How to Scale a Crypto Exchange Business and Stay Competitive

Apr 8, 2025

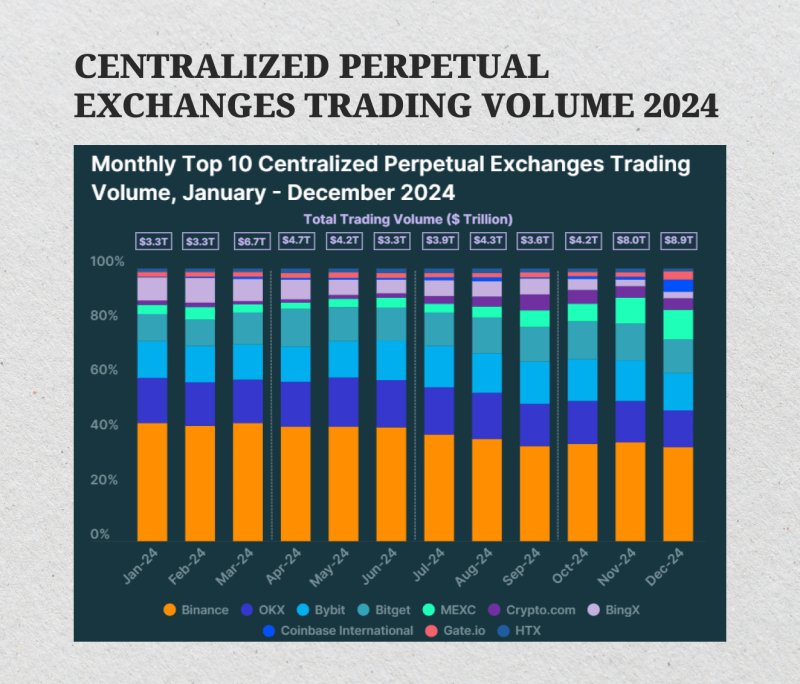

The crypto market isn’t slowing down. Total trading volume for crypto futures hit a record $58 trillion in 2024, surpassing the peaks of the last bull run.

More people are trading, deals are getting bigger, and even the institutional players are jumping in. While that sounds like great news for your exchange, it also puts immense pressure on your operations. If your platform cannot keep pace, it risks slow transactions, liquidity challenges, and security problems—issues that drive traders away.

So, how do you grow your crypto exchange without stumbling? This guide dives into what it really takes to scale successfully – and smartly.

Key Takeaways:

- Your exchange’s technology has to handle heavy trading traffic, keep user assets safe, and stay fast, no matter what the market throws at it.

- Keep users hooked and attract new ones by adding valuable features like margin trading options, staking rewards for holding assets, DeFi integrations, and more.

- Growing your user base means actively marketing – using smart SEO so people find you, building a loyal community, and rewarding users for bringing in their friends.

- Regulatory compliance is crucial for staying out of legal trouble and making sure your exchange remains stable and trustworthy in the long term.

Assess the Current State of the Exchange

Expanding your crypto exchange is a major move, and jumping in unprepared can lead to technical meltdowns, financial headaches, or regulatory nightmares. Before scaling, evaluate the platform’s current condition.

Performance and Technical Health

The core of any crypto exchange is its ability to process trades quickly and efficiently. Slow transactions or system downtime can drive traders away. That’s why performance analysis should be the first step.

Key factors to assess:

- Transaction speed: Orders should be executed instantly, with minimal delays.

- System response time: Users expect real-time updates without lag.

- Order book liquidity: A deep order book means smoother trades and better prices.

- Uptime reliability: The exchange should operate with at least 99.9% uptime, even during market surges.

If the system struggles under high traffic, it’s a red flag. A scalable architecture and cloud-based infrastructure might be necessary before expansion.

Understanding the User Base

A growing exchange must know its users. Without this factor, scaling efforts may attract the wrong audience or fail to meet trader expectations.

Important questions to ask:

- Who are the current users? Where are they located? What assets do they trade most?

- How engaged are they? Are most accounts active, or do many traders lose interest?

- What do they need? Do they prefer spot trading, futures, or staking?

User feedback is also valuable. Customer support tickets, online reviews, and social media comments often reveal hidden issues. Address these concerns before scaling and prevent larger problems later.

Financial Readiness

Expanding a crypto exchange also requires a strong financial foundation.

Here’s what to check:

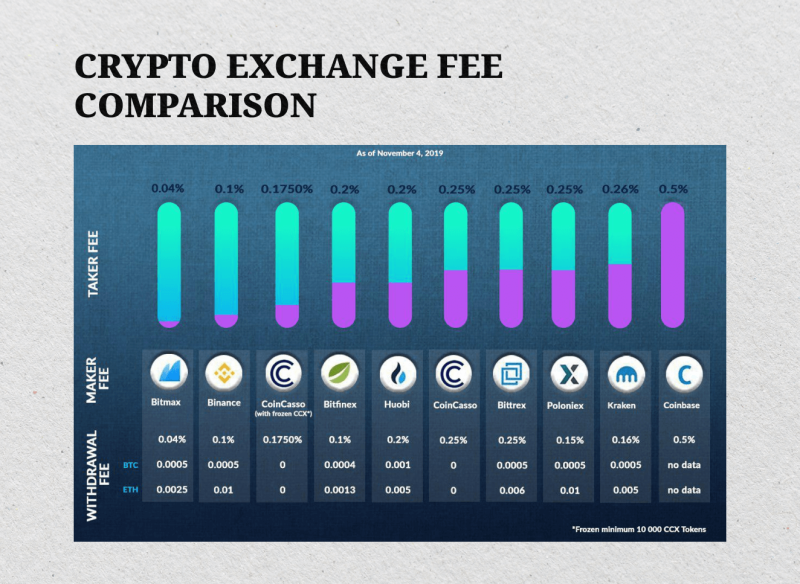

- Revenue streams: Where does the exchange make money? Trading fees, listings, premium accounts?

- Operational costs: How much is spent on infrastructure, security, and compliance?

- Liquidity reserves: Does the exchange have enough capital to handle sudden market swings?

If your exchange isn’t profitable yet, it needs a clear plan for sustainable growth. Relying too much on outside investors can be risky in a volatile industry.

Security and Compliance

Security is non-negotiable. As your exchange grows, it becomes a bigger target for hackers. A breach can be catastrophic, wiping out user funds and your reputation.

A security check should include:

- Asset protection: Most funds should be stored in cold wallets to prevent theft.

- Cybersecurity measures: Firewalls, DDoS protection, and multi-layered security are essential.

- KYC/AML compliance: Identity verification must meet global regulatory standards.

Compliance is the other side of this coin. Expanding geographically means navigating a complex web of different rules. Operating without the right licenses or ignoring local regulations is asking for hefty fines or even being forced to shut down. Get legal advice early and often.

Technical Side of Scaling

Scaling your exchange means ensuring your underlying systems can handle more users, more trades, more data, and more sophisticated security threats without buckling. If the tech isn’t ready, growth can paradoxically lead to a worse user experience – think slowdowns, outages, and financial risks.

Building an Infrastructure That Can Grow With You

A small exchange might run smoothly with a basic setup, but as trading volume grows, infrastructure bottlenecks appear. The platform must be built for cryptocurrency exchange scalability from the start, or at least be flexible enough to evolve.

A microservices architecture is one of the best approaches to handle this. Instead of running everything on a single monolithic system, microservices divide the exchange into independent components. Order matching, wallet management, user authentication, and trade execution each operate as separate services. This way, if one part experiences high traffic, it won’t slow down the entire system.

Relying solely on your own physical servers has scaling limits. Cloud platforms (like AWS, Google Cloud, Azure) offer fantastic flexibility. They can automatically spin up more resources when traffic spikes and scale back down when things quieten, helping you manage costs and performance.

Many larger exchanges find a sweet spot with a hybrid approach – keeping some sensitive operations on-premise while leveraging the cloud’s scalability for other components. Platforms designed for this, like B2BROKER’s B2TRADER SaaS solution, offer this kind of cloud-native performance specifically for exchanges planning to scale.

Speed and Performance Optimization

In trading, even milliseconds matter, especially for active or high-frequency traders, so traders expect speed. Slow order execution means “slippage” – the price changing between when a trader clicks ‘buy’ or ‘sell’ and when the trade actually happens. Consistent slippage drives traders away, and fast.

- Low-Latency is Key: This involves everything from using high-speed databases and efficient code (especially API calls) to strategically placing your trading engines in data centers around the world. The closer your servers are to your users, the faster their trades execute.

- Spread the Load: Load balancers are essential. They direct incoming requests across multiple servers so no single one gets overwhelmed, which prevents bottlenecks and single points of failure.

- Cache What You Can: Why make your system look up the same information over and over? Caching frequently accessed data (like snapshots of the order book or recent trades) allows for near-instant retrieval, taking pressure off your core database and making the user interface feel much more responsive.

Ensuring High Availability and Rock-Solid Stability

As an exchange grows, it must remain operational 24/7, even under extreme conditions. Downtime can cost millions in lost trades and shatter user confidence, potentially forever.

Geographic redundancy is one of the most effective ways to ensure the platform’s reliability. Having data centers in different physical locations means that if one goes down (due to a power outage, natural disaster, etc.), you can switch over to a backup system and keep operating.

Additionally, you need real-time monitoring systems constantly checking the pulse of your exchange, watching for slowdowns, weird transaction patterns, or servers getting overloaded. If an issue arises, engineers can respond before it escalates into major outages.

Security at Scale

We touched on security earlier, but it’s worth emphasizing: as you grow, your security measures must scale too.

A good security setup includes multiple layers of defence. Firewalls and DDoS protection help block large cyberattacks, while two-factor authentication (2FA) and biometric verification make it harder for unauthorised users to gain access. Sensitive information, especially things like API keys and the private keys that control crypto assets, demands top-notch encryption.

Reiterate this: the vast majority of crypto assets must be kept offline in secure cold storage. Hot wallets (needed for processing withdrawals and deposits) should hold only the minimum necessary, with strict withdrawal limits and anomaly detection.

Sadly, not all threats are external. Some of the most damaging breaches have involved insiders. Implement strict access controls (so people can only access what they absolutely need for their job) and consider multi-signature approvals for significant actions like large withdrawals. This prevents any single person from having too much power or making a catastrophic mistake.

Fast Fact:

On February 21, 2025, crypto exchange Bybit suffered a massive hack, losing 401,346 ETH (~$1.5 billion)—one of the largest breaches in crypto history. Hackers used an advanced transaction data manipulation technique, bypassing Bybit’s multi-layer security and accessing cold wallet funds.

Scaling Without Compromising Efficiency

While technical upgrades are crucial, they should not overcomplicate the system. A poorly optimised exchange can become bloated with excessive features and unnecessary processes, slowing everything down.

For example, advanced AI-driven solutions can streamline operations instead of manually handling tasks like KYC verification, fraud detection, and trade reconciliation. The more tasks that can be automated efficiently, the more scalable the exchange becomes.

Finally, technical scaling should always align with business goals. There’s no need to overinvest in expensive infrastructure if user growth doesn’t demand it yet. A smart, phased approach to scaling—expanding in response to real demand rather than speculation—ensures long-term sustainability.

Expanding the Product Offering

A growing crypto exchange can’t rely on just basic spot trading. As competition increases, users expect more advanced financial products and a wider range of trading opportunities.

Diversifying Trading Options

Spot trading is the foundation of any exchange, but experienced traders look for more than just buying and selling assets. Advanced trading products increase trading volume and improve user retention by giving traders more ways to profit.

Margin trading has become one of the most sought-after features today. It enables users to trade using leverage, enhancing potential profits and heightening the associated risks.

Futures and options trading take things even further. However, they also present regulatory challenges, as some jurisdictions have strict rules regarding derivatives. Before launching these features, an exchange must ensure full compliance with local financial regulations.

Adding More Cryptocurrencies and Trading Pairs

Offering more coins and trading pairs seems like an obvious growth lever. More choice equals more trading opportunities. Today’s users are savvy – they’re exploring altcoins, DeFi tokens, and various stablecoins.

However, before listing a new asset, your business should do some research. What’s its genuine trading volume and liquidity picture? How secure is its underlying network? Is there real market demand, or just temporary hype? Prioritize projects with solid fundamentals, active development teams, and perhaps even real-world applications. Listing low-quality or questionable tokens might create a short-term buzz but can seriously backfire through forced delistings, damage to your reputation, and leaving users holding worthless bags.

Another important aspect is fiat integration. Making it seamless for users to deposit and withdraw their local currency (USD, EUR, GBP, etc.) via familiar methods like credit cards, bank transfers, or popular payment processors will help attract new clients and boost overall trading volume.

Introducing Staking and Passive Income Features

Not every user is an active trader. A significant portion of the market prefers to buy and hold assets long-term. You can attract and retain these valuable users by offering ways to make their crypto work for them while it sits on your exchange.

Think about introducing features like:

- Staking: Offer easy, perhaps even one-click, options for users to stake their proof-of-stake (PoS) coins directly on your platform. This lets them earn rewards for supporting the network without needing deep technical know-how.

- Crypto Lending: Allow users to lend out their assets (often to margin traders on your platform) and earn interest.

- Yield Farming Access: Provide simplified gateways to participate in DeFi yield farming protocols.

These passive income features can be a powerful draw for long-term investors. Just be completely transparent about the associated risks (like borrower default in lending). Leading exchanges often mitigate these risks with insurance funds or strong collateral requirements – balancing attractive returns with user protection is key.

However, tread carefully. DeFi integrations demand rigorous security vetting to protect your users and your platform. It’s about thoughtful expansion, not just blindly chasing the latest trend.

Making Complex Trading Accessible with AI & Automation

Let’s be real: crypto trading can feel complex and intimidating, especially for newcomers. Leveraging technology to simplify the user experience (UX) can be a major advantage. Consider tools like:

- AI-driven trading assistants that help users set stop-losses or take-profits.

- Automated portfolio rebalancing features.

- Copy-trading functionalities.

- Smart order execution that aims for the best price across various parameters.

These features lower the entry barrier for less experienced traders and are highly valued by sophisticated institutional clients and algorithmic traders.

Marketing, Branding, and Building Trust

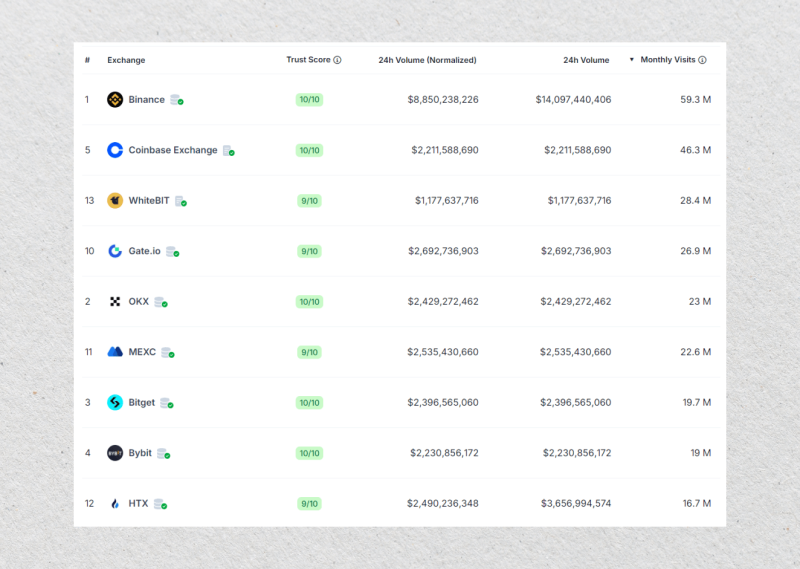

Here’s the hard truth: you could build the best exchange platform ever, but if no one knows about it or trusts it, it won’t succeed. The crypto market is incredibly crowded, and winning users is a constant battle.

What Do You Stand For? Build Your Brand

Your exchange needs an identity. Are you the low-fee leader? The security champion? The platform with the widest altcoin selection? The easiest on-ramp for beginners? Define your unique value proposition clearly. Knowing who you are helps attract the right audience.

The crypto industry has scars from past failures and scams, and users are rightfully cautious. Thus, build trust through relentless transparency. Publish regular operational updates, provide clear insights into your reserves or security practices, and communicate openly, especially during market turmoil or technical issues. Engage with your community on social media (X/Twitter, Reddit, Telegram etc.), listen to feedback, and show you’re committed for the long run.

Mastering Digital Marketing

Success usually comes from smarter, organic strategies. Platforms like Google and Facebook restrict crypto ads, so exchanges mostly rely on SEO (Search Engine Optimization), content marketing, and social media.

SEO is very important. Most traders Google everything—from “best crypto exchanges” to “how to buy Bitcoin.” If an exchange doesn’t rank high in search results, it loses potential users. Optimising the website, publishing helpful content, and getting backlinks from trusted sources increase visibility.

Blog posts, market analysis, educational guides, and even YouTube videos help position the exchange as an industry leader. Platforms like Binance and Coinbase regularly produce research reports and tutorials, attracting both new and experienced traders.

Social media engagement drives trust and user loyalty. Twitter, Telegram, and Reddit are where crypto communities thrive. Hosting AMAs (Ask Me Anything) sessions, discussions, and interactive campaigns builds trust and keeps users engaged. The more people interact with an exchange’s content, the more likely they are to use the platform.

Referral and Affiliate Programs

Word-of-mouth marketing is one of the most effective and cost-efficient ways to grow an exchange. Many of the biggest platforms owe their success to aggressive referral programs. Offering users rewards, such as reduced trading fees or bonuses, for bringing in new traders can lead to exponential growth.

Affiliate partnerships with crypto influencers, bloggers, and content creators can also drive traffic. Many traders trust recommendations from experienced investors more than traditional advertising. If an influencer actively uses and promotes an exchange, their followers are likely to do the same.

Referral and affiliate programs should be simple and transparent. Users should easily see how much they earn, and payouts should be fast and reliable. A poorly managed program can backfire, damaging trust instead of building it.

Fast Fact:

Many brokerage CRMs include Introducing Broker (IB) functionality that enables exchanges to establish their own affiliate networks.

Partnerships and Industry Collaborations

No exchange operates in isolation. Partnering with blockchain projects, fintech companies, and payment providers can boost credibility and user adoption. A collaboration with a well-known wallet provider or payment processor can make fiat deposits and withdrawals easier, attracting new traders.

Listing promising crypto projects before competitors also gives an exchange an edge. If a new blockchain startup gains popularity, being the first exchange to support its token can attract a wave of new users. However, careful vetting is necessary, as listing unreliable or scam projects can harm the platform’s reputation.

Many exchanges even form strategic alliances with institutional investors, market makers, or liquidity providers. These partnerships improve order book depth, leading to better trading experiences and higher retention rates.

Loyalty and User Retention Strategies

Attracting new users is just the first step—keeping them engaged is just as important. Loyalty programs, trading competitions, and VIP perks help turn casual users into long-term traders.

Many successful exchanges have tiered reward systems, where users who trade more frequently get lower fees, exclusive bonuses, and premium features. Gamification—such as leaderboards, achievements, and special promotions—also boosts engagement.

Another key factor is customer support. A well-staffed, responsive support team can make or break user retention. Exchanges with 24/7 multilingual support, live chat, and fast response times tend to build much stronger communities.

Legal and Compliance Aspects

The regulatory landscape for crypto is evolving fast, and exchanges that ignore compliance risk fines, shutdowns, or legal battles. A solid legal foundation is essential for sustainable growth.

Understanding Global Regulations

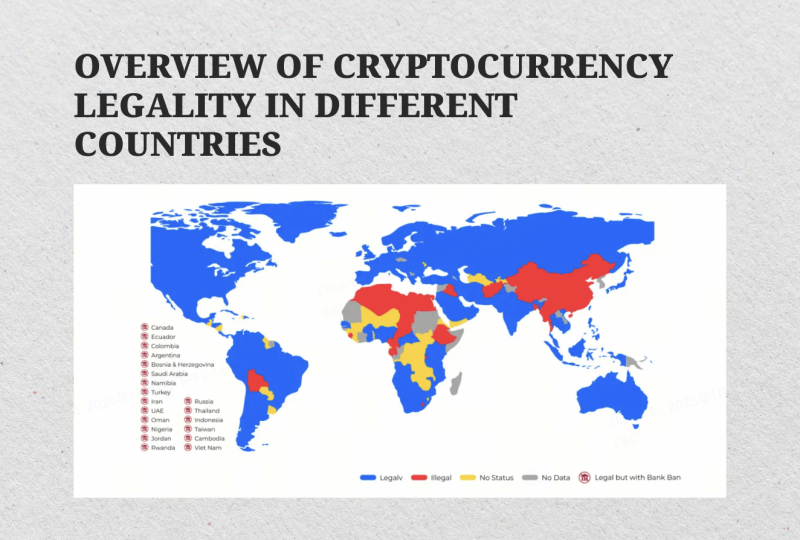

Crypto regulations vary by country. Some nations embrace digital assets, while others impose strict restrictions. An exchange looking to expand must research and comply with the laws in every target market.

Key areas to consider include:

- Licensing – Some regions, like the EU and the U.S., require exchanges to obtain special financial licenses.

- KYC/AML Compliance – “Know Your Customer” (KYC) and Anti-Money Laundering (AML) laws demand identity verification for all users.

- Tax and Reporting Obligations – Many countries now require exchanges to report user transactions for tax purposes.

Failing to meet regulatory requirements can lead to frozen assets, operational bans, or lawsuits. It’s crucial to consult legal experts before expanding into new territories.

Building a Strong Compliance Framework

A growing exchange needs clear internal policies to stay compliant. This includes automated KYC verification, transaction monitoring, and secure user data storage. Many top exchanges partner with compliance firms to streamline these processes.

Beyond user verification, exchanges must protect against fraud and illicit activities. Strong risk assessment protocols and real-time fraud detection tools help prevent money laundering and suspicious transactions.

Staying ahead of regulatory changes is also important. Governments update laws frequently, and exchanges must be agile enough to adapt. Regular legal audits and strong communication with regulators ensure long-term stability.

Risk Management and Financial Planning

Running a crypto exchange comes with risks—from market volatility to security threats. Investing in crypto as a business requires a strong risk management strategy to maintain stability and user trust, even in uncertain times.

Managing Liquidity and Market Risks

Liquidity is the lifeblood of any exchange. If order books are too thin, traders face slippage and poor execution prices. Partnering with market makers and liquidity providers ensures smooth trading conditions.

Market risk is another challenge. The crypto market is volatile, and sudden price swings can impact exchange stability. Risk management tools, such as price limits, stop-loss mechanisms, and volatility controls, help mitigate losses.

Financial Sustainability and Reserve Funds

Scaling requires smart financial planning. An exchange must have enough capital reserves to survive market downturns, cover operational costs, and handle unexpected expenses.

Diversified revenue streams—such as trading fees, staking rewards, and institutional services—help maintain financial health. Overreliance on one income source can be dangerous, especially in bear markets.

Finally, a sustainable exchange doesn’t expand recklessly. Growth should be measured and strategic, ensuring that resources are used efficiently and that the platform remains stable through all market conditions.

Conclusion

Scaling a crypto exchange starts with building a platform that can handle growth while remaining secure, efficient, and user-friendly. A strong platform, a variety of trading options, and a solid marketing strategy help attract and keep users. At the same time, following regulations and managing risks keeps the business stable and secure.

The best exchanges carefully plan their growth, ensuring they can handle more users without sacrificing performance or security. Crypto is always changing, and those who stay flexible, innovate, and scale responsibly will have the best chance of long-term success.

FAQ:

What is scaling in crypto trading?

Scaling in crypto trading refers to improving an exchange’s capacity to handle increased trading volumes, users, and transactions without performance issues.

How do you evaluate a crypto exchange?

Key factors include liquidity, security, trading fees, user experience, supported assets, and regulatory compliance.

How to start a crypto exchange business?

Starting a crypto exchange requires securing liquidity, obtaining licenses, implementing security protocols, and launching a trading platform.

How much does it cost to start an exchange?

The cost varies widely based on the technology stack, licenses, and liquidity requirements, ranging from $100,000 to several million dollars.