What is Thruster (THRUST): An Advanced AMM for the Blast Ecosystem

Jan 29, 2025

Imagine a world where trading tokens is seamless, liquidity is continually optimized, and inefficiencies of traditional systems are a thing of the past. Enter Thruster (THRUST) — a next-level automated market maker (AMM) built to power the Blast Ecosystem with unparalleled innovation.

Whether you’re a developer building the future of DeFi, a trader seeking the best execution prices, or a liquidity provider looking to maximize returns, THRUST offers the tools to make your journey smoother, smarter, and more rewarding.

Key Takeaways

- Thruster leverages advanced algorithms to dynamically manage liquidity, reducing slippage and impermanent loss while ensuring efficient capital utilization across diverse trading pairs.

- With multi-chain support and cross-chain asset bridging, THRUST creates a unified trading ecosystem, enabling users to access liquidity and execute trades across blockchains effortlessly.

- THRUST empowers developers with modular tools, APIs, and customizable pool configurations, fostering innovation while streamlining integration into the expanding DeFi ecosystem.

What is Thruster (THRUST)?

Thruster (THRUST) is a next-generation AMM designed to revolutionize liquidity provision and token trading within the Blast Ecosystem. Unlike traditional AMMs that rely on static and often inefficient liquidity pools, THRUST introduces dynamic mechanisms to optimize pool balancing, minimize slippage, and provide a seamless trading experience for users.

As a cornerstone of the Blast Ecosystem, THRUST empowers DeFi users with tools that are not only robust but also highly adaptive to market conditions.

At its core, THRUST serves as the liquidity backbone of the Blast Ecosystem. It enables efficient token swaps and facilitates deep liquidity for a wide range of trading pairs. It combines innovative features such as smart routing algorithms and customizable pools to ensure users always get the best execution prices.

With its emphasis on scalability and interoperability, THRUST is designed to function across multiple blockchain networks, making it a versatile solution for users and developers.

Fast Fact

Thruster is capable of performing token swaps with smart routing algorithms, navigating multiple liquidity pools in real time.

Core Features of Thruster AMM

Thruster (THRUST) introduces a suite of advanced features to redefine liquidity provision, trading efficiency, and user experience in the DeFi space. Below is a detailed explanation of its core functionalities:

High-Efficiency Liquidity Pools

Thruster (THRUST) employs dynamic liquidity management techniques to optimize pool balance, addressing inefficiencies such as impermanent loss and liquidity fragmentation in traditional AMMs. THRUST dynamically adjusts liquidity based on market demand using smart pool balancing algorithms. This results in lower slippage, enabling enhanced trade execution with minimal price impact, even for large transactions. Additionally, fees are optimized by dynamically adjusting based on pool activity, ensuring fair pricing for both traders and liquidity providers.

Customizable Trading Pairs

THRUST allows the creation of customizable liquidity pools, offering flexibility beyond predefined trading pairs in conventional AMMs. This feature is particularly advantageous for niche tokens and emerging projects within the Blast Ecosystem.

Developers and users can define pool weights and fee structures to create unique trading environments tailored to specific assets. For example, exotic token pairs with unique dynamics can find liquidity, and projects can incentivize liquidity providers through customized rewards and governance options.

Smart Order Routing

THRUST incorporates an advanced smart order routing system that scans multiple liquidity pools to route trades through the most efficient path.

The system optimizes each trade in real time by considering factors such as pool depth, trading fees, and slippage. This provides cost efficiency by reducing gas fees and trading costs while ensuring users achieve better execution prices than single-pool trades.

Interoperability and Multi-Chain Support

Thruster AMM is designed to operate seamlessly across multiple blockchain networks, ensuring its versatility and accessibility in the expanding DeFi ecosystem. It enables users to bridge and trade assets across different chains without leaving the Blast Ecosystem. Additionally, THRUST integrates with other DeFi protocols, broadening its reach and application scope in decentralized finance.

Advanced Security Protocols

Security is a key priority for THRUST, which employs rigorous measures to safeguard users’ funds and data. All contracts undergo comprehensive third-party audits, and real-time monitoring, ensures vulnerabilities are detected and addressed promptly. Fail-safe mechanisms are also implemented to manage edge cases such as flash loan attacks or unexpected market events, enhancing the platform’s reliability.

Incentive Structures for Liquidity Providers

THRUST offers competitive incentives for liquidity providers, making it an attractive platform for passive income generation. Providers earn a share of transaction fees generated by the pool and can participate in yield farming opportunities, receiving additional rewards in the form of native tokens or partner project incentives. THRUST fosters a sustainable and thriving liquidity environment by aligning these incentives with ecosystem growth.

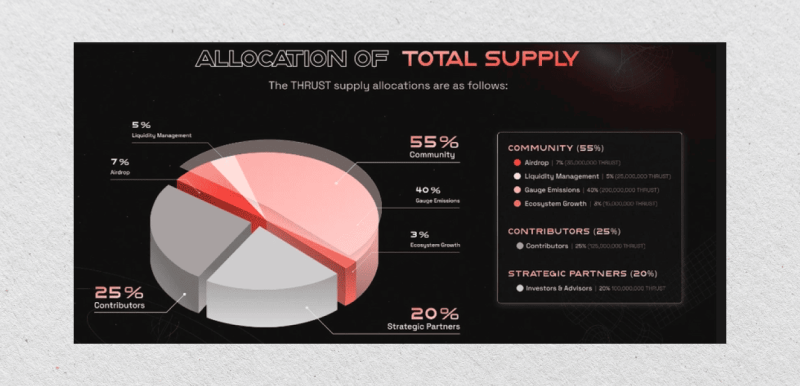

Governance and Decentralisation

THRUST emphasizes community involvement through a decentralized governance model. Token holders can participate in decisions on protocol upgrades, fee structures, and feature implementations. Users can submit and discuss proposals to enhance the platform, and a weighted voting mechanism based on token holdings ensures fair representation in governance.

Developer-Friendly Infrastructure

For developers, THRUST provides a suite of tools and APIs that simplify integration with existing DeFi applications or the creation of new products. Its modular design allows developers to connect specific features of THRUST without unnecessary overhead, and comprehensive documentation ensures the development process is straightforward and efficient.

How does THRUST integrate into the Blast Ecosystem?

Thruster is a pivotal component of the Blast Ecosystem, functioning as its primary AMM and liquidity engine. Designed to seamlessly integrate with the ecosystem’s various elements, THRUST enhances functionality across all DeFi operations layers, ensuring efficient and innovative liquidity provision, token trading, and user engagement.

A Liquidity Backbone for the Ecosystem

THRUST serves as the liquidity backbone of the Blast Ecosystem, enabling fluid and efficient token swaps for all ecosystem participants. By leveraging its dynamic liquidity pools and smart routing algorithms, THRUST ensures deep liquidity across various trading pairs. This not only supports native tokens within the Blast Ecosystem but also encourages external tokens to be onboarded, creating a robust and versatile trading environment.

Enhanced Token Swaps

At the core of THRUST’s integration is its ability to power token swaps within the Blast Ecosystem. Whether a user wants to trade Blast-native tokens or third-party assets, THRUST facilitates seamless and cost-effective transactions. Its smart order routing system scans liquidity pools in real time, ensuring users achieve the best execution prices with minimal slippage. This capability reduces the fragmentation often seen in other ecosystems and positions Blast as a preferred hub for decentralized trading.

Synergies with Staking and Yield Farming

THRUST’s integration extends beyond simple token swaps to synergize with the Blast Ecosystem’s staking and yield farming mechanisms. Liquidity providers on THRUST can stake their LP (liquidity provider) tokens in Blast’s farming modules to earn additional rewards. This dual incentive model boosts liquidity while providing users with lucrative earning opportunities. THRUST supports creating a sustainable DeFi environment by aligning these incentives with ecosystem growth.

Driving Ecosystem Growth through Incentives

THRUST’s integration into the Blast Ecosystem is underpinned by its incentive structures, which align with the ecosystem’s broader growth strategy. Liquidity providers and traders are rewarded with native tokens or ecosystem-specific perks, encouraging active participation. These incentives create a virtuous cycle of liquidity, trading activity, and ecosystem adoption, ensuring long-term sustainability and user retention.

Security and Reliability

Given the Blast Ecosystem’s commitment to user safety, THRUST plays a vital role by adhering to rigorous security protocols. Its smart contracts are thoroughly audited, and its real-time monitoring systems ensure that liquidity provision and trading activities remain secure.

By integrating these features into the Blast Ecosystem, THRUST enhances user confidence and reinforces the ecosystem’s reputation as a secure and reliable DeFi platform.

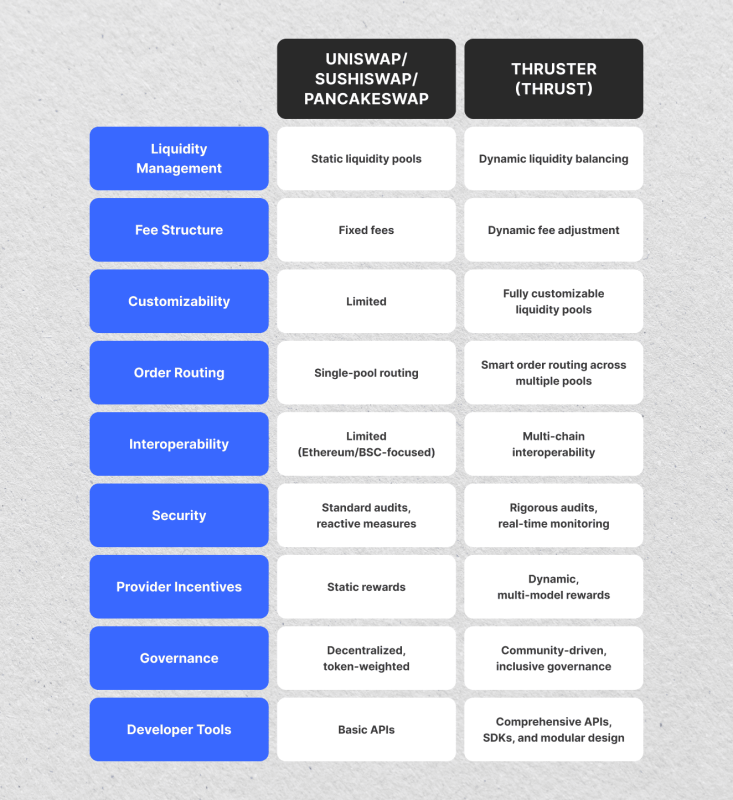

Comparison of Thruster (THRUST) AMM with Other AMMs

Thruster stands out among AMMs by addressing the limitations of traditional platforms and introducing innovative features tailored to the Blast Ecosystem.

Below is a detailed comparison of THRUST with other well-known AMMs, such as Uniswap, SushiSwap, and PancakeSwap, highlighting its unique advantages.

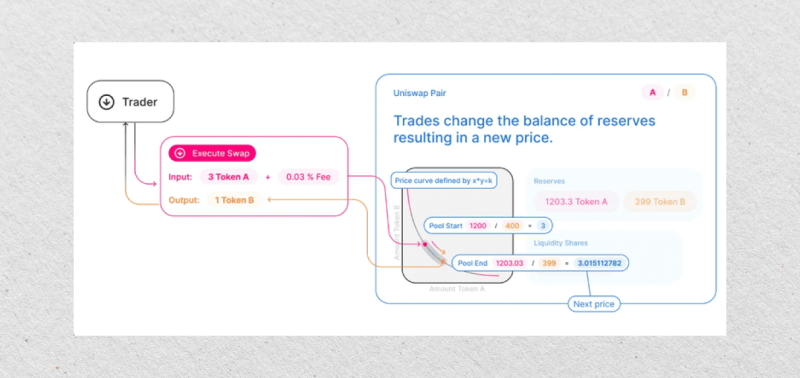

Liquidity Management

Traditional AMMs rely on static liquidity pools, which require liquidity providers to deposit equal amounts of two assets. This static model can lead to inefficiencies such as high slippage, limited liquidity for less popular pairs, and impermanent loss during volatile market conditions. Capital often remains underutilized in these systems, especially during periods of low trading activity.

THRUST employs dynamic liquidity management, where advanced algorithms adjust real-time liquidity based on market demand. This ensures that liquidity is concentrated where needed most, reducing slippage for traders and optimizing capital utilization for liquidity providers. By dynamically rebalancing pools, THRUST minimizes impermanent loss and provides both participants with a more efficient, responsive system.

Fee Structures

Most traditional AMMs implement a fixed fee model (e.g., Uniswap’s 0.3% fee). While simple, this approach fails to account for market variability. High-volume traders may find these fees prohibitive, and during periods of low activity, fees may not generate sufficient returns for liquidity providers.

THRUST introduces dynamic fee adjustment, where fees vary based on pool activity, trading volume, and market conditions. During high demand, fees can be lowered to attract more trading, while in quieter periods, fees are adjusted to sustain returns for liquidity providers. This adaptive model ensures fair pricing for traders and better profitability for providers, making THRUST more flexible and appealing to all participants.

Customisability

Traditional AMMs offer predefined, standardized liquidity pool configurations. While effective for common use cases, this lack of flexibility limits their ability to accommodate niche tokens, exotic trading pairs, or specific project requirements.

THRUST supports customizable liquidity pools, allowing users and developers to configure parameters such as token weights, fee structures, and reward mechanisms. For example, emerging projects can create pools tailored to their token dynamics, and niche communities can set up trading environments for less popular tokens. This flexibility makes THRUST an ideal choice for diverse and evolving DeFi ecosystems.

Smart Order Routing

In traditional AMMs, trades are executed within a single liquidity pool, regardless of whether better rates or liquidity are available elsewhere. This limitation often results in suboptimal prices, higher slippage, and increased user costs, particularly for large transactions.

THRUST incorporates smart order routing, an advanced algorithm that scans multiple liquidity pools and blockchains to find the most efficient trading paths. By analyzing factors such as pool depth, fees, and slippage, THRUST ensures users receive the best execution prices while minimizing costs. This feature makes trading on THRUST more efficient and cost-effective.

Interoperability

Uniswap and SushiSwap are primarily focused on Ethereum and have limited multi-chain support on compatible networks. PancakeSwap operates predominantly on Binance Smart Chain (BSC) and has only basic multi-chain capabilities.

THRUST is designed with multi-chain interoperability as a core feature. It facilitates seamless asset trading and liquidity sharing across multiple blockchains, ensuring users can manage their assets in a unified environment. By leveraging cross-chain bridges and unified liquidity pools, THRUST provides a more versatile and inclusive trading experience, appealing to users operating on various networks.

Security

While these platforms are audited and widely used, they have experienced incidents like rug pulls and flash loan attacks, particularly on poorly vetted pools. Security measures often depend on third-party audits and user diligence.

THRUST prioritizes security with audited smart contracts, real-time monitoring, and fail-safe mechanisms to protect user funds and mitigate vulnerabilities. These systems safeguard against common threats like flash loan attacks, instilling confidence in users and liquidity providers.

Incentives for Liquidity Providers

In traditional AMMs, rewards for liquidity providers typically consist of a share of transaction fees and, occasionally, governance tokens. However, these static incentive structures fail to adapt to market changes, often leading to unequal or unsustainable rewards.

THRUST offers dual incentive models, where providers earn trading fees and additional rewards through yield farming. Its dynamic reward allocation adjusts incentives based on pool activity and contributions, ensuring sustainable growth and equitable returns. This makes liquidity provision on THRUST more rewarding and aligned with market dynamics.

Governance

Most traditional AMMs offer decentralized and token-based governance, but large token holders often dominate decision-making, limiting smaller participants’ influence.

THRUST emphasizes community-driven governance with weighted voting based on token holdings. It includes a proposal system that allows users to actively contribute to the platform’s evolution, ensuring fair representation and inclusive decision-making.

Developer-Friendly Infrastructure

Traditional AMMs offer APIs for integration, but their infrastructure often lacks flexibility for developers seeking advanced customizations.

THRUST is developer-centric, providing comprehensive APIs, SDKs, and modular smart contracts. Developers can easily integrate THRUST’s features into their applications, customize liquidity pools, and design unique incentive models.

This infrastructure fosters innovation and supports the creation of sophisticated DeFi solutions within the Blast Ecosystem.

Roadmap and Future Plans for Thruster (THRUST) AMM

Thruster is committed to driving innovation within the Blast Ecosystem by continually improving its features and expanding its reach. Below is a detailed roadmap highlighting THRUST’s key milestones and future plans to ensure it remains at the forefront of AMM technology.

Advanced Liquidity Management Enhancements

Thruster plans to introduce innovative concentrated liquidity pools in the near term, allowing providers to allocate their capital more effectively within specific price ranges, maximizing efficiency and reducing slippage. Impermanent loss protection mechanisms will offer partial or full compensation to address market volatility.

Over the medium term, the platform will deploy intelligent incentive models that dynamically reward liquidity providers based on activity, volume, and demand trends.

Expansion of Customisability

In the short term, Thruster will empower developers with tools to craft tailored reward structures and design bespoke token pair pools, enabling greater flexibility in liquidity provision.

Moving forward, the platform will launch personalized dashboards, providing liquidity providers with granular insights and control over their contributions, ensuring a streamlined management experience.

Cross-Chain and Interoperability Expansion

Thruster aims to connect seamlessly with blockchains such as Avalanche, Solana, and Polygon in the short term, fostering a unified multi-chain ecosystem. These integrations will support the creation of cross-chain liquidity pools, eliminating fragmentation.

Looking ahead, the platform plans to collaborate with cross-chain bridge solutions and introduce governance voting across networks, ensuring decentralized participation across different chains.

Improved User Experience and Accessibility

The platform will unveil a revamped user interface in the short term, designed to simplify trading and liquidity provision for users of all experience levels. Additionally, a one-click liquidity provision feature will remove barriers for newcomers.

Over time, Thruster will launch a mobile app for Android and iOS, paired with social trading tools, allowing users to follow successful strategies and enhance their engagement.

Enhanced Security and Compliance

To fortify user trust, Thruster will conduct thorough third-party audits of its smart contracts and implement on-chain insurance to safeguard against unexpected losses in the short term. For the mid-term, the platform will roll out compliance modules that align with global regulations while offering optional KYC-enabled pools for compliance-sensitive projects, balancing user privacy and regulatory needs.

Developer Ecosystem Expansion

In the short term, developers will benefit from an upgraded portal offering comprehensive SDKs, documentation, and tutorial resources. Thruster will also introduce grants and incentives to support innovative projects within the ecosystem.

Later, a dedicated marketplace will allow developers to collaborate, share, and monetize custom-built smart contract templates and tools. Additionally, tailored protocol integrations will enable the creation of specialized DeFi applications.

Community and Governance Growth

Thruster will engage its community with a rewards-based incentive program and host interactive workshops to educate users on governance participation in the short term.

In the mid-term, the platform will implement upgrades to decentralized governance, ensuring fair representation for smaller stakeholders. Collaborative voting mechanisms allow users to co-develop and refine proposals, fostering a more inclusive decision-making process.

Integration with Advanced DeFi Products

Short-term plans include partnering with lending platforms to enable collateralized loans backed by AMM liquidity positions, allowing users to leverage their LP tokens. The platform will also introduce tokenized derivatives to expand financial opportunities.

Mid-term goals focus on integrating decentralized insurance solutions for enhanced safety and rolling out algorithmic strategies for automated trading and liquidity management.

Global Expansion and Education

Thruster will localize its platform with multilingual support and collaborate with educational institutions to provide DeFi workshops and webinars globally.

Mid-term plans involve establishing regional hubs to offer localized support in key markets such as Asia, Europe, and the Americas. Partnering with influential thought leaders and content creators will further boost global awareness and adoption of the platform.

Conclusion

Thruster doesn’t just adapt to the changing DeFi landscape — it shapes it. THRUST empowers users and developers to explore new horizons in liquidity provision, trading, and innovation by addressing traditional inefficiencies and introducing forward-thinking solutions. From its cutting-edge features to its seamless integration with the Blast Ecosystem, THRUST is the engine that drives decentralized finance into the future.

With THRUST, you’re not just participating in DeFi but leading it. Get ready to transform your trading experience and unlock limitless possibilities in a world powered by innovation.

FAQ

What makes Thruster (THRUST) different from traditional AMMs?

THRUST introduces dynamic liquidity management, smart order routing, and customizable trading pools, addressing inefficiencies like high slippage and limited token options in traditional AMMs.

How does Thruster ensure security for its users?

THRUST employs rigorous security protocols, including third-party audits, real-time monitoring, and on-chain insurance, to protect user funds and ensure platform reliability.

Can developers integrate their projects with Thruster?

Yes, developers can leverage comprehensive APIs, SDKs, and a modular infrastructure to create custom DeFi applications and integrate seamlessly with THRUST’s ecosystem.

Does Thruster support cross-chain trading?

Absolutely. THRUST is built with multi-chain interoperability, allowing users to trade and bridge assets across various blockchains, such as Avalanche, Solana, and Polygon.