ICT Trading Explained: Smart Money Concepts, Tools and Setups

July 02, 2025

Many traders get stopped out just seconds before the market moves in their favor, and that’s not bad luck. ICT trading, developed by Michael J. Huddleston (Inner Circle Trader), reveals how institutional players engineer prices to trap the crowd and collect liquidity.

This guide strips away indicators and noise, teaching you how to read the market like smart money does — through structure, timing, and intention. If you’re ready to move from guessing to anticipating, you’re exactly where you need to be.

Key Takeaways:

- ICT trading strategies focus on smart money behaviour, utilising tools such as liquidity pools, order blocks, and fair value gaps to identify high-probability trades.

- Timing and session awareness are just as important as technical structure — knowing when to trade is key.

- The ICT trading meaning goes beyond patterns; it’s a mindset grounded in market logic, patience, and alignment with institutional intent.

What is ICT Trading?

ICT Trading, also known as Inner Circle Trader, is a trading methodology developed by Michael J. Huddleston, a renowned educator in the world of Forex and financial markets. Rather than relying on indicators or traditional technical analysis, ICT focuses on how institutions and “smart money” manipulate prices.

The core philosophy of the method is understanding why the market moves the way it does and how big players, like banks and hedge funds, leave footprints in the price action.

ICT trading teaches traders to recognise liquidity zones, order blocks, imbalances, and shifts in market structure. These concepts help traders pinpoint areas where institutional activity is likely to occur — essentially showing you where the money is hiding.

ICT believes that retail traders often get trapped during key moments, such as breakouts or false reversals, and aims to position you on the smarter side of the trade.

What sets ICT apart from many strategies is that it trains your eyes to read the market like a story, from the way prices react to key levels, to how they behave during specific sessions, such as the London or New York open. There’s a strong emphasis on timing, patience, and understanding the psychology behind price movements.

Fast Fact

The term “fair value gap“, a central concept in ICT trading, was popularised by Michael Huddleston and is now widely used by institutional-level traders globally.

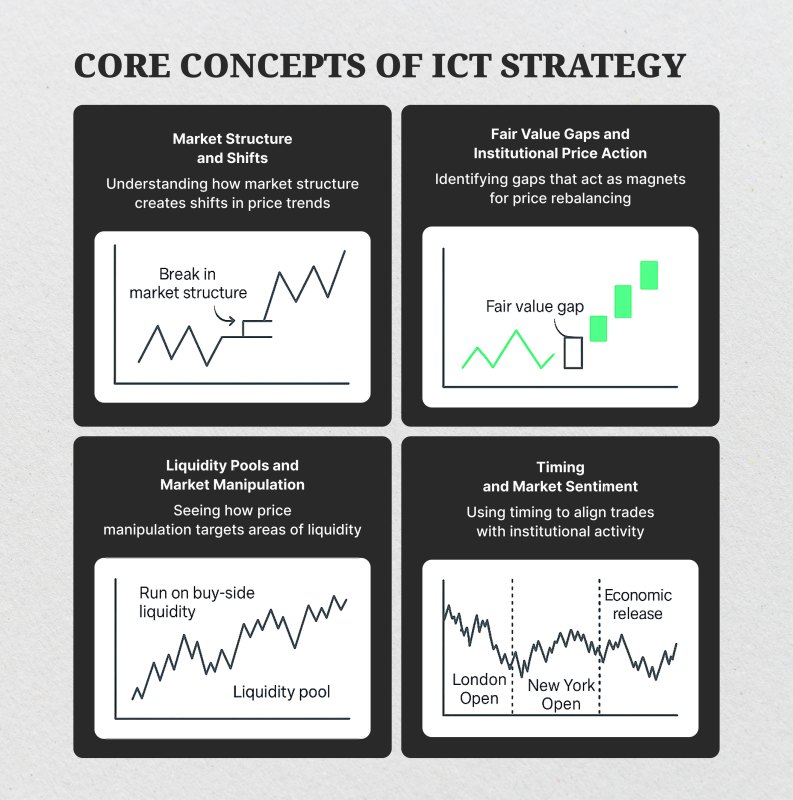

Core Concepts of ICT Strategy

The foundation of ICT trading lies in understanding how and why prices move the way they do — not just reacting to charts but reading into the intent behind each move.

Unlike conventional methods that rely heavily on indicators, ICT trading strategies focus on observing price action and decoding the behaviour of institutional traders.

The approach focuses on how these powerful market participants use market manipulation to create false signals, trap retail traders, and accumulate large positions.

Market Structure and Shifts

At the heart of every ICT trading strategy is market structure — the way price creates higher highs, lower lows, and retracements. Recognising market structure shifts is critical for any Inner Circle Trader, as they often signal a transition from one phase of the market to another.

For instance, a break in a previous low followed by a failure to reclaim it might suggest the beginning of a downtrend. But within ICT, this is not just a change in direction; it’s an indication of institutional intent, revealing where liquidity might be harvested next.

This deeper insight into market dynamics helps traders prepare for the next wave of market movements rather than chase after them.

Fair Value Gaps and Institutional Price Action

One of the most recognizable features in ICT trading is the fair value gap. This is a small void on the price chart left behind when the price moves too rapidly in one direction.

According to Inner Circle Trading, these gaps often act as magnets, drawing prices back to rebalance before continuing in the same direction. Spotting a bullish fair value gap in a discount zone could signal one of the best optimal entry points in a trade.

The ICT framework teaches traders to wait patiently for these setups to align with a broader market structure, offering an optimal trade that reflects the underlying activity of institutional traders.

Liquidity Pools and Market Manipulation Patterns

Understanding what ICT is in trading also requires an appreciation of how liquidity works. Markets move not only to reflect supply and demand, but also to tap into areas where traders have placed their stop-losses or pending orders.

These zones are known as liquidity pools, and they’re often the target of sophisticated market manipulation patterns. The price may deliberately run above a previous high — inducing buyers — only to sharply reverse once that liquidity is exhausted.

For the well-trained circle trader, this is a key signal, not a trap. The ability to anticipate such movements is what makes ICT trading strategies feel almost surgical in execution.

Timing, Sessions, and Market Sentiment

A unique aspect of Inner Circle Trading is the emphasis on timing. Not all price movements are created equal, and market conditions change depending on the session.

The London Open, New York Open, and key economic releases are critical points where market sentiment shifts and institutional traders often make their moves. This is why the ICT method places importance not just on levels, but on when the price approaches those levels.

It’s a strategic blend of technical precision and psychological awareness — a layered approach to market analysis that gives traders an edge in real-world scenarios.

Decision-Making and Strategy Alignment

Ultimately, the ICT trading meaning goes beyond spotting patterns or zones. It’s about making informed trading decisions rooted in the logic of smart money concepts.

By understanding the deeper mechanics of market manipulation, price delivery, and structural flow, traders can align their positions with institutional intent — moving in the same direction as the professionals rather than against them.

This strategic clarity allows the circle trading community to avoid emotional trading and instead approach each session with a defined plan and framework.

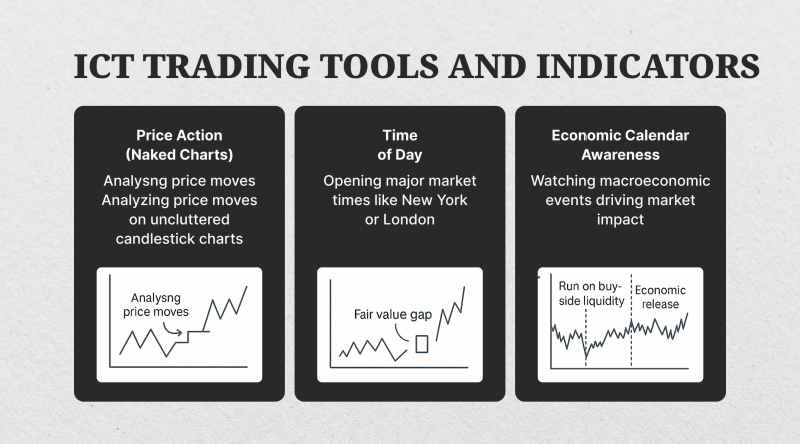

ICT Trading Tools and Indicators

In the world of ICT trading, tools and indicators are approached quite differently from traditional technical analysis. Rather than filling charts with oscillators, moving averages, or complex indicators, ICT emphasises clarity and intent.

The focus is on what price is doing, when it’s doing it, and why — all viewed through the lens of institutional behavior and smart money logic.

While the method can be applied using modern platforms like TradingView or MetaTrader, the tools themselves remain elegantly simple yet highly effective.

Price Action (Naked Charts)

Perhaps the most distinctive aspect of the ICT trading strategy is its reliance on naked charts, also known as pure price action trading. This means stripping the chart down to just candlesticks and raw price movement without any overlays or traditional indicators.

ICT traders learn to “read” the market by observing how prices behave around key levels, such as order blocks, fair value gaps, and previous highs and lows. Every wick and body of a candle holds information — from engineered liquidity grabs to signs of institutional accumulation or distribution.

The absence of visual clutter enables the trader to focus on market structure, identify manipulative moves, and understand the underlying story behind market movements.

Time of Day

Timing is everything in Inner Circle Trading. Price doesn’t just move randomly; it tends to react and shift at specific times of day — particularly during major trading sessions.

The New York Open, for instance, is often a key window where institutional traders become active, and significant market manipulation tends to unfold. ICT traders pay close attention to session overlaps (like London–New York) as these periods typically bring a surge in volume and volatility.

By focusing on precise timeframes rather than arbitrary signals, traders can better predict when the market is likely to engineer liquidity or make a decisive move, enhancing their chances of catching optimal trades aligned with market structure shifts.

Economic Calendar Awareness

While ICT traders rely heavily on price action and structural behaviour, they are not blind to the impact of macroeconomic events. In fact, awareness of the economic calendar is an essential part of the toolkit.

News releases, such as Non-Farm Payrolls, interest rate decisions, or CPI data, can serve as catalysts for shifts in market sentiment and large-scale liquidity movements. These events are often exploited by savvy investors to drive prices into key areas — whether to trap retail traders or to rebalance market imbalances.

ICT traders plan accordingly, either staying out of the market during high-risk news spikes or preparing for setups that unfold once the volatility subsides. Knowing when not to trade is just as important as knowing when to enter a trade.

Platform Integration: TradingView and MetaTrader

Although the strategy itself is rooted in concepts that transcend platforms, many ICT traders prefer tools like TradingView for its clean interface and extensive charting flexibility. MetaTrader, on the other hand, remains popular due to its broker integration and execution capabilities.

Both platforms can be used to identify fair value gaps, draw liquidity zones, and visualise market structure in line with ICT trading strategies.

Some traders also use custom indicators to automate the drawing of order blocks or FVGs — though purists tend to stick with manual charting to sharpen their own perception and maintain control over their analysis.

Step-by-Step ICT Trading Setup

Executing a successful trade using the ICT trading strategy requires more than just spotting a single pattern — it’s a structured process that involves careful observation, timing, and alignment with institutional behaviour.

Below is a comprehensive breakdown of how a typical Inner Circle Trading setup unfolds, from analysing the chart to managing risk and reward.

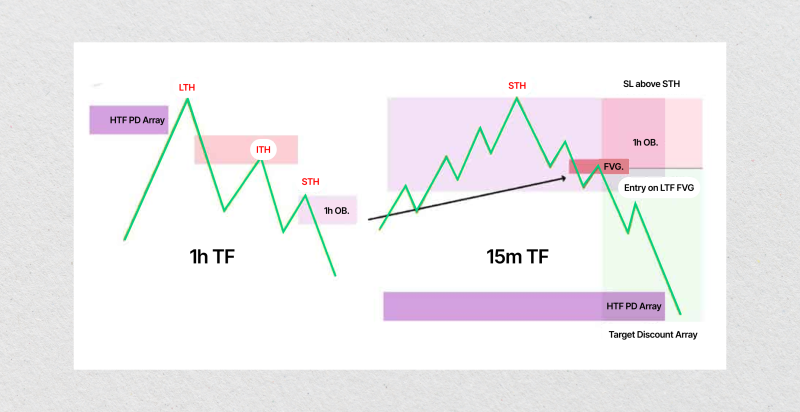

Identifying Market Structure

The first step in any ICT setup is to determine the current market structure. This means examining how price is forming highs and lows — is the market trending upward, downward, or consolidating?

More importantly, traders look for market structure shifts, which are signs that the price is reversing or transitioning between phases. For example, a break below a key higher low in an uptrend may signal the start of a bearish order flow.

Recognising these changes early allows the trader to prepare for a shift in market sentiment and anticipate the zones where the price may next react.

Locating Liquidity Pools

Once the structure is understood, the next step is identifying liquidity pools — areas where retail stop losses or pending orders are likely to be concentrated. These are usually found above previous highs or below swing lows.

From an ICT perspective, institutional traders often deliberately drive prices into these zones to capture liquidity before executing their own larger trades.

By mapping these levels in advance, a trader can begin to understand where market manipulation might occur and wait for the price to sweep those areas before forming a potential reversal.

Marking Order Blocks

With liquidity zones outlined, the trader then identifies order blocks — specific candles or clusters that represent where the smart money has previously entered the market.

These blocks act as zones of interest, often functioning as support or resistance once the price returns. A well-defined order block that aligns with a previous liquidity grab is a strong signal that institutional intent may be present.

Traders mark these levels to monitor how the price behaves when it re-enters them, looking for confluence with other technical indicators, such as fair value gaps.

Confirming FVG and Imbalance Zones

Fair value gaps and imbalances are another hallmark of the ICT approach. These are voids in the price where the market moved too quickly to fill orders efficiently, leaving behind areas that may later act as magnets for future trades.

A bullish fair value gap in a down move, especially when it overlaps with an order block or forms just below a swept liquidity level, provides compelling evidence that the price may return to rebalance before continuing in its original direction.

Entry and Stop Loss Placement

Once all the ingredients of the setup align — market structure break, liquidity sweep, return to an order block with FVG confluence — the trader begins planning the entry.

Typically, entries are placed on a retracement into a discounted area of interest rather than chasing price. Stop loss placement is then calculated logically — it should sit just beyond the structure that would invalidate the idea.

For instance, in a bearish setup, the stop might go just above the high that marked the liquidity grab. This level of precision helps control risk while keeping the trade grounded in sound financial principles.

Take Profit Targets and Risk-Reward Ratio

Finally, every ICT trade must be measured with clear take-profit objectives and a realistic risk-to-reward ratio. Common targets include the next opposing liquidity pool, a previous low or high, or a rebalancing zone that has not yet been filled.

The goal is not simply to be right, but to be consistent — seeking setups that offer at least a 2:1 or 3:1 reward for the risk taken. The ICT method places just as much emphasis on patience and discipline as it does on entries, encouraging traders to wait for the best possible market conditions before committing to a position.

Conclusion

With ICT, every move has meaning. You stop chasing trends and start thinking like the institutions that create them. Liquidity grabs, fair value gaps, and market structure shifts become your roadmap.

It’s not about reacting to the market — it’s about understanding its plan. Master this mindset, and you’re no longer playing catch-up. You’re finally trading ahead of the curve.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment and trading decisions.

FAQ

What is ICT in trading?

ICT stands for Inner Circle Trader, a trading methodology focused on smart money concepts and institutional behaviour.

Is ICT trading good for beginners?

Yes, but it requires patience. Beginners can benefit greatly if they commit to learning and backtesting.

What platforms can I use for ICT trading?

Most traders use TradingView or MetaTrader to chart ICT trading setups with clarity.

Do I need indicators for ICT trading?

No. ICT relies mainly on price action, market structure, and liquidity-based tools, not traditional indicators.