What is a Multisig Wallet and How Does it Work?

Feb 16, 2024

The distribution of authority among several parties is known as decentralisation. The level of decentralisation and security is enhanced when more parties are involved because there is no single point of failure.

Most cryptocurrencies try to implement this idea in their internal systems. However, it can also be implemented on its own by using a cryptocurrency wallet or a multi-signature address, which significantly increases the level of security when dealing with crypto assets.

This article is a brief study aimed at exploring what a multi-sig wallet is, what types of wallets exist, and what advantages they offer in terms of practical use.

Key Takeaways:

- Multisig wallet is a type of classic wallet that uses a set of additional signatures as part of a transaction to increment security.

- Multisig wallets are categorised based on the number of signatures required for a transaction.

What is Multisig Wallet?

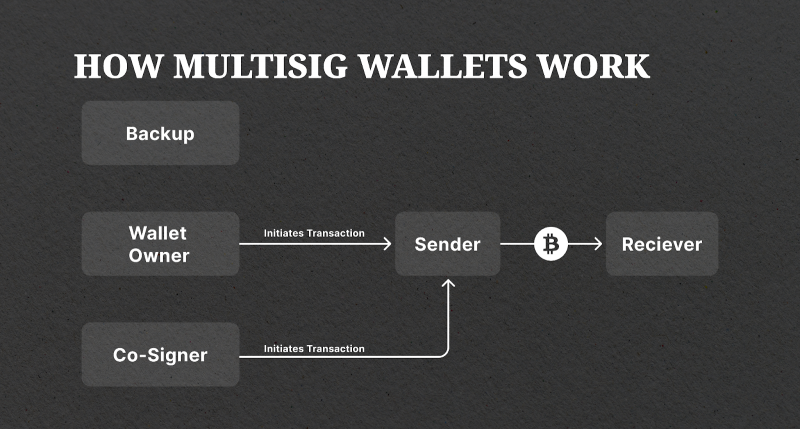

Multisig wallets are crypto wallets that require two or more private keys to perform specific tasks. This aims to enhance the security of the funds stored in the wallet by necessitating multiple parties to approve before any transactions can be sent.

The multi-sig wallet process involves numerous signatures from a set of predetermined addresses, and if any of these signatures still need to be included, the transaction cannot proceed. It can be considered a safe with unique keys that must be used together to open it.

Generating a unique multi-signature address is imperative when setting up a multi-signature wallet, whether through an exchange or self-custody. This address is closely associated with the wallet and intended for receiving funds.

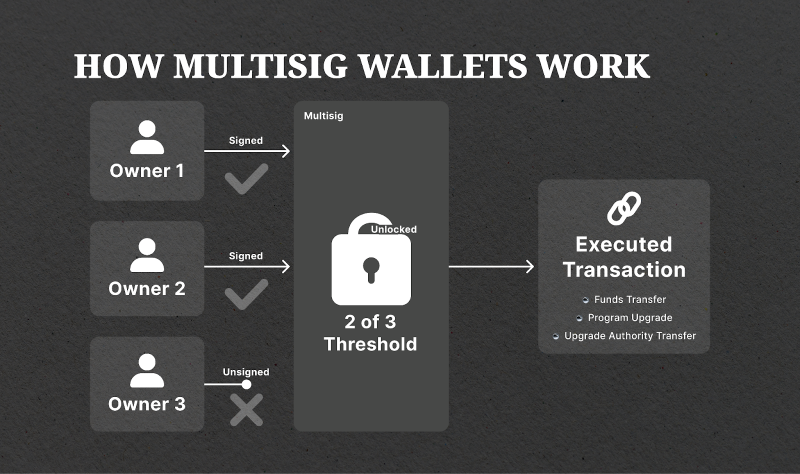

Transactions from a multi-signature wallet require the signature of a specified number of co-signers. For instance, in a two-of-three multisig configuration, at least two private keys are necessary to authorise the transaction.

Fast Fact

Multisig wallet is a flexible solution because it allows you to customise the number of signatures required to validate a transaction, thus changing the level of security.

Types of Multisig Wallets

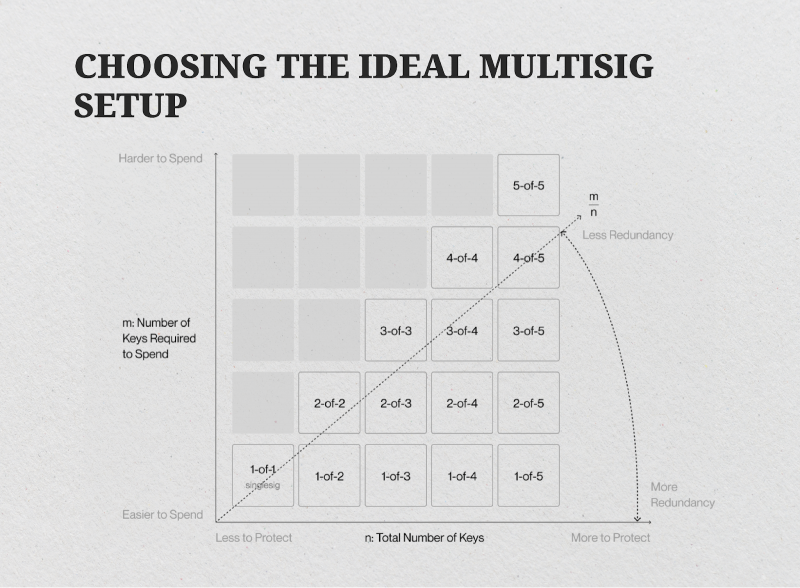

The classification of multisignature crypto wallets can be determined based on the number of private keys they contain and the number of signatures required to approve a transaction. Thus, let’s look at each of them in more detail:

1-of-2 Signatures

Multisig storage is a popular method of securing crypto wallets that require more than one signature to approve transactions. One of the simplest forms of multisig storage is the 1-of-2 setup. In this setup, users can bind two private keys to a single wallet, allowing either of the keyholders to approve transactions.

This setup is particularly useful for small businesses, where trust is established through contractual and personal relationships. In such cases, either of the two founders can transfer funds. Additionally, a 1-of-2 setup can also serve as a personal backup solution. In the event of a lost private key, users are still able to access their funds with the remaining key.

2-of-3 Signatures

This type of wallet requires the approval of two of three authorised signatories to conduct a transaction. It is a helpful tool for securing escrow transactions and is also implemented by crypto custodians to enhance security measures.

In the latter scenario, the company holds two keys, one stored securely offline and the other available online, to simplify the signing process. The third key is entrusted to a trustworthy blockchain security company, which may be called upon if the crypto custodian loses one of its keys.

3-of-5 Signatures

This setup requires three out of five signatures to validate transactions. It is ideal for corporations where multiple decision-makers must approve transfers. If over 50% of the parties agree to the decision, they can authorise fund transfers. Like other multi-signature setups, delegating signatures to entities in different geographical locations could enhance security.

M-of-N Type

This particular wallet type utilises “N” private keys for approval. To initiate, process and execute a transaction, a certain number of “M” keys out of the total “N” is required. The most common setups are two-of-three, three-of-five, and so forth, indicating the minimum number of signatures needed out of the total keys.

N-of-N Type

To execute and process a transaction, every person involved in a multi-sig or shared crypto wallet setup must validate it. This means all parties must sign with their private keys for the transaction to be valid. For instance, every co-signatory must validate the transaction in a two-of-two or a three-of-three method.

In addition to the commonly used types, a smart contract can implement a sequential multi-signature crypto wallet, which requires private keys to sign transactions in a predetermined order for them to be processed.

Another type is the time-locked multi-sig wallet, which allows transactions to be authorised only after a specified time delay. This additional layer of security measures is based on time constraints.

Selling Points of Utilising a Multisig Wallet

Using a multisig wallet has several advantages, in addition to enhanced security and the ability to involve multiple parties. In particular, institutions and DAOs can enjoy a much better user experience thanks to multisig wallets’ architecture, which significantly improves over traditional hot or cold wallets.

1. Escrowed Transactions Ability

Multi-signature wallets are an optimal solution for secure and reliable escrowed transactions. They assure each party will fulfil their obligations once the mutually agreed-upon terms are met. So, in the context of a 2-of-3 multi-sig wallet, the buyer may deposit funds into the wallet with the assurance of releasing the funds to the seller upon receipt and satisfaction of the purchased goods. This transaction mechanism guarantees high trust and confidence in the process, providing a secure environment for all parties involved.

Along with a trusted third party acting as the final signatory to the multi-sig contract, the seller also retains a key. If the contract terms are met, both the buyer and seller can sign to confirm the trade. However, if either party breaches the contract terms, the third party can release the funds to the other party.

2. Two-Factor Authentication (2FA)

With a multi-signature wallet, a transaction must be approved by multiple signers before it can proceed. This acts as a form of two-factor authentication (2FA), making it more difficult for malicious actors to gain unauthorised access to the wallet.

If an unauthorised person or entity gains access to one of the associated keys, the user can easily revoke their access. Keeping the private keys in multiple locations or with different individuals further strengthens the wallet’s preservation.

3. Key Person Risk Elimination

Multisig wallets are structured to eliminate traditional “key person” risk. The term “key person” risk refers to a situation where a company’s success depends on a single individual. This is a common issue in the world of cryptocurrency, especially when one individual has control over a wallet’s seed phrase.

Multisig wallets require multiple participants to complete a transaction, eliminating the risk of a single point of failure and critical person risk. With the implementation of two of three multisig, critical transactions can still proceed even if one key party is not present during the transaction.

4. High Security

Having a multi-sig wallet can provide an added layer of security and peace of mind, which is crucial in light of the heightened security risks in the world of cryptos and the irreversible nature of blockchain transactions. With a multisig wallet, users can feel confident that the likelihood of a hacker obtaining all necessary private keys is minimal.

Moreover, a backup option is available with a multi-sig wallet. If not all signatures are required to validate transactions during the setup, users can recover their wallets quickly if one or more private keys are missing. Additionally, new signatures can be added to enhance safety and distribute ownership further.

Conclusion

Multisig Wallet is a versatile place to store crypto instruments, offering enhanced security with additional signatures when making a transaction. In addition to benefits such as 2FA and escrowed transactions, it also removes critical personal risk, which makes it one of the best forms of crypto asset storage on the market overall.