What is the Difference Between Centralized and Decentralized Exchange?

Nov 23, 2021

The crypto market expands its borders, undergoing the transformation into a giant ecosystem. With the explosive growth in demand towards crypto-related services, the number of trading platforms is mushrooming. According to Coinmarketcap, the overall number of crypto exchanges is more than 430, and the amount continues to grow.

The development of the Decentralized Finance industry unlocked the community’s access to DEXes (decentralized exchanges). What are their pros and core differences compared to traditional platforms (centralized exchanges)?

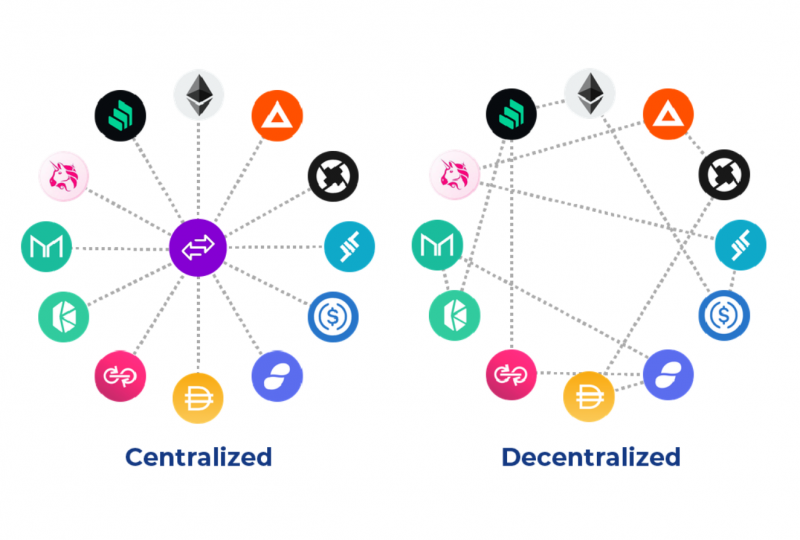

CEXes and DEXes: Definition and Main Idea

According to statistics, more than 60% of crypto holders prefer to keep their assets in wallets linked to centralized exchanges. The community trusts trading platforms with giant trading volumes, understanding CEXes as secure and protected enough.

A centralized cryptocurrency exchange is ruled by a certain company. That company introduces requirements, rules, and limits for crypto holders, and users are obliged to follow the requirements. Furthermore, a CEX is a licensed entity forced to adjust its activity to a certain country’s demands and legislative norms. All the traders are obliged to undergo the KYC verification – i.e. inscribe their personal data and send scans of their documents.

Some community members understand this measure as a violation of the anonymity principles, as an exchange knows exactly who is a wallet’s owner. Other users don’t think much about the verification, as such a procedure protects their funds.

One more important characteristic of a centralized trading platform lies in the way crypto assets are managed. CEXes manage their traders’ assets, holding them in cold and hot wallets. As such, a CEX is responsible for the protection of users’ funds.

How does a decentralized exchange work? Let’s clear the differences up.

A decentralized blockchain-based trading platform is ruled by no entities, while all the procedures are executed according to smart contracts. This is why all the transactions are anonymous and users do not undergo KYC verification. DEXes remain entirely anonymous.

As for the funds, a platform manages no funds – users connect their crypto wallets (MetaMask, Trust Wallet) and all the transactions are technically executed on the wallets. A DEX plays the role of a mediator between buyers and sellers.

What are the top Pros and Cons of CEXes and DEXes?

A centralized exchange is marked by the following pros:

1. Users get an opportunity to utilize fiat currencies.

2. The trading functionality is wide enough.

3. Liquidity of centralized exchanges is exceptionally high.

As for the weak points, the following cons are outlined:

1. Holders cannot access private keys.

2. An account verification is a mandatory step.

3. Users don’t impact the security level.

As such, a centralized exchange is a perfect choice for holders who don’t want to be responsible for security and protection. Furthermore, such an option matches holders who are not afraid of disclosing their identities.

While talking about a decentralized trading platform, the list of advantages includes:

1. All the transactions are entirely anonymous.

2. Private keys belong to crypto holders only.

3. The KYC verification step is not required.

4. No one has the right to ban your account.

As for the main disadvantages, the weak points are:

Inner liquidity pool is rather limited.

Beginners understand the interface and functionality of DEXes as more complicated compared to centralized platforms.

Decentralized exchanges do not work with fiat currencies.

As such, decentralized platforms are better for professional traders who want to keep all the crypto assets under management.

While comparing trading platforms, centralized exchanges are more in-demand than DEXes. For instance, the top-5 CEXes (according to Coinmarketcap) unites the overall 24 h trading volumes of $44.9 billion. As for decentralized platforms, the overall trading volume of the top-5 DEXes is $8.7 billion. According to experts, more than 90% of daily trading transactions take place on centralized platforms.

Which route is the best one?

When a beginner trader is looking for an answer to how to create a crypto exchange, the type is among the core issues. Which platform to run?

The crypto market is definitely going out of the shadows; this is why newcomer holders prefer to buy digital assets in full correspondence with the legal requirements. On the other hand, decentralized platforms are in-demand as well, offering a set of extra products and the highest security level for users.