Portfolio Management: Definition, Types, and Strategies to Succeed

Nov 18, 2024

As an investor, you should always consider ensuring your investments are safe and balanced. The methodical process of creating and overseeing an investment portfolio is known as portfolio management. It entails risk assessment, strategic asset allocation, and continuous monitoring to maximize returns and control market risk.

In this article, we cover the concepts, types, and tactics of portfolio management. Additionally, we examine the methods asset and portfolio managers use to make good decisions.

Key Takeaways:

- Portfolio management is the systematic control of assets to ensure they are aligned with multiple aspects to maximize returns while managing risks.

- Diversification is a crucial approach for reducing reliance on a single asset by spreading investments over other asset classes, thus lessening the impact of volatility.

- It is divided into two approaches: active management focuses on outperforming the market by frequent trading, while passive management tries to mirror market index performance with reduced expenses.

What is Portfolio Management?

Portfolio management is the structured approach to handling investments, tailored to an investor’s financial goals, risk tolerance, and investment horizon. It involves strategies to optimize asset allocation, reduce risk, and maximize returns.

The process includes regularly assessing and adjusting investments to build a balanced, diversified portfolio that aligns with market trends and the investor’s specific objectives. The key priorities in portfolio management are risk management, capital preservation, and capital growth. By using effective techniques, investors can create a well-diversified portfolio that meets their financial goals.

The ultimate aim is to balance investments for optimal returns while managing risks like market volatility, liquidity challenges, and other uncertainties. Portfolio management also focuses on efficient liquidity management and finding the best asset allocation strategy to grow funds while minimizing potential losses.

Consider two options for your investments:

- Single Stock Investment: You put all your money into one stock. While the potential for high returns exists, your entire investment is at risk if that stock plummets suddenly.

- Portfolio Management: Here, you diversify your investments. A portfolio manager might recommend spreading your funds across multiple assets, such as bonds, real estate, gold, and stocks from various sectors, like IT. By diversifying, you reduce the likelihood of significant losses if one investment underperforms, as other assets in your portfolio can compensate.

In short, portfolio management helps you grow your wealth systematically while minimizing the risks associated with concentrated investments.

Key Components of Portfolio Management

The cornerstone of portfolio management is asset allocation, which involves distributing investments among several asset classes, including stocks, bonds, and cash equivalents, to maximize returns and control risk exposure.

Effective management methods blend each asset class’s distinct qualities, risks, and possible returns to match an investor’s risk tolerance and financial objectives. A portfolio management plan may also further incorporate alternative investments like commodities, real estate, or cryptocurrency to diversify risk and opportunities within the investment.

Diversification

A risk management strategy called diversification aims to lessen the effect that the performance of any one asset will have on the portfolio as a whole. Diversification makes sure the portfolio isn’t too dependent on any one investment by distributing assets across several asset classes, industries, and even geographical areas.

This strategy protects against market volatility and maintains a steady risk-return balance. Diversification-focused investment techniques are crucial for building a robust portfolio that can endure volatile financial markets.

Let’s say you have made the decision to invest in cryptocurrencies. You diversify your investment portfolio by holding Ethereum, Solana, and a few other promising altcoins in addition to Bitcoin. In this manner, your losses could be compensated for by gains in other cryptocurrencies if Bitcoin’s value declines. Your investment is shielded from the risks connected to any one asset via diversification.

Risk Management

Risk management is crucial, as it aims to balance certain investments’ risks and possible rewards. Various strategies, such as active and passive management, use techniques to evaluate risk tolerance and restrict exposure to high-risk assets.

To create a portfolio that fits an investor’s goals and risk tolerance, portfolio managers and other financial experts conduct market research and employ instruments such as asset class selection and allocation.

Rebalancing

It is the process of periodically modifying a portfolio to preserve the desired asset allocation, particularly when market swings alter the initial asset composition.

For instance, a portfolio that started out with 60% stocks and 40% bonds may now have 70% of its weight due to market gains in the equity part. Rebalancing would entail selling some stocks and transferring money to bonds or other cheap securities to achieve the intended balance. Maintaining the portfolio’s alignment with the investor’s risk-return profile and investment objectives requires constant monitoring.

Fast Fact:

It is suggested by the “30-stock rule” that having 30 stocks offers adequate diversification. However, exposure to many more equities from several international industries is frequently necessary for meaningful diversification.

Types of Portfolio Management

There are several ways you can manage your portfolio. Let’s discuss some of them below:

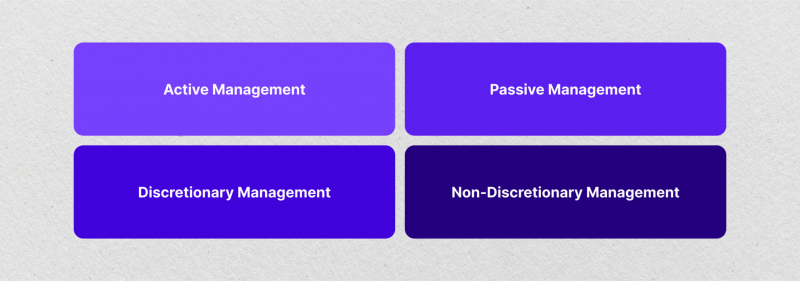

Active Portfolio Management

Frequent trading to exceed the market’s standard benchmarks is the foundation of this method. This strategy, which requires constant attention to market conditions and trends, often employs strategies like stock selection and market timing to profit on transient price swings.

Investors with a high-risk tolerance and who want to outperform the market are typically better suited for active management. Mutual funds and other actively managed investment vehicles are frequently employed as tools in this strategy.

Passive Portfolio Management

By closely following a particular market index, passive management—also referred to as index investing—emphasizes long-term growth. This approach usually results in cheaper fees and offers a tax-efficient means of generating consistent returns by holding investments that closely resemble an index.

Index funds and exchange-traded funds are popular choices for investors looking for stability and cheaper solutions. Passive management is frequently preferred because it can reduce transaction costs and provide market-matching returns without requiring regular trading.

Discretionary Portfolio Management

A professional portfolio manager makes all investment decisions under discretionary portfolio management. In this arrangement, the portfolio manager creates a customized strategy by adjusting investment strategies to match each client’s financial objectives.

The manager is given complete decision-making authority by the clients, enabling a hands-off approach perfect for people who would rather receive professional advice without being directly involved. Investors who want individualized portfolios but lack the time or experience to make investing decisions are frequently drawn to this management style.

Non-Discretionary Portfolio Management

While offering expert advice from an advisor, non-discretionary portfolio management gives investors ultimate authority over their choices. Here, the client controls their portfolio while the advisor makes suggestions based on the investor’s goals and risk tolerance.

This structure offers flexibility and an appropriate degree of specialist knowledge for investors who would rather be actively involved in their portfolios while still receiving expert guidance.

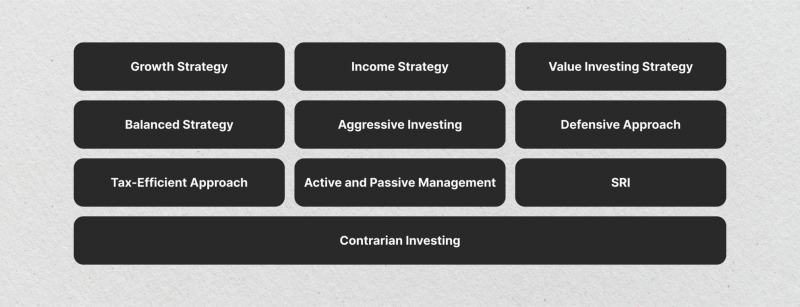

Portfolio Management Strategies

Selecting the best approach requires matching an investor’s time frame, risk tolerance, and financial objectives. These essential techniques are appropriate for various investor types and financial goals.

Strategy for Growth

This approach concentrates on assets that have the potential to increase in value significantly, frequently in industries with rapid growth, such as technology or renewable energy. Investors who use this management strategy put high returns ahead of stability and are willing to take on more risk in exchange for the potential for large profits.

Because growth assets can be unpredictable in the short term but have the potential to yield substantial returns over time, this approach is best suited for investors with a lengthy investment horizon and a high-risk tolerance.

Income Strategy

Investments that generate consistent cash flow, usually in the form of dividends or interest payments, are given priority in income-focused portfolios. REITs, bonds, and stocks that pay dividends are examples of common assets.

A good option for investors who want stability and less risk while preserving a consistent income stream, this method is well-liked by retirees and those seeking dependable income without liquidating assets.

Value Investing Strategy

The main goal of value investing is finding cheap stocks with room to grow in value. Investors look for assets trading below their inherent worth, frequently using market capitalization or the P/E ratio as a benchmark. This approach, which is best suited for long-term, patient investors, attempts to take advantage of market inefficiencies by placing bets on the eventual increase in the value of cheap securities.

Balanced Strategy

The balanced strategy combines income and growth assets to produce a diverse portfolio that provides stability and development potential. A conventional balanced portfolio may include bonds for consistent income and stocks for capital growth.

Investors with a modest tolerance for risk who want a well-balanced risk-return profile and the freedom to modify allocations in response to market conditions would find this strategy ideal.

Aggressive Investing

Taking significant risks to earn large returns is the hallmark of aggressive investing, which usually concentrates on equities in younger markets or rising industries.

Aggressive investors can consider using leverage, trading on margin, or purchasing speculative assets to optimize possible profits. Younger investors or those with a high-risk tolerance who can tolerate market volatility in the hopes of long-term, significant rewards are well suited for this strategy.

The Defensive Approach

By making investments in reliable, low-volatility assets, frequently in vital industries like utilities or healthcare, a defensive strategy aims to protect wealth. Here, investors seek steady performance across market cycles and prioritize risk management more than large profits. Investors who are risk-averse or getting close to retirement and prioritize capital preservation over growth frequently employ this tactic.

Tax-Efficient Strategy

A tax-efficient approach reduces the tax effect on investment returns. Typical strategies include owning securities with fewer tax obligations, such as index funds, or investing in tax-advantaged accounts, such as 401(k)s or IRAs. Because it concentrates on optimizing after-tax returns, this strategy helps investors with long investment horizons or those in high tax bands.

Active vs. Passive Management

Let’s now distinguish the difference between the two:

In an effort to beat a certain market index, active managers regularly modify the portfolio in response to market analysis. Although this strategy usually entails greater fees and calls for constant monitoring and experience, it can provide flexibility and the possibility of large returns.

By maintaining a comparable asset mix, passive managers seek to mimic the performance of a certain index, such as the S&P 500. Passive techniques are appropriate for long-term, budget-conscious investors because they often have reduced fees and tax implications.

Socially Responsible Investing

The goal of SRI is to make investments that meet specific moral, environmental, or social standards. Businesses with ethical business practices—like robust governance or sustainable operations—are given preference by investors. In addition to offering financial rewards, this strategy appeals to investors who value matching their assets with social or personal ideals.

Contrarian Strategy

Purchasing assets that others are selling and placing a wager on a market reversal constitute the contrarian strategy. In sinking markets, contrarian investors seek cheap stocks to buy low and profit from a future comeback. This high-risk, high-reward strategy works well for seasoned investors who can predict changes in the market and bear possible short-term losses.

Key Metrics for Measuring Portfolio Performance

Return on Investment (ROI) is a fundamental metric for determining the profitability of an investment. It assesses an investment’s percentage return or loss concerning its starting cost. The formula is basic.

ROI = Net Profit / Cost of Investment x 100

ROI assists investors in determining whether their portfolio is reaching their financial objectives by displaying how much an investment has earned relative to its cost.

Sharpe Ratio

The Sharpe Ratio is another important performance metric that compares the return of an investment to its risk. It specifically quantifies the excess return earned in exchange for the additional volatility an investor experiences due to holding riskier assets. Here’s the formula:

Sharpe Ratio = (Rx – Rf) / StdDev Rx

Rx = return of the portfolio

Rf = risk-free rate

StdDev Rx = standard deviation of the excess return

When evaluating various investment possibilities, a greater Sharpe Ratio can be very helpful as it shows that an investment yields a larger return per unit of risk.

Beta and Alpha

When evaluating investment performance concerning market changes, alpha and beta are crucial measures.

Compared to a market index, alpha quantifies the active return on an investment. Outperformance relative to the benchmark is indicated by a positive alpha, whilst a negative alpha shows underperformance.

The volatility of an investment with respect to the market is evaluated by beta. An investment with a beta of 1 moves in tandem with the market; a beta of less than 1 indicates reduced volatility, while a beta greater than 1 indicates higher volatility.

These metrics are essential for an investment portfolio manager to match investments with an investor’s goals and risk tolerance.

The Standard Deviation

The standard deviation sheds light on volatility and risk by measuring the distribution of investment returns. Bigger risk is indicated by a bigger standard deviation, which suggests more significant returns. Investors can better manage their investment plan over time by understanding the possible variability in the performance of their portfolio by evaluating standard deviation.

Benchmarking

Comparing the performance of an investment to a certain market index or group of indexes is known as benchmarking. Investors can use this approach to assess how well their portfolio is doing compared to industry standards across various asset types. Investors can use benchmarks to assess the effectiveness of their investing strategy and determine whether changes are necessary to reach their financial objectives.

Conclusion

Understanding this concept is critical to accomplishing investment goals. Choosing the right style, methods, and tools is crucial for optimizing your performance.

Investors should see management as a continual activity. It requires ongoing modifications based on many things. Adapting to changes ensures that your investment strategy stays effective and aligned with your objectives. Staying educated and flexible can lead to greater investment results.

FAQs:

What is portfolio management?

It is the process of supervising individual investments to maximize returns over a set time period.

What are the portfolio managers’ responsibilities?

Portfolio managers are accountable for making investment decisions. They create and implement plans to help clients reach their goals, design and manage portfolios, and decide when and how to buy and sell investments.

What is a portfolio management scheme?

It is an organized method of investment management. It describes specific techniques and processes to help individuals achieve what they are aiming for.