caused by the manual filling of numerous forms.

Cons

However, despite all the benefits, these contracts have some weaknesses.

Code Vulnerability

Smart contract code is effective, but errors or oversights can lead to unintended consequences or security vulnerabilities if not thoroughly audited.

Complexity

Smart contracts, a new technology, are not yet user-friendly due to their technical knowledge requirement, which is a significant barrier to their adoption.

Regulatory Uncertainty

Smart contracts face legal challenges due to varying enforceability and recognition across jurisdictions, and lack of international regulations on blockchain, mining, and cryptocurrency.

Limited Flexibility

Smart contracts are designed to ensure trust but may not handle unexpected external factors or situations. In some cases, smart contracts require human judgment or discretion.

Future Of Smart Contracts

Smart contracts are poised for a promising future, with several key trends shaping their evolution. These include increasing adoption across industries, specifically IoT integration.

IoT integration is a significant trend for efficient data management and security protocols. Artificial intelligence and machine learning are expected to bring new advancements, such as automated decision-making, predictive analytics, and intelligent automation. Legal and regulatory developments are needed to ensure the validity and enforceability of smart contracts. Interoperability is a major goal, allowing smart contracts to interact across different blockchains.

To fully realize the potential of smart contracts, ongoing research, development, and collaboration with a dedicated smart contract development company and legal frameworks are necessary. The future of smart contracts holds immense potential to transform transactions, but it will require ongoing research, development, and collaboration with a dedicated company.

Final Thoughts

Smart contract development is a rapidly evolving field with immense potential for transforming industries, with organisations increasingly integrating smart contracts into their operations.

Smart contracts are a promising technology in development that could replace trust in centralized institutions with blockchain-compatible computer code. While relying on computer code for important tasks can be efficient, it is also risky. As smart contracts become mainstream, they could have a disruptive role in the future of the economy and society.

FAQ

What is the point of a smart contract?

Blockchain-based smart contracts aim to streamline business and trade between parties, reducing formality and costs while maintaining authenticity and credibility without a middleman.

What is the prediction for smart contracts?

Smart contracts hold promise for a blockchain environment, but their widespread adoption will be slow due to the technology’s infancy and the need for further development.

Is a smart contract legal?

A smart contract, while legally binding, must meet all legal requirements, including intent to form, which may vary by jurisdiction, and may not always be binding.

Are smart contracts susceptible to hacking?

Hackers can exploit vulnerabilities in smart contracts stored on-chain by examining the public codebase for reentrancy or missing checks.