What Is an Investment Priorities Plan?

Nov 09, 2023

In the world of business and finance, strategic planning is everything. Companies and governments need to have a clear roadmap for decision-making and resource allocation in order to achieve their specific goals, be it economic development or specific sector growth. In this regard, an Investment Priorities Plan (IPP) serves as a key document that defines long-term investment objectives.

In this article, we will delve into the investment priorities plan meaning, the importance of IPPs, how they are used, and how one can create such a plan for their own business.

Key Takeaways:

- Governments strive to plan ahead by creating long-term economic and financial strategies that address specific issues.

- A sound investment and priorities plan form the basis of any successful business.

- IPP should identify and prioritize goals, assess available resources, and set timelines to reach desired outcomes.

- Investment planning helps investors identify their goals, assess their risk tolerance, and create a diversified portfolio.

What is an Investment Priorities Plan?

An Investment Priorities Plan is a crucial tool for any government or business looking to effectively allocate resources and drive development. It is a strategic document that outlines the priorities and strategies for investing financial resources in a particular area or sector. It provides a clear path and direction for investing resources to achieve the desired outcomes.

Investment plans and frameworks take many forms and are applicable to a variety of entities and purposes:

Governments

In the case of governments, the process of creating an IPP involves thorough research and analysis to identify key fields that require improvement and financial support. These could include industries with high growth potential, critical infrastructure projects, or social programs aimed at improving quality of life. The identified priorities are then matched with available resources and funding sources to create a feasible plan that maximizes impact.

Investment plans can be developed for various levels of government, such as national, regional or local levels. They can also be tailored to specific sectors, industries or development goals.

Among the examples of IPPs created by governments are the Philippines’ 2022 Strategic Investment Priority Plan, which outlined a range of initiatives, including expanded tax incentives for various industries, different investment programs related to green ecosystems, health-related activities, research and development sector, and more.

Businesses

As for businesses, an IPP provides a comprehensive overview of the market, competition, and potential risks, enabling businesses to make informed decisions on which projects to invest their funds in.

Individual investors

When it comes to individual investors, a personal financial plan that outlines their investment goals, risk appetite, and time horizon is crucial for one’s financial success. It helps in creating a diversified portfolio by identifying suitable investment avenues across different asset classes.

How Investment Priorities Plans Drive Economic Development

Strategic investment planning is a must when it comes to the elaboration of the future economic development of a country.

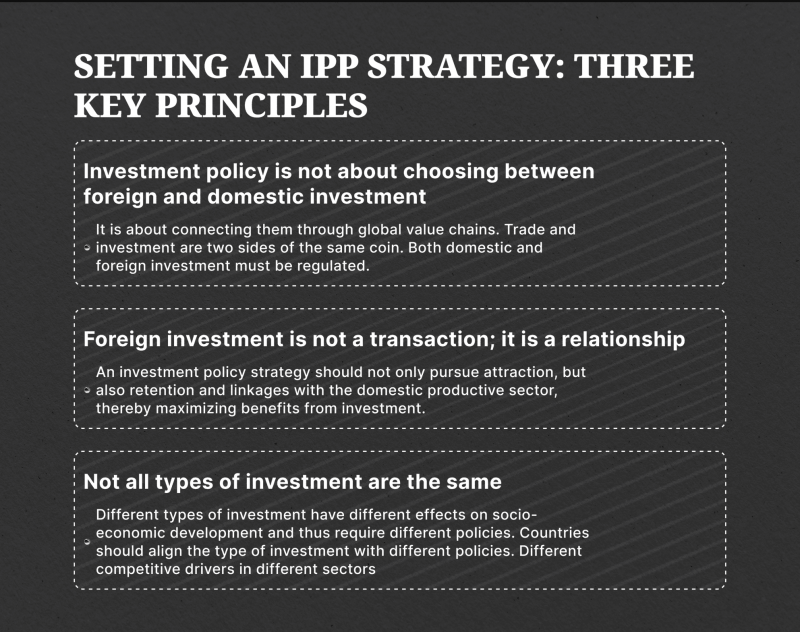

Guiding Resource Allocation

One of the key functions of an IPP is to guide resource allocation towards priority sectors or industries. Using IPPs, governments target critical areas, such as infrastructure, renewable energy, and technology, to spur growth and create jobs. This focused approach allows for more efficient use of limited resources and can attract private investment by demonstrating a clear vision for these sectors. IPPs also provide transparency in the allocation process, reducing the risk of corruption and ensuring fairness.

Aligning with Strategic Objectives

By identifying key priorities such as poverty reduction, job creation, or environmental sustainability, governments can align investments to achieve these goals. This not only helps to promote balanced growth but also ensures that resources are used effectively for long-term benefits. IPPs also enable government agencies to hold themselves accountable by setting specific targets and metrics.

Fostering Stakeholder Engagement

IPPs involve thorough consultation and engagement with various stakeholders, including businesses and the public. This collaborative approach allows for a diverse range of perspectives to shape the priorities and strategies within the plan. It also creates buy-in from key stakeholders, increasing the likelihood of successful implementation. As a result, IPPs can facilitate more inclusive economic development by considering input from different sectors and communities.

Encouraging Long-term Planning and Implementation

The time frame of an IPP typically spans several years or decades. This enables governments to make strategic decisions that consider future trends and factors rather than just short-term needs. IPPs reduce the risk of competing interests or conflicting priorities hindering development efforts by providing a clear direction for investments.

Who Creates Investment Priorities Plans?

The responsibility for IPPs can fall on various entities, depending on the specific context and objectives. But who exactly is responsible for creating them?

Typically, government agencies or ministries overseeing economic development and finance take the lead in developing these plans, working closely with other entities such as regional development authorities or public-private partnerships. International development organizations (like the United Nations, the World Bank, and regional development banks), NGOs (Non-Governmental Organizations), and consulting firms may also play a role in providing expertise and support.

Sometimes, IPPs are carried out by interdisciplinary teams made up of economists, urban planners, policy analysts, and environmental experts. These teams work together to identify opportunities, assess needs, and formulate strategies.

Additionally, the involvement of a diverse range of stakeholders plays a vital role in establishing an effective Investment Priorities Plan meaning that corporations, associations, organizations, and academic institutions all contribute to the process. As a result, the plan reflects diverse perspectives and addresses various needs within the community.

How IPP and Investment Portfolio Management Work in Businesses

The success of any organization depends on its ability to effectively manage its assets. This includes planning and managing asset lifecycles, as well as making strategic investment decisions. The process of investment, prioritization and planning thus is crucial for businesses to ensure that organizations are able to maximize the value of their assets and achieve their business objectives.

What is Investment Portfolio Management?

Investment Portfolio Management (IPfM) is a discipline that helps businesses maximize the value of their investments. It involves continuously aligning project activity with the overall business strategy to ensure optimal results.

The IPfM team plays a vital role in this process by providing timely and accurate information for evidence-based decision-making. This information includes assessing risk, evaluating investment options, and ultimately selecting which projects should be prioritized.

The main goal of Investment Portfolio Management is to ensure that investments deliver the most value to the business while reflecting a balance of risk and return consistent with strategic goals and objectives.

The benefits of effective IPfM are numerous. It allows businesses to maintain a comprehensive view of their investments by considering factors such as risks, resources, skills, stakeholders, and benefits. With this holistic perspective, the IPfM team can proactively address issues and adapt to changing business demands. They also provide leadership and direction to project managers while maintaining strong relationships with third-party vendors.

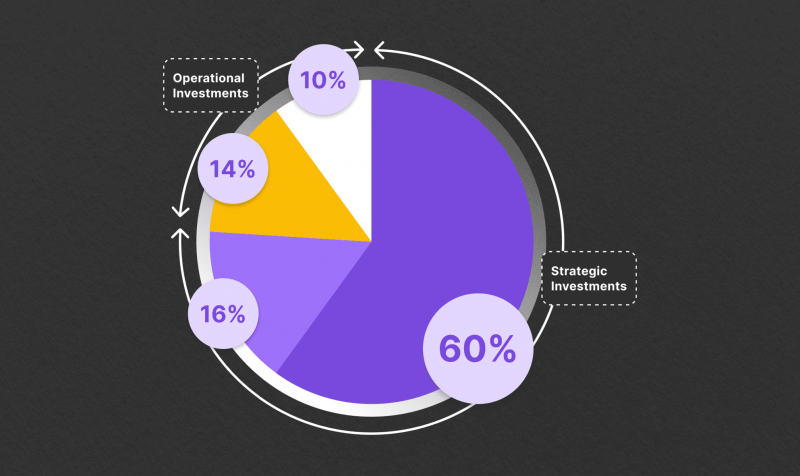

Key components of Investment Portfolio Management involve:

- Identifying emerging investment opportunities,

- Managing the financial aspect of investments, budget allocation, and resource utilization,

- Prioritizing investments to ensure that resources are allocated to the most critical projects or initiatives,

- Monitoring the performance of individual investments, assessing their alignment with strategic goals, and making adjustments as needed.

Creating an Investment Priorities Plan for Your Business

Here are the steps to develop an effective IPP tailored to your business:

- Assess Strategic Goals: Begin by identifying your company’s strategic goals and objectives. Understand the areas where investments are needed to achieve these goals.

- Analyze Market Trends: Conduct a thorough analysis of market trends and industry developments. Identify emerging opportunities and potential risks that could impact your business.

- Evaluate Resource Allocation: Assess your financial resources, budget constraints, and available funding sources. Determine how much capital can be allocated to investments.

- Identify Investment Opportunities: Identify specific investment opportunities that align with your strategic goals and have the potential for significant returns. Consider factors such as market demand, competitive advantage, and sustainability.

- Perform Risk Assessment: Evaluate the risks. Consider factors such as regulatory changes, technological advancements, and unforeseen circumstances that could impact the success of your venture.

- Establish Investment Priorities: Prioritize investment opportunities based on their alignment with strategic goals, potential returns, and risk assessment. Determine which projects or initiatives should be given priority for resource allocation.

- Develop an Implementation Plan: Create a detailed implementation plan for each investment opportunity, including timelines, resource requirements, and key milestones. Define the necessary steps to execute the investments successfully.

- Engage Stakeholders: Involve relevant stakeholders, such as executives, managers, and key employees, in the decision-making and implementation processes. Seek their input and support to ensure the success of the Investment Priorities Plan.

- Monitor and Evaluate: Continuously monitor the progress of investments and evaluate their performance against predefined metrics and objectives. Regularly review the IPP and make adjustments as necessary.

- Adapt to Changing Circumstances: Remain flexible and adaptable to changing situations. Regularly reassess your IPP to ensure its continued relevance and effectiveness.

It is important to note that creating a thorough IPP is a challenging task that demands the collective efforts of a dedicated team of experts and analysts. The process involves extensive research, data interpretation, and strategic planning to ensure that all aspects of performance are taken into account.

Personal Investment Plan for Investors

Individuals can also greatly benefit from developing an investment plan, regardless of their level of experience or the amount of capital they have to invest.

Such a plan serves as a roadmap for an investor’s financial journey and is usually made by an investor who has a specific long-term objective, like buying a house or gaining a passive income from the stock markets.

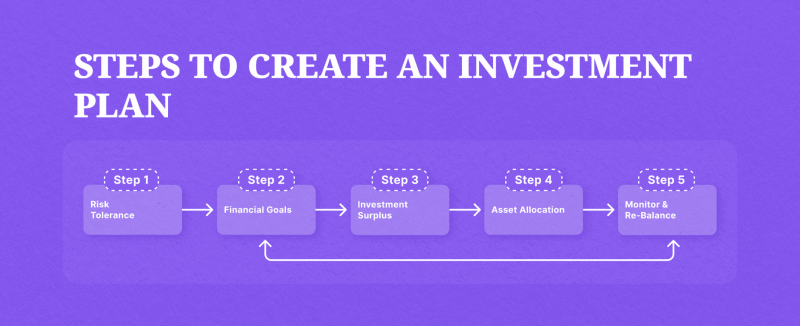

When creating a personal investment plan, consider the following steps:

- Set Your Financial Goals: Clearly define your financial goals, such as retirement, education funding, or purchasing a home. Establish specific targets and timeframes for achieving these goals.

- Assess Risk Tolerance: Evaluate what level of risk you are comfortable with and your investment preferences. Determine how much risk you are willing to take and whether you prefer conservative, balanced, or aggressive investment strategies.

- Build a Diversified Portfolio: Develop a diversified investment portfolio that spreads risk across different asset classes. Diversification helps mitigate risk and maximize returns.

- Research Potential Investments: Conduct thorough research on potential investments. Analyze historical performance, future prospects, and associated risks. Consider factors such as company fundamentals, industry trends, and economic indicators.

- Have an Asset Allocation Strategy: Determine the appropriate allocation strategy of your investment portfolio. Balance your investments based on risk tolerance, investment goals, and market conditions.

- Monitor Regularly: Make sure your investment portfolio stays aligned with your investment priorities and financial goals by regularly monitoring it. Continually evaluate performance and adjust your investments as needed.

- Seek Professional Advice: Consult with financial advisors or to determine what is best for you based on your particular financial situation.

Conclusion

So, what is an Investment Priorities Plan? IPPs are powerful tools that guide the allocation of resources and promote targeted development and growth. The creation and implementation of these plans can benefit governments, organizations, and even individual investors. By aligning investments with strategic goals, considering risk and return, and regularly monitoring performance, entities and individuals can make informed decisions that maximize value and contribute to long-term success.

FAQs

Do taxes affect my investments?

Taxes can significantly impact your investment returns, so consider tax implications when making investment decisions. Different types of investments are subject to different tax rates, and certain accounts like a 401(k) or IRA may offer tax advantages. It is always recommended to consult with a tax professional for personalized advice on how taxes may affect your specific investments.

How do I determine my risk tolerance?

There are various methods to assess your risk tolerance, such as online questionnaires or seeking advice from a financial advisor. Factors such as age, financial goals, and investment experience can also play a role in determining your risk tolerance. Ultimately, try to find a balance between risk and potential returns for your investments.

Should I make changes to my investment strategy when the market is down?

It can be tempting to make changes to your investment strategy when the market is down? However, it is prudent to approach these decisions carefully. A market downturn may present buying opportunities for long-term investors with a high-risk tolerance, while others may choose to ride out the storm and stick with their current investments. It is best to avoid acting impulsively and instead consult with a financial advisor.

How can I determine the best time to buy or sell investments?

Timing the market can be difficult and risky, as it requires predicting future market movements. Instead of trying to time the market, it is generally recommended to focus on long-term investing strategies and periodically check your portfolio to make sure it matches your goals and risk tolerance. It is also important to stay away from emotional decisions driven by short-term volatility.