4 Healthcare Stocks That Wall Street Analysts Love

Dec 16, 2021

Are you looking for a value in healthcare? Pay attention to the industry's less visible nooks and crannies.

This list focuses on those healthcare firms that Wall Street experts believe have the most room to rise.

A screening of the S&P 500 healthcare companies was conducted to find those whose average analyst price targets suggest returns of a minimum of 25%, as estimated by FactSet. Among these equities were found those rated as Buy or Overweight by at least 65% of experts. The aim was to limit the list to firms that are generally popular and to filter out companies whose average target prices may be distorted by one or two particularly optimistic predictions.

Stocks that have made a comeback are not among the biotech ones. Considering the recent hammering of prominent biotech stocks in the S&P 500, such as Moderna (MRNA), that's hardly surprising. They are also not pharmaceutical companies.

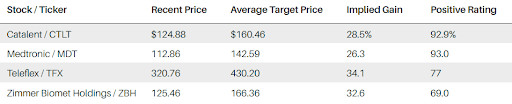

Instead, the equities that have received favorable scores are mostly medical-device manufacturers. Medtronic (MDT), Teleflex (TFX), and Zimmer Biomet Holdings (ZBH) all passed the screening. Catalent (CTLT), a provider of delivery technologies and consumer health products, completes the list.

These Four Healthcare Equities Are Analysts' Favorites

About 65% of experts rank these healthcare companies as Buys or Overweights, with target prices indicating over 25% upside.

The medical-device firms have underperformed the market this year. The iShares U.S. Medical Devices ETF (IHI) gained 15.3% this year, behind the broader medical sector and lagging the S&P 500.

The virus and its refusal to back down has taken a heavy toll on businesses. When clinics stopped routine operations in 2020, medical equipment sales plummeted. The Delta wave struck again later this year, just as medical-device producers believed the situation was slowly improving.

Medtronic is a prime example. Back then, in August, company bosses were full of optimism, claiming that sales had increased 19% on an organic basis for the quarter ending July 30 and that the coronavirus' influence was waning. Nothing like that happened. Sales for the third quarter ended in October fell short of Wall Street's forecasts, prompting Medtronic to reduce its income projections.

"What has changed that we had not completely realized was the lack of nurses in the United States," Chairman and CEO Geoff Martha said. Although hospital beds were not always filled with COVID-19 patients, a nursing shortage caused by the pandemic implied that clinics could not provide treatments involving Medtronic's equipment.

Given the development of the Omicron form, the pandemic crisis in the United States does not appear to be improving in the near future. Experts, on the other hand, are optimistic about equities. Medtronic's consensus analyst target price is $160.46, representing a 28.5% increase from its current price of $124.88. Teleflex's consensus analyst target price is $430.20, representing a 34.1% increase from its current price of $320.76. The median analyst target price for Zimmer Biomet Holdings is $166.36, 32.6% more than its current price of $125.46.

Catalent, on the other hand, has a median analyst target price of $160.46, representing a 28.5% increase from its previous price of $124.88. Catalent is a global provider of delivery technologies, development, drug manufacturing, biologics, gene therapies, and consumer health products. Since the start of the year, the stock has increased 18.1%.