10 Beaten-Down Stocks That Investors Are Starting to Like Again

Apr 13, 2022

The 20 percent increase in Twitter shares since Tesla CEO Elon Musk announced his 9 percent interest in the social media network got Barron's thinking. Are there any other undervalued equities that might provide investors with large gains?

We didn't check for alternative equities in which the world's wealthiest individual may invest, substantially altering the investing picture. Finding firms where investor sentiment was low but showing indications of improvement appeared to be a more feasible strategy.

Before Musk came, investors were pessimistic about Twitter (TWTR). The stock's short-interest ratio — a measure of bearishness — was about 5.5 percent, which was higher than the Russell 1000 index's 4 percent average.

The short-interest ratio compared the total number of shares available for trading to the amount of stock borrowed and sold short by investors speculating on price drops. Stock held by insiders or founders is often excluded from the available-for-trading category since such shares do not change hands frequently.

Prior to Musk's intervention, the bears on Twitter stock were correct. Shares plunged nearly 38% in the year before Musk's ownership was revealed, while the S&P 500 and Nasdaq Composite increased roughly 13% and 6%, respectively, during the same period.

It's difficult to predict what Elon Musk or Warren Buffett will purchase next, but it is feasible to discover beaten-down firms where investor sentiment has begun to recover. Short interest is declining, indicating that short-sellers (those who are pessimistic about the stock) are beginning to finish out their holdings.

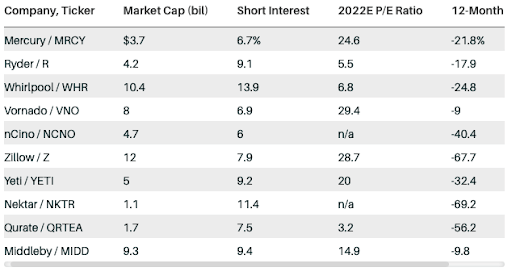

The ten stocks we discovered are defense contractor Mercury Systems (MRCY); restaurant-equipment maker Middleby (MIDD); Qurate Retail (QRTA), the operator of QVC shopping; Nektar Therapeutics (NKTR), a biopharma company; high-end cooler-maker Yeti (YETI); online real estate company Zillow (Z); nCino (NCNO), a software provider; Vornado Realty Trust (VNO); Whirlpool (WHR); and trucking (R).

Are You Ready to Bounce?

Ten stocks with decreasing short interest.

These ten stocks are down roughly 12% on average in the last month and 36% in the last year. The average short interest ratio is 8.7 percent, which is more than double the average for businesses in the Russell 1000 stock index but less than 5% down from the previous month's level of 9.2 percent.

Of course, the fact that short interest is declining paints a partial picture of these equities. Each organization has a unique tale to tell. And, as always, stock screens like this one are only a jumping-off place for future development.

However, the data suggests that at least some investors who have placed negative bets – market players who presumably know the companies well — have elected to withdraw some of their chips.

That might be a hint that the worst is behind us.