This Stock Is a Buy — Even After a Disappointing Quarter

Jan 24, 2022

Goldman Sachs Group is coming off a record-breaking year in which it made $21 billion — more than double what it earned in the pre-epidemic year of 2019.

Investors are not in a jubilant mood. Goldman shares (GS) plummeted 10% this week, bringing them to a 19% loss to their November high, after the company's fourth-quarter earnings of $10.81 per share fell short of forecasts for the first time in seven quarters.

The selloff is an excellent chance to acquire shares in Wall Street's most prominent investment bank and trading house at a discount. Goldman was Barron's best stock choice for 2021, returning 47.6 percent, and the company appears to be on track for another successful year.

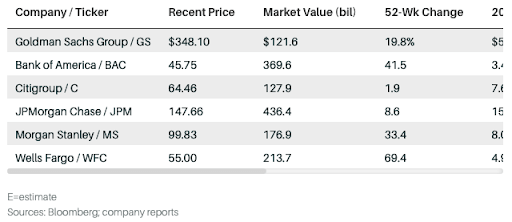

At a recent $345, the stock trades at less than nine times estimated 2022 earnings of around $40 per share and at less than 1.2 times year-end 2021 book value of $284 per share. This is a significant discount to competitors Morgan Stanley (MS) and JPMorgan Chase (JPM), which trade at around 13 times anticipated 2022 profits and roughly double book value, despite identical fourth-quarter returns on equity.

Goldman, like those Wall Street titans, has profited handsomely from trading bonds, currencies, commodities, and stocks. Goldman, on the other hand, is more reliant on such trading and investment banking than its competitors. As a result, its earnings may become more variable and unpredictable.

This chart compares Goldman Sachs to its banking counterparts.

Even if markets return to more normal state, if less lucrative, levels, "Goldman's earnings should be much greater than they were prior to the epidemic," Devin Ryan, an analyst at JMP Securities, argues. On the stock, he has an Outperform rating and a $460 price target.

Ryan asserts that the corporation is receiving little credit for some of its more recent ventures, most notably Marcus, a digital consumer banking franchise with more than $100 billion in deposits, 10 million clients, and $1.5 billion in income in 2021. Goldman does not publish its consumer bank's profitability. However, public digital banks are valued at a multiple of revenue, implying that the Goldman platform is worth at least $10 billion.

Additionally, the firm has a rapidly increasing business managing alternative assets for customers, including private equity. With $2.5 trillion under management across a number of platforms, its asset management division may be worth $30 billion or more, or almost a fourth of the firm's market value.

These companies contribute significantly to Goldman's objective of diversifying its revenue stream.

Investors continue to face difficulties. Despite its expanding consumer business, Goldman is not betting on higher interest rates, as other banks do.

Another concern is that Goldman's spending are increasing rapidly, notably pay, which increased 33% to $17.7 billion last year. Investors are concerned that the corporation would have to pay a higher price to recruit and retain talented employees .

Goldman downplays these worries.

"As a result of our pay-for-performance attitude, remuneration is flexible in both directions," Goldman's chief financial officer, Denis Coleman, tells Barron's. "If this year is not the same as 2021, we may remove it."

By the end of 2022, Goldman's book value might reach $310 per share, implying that the company trades at 1.1 times ahead book value. This implies that there is little disadvantage. Intangible assets account for approximately 5% of the book value. Additionally, the business adheres to the traditional concept that continually increasing book value is a critical corporate objective.

Goldman is likely worth far more than book value, given its lucrative capital-light businesses, such as investment banking and asset management. Earnings of $40 per share in 2022 would be quite fascinating—nearly double the level in 2019—and would translate into a good return on equity of roughly 14%. In 2021, Goldman earned a record $59.45 per share.

Its shares currently yield 2.3 percent following a 60 percent increase in the dividend in 2021. Another dividend rise in 2022 is a great strong bet.

Goldman is scheduled to inform investors in February on its early 2020 strategic plans. It has thus far succeeded in achieving its three primary objectives of developing and enhancing existing businesses, diversifying its business mix, and increasing previously unsatisfactory profits. Investors will be watching to see if Goldman increases its target return on equity, which is now set at 13%.

"We have a top-five asset manager as part of Goldman Sachs," Coleman explains. Within Goldman Sachs, we have a consumer digital bank with distinct products that is growing. Within Goldman Sachs, we have a world-class investment bank and a world-class sales and trading business."

The aggregate of those components is almost certainly substantially more valuable than Goldman's current market capitalization of $120 billion. Its franchise continues to grow in strength.