Liquidity Provision in Crypto: How Does It Work?

Jan 18, 2024

The recent launch of spot Bitcoin ETFs has sparked discussions around liquidity in the cryptocurrency sector. The first day of trading showed record turnover volumes exceeding $4 billion, with experts now closely monitoring how this new development will impact market liquidity and what it will mean for investors globally.

According to crypto market data provider Kaiko, the ETFs are expected to increase demand and attract more capital from market makers and institutions to Bitcoin, leading to a boost in its liquidity and price.

So, what exactly is liquidity, and how crucial is it for cryptocurrency markets? How do exchanges support liquidity on their platforms? And how do you guarantee liquidity in decentralised finance (DeFi), where the principle of decentralisation is central?

Key Takeaways:

- Liquidity ensures efficient trading conditions and better prices in both centralised and decentralised markets.

- Exchanges in DeFi operate without intermediaries, utilising liquidity pools and automated market makers to facilitate trades.

- Liquidity providers in DeFi are contributors to these pools, earning on trading fees.

- Liquidity mining allows investors to earn rewards by providing liquidity to protocols or platforms, usually in the form of native tokens.

- Institutional liquidity providers play a crucial role in providing liquidity to centralised exchanges in the crypto market.

- A crypto exchange can act as a market maker on its own.

What Is Liquidity?

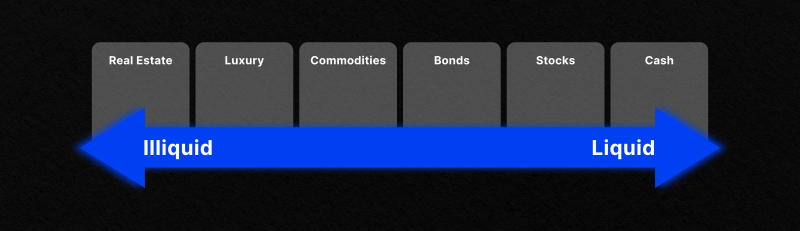

Liquidity refers to the ease and speed at which an investment can be exchanged for other assets (usually cash) without impacting its value. Highly liquid assets can be bought or sold quickly and at a fair price, while illiquid instruments may be harder to trade due to a lack of market participants or other factors.

On the other hand, illiquid assets, such as rare collectables or real estate properties, may have limited buyers or sellers, making it challenging to find a fair price.

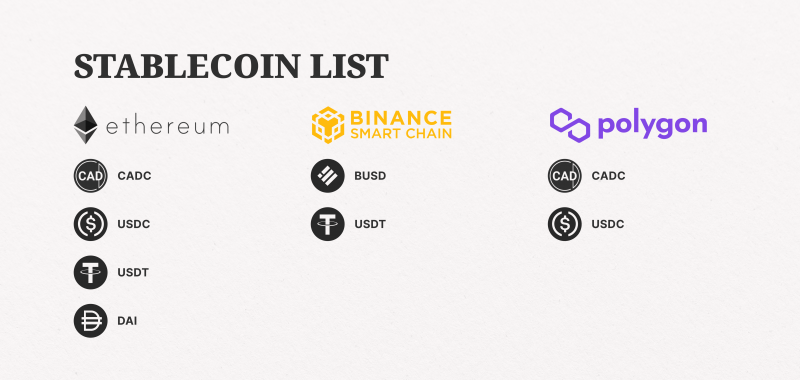

In the centralised cryptocurrency market, stablecoins like Tether (USDT) or USD Coin (USDC) often serve as a liquidity bridge between cryptocurrencies and traditional fiat currencies. These stablecoins are designed to maintain a 1:1 peg with a specific fiat currency, providing stability and making it easier for investors to assess the value of an asset.

The Importance of Liquidity Provision in Crypto

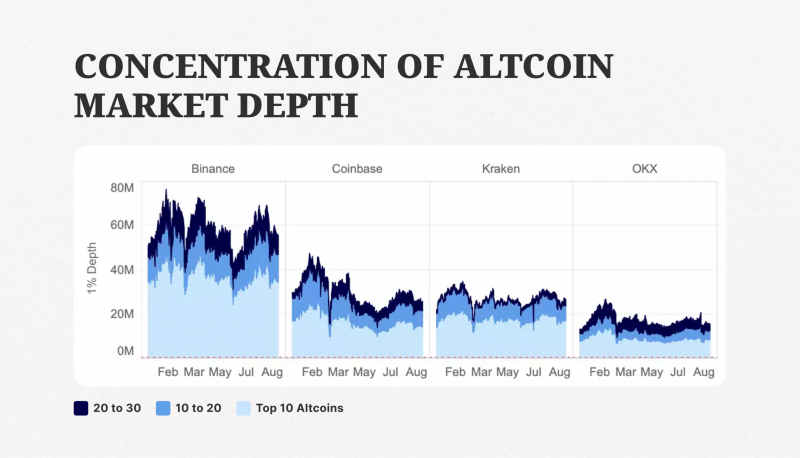

Liquidity is vital for the healthy functioning of every financial market, not just for cryptocurrencies. While major cryptos with significant market caps like Bitcoin and Ethereum enjoy high liquidity due to their popularity, accessibility and abundant use cases, other tokens frequently suffer from liquidity deficiencies.

Trading altcoins, which are alternative cryptocurrencies to Bitcoin, can be particularly challenging in low-liquidity markets. Building a position in an illiquid coin will certainly result in difficulties selling it at the desired price, potentially leading to financial losses. This is called slippage — the difference between the intended price and the execution price.

Slippage occurs when there aren’t enough orders in the order book to match the desired trade price, causing an execution price significantly different from what was expected. Slippage can be especially damaging when placing big orders in illiquid coins.

To combat slippage and improve trading conditions, platforms and projects refer to liquidity providers or connect to market makers (depending on the centralisation aspect), which guarantees them that the flow of capital will remain uninterrupted. As a result, such platforms can offer their users better prices, as well as fast and seamless execution.

Liquidity Provision in Decentralised Markets

DeFi changed the way crypto markets operate by offering alternatives to traditional financial systems. But how do we support necessary liquidity in the decentralised environment?

To solve this problem, bright minds of the crypto world came up with the idea of liquidity pools and liquidity mining as powerful tools to bootstrap liquidity for tokens within the DeFi ecosystem.

DEXes vs. CEXes

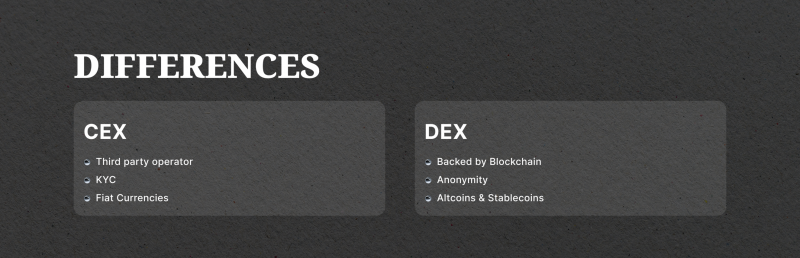

In the crypto industry, there are two main types of exchanges:

- centralised exchanges (CEXes)

- decentralised exchanges (DEXes).

While CEXes rely on intermediaries to facilitate trades and hold assets on behalf of users, DEXes operate in a trustless manner without the need for intermediaries.

CEXes rely on order books to match buy and sell orders, with a matching engine ensuring efficient trade execution. However, DEXes operate differently, utilising liquidity pools and automated market makers (AMMs) to enable trading without the need for counterparties.

You can check the list of the best AMMs on the market in this article.

So, how do these systems work?

Liquidity Pools’ Principles of Operation

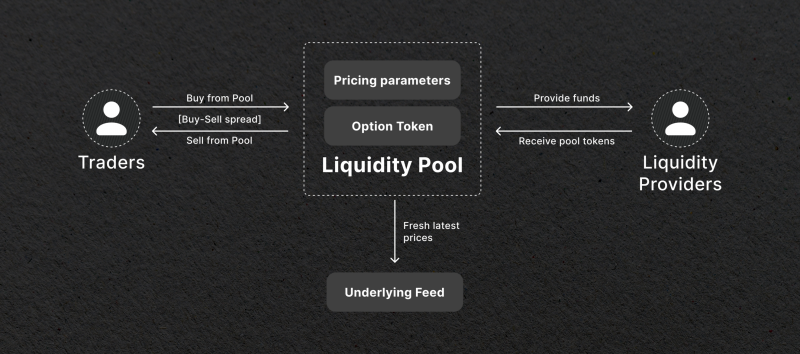

Liquidity pools are smart contracts that allow crypto investors to deposit tokens into a common pool for a certain reward. Many decentralised exchanges, such as Uniswap or Orca, rely on liquidity pools to power their operations. These pools are the backbone of DeFi, enabling efficient and seamless trading.

AMMs are protocols that play a key role in liquidity pools. AMMs utilise mathematical formulas to determine the price of assets, matching users with pooled assets and eliminating the need for traditional order books. Instead, assets are priced algorithmically based on the available liquidity in the pool.

When a user wants to execute a trade on a DEX, they interact with the pool rather than directly finding a buyer or seller. Sufficient liquidity in the pool enables the transaction to be completed, ensuring that trades can be executed without relying on external market participants.

Liquidity Providers in Liquidity Pools

Users who deposit their funds into crypto liquidity pools are referred to as liquidity providers (LPs). To create a market, LPs contribute two tokens of equal value to the pool with a primary motivation to earn a passive income.

In return, LPs earn trading fees proportional to the amount of liquidity they contribute in a form called liquidity provider tokens. When trades occur within the pool, LPs receive a share of the fees generated, incentivising them to contribute more to the market.

Liquidity pooling is a concept with various applications, one of which is liquidity mining.

Liquidity Mining

Liquidity mining, also sometimes referred to as yield farming, has gained significant popularity among investors in recent years. This concept allows investors to earn rewards by providing liquidity to specific protocols or platforms. The rewards are typically paid out in the form of native tokens associated with the protocol.

While liquidity mining and yield farming are often used interchangeably, there is a subtle difference between them. Liquidity mining primarily focuses on earning native tokens, while yield farming involves earning interest on investments.

The concept of liquidity mining existed before its rapid rise in popularity in 2020. Platforms like SushiSwap, Uniswap, and Compound played a significant role in refining and popularising the idea. Since then, the total value locked (TVL) in DeFi protocols has grown exponentially, reaching billions of dollars.

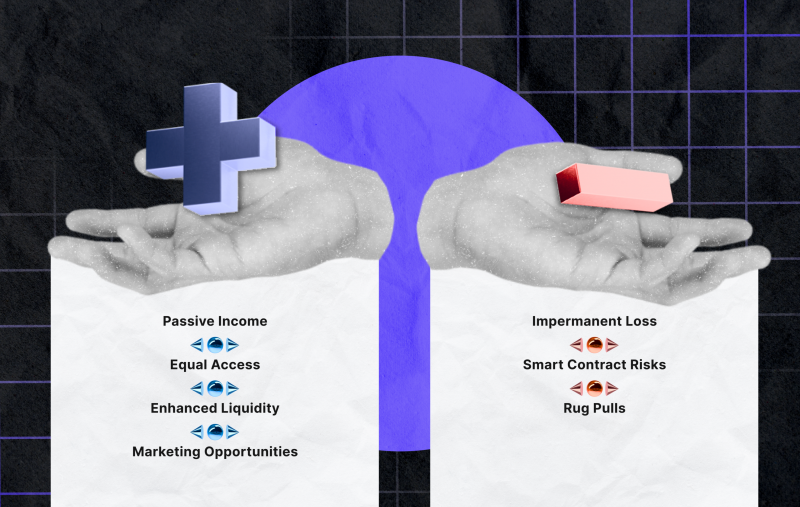

Benefits of Liquidity Mining

Liquidity mining offers several benefits for investors and the overall growth of the DeFi ecosystem. Here are some key advantages:

- Passive Income: LP can earn additional revenue by trading the obtained tokens on exchanges.

- Equal Access: Liquidity mining allows both retail and institutional investors to participate and earn rewards based on their contribution to the pool.

- Enhanced Liquidity: By rewarding LPs, liquidity mining contributes to the overall liquidity of specific assets and the crypto market.

- Marketing Opportunities: Liquidity mining campaigns can attract press coverage and raise awareness for projects, enhancing their visibility in the market.

Risks of Liquidity Mining

Liquidity pools, despite their advantages, are not entirely risk-free. Here are some risks associated with liquidity mining:

- Impermanent Loss: When prices of tokens in a pool fluctuate, LPs may experience impermanent losses. These losses occur when the value of tokens changes compared to when they were initially deposited into the pool.

- Smart Contract Risks: In decentralised systems, smart contracts govern liquidity pools. If there are bugs or vulnerabilities in these contracts, funds deposited into the pools may be at risk of being lost permanently.

- Rug Pulls: In some cases, pool developers or protocol creators may engage in fraudulent activities, known as rug pulls. This involves abruptly shutting down a project and taking all the invested funds.

Liquidity Provision in Centralised Markets

In addition to DeFi solutions, institutional liquidity providers play a vital role in crypto. These third-party entities actively participate in the market to ensure sufficient trading activity for digital assets.

Institutional Liquidity Providers

In the world of traditional financial markets, there are big institutional players called liquidity providers or market makers, which provide market participants with access to liquid assets. These entities, usually banks, hedge funds, or prime brokerages, have the financial resources and expertise to facilitate large trades and ensure smooth market functioning.

Check this page to see the list of the best Forex liquidity providers on the market today.

Similarly, in the crypto market, liquidity providers offer liquidity services to centralised exchanges, facilitating faster and broader market access. These participants quote both buy and sell prices for assets, ensuring liquidity for traders.

Institutional LPs trade on multiple platforms simultaneously, sourcing liquidity from one platform and executing trades on another. Their presence ensures that digital assets can be sold quickly and efficiently, benefiting both traders and exchanges.

Some professional market makers in the crypto market offering spot and derivatives liquidity include:

- NinjaPromo

- BitGo

- GSR Markets

- Galaxy Digital Trading

For CFD crypto liquidity, these companies are often consulted:

- B2Broker

- GBE Prime

- Leverate

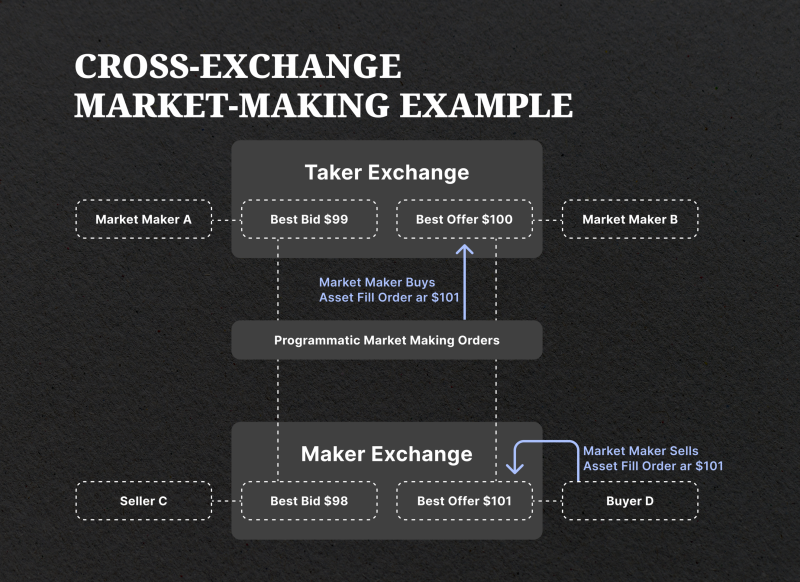

Interexchange Market Making

In some cases, exchange operators themselves take on the role of supporting liquid crypto markets, eliminating the need for third-party LPs. As market makers, exchange operators set the prices of assets within their platforms, adding a markup to prices obtained from other exchanges.

While this approach provides direct access to liquidity without additional costs, it may not be the most capital-efficient solution. Capital tied up in market-making activities could be used for other purposes.

Closing Thoughts

Liquidity is a critical aspect of the crypto market, impacting the tradability and value of assets. In the DeFi ecosystem, pools and liquidity mining have emerged as powerful tools to bootstrap liquidity and enable seamless trading.

Liquidity providers play a vital role in these pools, earning rewards and contributing to the overall availability of assets. Institutional liquidity providers are also important players that ensure necessary volumes in centralised markets, benefiting both traders and exchanges.

As the crypto market continues to evolve, providing liquidity will remain a key consideration for investors and market participants.

FAQs

How do you become a liquidity provider in DeFi?

To become a liquidity provider in DeFi, follow these simple steps:

- Choose a suitable platform: The first step is to choose the right DeFi platform that caters to your investment goals and offers a reliable infrastructure for liquidity provision.

- Connect a wallet: You will need to connect a compatible wallet that supports DeFi applications like Trust Wallet or MetaMask.

- Choose a suitable asset pair: Select the asset pair that you want to maintain liquid markets.

- Deposit your assets: Deposit the desired amount of assets into the pool.

- Receive LP tokens: In return for your contribution to the liquidity pool, you will receive LP tokens that represent your share in the pool.

- Earn rewards: As users trade on the platform, you will earn a portion of the trading fees as rewards.

How are fees allocated among liquidity providers?

Liquidity providers receive fees based on the amount of liquidity they contribute to the pool. The more liquidity they provide, the greater their share in the pool and the higher their portion of the earnings. This encourages providers to contribute more assets, benefiting both themselves and other platform users.

How do staking and liquidity mining differ?

Staking and liquidity mining are two terms that are often used interchangeably. Staking involves holding a certain amount of coins or tokens in a wallet for a certain period of time in order to support the network and earn rewards. On the other hand, liquidity mining is a process where users provide liquidity to DEXes or protocols and, in return, are rewarded with additional coins or tokens.

The main difference lies in the purpose and method of earning rewards. Staking is typically used to secure a network and maintain its operations, while liquidity mining is used to incentivise users to provide liquidity and boost trading volumes on DEXes.

What is the total value locked (TVL)?

Total value locked, or TVL, is a metric that represents the total value of assets and investments within a specific smart contract. It is calculated by adding up the individual values of all assets and projects connected to the network.

TVL serves as an indicator of a platform’s reputation and worth within the crypto industry. A higher TVL usually indicates a stronger and more successful project, making it an important metric for investors to consider when assessing potential investments.

Wondering how these solutions can drive scalability?

Leave a request, and let our experienced team guide you towards success and growth.