What Are Binary Options? A Simple Guide to Trading

Jan 16, 2025

Binary options have become a widely recognized financial tool, appreciated for their ease of use and accessibility. In contrast to conventional trading techniques, binary options enable traders to determine the price swings of a range of valuables, including shares, commodities, currencies, and indices.

Binary options feature a simple “all-or-nothing” model and provide predetermined returns and clear risk parameters, appealing to both debutantes and more experienced traders. Nevertheless, the inherent risks and various trading strategies necessitate a deep investigation prior to engaging in this type of trading.

This short guide delves into the fundamentals of binary options, how they work, and their types.

Key Takeaways

- Binary options are based on a simple “yes or no” anticipation regarding the price progress of an asset.

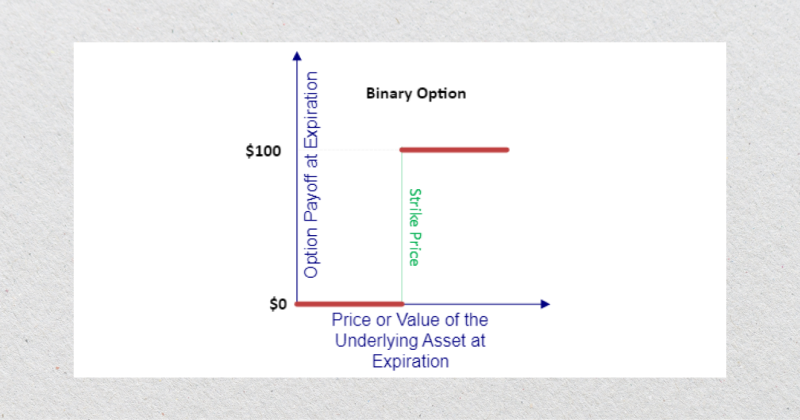

- Traders earn a fixed payout if the binary option expires in the money but fail to recover their investment if it expires out of the money.

- Binary options predetermine the potential profit and the maximum loss before the trade begins.

What Do Binary Options Stand For?

Binary options are a type of financial product that allows professionals to wager on the price shift of various tools such as securities, currencies, commodities, or indices. They are called “binary” because the outcome is limited to two possibilities: a trader either earns a fixed profit or loses their initial investment, depending on whether their projection is correct.

Fast Fact

Binary options do not involve ownership or a position in the basic asset; traders only speculate on its price shift.

How Do Binary Options Work?

Binary options operate on a simple premise: they bet on the future price shift of a security within a set time interval. For example, a trader might assume that the price of gold will increase within the next hour. If the estimated outcome is accurately calculated when the option expires, the trader earns an intended payout, often a percentage of the initial investment. If mistakes are made, the entire investment is lost. This binary nature—win or lose—makes this financial instrument appealing and risky.

Major Types of Binary Options in Trading Practice

Binary options come in several variations, each tailored to different trading styles and strategies. Understanding these types is crucial for selecting the right approach to match your risk tolerance and market analysis skills.

Here are the most common kinds of binary options that can be found in trading practice:

High/Low Options (Call/Put Options)

High/Low options are the most straightforward and widely used form of binary options speculation. Traders forecast how far the price of a tool will rise above (“Call”) or fall below (“Put”) a predefined level, known as the strike price, when the option expires.

The simplicity of this type lies in the fact that traders only need to gauge the direction of price shifts. The potential payout and loss are fixed before entering the trade, making it easy to understand. High/Low options can be used for short-term trades lasting a few minutes and longer trades lasting several days.

These options are popular among beginners because they are accessible and require no advanced technical knowledge or tools. Trending markets, where prices move in a clear direction, are ideal for this type of trading.

One-Touch Options

One-Touch options focus on the probability that the price of a tool will reach or “touch” an intended target level at any point before the option expires. If the price touches the target, the trade pays out immediately, regardless of what happens afterward.

These options often offer higher payouts than High/Low options because projecting a specific price level is more challenging. One-Touch options require traders to anticipate significant price shifts and are well-suited for volatile markets or during events like economic releases.

They are popular among traders who are confident in market trends or who are tracking major events that could cause significant price volatility.

No-Touch Options

No-Touch options are the opposite of One-Touch options. In this case, traders anticipate that the price of a security will not reach a specific level during the option’s duration.

The trade succeeds if the price avoids the predefined level until expiration. This type of binary option relies on the asset maintaining a stable price or moving within a limited range, making it a suitable choice for risk-averse traders. Compared to One-Touch options, the risk is lower, but the payouts may also be smaller.

No-Touch options are ideal for range-bound markets or calm conditions with minimal volatility or external disruptions.

Range (Boundary) Options

Range options involve predicting where the price of an instrument will stay within a designated price range (In-Range) or move outside it (Out-Range) by the expiration time. Traders can bet on stability, where the price remains within the range, or on a significant price shift, where the price breaks out of the range.

The predefined boundaries set precise levels for success or failure. Payouts for these options may vary depending on the width of the range and the likelihood of the price staying within or breaking out of it.

Range options are versatile and suitable for both highly volatile and stable markets. Sideways or consolidating markets are ideal for In-Range predictions, while volatile markets are better suited for Out-Range trades.

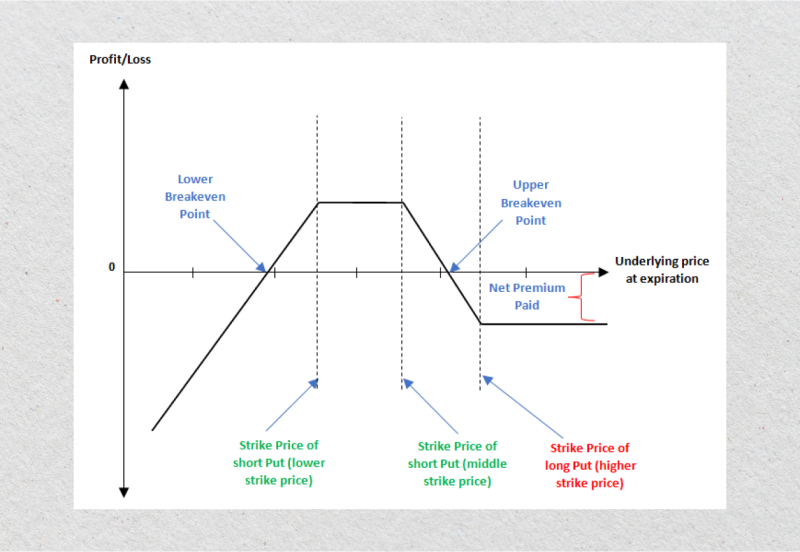

Ladder Options

Ladder options allow traders to select multiple price levels, or “steps,” as target points for an asset. Each step comes with its payout ratio and risk level, depending on how far the target price is from the current price.

Traders can choose safer, lower steps with modest payouts or higher, riskier steps with larger payouts. This type of binary option requires a deeper understanding of market trends and price behavior, offering strategic flexibility and opportunities for diversification within a single trade.

Ladder options are popular among experienced traders who aim to optimize returns while effectively managing risk. They are best suited for trending markets with strong momentum for higher steps or mild trends for lower steps.

Pairs Options

Pairs options focus on the relative performance of two assets rather than their absolute price shifts. Traders predict which assets will outperform the other over a specified period. Success depends on comparing the performance of two assets rather than analyzing one in isolation.

This type does not require traders to be concerned with the fact that the prices of the assets rise or fall; it is only those that perform better. Pairs options are often used for assets that share a market or economic connection, making them ideal for traders who specialize in analyzing relationships between assets.

Competitive or correlated markets are the most suitable conditions for this type, especially when one asset is expected to gain an advantage.

Binary Options vs. Vanilla Options: Main Differences

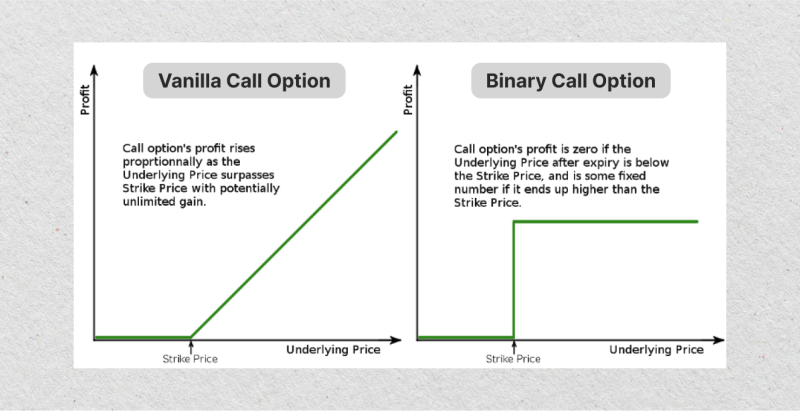

Binary and vanilla options are both financial products used for trading in markets, but they differ significantly in structure, functionality, risk, and reward mechanisms. Here’s a detailed comparison to help you understand their distinctions:

Definition

Binary options are inexpensive, “all-or-nothing” trading products. A trader predicts whether the price of a basic asset will rise above or fall below a specified level (the strike price) by an intended expiration time. If the forecast is correct, the trader earns a fixed payout; if mistaken, they lose their initial investment.

Vanilla options, also known as traditional options, give the holder the right (but not the obligation) to buy (call option) or sell (put option) a basic asset at a specific price (strike price) before or at the expiration date. The trader pays a premium to purchase the option, and their profit or loss depends on the actual price shift of the asset.

Payout Structure

In the case of binary options, the payout is fixed and intended, typically varying from 70% to 90% of the initial investment. If the trade is unsuccessful, the trader loses their entire investment.

With vanilla options, the payout depends on how far the basic asset’s price moves in favor of the trader’s position. There is no fixed profit; potential gains or losses are theoretically unlimited.

Risk and Reward

The risk is capped in binary options at the amount stipulated in the trade. The reward is also fixed, so the trader knows the maximum profit or loss in advance.

In the case of vanilla options, the risk is limited to the premium paid for the option, but the reward can be unlimited if the price of the basic asset moves significantly in favor of the option holder.

Complexity

Binary options are lightweight and easy to acquire. Traders only need to forecast when the price of a tool will rise or fall within a specific time frame.

Vanilla options are more complex and require understanding factors like option pricing models (e.g., Black-Scholes), time decay, implied volatility, and intrinsic vs. extrinsic value.

Ownership of the Asset

In binary options trading, no ownership or rights are associated with the basic asset. Traders are merely speculating on the price shift.

With vanilla options, traders have the right to buy or sell the basic asset, which can lead to ownership (in the case of a call option) or the obligation to sell (in the case of a put option, if exercised).

Expiration

Binary options have fixed expiration times, ranging from 30 seconds to a few hours or days. The trade outcome is determined immediately after expiration.

Vanilla options have more flexible expiration dates, ranging from days to months or even years. The trader is free to sell or exercise the option at any point before expiration.

Pricing

The cost of entering a binary options trade is equal to the amount invested. There are no premiums, spreads, or royalties.

Vanilla options require upfront premiums, which are influenced by factors such as volatility, time to expiration, and the difference between current and strike prices.

Market Participation

Binary options are regularly speculated on online exchanges and are more appealing to private traders. However, they are not widely regulated, which increases the risk of scams.

Vanilla options are traded on regulated exchanges or OTC markets, which provide greater transparency and security. They are used by retail traders, corporate investors, and corporations.

Use Cases

Binary options are primarily used for speculative purposes, as traders aim to profit from short-term price shifts.

Vanilla options are versatile. They can be used for speculation, hedging against price shifts, or generating income through strategies like covered calls.

Conclusion

Binary options are a versatile and simplistic way to interact in securities markets, offering both high-reward opportunities and substantial risks. With multiple trading styles, such as High/Low, One-Touch, and Range options, traders can tailor their investment plans depending on market context and risk tolerance.

Whether you are a beginner exploring short-term trading or an experienced investor looking for new strategies, binary options provide a unique but challenging avenue in the financial world.

FAQ

What are binary options, and how do they work?

Binary options are gambling contracts in which traders establish whether the price of a tool will rise or fall within a set timeframe. If the prediction is correct, they earn a fixed repayment, but they lose their investment if it is botched.

Are binary options risky?

Yes, binary options are high-risk due to their all-or-nothing nature and short timeframes. They can potentially result in the loss of your entire investment.

Are binary options legal and regulated?

The legitimacy of binary options varies by country; in some regions, they are regulated, while in others, they are banned.