Investing Basics Quiz: How Well Do You Know Financial Markets?

Jan 19, 2024

As we enter 2024, the world of investing is at a crossroads. After a year of record-high gains in the S&P 500 Index, investors face new challenges. The economy has exceeded expectations, the Fed is expected to cut rates, and with it, the market is becoming more volatile.

In this climate, it is essential to have a good understanding of the basics of investing and financial planning. Are you confident about your grasp of financial markets? Take our quiz to test your knowledge.

Question 1: What is the first step in the investing process?

a) Selecting investment vehicles

b) Defining investment goals

c) Assessing risk tolerance

d) Building a portfolio

Correct Answer: b) Defining investment goals

Before you start investing and making financial decisions, you need to define your goals. Ask yourself what you want to achieve with your investments. Are you saving for retirement, a down payment on a house, or something else? Understanding your goals will help you determine the investment timeline and the level of risk you can tolerate.

For example, if you’re investing for retirement, consider tax-advantaged accounts like an Individual Retirement Account (IRA) or a 401(k) offered by your employer.

Question 2: Which investment vehicle allows you to buy and sell stocks, mutual funds, and ETFs?

a) Retirement accounts

b) Robo-advisors

c) Brokerage accounts

d) Index funds

Correct Answer: c) Brokerage accounts

Brokerage accounts are popular among investors due to their flexibility and lack of restrictions on withdrawals or contributions. They also offer various investment options, including stocks, funds, and ETFs.

Other vehicles can include retirement accounts, which offer tax advantages for long-term savings, and robo-advisors, which are automated investment platforms that manage your portfolio based on your goals and risk tolerance.

Question 3: What is the recommended percentage of income to invest for retirement goals?

a) 5%

b) 15%

c) 25%

d) 50%

Correct Answer: b) 15%

Most experts recommend saving at least 10% to 15% of your income annually for retirement. However, the percentage may vary depending on your age, income level, and retirement goals. Also, you can increase your contributions with time as your income grows and expenses decrease.

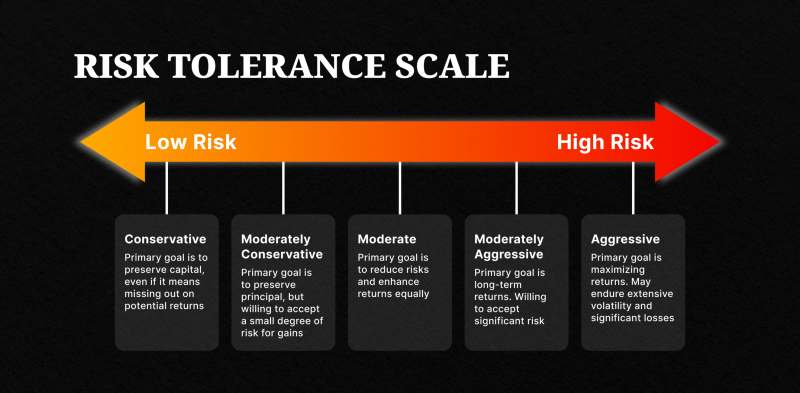

Question 4: What does risk tolerance refer to in investing?

a) The level of risk an investor is willing to take for potential returns

b) The amount of money an investor can afford to invest

c) The time horizon for an investment goal

d) The tax advantages of different investment accounts

Correct Answer: a) The level of risk an investor is willing to take for potential returns

Risk tolerance is the amount of volatility and potential loss an investor can withstand in their investments. It depends on an individual’s emotional response to market fluctuations and their financial circumstances. Generally, younger investors with more extended investment timelines can afford to take on more risk, while older ones who are closer to retirement may prefer a lower level of risk.

To assess your risk tolerance, you can take a risk tolerance questionnaire or work with a financial advisor who can help you determine the appropriate level of risk for your portfolio.

Question 5: What is the advantage of diversifying your investment portfolio?

a) Higher potential returns

b) Lower risk through spreading investments

c) Tax advantages

d) Easier management of investments

Correct Answer: b) Lower risk through spreading investments

Diversification is spreading your investments across various assets, such as stocks, bonds, and cash. This strategy helps reduce your investment risk because if one asset performs poorly, others may perform well and balance the losses.

It’s important to note that diversification does not guarantee a profit or protect against loss in a declining market. However, it can reduce the impact of market volatility on your portfolio.

Question 6: What is dollar-cost averaging?

a) Investing a fixed amount of money on a regular schedule

b) Diversifying investments across different sectors

c) Buying and selling stocks quickly to take advantage of market trends

d) Purchasing stocks at their peak value

Correct Answer: a) Investing a fixed amount of money on a regular schedule

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the market price. This approach helps reduce the impact of market volatility by spreading out your investments over time.

For example, if you invest $500 monthly in a stock through dollar cost averaging, you will buy more shares when the price is low and fewer shares when it’s high. In the long run, this strategy can help you achieve lower average costs and potentially higher returns.

Question 7: How does inflation affect your investments?

a) It increases the value of your investments

b) It depends on the type of investment

c) It has no impact on your investments

d) It decreases the value of your investments

Correct Answer: d) It decreases the value of your investments

Inflation is a general increase in prices and a decrease in purchasing power. As prices rise, the value of your money falls, leaving you with less purchasing power. This also affects your investments, as your returns may not keep up with inflation.

Question 8: What is the difference between a bull and a bear market?

a) A bull market is positive, and a bear market is negative

b) A bull market is long-term, and a bear market is short-term

c) A bull market has high returns, and a bear market has low returns

d) Bull markets are for aggressive investors, and bear markets are for conservative investors

Correct Answer: a) A bull market is positive, and a bear market is negative

A bull market refers to a long period of time where the stock market is on an upward trend, with rising stock prices and investor optimism. On the other hand, a bear market involves falling prices and pessimism among investors.

Question 9: What is the difference between dividends and capital gains?

a) Dividends are the increase in value of an investment, while capital gains are profits paid out to shareholders

b) Dividends are interest earned on investments, while capital gains are losses incurred on investments

c) Dividends are profits paid out to shareholders, while capital gains are the increase in value of an investment

d) Dividends and capital gains are two terms for the same concept

Correct Answer: c) Dividends are profits paid out to shareholders, while capital gains are the increase in value of an investment

Dividends and capital gains are often confused but have distinct meanings. If you own stocks and the company issues dividends, you will receive a portion of their profits. If you sell those stocks for a profit at a later time, that would be considered a capital gain.

Question 10: Which of the following is NOT a type of investor based on risk tolerance?

a) Average

b) Aggressive

c) Conservative

d) Moderate

Correct Answer: a) Average

The three main types of investors based on risk tolerance are conservative, moderate, and aggressive. Conservative investors are more risk-averse and prefer safer investments with lower returns. Moderate investors are willing to take on some risk for potentially higher returns, while aggressive investors are comfortable taking on greater risks for the potential of significant gains.

Question 11: What is the best way to calculate a company’s financial health?

a) Looking at its revenue growth

b) Analysing its stock price

c) Reviewing the company’s balance sheet

d) Examining its social media presence

Correct Answer: c) Reviewing the company’s balance sheet

A company’s balance sheet provides valuable data about its financial health. It includes assets, liabilities, and shareholder equity, which give insight into the company’s overall financial position. The balance sheet can also reveal if a company is heavily reliant on debt or has enough cash reserves to cover its short-term obligations.

Question 12: What is ROI?

a) Risk-free option

b) Risk of investment

c) Rate of income

d) Return on investment

Correct Answer: d) Return on investment

Return on investment (ROI) measures the gain or loss generated by an investment in relation to its cost. It is typically expressed as a percentage, and it helps investors compare the profitability of different assets. A high ROI means a higher return on your investment, while a low ROI indicates a lower return.

Question 13: Which of the following measures a company’s ability to meet its short-term debt obligations?

a) Efficiency

b) Solvency

c) Profitability

d) Liquidity

Correct Answer: d) Liquidity

Liquidity measures a company’s ability to meet its short-term debt obligations through cash or easily convertible assets. In order for companies to prosper, they need to have enough liquidity to cover their liabilities, as it indicates that they can quickly access funds when needed.

Question 14: What does the D/E ratio indicate?

a) A company’s ability to meet its short-term debt obligations

b) A company’s long-term sustainability

c) The amount of financing provided by shareholders vs. creditors

d) Interest charged on the financing provided by shareholders

Correct Answer: b) A company’s long-term sustainability

The Debt-to-Equity (D/E) ratio measures a company’s long-term sustainability. It compares a company’s long-term debt to its assets or equity. A lower D/E ratio indicates that more of a company’s operations are being financed by shareholders rather than creditors, which is beneficial for the company.

Question 15: What is a mutual fund?

a) A fund managed by one individual

b) A type of savings account

c) A stock issued by a company

d) An investment option that pools money from multiple investors to purchase securities

Correct Answer: d) An investment option that pools money from multiple investors to purchase securities.

Mutual funds are managed by a professional money manager who makes investment decisions based on the fund’s stated objectives and goals. These objectives can include growth, income generation, or a combination of both. By investing in mutual funds, individuals gain access to a diversified portfolio of stocks, bonds, and other assets that help reduce risk compared to bond investing or stock trading.

Question 16: How do ETFs differ from mutual funds?

a) ETFs hold a mix of assets, while mutual funds focus on a specific asset class.

b) ETFs are actively managed, while mutual funds are passively managed.

c) ETFs trade throughout the day like stocks, while mutual funds price once daily.

d) There is no difference between ETFs and mutual funds.

Correct Answer: c) ETFs trade throughout the day like stocks, while mutual funds price once daily.

ETFs (Exchange-Traded Funds) and mutual funds have some similarities – both are managed by professionals and offer a diversified portfolio of investments. But there are key differences between the two.

One significant difference is how they trade. ETFs can be bought and sold throughout the day on an exchange, similar to stocks. On the other hand, mutual funds price once a day after the market closes.

Question 17: How does compounding interest work?

a) Interest earned on your initial investment only

b) Interest earned on both the initial investment and any accumulated interest

c) The process of earning interest on borrowed money

d) None of the above

Correct Answer: b) Interest earned on both the initial investment and any accumulated interest

With compounding, you earn interest on your interest, which can significantly increase your returns over time. The more frequently interest is compounded, the faster your money will grow.

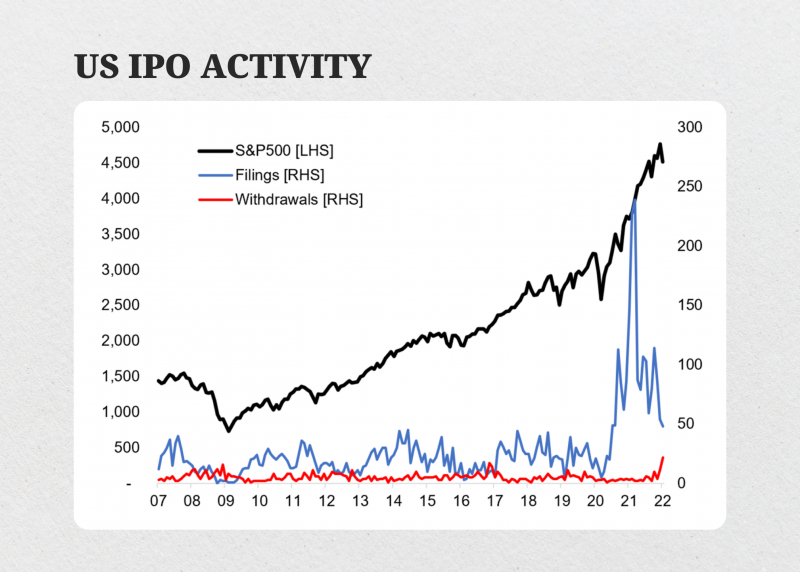

Question 18: What is an IPO, and how does it benefit a company?

a) International Private Offering; enables a company to access private investors from different countries

b) Integrated Public Offering; allows a company to merge with another publicly traded company

c) Initial Public Offering; allows a company to raise equity capital from public investors

d) In-depth Profit Opportunity; provides companies with higher returns on their investments

Correct Answer: c) Initial Public Offering; allows a company to raise equity capital from public investors

An initial public offering (IPO) is the process of offering shares of a private company to the public for the first time. This allows the company to raise capital by selling shares to investors. It also provides greater visibility and credibility for the company, making it easier for them to expand their business.

Question 19: What is the main difference between future contracts and options?

a) Futures have a specific expiration date, while options can be exercised at any time

b) Options require the holder to buy/sell, while futures do not

c) Options can only be used for commodities, while futures are for securities only

d) None of the above

Correct Answer: a) Futures have a specific expiration date, while options can be exercised at any time.

Options and futures are both financial derivatives that allow an investor to buy or sell an underlying asset at a predetermined price. However, options give the holder the right to buy/sell the asset, while futures require the holder to do so. Additionally, options can be exercised at any time before expiration, while futures have a specific expiration date.

Question 20: What is the P/E ratio?

a) A measure of a company’s profitability

b) A ratio used to value a company’s shares

c) An indicator of market volatility

d) A measure of a company’s debt load

Correct Answer: b) A ratio used to value a company’s shares

P/E, or price-to-earnings ratio, is a valuation metric that measures a company’s current stock share price relative to its earnings per share (EPS). It is also known as the price multiple or the earnings multiple. A higher P/E ratio indicates that investors are willing to pay more for a company’s shares, while a lower P/E ratio suggests undervaluation.

Question 21: Which of the following statements about investing is false?

a) Investing involves risk

b) The higher the risk, the higher the potential return

c) Diversification reduces risk

d) Investing guarantees a profit

Correct Answer: d) Investing guarantees a profit

Investing is not a guaranteed way to make money. In fact, investing always carries some degree of risk, as even low-risk investments like bonds or certificates of deposit (CDs) can be impacted by economic factors.

Question 22: Which of the following statements about investing is true?

a) You should only invest in the stock market

b) Bonds are riskier than stocks

c) You should invest in what you know

d) Interest rates have no impact on investments

Correct Answer: c) You should invest in what you know

One common mistake among beginner investors is investing in something they don’t understand. Just because your friends or family members are making money from a certain investment doesn’t mean it’s the right fit for you. Stick to investments that align with your knowledge and expertise, and seek professional advice if needed.