The Key to Surviving Inflation is ‘Pricing Power.’ These Companies Have It in Spades

Apr 06, 2022

In 2021, the S&P 500's total profit margin set a new high. But it is ancient news, and the current context is even more difficult. The capacity to maintain or enhance profit margins in the face of rising prices and declining economic growth will be a differentiating factor for businesses in 2022. Their stocks are expected to prosper.

Companies can gain price power in a variety of ways. A company can sell a product or service that is essential to customers or in short supply, leaving them with little choice but to pay—the product has low price elasticity, to put it in economic terms. That may be fuel at the only station for miles, toilet paper at the grocery store, or tax preparation services during the tax season.

The more a company's power to determine pricing, the fewer direct competition it has. A strong brand with a high affinity or loyalty among customers may also contribute to increased pricing power. Consider the difference in price per unit between Procter & Gamble's (PG) Tide laundry detergent and the similar retail brand.

A corporation can also develop and enhance its offerings, raising pricing when the updated offerings are rolled out. Pricing power exists when the price increases surpass the cost of the improvements. It is widespread in new software versions, medicines and medical devices, semiconductors, and other high-tech goods and services.

Finally, businesses may increase their profit margins by being more efficient and productive, or by taking advantage of economies of scale. This reduces the cost of items sold per unit produced while increasing profits without boosting pricing.

Companies with pricing power are especially appealing in this climate, according to Eric Schoenstein, chief investment officer of Jensen Investment Management.

Inflation is reaching four-decade highs, influencing corporate input costs—investors will want to hold companies that can pass that inflation on. The new inflation dynamic has emerged at a time when the economy's boom is winding down, implying that GDP growth would be weaker in the future. Stocks of firms that can keep or enhance their profit margins in 2022 should be in high demand.

"There are so many cost constraints out there these days," says Schoenstein, whose $14.5 billion corporation is situated in Oregon."We're looking for firms that have persevered in the face of adversity.Those who have once been tried and come out on top should be able to do it again."

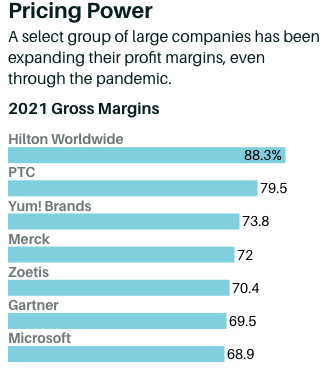

Barron's looked for S&P 500 firms that not only increased their gross margin (revenue minus cost of goods sold, divided by sales) from 2020 to 2021 as the economy recovered, but also had growing, positive gross margins for at least three years prior to the Covid-19 outbreak. Those that were best able to demonstrate pricing power in a 2% annual inflation environment should be better positioned to do so when inflation rises over 7%. The enterprises must also have generated positive free cash flow in 2020 and 2021, proving their ability to weather an economic downturn.

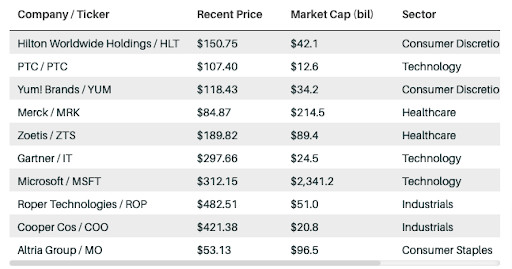

The screen produced 27 names. As with any screen, it's a crude tool that serves as a jumping-off point for future investigation. Here is a list of them:

The screen is manufactured by many major technology companies, including Microsoft (MSFT), Nvidia (NVDA), and Broadcom (AVGO). So do pharmaceutical companies such as Merck (MRK), Zoetis (ZTS), and Mettler-Toledo International (MTD). Their products and services are usually distinct from the competitors, and they rely on ongoing innovation and improvements. Customers' demand or desire for the most up-to-date software, semiconductors, medicines, or medical equipment provides enterprises with pricing power and the capacity to sustain profit margins even in an inflationary or slowing-growth environment.

Inflation is showing up in labor, packaging, meat, and other input prices for McDonald's (MCD) and Yum! Brands (YUM), which owns KFC and Taco Bell. On a market-by-market basis, fast-food restaurants are hiking prices to compensate. In the United States, McDonald's total pricing will rise by around 6% in 2021.

"We're witnessing both labor and commodity inflation," McDonald's CFO Kevin Ozan said at a March conference. "Our franchisees decide our rates... We prefer smaller, more regular increases than larger, less frequent increases. And we make every effort to customize all of the increases to the local market."

Several S&P 500 industrials, like Rockwell Automation (ROK), General Electric (GE), and Lockheed Martin, have been able to regularly grow their gross margins (LMT). Transportation, labor, energy, semiconductors, and various basic materials such as metals, resins, and industrial gasses are all becoming more expensive.

Companies that pass the screening adopt a range of techniques to maintain their profit margins.

Rockwell, which manufactures factory equipment, is raising its prices in tandem with its input costs. "We will implement price hikes with the goal of balancing what we perceive in cost increases," stated Nick Gangestad at a March conference. "We've seen many publicized price hikes in the previous six months."

Cintas, which offers businesses with uniform rentals, cleaning, and other office and facility services, says it is aiming to reduce expenses through automation.

"Pricing is a component of our plan, but it is by no means the only way to battle inflation," Cintas CEO Todd Schneider said last month during the company's earnings call. "We're doing additional approaches, practically all of which involve technology."

Some businesses are boosting prices to cover some of their rising expenses, while others are using different levers to preserve or improve profit margins. "Of course, innovation is one of the finest ways to expand," said GE CFO Carolina Dybeck Happe during the company's March investor day. "Overall, the efforts we're doing throughout the firm to enhance volume and productivity more than balance the challenges that you see from mix, inflation, and growth investment."