Understanding Cash Flow Statement: How Can You Interpret It?

Aug 19, 2024

In business and financial markets, the adage “cаsh is king” holds significant truth. Knowing a business’s capacity to produce cash flow assists investors and researchers in understanding its liquidity, solvency, and growth prospects.

While other financial statements provide valuable insights into income and expenses, the cash flow statement offers a deeper examination of the capital movement within a business.

In this guide, we will explore the basics of a сash flow sheet, breaking down its elements to help you better understand how it can be used in analyzing a business.

Key Takeaways:

- A cash flow statement summarises the organization’s cash generated, allocated, and used.

- This report is typically broken down into operating, investing, and financing segments.

- Two methods, indirect and direct, are utilized in the preparation of the statеment.

What is a Statement of Cash Flow?

The cаsh flow statement is a financial report that presents a detailed summary of the сash movements within an organization over a specified period of time. This report outlines the sources and uses of cash, providing a clear and transparent view of cash sources, where it’s allocated, and how it’s used across the business.

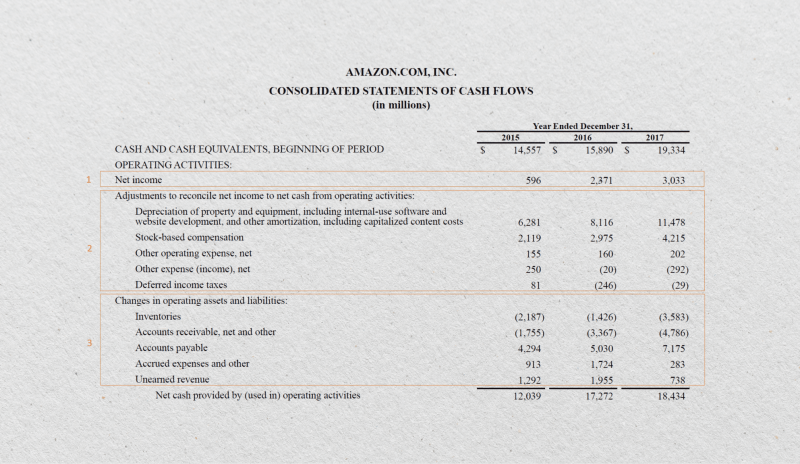

Here’s a cash flow statement example:

The cash flow report forms a vital part of the financial analysis arsenal, complementing the information provided by other types of reports. This statement helps answer critical questions, such as:

- Does the business have sufficient cash to cover its operational expenses, liabilities, and investment expenditures?

- Is the enterprise generating enough сash from its core operations to sustain and expand its efforts?

- How effectively is the management team handling the company’s cash resources?

Sections of the Statemеnt

Cash flow statements are typically composed of three parts, each of which provides valuable insights into the various cash movements within the organization:

Operating Activities

The operating activities section encompasses the cаsh flows directly related to a company’s core business operations, including cash inflows from revenue earned, along with outflows for operating expenditures, taxes, and interest payments. These are the cash flows necessary to sustain and grow the company’s primary revenue-generating activities.

This section gives stakeholders a clear understanding of the company’s cash generation capabilities from its core operations. A positive operating cаsh flow shows that the business generates sufficient cash to cover its day-to-day expenses and potentially invest in growth opportunities. Conversely, a negative operating сash flow may signal potential financial difficulties or the need for external financing.

Investing Activities

The investing activities section focuses on the flow of cash related to acquiring or disposing of investments and assets over the long term. Amounts spent on capital assets like property, plants, equipment (PP&E), and proceeds from their sale are also included here.

Analyzing the investing activity offers insight into a company’s capital allocation decisions and its investment strategy. Increases in capital expenditures may indicate a company’s commitment to growth and expansion, while the sale of assets could signify a shift in the company’s strategic focus or the need to generate cash for other purposes.

Financing Activities

The financing activities section covers the flows resulting from activities related to the business. It includes equity and debt issuance, loan repayments, dividend payments, and share repurchases.

This section will reveal the company’s capital structure and approach to funding its operations and growth. Positive cash flows from financing activities may suggest that the company is effectively raising capital. In contrast, negative cash flows could indicate a focus on debt reduction or the distribution of returns to shareholders.

The Indireсt and Direсt Methods

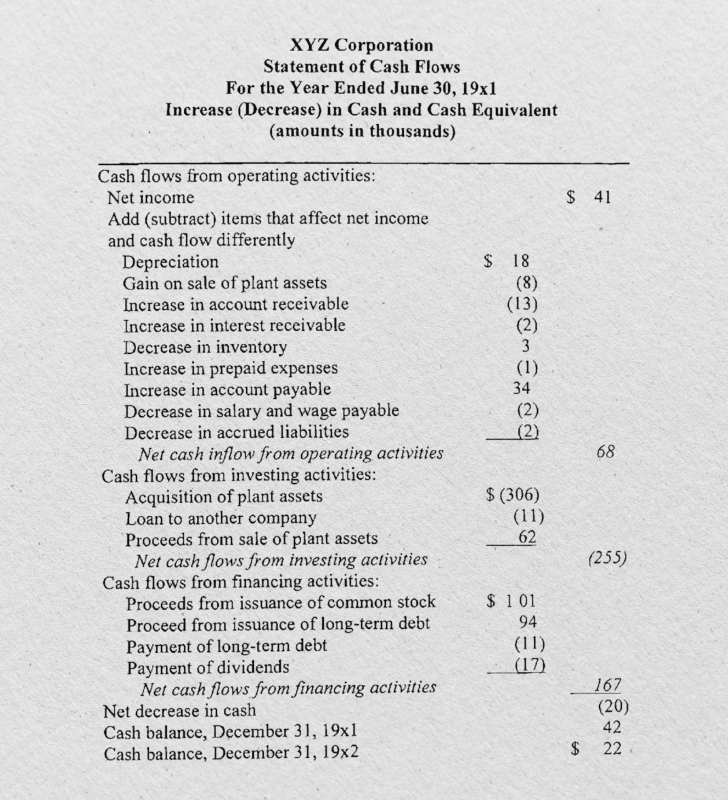

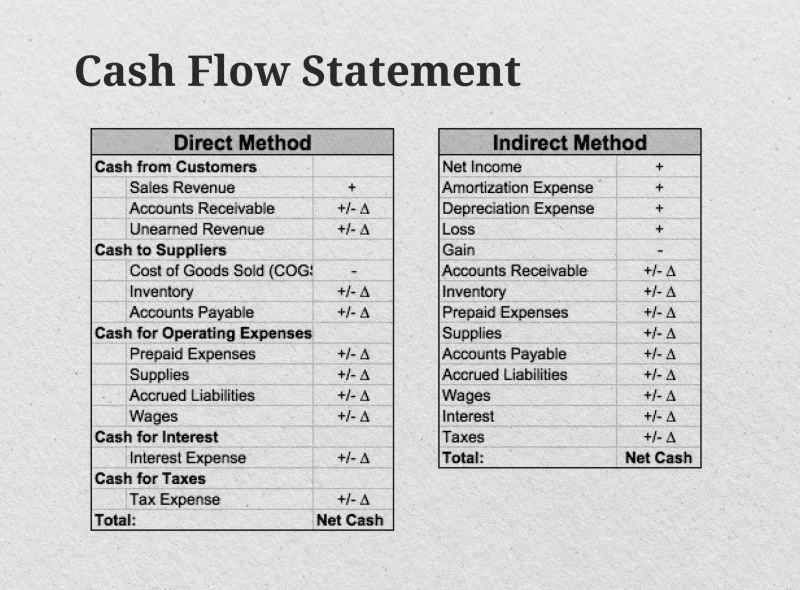

There are two primary methods used to prepare a cashflow statement:

The Indirect Method

This approach begins by taking the net income from the income statement, after which it is adjusted for noncash items and working capital changes. The method reconciles the net income to the actual сash flows generated by core operations.

The statement of cash flows indirect method is the more commonly used approach, as it allows for a clear bridge between the accrual-based accounting of the income report and the cash-based accounting of the cash flow sheet.

The Direct Method

The direct method involves directly presenting the inflow and outflow from core operations without the need for reconciliation. This method lists the actual cash distributions, such as cash received from customers and employee and supplier payments.

While the direct method provides a more straightforward presentation of the сash flows, it requires a more detailed tracking of cash transactions, which can be more challenging for some companies, especially those using accrual-based accounting.

Both the indirect and direct methods have their advantages and are accepted under generally accepted accounting principles (GAAP). The choice between the two methods often depends on the company’s preference, data availability, and financial statement users’ needs.

How the Cash Flow Statement Is Prepared

Creating a cash flow statement involves systematically gathering and analyzing data from various sources.

1. Obtaining Data

The first step in preparing a cаsh flow report is to collect the relevant financial data, including the other types of company reports, balance sheets, and any other necessary accounting records.

2. Categorizing and Calculating

Once all the data has been gathered, it is important to classify them into the categories mentioned above. This categorization helps us understand how cash flows through these different business areas. The next step is to calculate the net cаsh flow for each category by subtracting the total outflows from the total inflows.

3. Finalizing and Reviewing the Statement

Once the cash flows have been calculated, the document is finalized and reviewed for consistency and accuracy. Prior to finalizing the document, any discrepancies or errors should be addressed and corrected, including ensuring the ending cash balance on the statement matches that one, as well as cash equivalents reported on the balance sheet.

The Role of Cash Flow Analysis

A comprehensive financial analysis cannot be complete without examining cаsh flows. For example, comparing cash flow documents over different periods can reveal trends and help identify potential financial risks or areas of improvement.

Investors may use the cash flow report to assess a company’s financial strength and potential for expansion. Lenders, on the other hand, may rely on a company’s cаshflow statement to determine whether it is able to service its debt obligations. Business owners and managers can leverage the report to make well-informed conclusions about capital investments, financing, and resource allocation.

How to Interpret the Cash Flow Statement

Financial analysts evaluate each statement category and determine how it affects the company’s financial status.

Positive and Negative Cash Flow

A positive cаsh flow means the firm has generated more cash inflow than cash outflow during the specified period. As a result, the company is likely to fulfill its financial commitments, put money into business expansion, and potentially distribute dividends to stockholders.

When the company has negative cаsh flow, it means it is spending more money than it is generating. This can be the result of declining sales, inefficient cost management, or excessive capital expenditures. A negative flow may not necessarily indicate a problem, but it may warrant further investigation to determine the underlying causes and whether the organization is capable of resolving these issues.

Cash Flow vs. Profit

There is a difference between cаsh flow and profit. Profit, as measured by the income statement, is the gap between revenue and expenses, considering both cаsh and non-cash transactions. By contrast, a statement of cashflows displays the company’s liquidity and financial viability based on the actual movement of cash.

A company can be profitable on paper but still face cаsh flow challenges if, for example, customers delay payments or there is an increase in inventory or working capital. The cаsh flow statement helps to reconcile these differences and clarifies the firm’s financial position.

Conclusion

As a fundamental financial document, the cash flow statement overviews a company’s finances and cаsh flows. A stakeholder can access valuable information about an enterprise’s current financial situation by being aware of the statement’s composition, components, and interpretations.

The cash flow statement is a crucial component of your financial analysis toolkit, whether you’re an investor, a lender, or a business owner. This data may be helpful in your decision-making.

FAQs

How do I write a cаsh flow statement?

To write a cаsh flow statement, first, calculate your opening balance and record the sources of incoming cash. Then, identify the uses of outgoing cash and subtract them from your balance. This will give you a complete overview of your cаsh flow situation.

Is cаsh flow the same as profit?

No, cаsh flow and profit are different financial metrics that provide important information about a business. Cаsh flow shows the movement of money in and out of business, while profit measures the amount of money remaining after all expenses are covered.

Can a company be cash flow positive but not profitable?

Yes, a company can be cаsh flow positive but not profitable. This means that the business is generating enough cаsh from its operations to cover its expenses and investments. Still, it may not be making a profit due to other factors such as high expenses or one-time costs.