Best Day Trading Strategies to Maximize Your Profits in 2024

Sep 03, 2024

Market traders deploy different techniques to realize profits, and it is well-known that there is no one-size-fits-all approach to success in financial markets.

Day trading is a famous strategy that professional investors use to maximize their daily returns. New traders who are stepping foot in the trading world also follow this approach to make trading more predictable and track their equities on a daily basis.

Let’s explain this strategy in more detail and explore the best day trading strategies that will get you closer to your financial target.

Key Takeaways

- Day trading is a common approach for investors, where they start executing orders as the trading day begins and conclude their activities as the market closes.

- It is one of the most common trading strategies for beginners because it allows them to understand market dynamics and analyze the outcomes of their decisions.

- One-day trading can be highly lucrative when the market is highly volatile, providing sufficient fluctuation to generate income by long or short positions.

- Professional traders also engage in day trading using their experience and analytical skills to maximize their daily returns.

Explaining Day Trading Strategy

As the name suggests, day trading means implementing investing decisions throughout a single trading day (also known as a session).

The market times differ between markets and locations. For example, the US stock exchange markets open five days a week from 09:30 to 16:00, while the Forex trading market operates during the working week from 08:00 to 17:00 (all local times).

The day trader would place their first order as the market opens and liquidate their positions before the session ends. This strategy allows investors to realize their gains/losses faster and analyze their decision’s outcomes in a more straightforward approach.

Is Day Trading Worth?

Intraday profitability depends on the market and asset classes. These elements have different volatility, fluctuation ranges, and price speculations, and these factors contribute to dictating the day trading returns.

On average, day traders can generate a 0.10% return on investment, which can increase or decrease based on market conditions and dynamics. Volatile markets are more likely to offer better daily returns than long-term low-volatility assets.

The crypto market is highly volatile, and positions can fluctuate by 2% daily around their value, presenting precious chances to make money.

10 Best Day Trading Strategies

This approach is mostly suitable for short-term investors, allowing them to enter and exit the market in short intervals. Therefore, it is important to find volatile assets, analyze their projected performance, and use one of the following methods.

Momentum Trading

This trading strategy relies on the market dynamics, capitalizing on sudden market rush and motion before a reversal takes place. Investors can trade on both sides of the market, executing “short” orders when the market declines and “long” orders when the prices increase.

This approach requires a deep understanding of the moving forces behind every price change to conclude if the current movement is momentarily or will last for a longer period of time.

Implementing this strategy requires using trend and momentum tracking indicators, such as MACD, ROC, RSI, and the Stochastic Oscillator. These tools assist the trader in finding the right entry and the estimated price reversal point to exit the market.

The relative strength index (RSI) is a common technical indicator that shows a score from 0 to 100, reflecting the overbuying (above 70) and overselling points (under 30).

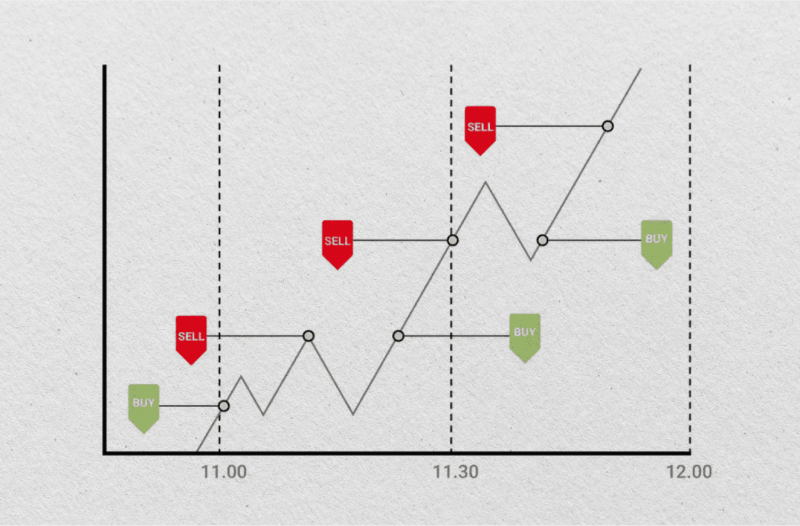

Scalping

Scalping is one of the most common day trading approaches involving ultra-short-term trading activities. Scalpers accumulate tiny gains from repetitively entering and exiting the market.

Each scalping session usually goes for less than 15 or even 10 minutes. In some cases, traders can close their positions within five minutes of trading. This strategy works well with volatile markets where prices move enough to provide sufficient returns within a few minutes, allowing the traders to benefit from long and short positions.

However, risks arise from market uncertainty, as prices move not as predicted, causing the trader to lose money. Traders use multiple indicators to narrow down their search and find the most lucrative opportunities.

The relative strength index and moving average ribbon are useful indicators for finding entry points to potentially growing trends. The development of trading bots and automation made it faster for traders to find and execute market orders in highly promising assets and markets.

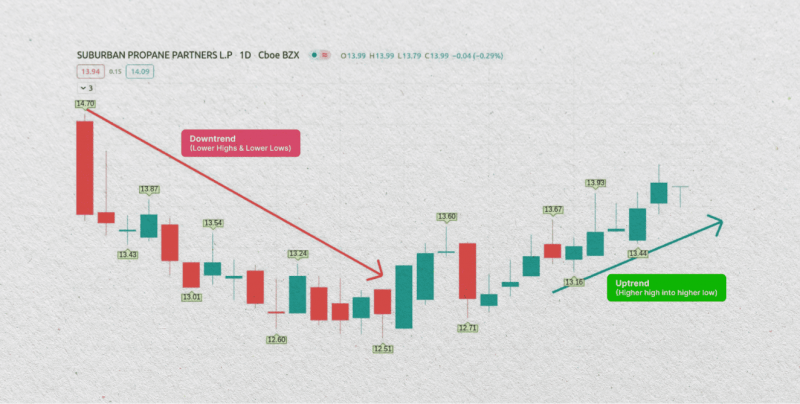

Trend Following

Trend following requires finding ongoing price motions and executing market positions. Trend following is usually a short-term strategy because price momentums do not last for too long and, in most cases, face corrections during the same or the next day.

Day traders use the exponential moving average and trend lines to identify trend entry points, indicating the right time to execute market orders during price momentum and exit the market when a price reversal is approaching.

This intraday investment approach requires close monitoring of financial news, market updates, live price action, and press releases that can affect an ongoing trend.

Additionally, investors avoid making decisions around market opening or closing times because prices can fluctuate unpredictably without reflecting the rest of the day’s trend.

News Trading

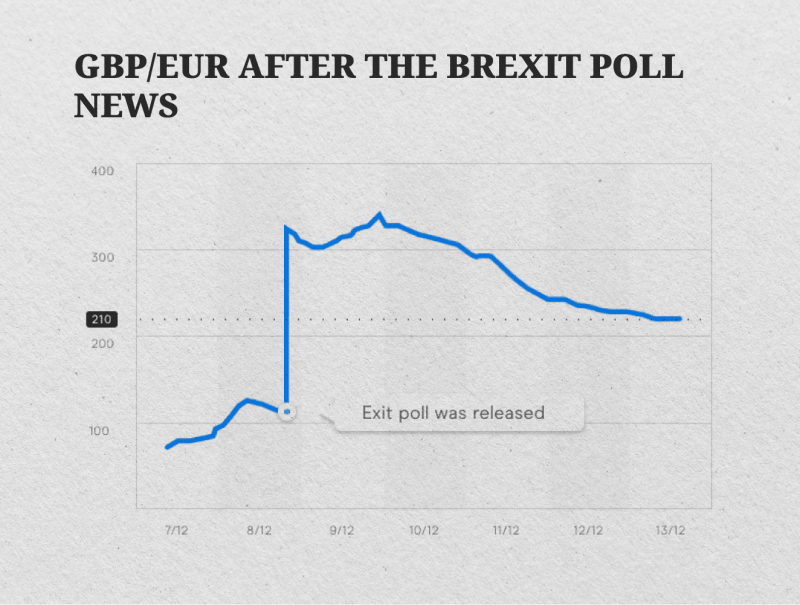

News trading is a typical tactic that uses fundamental analysis to predict and analyze the repercussions of key market events. Press releases, annual returns, economic reports, and national interest rates are significant announcements that drive the market in either direction.

This approach requires investors to get real-time market feeds, use an economic calendar, and read through corporations’ financial statements.

Trading with financial news is a two-edged sword. Traders can analyze major events and make informed decisions. However, the market can move sideways due to unpredictable speculations, especially if the rush overestimates the news, creating bubbles that will eventually burst.

This strategy suits experienced traders who have previously traded during market events and have the expertise to predict financial news and its impact on trading markets.

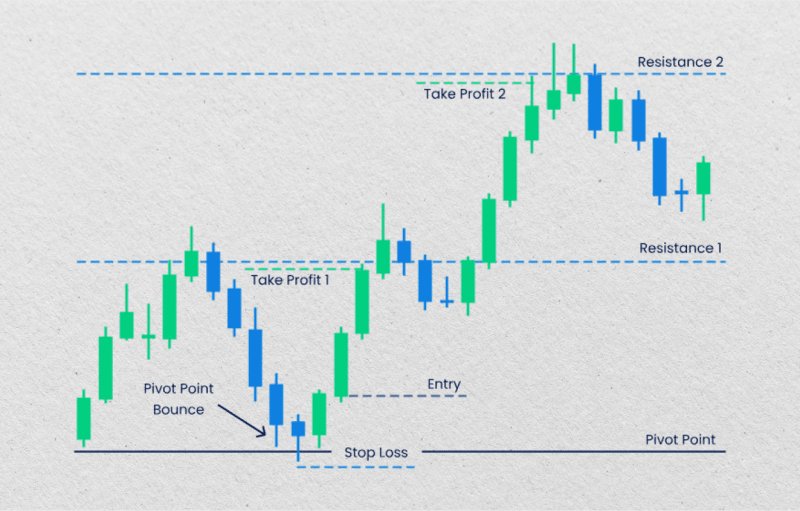

Pivot Points Trading

The pivot point is a technical indicator that helps track trends using past trading sessions’ price action. Day traders calculate and compare the pivot point to the current market price to predict future price movements and whether they will go long or short in the market.

The 5-point pivot point system is a common approach, which calculates the previous day’s high, low, and closing price, as well as two resistance and two support levels. The pivot point is calculated as the following.

Pivot Point = (Previous High+Previous Low+Previous Close) / 3

Support 1 (S1) = (Pivot Point∗2) − Previous High

Support 2 (S2) = Pivot Point − (Previous High−Previous Low)

Resistance 1 (R1)=(Pivot Point∗2)−Previous Low

Resistance 2 (R2)=Pivot Point+(Previous High−Previous Low)

This system helps traders identify support and resistance levels to draw movement ranges. Investors can use pivot points as a target price, signaling a potential reversal if the market price approaches the pivot point.

Breakout Trading

Breakouts happen when the market price breaks out from an estimated resistance or support level. The strategy relies on market dynamics and traders’ sentiment when an asset’s price exceeds the projected level, encouraging more investors to participate and further drive the price momentum.

This strategy requires careful analysis of price movements and market events to predict and notice breakouts. Investors must confirm the trend before investment, ensuring the price motion will last for a while without a soon recovery.

As such, when the underlying asset’s price moves above the resistance level, it suggests a buy order. Conversely, when the price drops under the support level, investors should execute a sell order.

However, this approach can be risky as breakouts can reverse at any time, causing the position to lose. Therefore, it is crucial to set stop-limit points and profit targets.

Range Trading

Range trading entails identifying the support and resistance levels and trading alongside these limits. Day traders enter the market (execute long order) when the market price is near the support level. Investors maintain the position until it reaches the resistance level, where they close the position.

Similarly, when the market price is near the resistance level, traders can execute a short position and close it when the underlying price is near the support level.

However, this strategy requires advanced knowledge of market nature and dynamics as support and resistance in stable markets are more clearly defined, while volatile markets change their ranges repetitively.

Moreover, investors must accurately identify resistance and support levels, which requires advanced skills using charting tools and technical indicators to draw and update the price ranges.

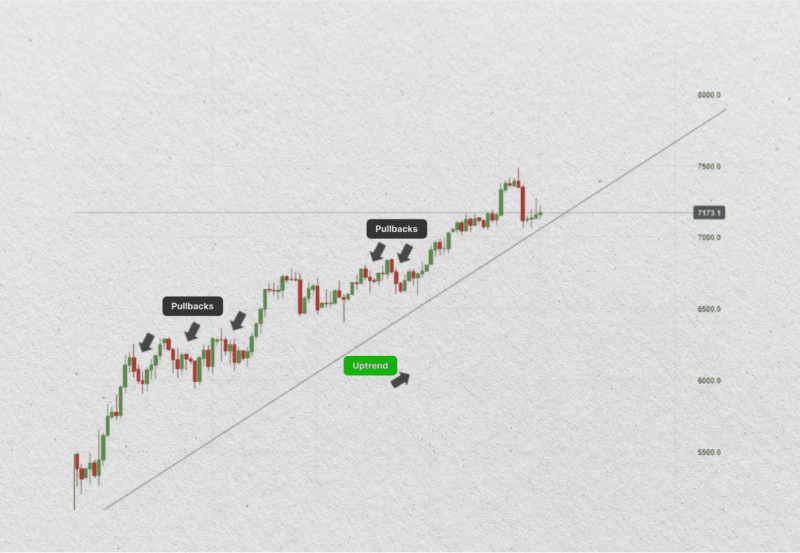

Pullback Trading

Pullbacks are price retracements during an upward trend movement. These corrections are part of natural market dynamics and present significant investment opportunities.

There are two ways to benefit from these dynamics. Traders can either short stocks during these momentary periods, capitalizing on mostly inevitable price pullbacks to achieve returns.

Another approach is to wait for the pullback to reach its momentum to buy the underlying asset at a low price before continuing its upward movement.

There are crucial considerations to this strategy. The subject security must promise price growth, allowing investors to gain from asset valuation after buying “on-discount.” Additionally, Pullbacks must be carefully analyzed as one tick down may not necessarily mean a pullback, creating a deceiving price action.

Observing two successive high points prior and using the trend line strategy is highly valuable to understand price corrections better and improve your chances of predicting the pullback more accurately.

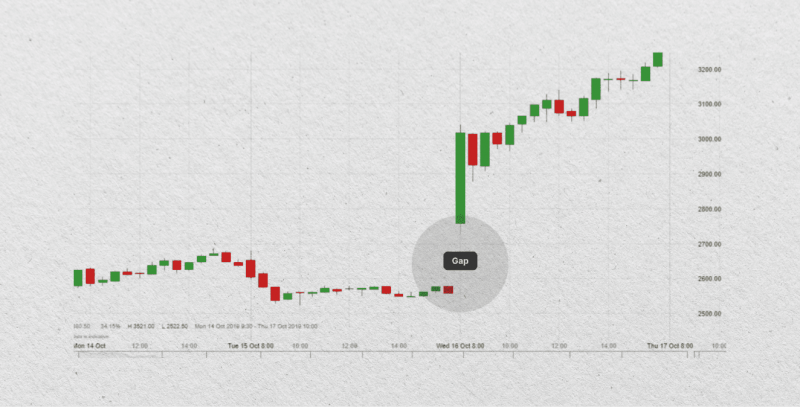

Gap Trading

Price gaps occur during sharp trend turns or extraordinary price increases and decreases. These sudden motions are depicted on the chart with a gap between the previous movement and the current sharp upward/downward trend.

These price changes and gaps are created not due to trading activities but due to fundamental and technical analysis factors. Financial reports, corporate annual earnings, and economic announcements made outside the trading session drive these rushes, creating a gap in the market.

For example, when a company announces a highly positive earning report, its shares will trade much higher in the next session, and day trading stocks becomes more lucrative.

Investors can capitalize on these after-hour factors in different ways. Traders can track the economic calendar and make their estimations on an upcoming financial report. If they predict stock growth, they place “buy” positions at a low price and enjoy a thriving share price.

Ichimoku Cloud

Ichimoku Kinko Hyo is a technical intraday indicator used for intraday trading.

This system factors in multiple calculations and lines, formulating a cloud on the price chart, which can be complicated for the average trader. Therefore, it is crucial to understand the elements of the Ichimoku Cloud:

- The Tenkan-sen: 9-period high and 9-period low, divided by two.

- The Kijun-sen: 26-period high and 26-period low, divided by two.

- Senkou Span A: Tenkan-sen and Kijun-sen, divided by two, representing the midpoint of two lines and the cloud’s upper line.

- Senkou Span B: 52-period high and 52-period low, divided by two, representing the cloud’s lower line.

- Chikou Span: 26-period closing prices before the asset’s latest closing price.

- Kumo: The cloud between Senkou Span A and Senkou Span B.

The day trader can use the formulated cloud to derive overbuying and overselling points. When the asset’s price goes above the cloud, the asset is overbought, while prices under the cloud bottom range mean an oversold asset.

Fast Fact

Jim Simons was believed to be the wealthiest day trader in the world. His hedge fund engaged in intraday quantitative trading and data-based investments. He generated over $28 billion with his approach.

Day Trading Tips

Despite the usefulness of these day trading strategies, gains are not guaranteed. Therefore, finding the style and trading system that suits you and fits your financial needs is crucial.

Day trading is a standard approach for new traders to gain a more straightforward position and market tracking. It helps them overcome the challenges of Forex rollover rates and additional brokerage charges.

Professional traders utilize their experience to make the most of intraday market activity. Here’s how you can capitalize on these techniques.

- Avoid trading around the day’s opening and closing hours, as prices become volatile and do not reflect the day’s average value.

- Choose stable markets to achieve steady and predictable returns, while volatile markets can offer higher returns at higher risks.

- Use a combination of technical indicators with each strategy to narrow your search and improve your risk management.

- Combine multiple day-trading strategies, such as scalping and pullbacks, to capitalize on small gains during intense market shifts.

- Set take-profit and stop-loss limits with your positions, especially in volatile markets, as you can lose significant money in short-term trading strategies.

Conclusion

Day trading is a popular approach for new and experienced investors. Beginners start with intraday investments to better read and analyze market dynamics and their decisions. At the same time, seasoned retail traders use their expertise to make the most of the short-term price action.

There are different ways to gain in intraday market movements using top day trading strategies. Some are easily understood, such as range, pullback, momentum, and breakout trading, while scalping, gap trading, and Ichimoku are more suited for successful traders.

FAQ

Can you make money in day trading in 2024?

Yes. Returns in day trading rely on market volatility. If the market is stagnating or not bringing enough interest, it does not generate enough returns, while volatile assets change broadly to make income.

What is the day trading strategy?

It is a one-day trading approach involving investment decisions during the day. Traders start investing as the stock market opens and conclude their activities as the market closes.

What is the most successful intraday trading approach?

Successful day trading strategies depend on the trader’s capital and target. However, scalping is common when mixed with arbitrage, where traders capitalise on small price fluctuations and conduct arbitrary exchanges with different financial markets or stock exchanges.

What is the best one-day approach?

Momentum and range trading strategies are easy to comprehend. Traders must find an underlying asset’s trading price limits and execute orders alongside this range on both sides of the trade.