How Liquidity Providers Drive The Foreign Exchange Market

Jul 06, 2023

The Forex market is a colossal financial arena where $6.6 trillion is transferred every day, equivalent to roughly $250 billion per hour. To keep this vast market running smoothly, it relies on something called “liquidity” – a constant stream of funds circulating within it. This is where the critical role of liquidity providers comes into play.

These important players facilitate the continuous flow of funds and ensure that the market always remains adequately liquid. Therefore, while they might not always be in the spotlight but instead act behind the curtains, their work is essential to the proper functioning of the Forex market.

So, who are these liquidity providers, and what role are they playing exactly?

Key Takeaways

- Liquidity is the ease of buying or selling an asset without impacting its price, which is crucial for smooth financial transactions.

- Liquidity providers ensure smooth Forex trading, preventing price volatility and facilitating competitive pricing.

- When selecting liquidity providers, consider pricing, stability, and regulatory compliance.

- B2Broker, FXCM Prime, Top FX, Saxo Bank, and CMC Markets Connect are prominent liquidity providers known for their extensive services, advanced technology, and global presence.

Understanding The Concept Of Liquidity

So, what exactly is liquidity? It’s a word you’ll often hear in financial circles, but it’s not always clear what it means. Simply put, liquidity refers to how quickly something can be turned into cash without affecting its price.

Think about selling a house versus selling an apple. You can sell an apple instantly without affecting its price, but selling a house takes time and might even require you to lower the price to make it happen quickly. High liquidity means there’s enough money moving around in the Forex market that large transactions can happen fast without impacting the price too much.

But why is liquidity so important for the Forex market? Well, imagine you’re a trader and want to buy a large amount of a certain currency. If the market isn’t liquid enough, your large purchase could increase the price, meaning you’re suddenly paying more than planned.

On the other hand, a liquid market absorbs these big transactions easily, keeping prices stable. This is why liquidity providers are so crucial. They keep enough money flowing in the market to ensure prices don’t jump around too much and transactions can happen smoothly.

Who Provides Liquidity To The Forex Market?

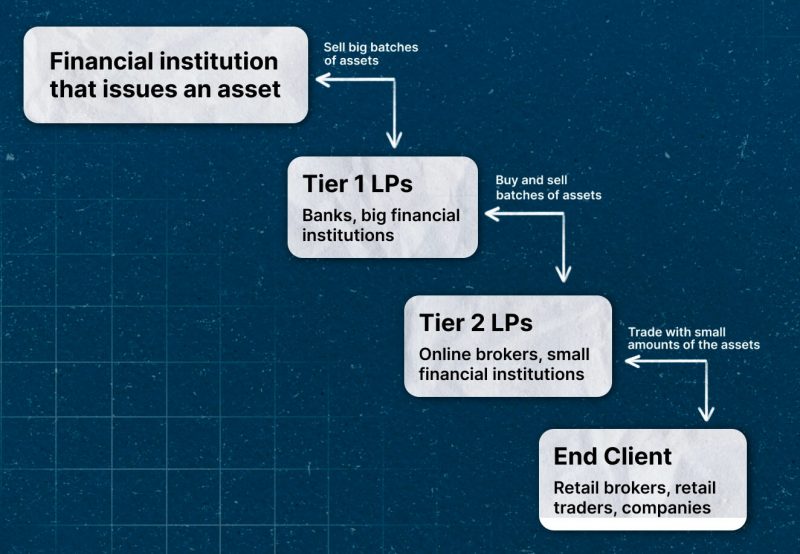

Liquidity in the Forex market is typically supplied by two primary entities: Banks and Non-Bank liquidity providers. These entities are responsible for ensuring the steady flow of capital within the market.

Banks, often called Tier-1 liquidity providers, form the core of liquidity supply in the Forex market. These are typically large international banks such as JP Morgan, Barclays, or Deutsche Bank. Owing to their substantial balance sheets and global reach, they can engage in high-volume trading, providing significant liquidity.

Banks make markets in currencies by quoting a bid price and an ask price. The bid price is the price at which they are willing to buy a currency, and the ask price is the price at which they are willing to sell it. The difference between these two prices, known as the spread, is how banks earn from providing liquidity.

On the other hand, Non-Bank liquidity providers have emerged more prominently over recent years. These include prime of prime brokerages, hedge funds, private trading firms, and certain high-frequency traders. Unlike banks, Non-Bank liquidity providers do not rely on large balance sheets.

Instead, they utilize sophisticated algorithms and high-speed networks to transact large volumes of trades within microseconds. This allows them to profit from tiny, fleeting price discrepancies in the Forex market, a practice known as arbitrage.

While banks tend to offer more consistent liquidity owing to their size, Non-Bank liquidity providers can provide competitive pricing due to their technological advantage. Their emergence has diversified the liquidity sources in the Forex market, resulting in a more robust and efficient trading environment.

So, why Do LP Providers Play A Crucial Role In The FX System?

Today, liquidity providers are important in the Forex market because they ensure that there is always someone on the other end of a deal, whether you are buying or selling.

Once again, think of yourself as a currency trader attempting to make a deal. You may have difficulty finding a buyer if you don’t have access to liquidity sources. However, large market participants like banks and financial institutions construct a network that pools funds to provide a consistent pricing supply for intermediate market participants like brokers.

Meanwhile, your broker may be able to sell assets on your behalf without using a third-party liquidity source. This implies that instead of buying from a third party, you are buying from your broker. Liquidity providers collaborate with these brokers to make this system work by pooling resources from the world’s major banks and financial institutions.

Benefits Of Working With A Liquidity Provider As A Broker

Working with liquidity providers as a broker, exchange, or any financial institution can offer several significant benefits to brokers.

- Access to Deeper Liquidity Pools

Liquidity providers offer a gateway to larger pools of liquidity. This means brokers can complete more substantial trades without causing a significant shift in the price—a phenomenon known as price slippage.

For example, if a broker wants to help a client trade a large volume of a specific currency, they can do so without worrying about drastically changing the price. This advantage is critical in maintaining a high level of service and staying competitive in the market.

- Tighter Spreads

Brokers who work with liquidity providers can also offer tighter spreads to their clients. This is possible because liquidity providers connect brokers to a broad network of liquidity sources, including large banks and financial institutions. These connections help brokers access the best possible rates.

Let’s say a client wants to buy currency. A tighter spread could mean the difference between paying more or less for each currency unit. This can attract more clients since it essentially reduces the cost of trading.

- Enhanced Risk Management

The volatile nature of the Forex market presents risks to brokers, especially during significant price movements. Liquidity providers can help brokers manage these risks. They ensure there’s always a buyer or seller for any trade, limiting the risk of price gaps and market volatility.

For instance, if there’s a sudden downward price movement, the broker won’t be left with a significant amount of a devalued currency they can’t sell.

- Price Stability

Liquidity providers are critical in maintaining price stability in the Forex market. With the substantial amounts of money circulating in the market, prices could fluctuate wildly without them.

Their presence helps to keep a steady flow of trades and prices, making the market more predictable and easier to navigate for brokers and their clients.

How To Choose The Best Liquidity Provider

When it comes to choosing the best liquidity providers, there are a few key considerations to keep in mind:

1. Look at their Liquidity Depth

Liquidity depth is all about how much currency a liquidity provider can trade without affecting the price too much. Brokers should consider providers who can handle high volumes of trades, which can be crucial when dealing with large transactions. A provider with deep liquidity can facilitate large trades smoothly, reducing the risk of price slippage, which could impact your clients’ trading experience.

2. Check Their Market Coverage

A good liquidity provider should cover many currency pairs, not just the most popular ones. This means your clients will have more options for trading, which can help you attract a diverse range of traders. Additionally, broad market coverage implies the provider has a wide network, which can further contribute to better rates and tighter spreads.

3. Assess their Technological Capabilities

In today’s digital age, technology is a significant part of trading. Look for a provider who uses advanced technology for quick and efficient trade execution. They should also have reliable systems to protect against technological failures, ensuring uninterrupted service. Additionally, a provider that offers flexible integration options can help make the transition smoother for your trading platform.

4. Evaluate their Pricing Structure

The pricing structure of a liquidity provider is another vital aspect. Make sure you understand their fee structure and if there are any hidden charges. Ideally, a provider should offer competitive pricing without compromising the quality of service. Remember, while finding a cost-effective solution is essential, the cheapest option may not always be the best.

5. Check their Reputation and Regulation

Lastly, thoroughly check the provider’s reputation in the market. Look at reviews and feedback from other brokers. A provider with a good reputation likely delivers high-quality service. Additionally, check if the provider is regulated by a reputable authority, which adds an extra layer of security and trust.

Top 5 Liquidity Providers In FX

According to our throughout research, we have named five organizations standing out as superior liquidity providers.

1. B2Broker – Top-Ranked Overall LP

Leading the pack is B2Broker, a renowned player in both the cryptocurrency and Forex markets, renowned for its technology and liquidity services. Its clientele spans various sectors, including crypto exchanges, hedge funds, licensed brokers, and professional managers.

B2Broker’s extensive liquidity pool, aggregated from premier Banks and non-Bank providers, ensures flawless execution of any transaction size. Additionally, they offer a CRM system setup at no additional cost to their liquidity clients, enhancing the overall service value.

Known for a wide array of over 800 trading instruments over eight asset classes (Rolling Spot FX & Precious Metals, Equity, Indices, Energies, Commodities, Crypto Derivatives/CFDs, Single Stocks/CFDs, ETFs, and NDFs) and an extensive global footprint, B2Broker is licensed by several notable financial regulatory bodies including the FCA AEMI, CySec, and FSA.

2. FXCM Prime – Premium FX LP

FXCM Prime shines as a single-stop solution for customers requiring a centralized platform for Forex market data and transaction execution across diverse trading firms. FXCM Prime integrates trades from various ECN and individual bank trading platforms with its in-house back office, providing a consolidated view of client positions. Key service offerings include cost-effective connectivity options, Forex market data services, and unbiased prime services.

3. Top FX – Superior Retail LP

With a 12-year history as a Prime CFDs Broker, TopFX offers unmatched liquidity services to many startups and established brokers in the e-FX & CFD industry. Its service suite enables clients to trade over 600 assets across various categories, like Forex, Shares, Indices, Metals, and Cryptos. Further adding to its appeal, TopFX maintains client funds in secure, segregated accounts with reputable banks.

4. Saxo Bank – Leading Equities LP

Saxo Bank is a global pioneer in electronic trading and investment services committed to bridging the gap between traders, investors, and global markets. They offer a one-stop platform for multi-asset execution and post-trade processes from a single margin account. Their extensive offering includes a range of tradable assets like 171 Forex currencies, 26 indices, and 9,000 equities.

5. CMC Markets Connect – Top Web-based Platform LP

Garnering over 50 awards in the recent two years, CMC Markets is a stalwart in the CFD industry. Its award-winning trading platform and user-friendly mobile apps serve a large active client base worldwide. Utilizing API technology and liquidity, CMC Markets offers clients access to top-tier liquidity from a reliable, experienced market provider.

Each liquidity provider offers distinctive features, extensive offerings, and reliable technologies, instrumental in ensuring seamless operation and competitive pricing in the Forex market.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

Who is a liquidity provider?

A liquidity provider is a financial entity, such as a bank or non-bank institution, that supplies liquidity to a market by offering to buy or sell assets at competitive prices.

How does liquidity affect the forex market?

Liquidity is essential for the Forex market as it ensures the smooth flow of transactions and stable pricing. Sufficient liquidity allows traders to enter and exit positions easily, prevents drastic price fluctuations, and facilitates efficient execution of trades.

How do liquidity providers make money?

Liquidity providers make money through the bid-ask spread, the difference between the price they are willing to buy (bid) and sell (ask) an asset. Liquid providers profit from the spread by offering competitive prices to buy from or sell to market participants.

What are liquidity providers in crypto?

Crypto liquidity providers deposit assets into liquidity pools on decentralized exchanges (DEXs) and automated market makers (AMMs). In return, they receive liquidity pool tokens (LP). LP tokens represent the provider’s share in the pool, enabling smooth trading and liquidity on the platforms.

The Bottom Line

Liquidity is the lifeblood of efficient trading, regardless of the market, but its importance is particularly pronounced in the foreign exchange arena. A market with robust liquidity levels ensures stability and prevents abrupt price shifts. For instance, a sizable order from a major institution like a bank could dramatically sway the market in the short term if liquidity is low.

The role of liquidity providers in the Forex market is truly indispensable. The overall efficiency and fluidity they bring to the market are vital to its function and growth. Therefore, if you are working in a financial institution or plan to open a brokerage firm, consider the top liquidity providers as your go-to companions to facilitate smooth financial operations for your end users.