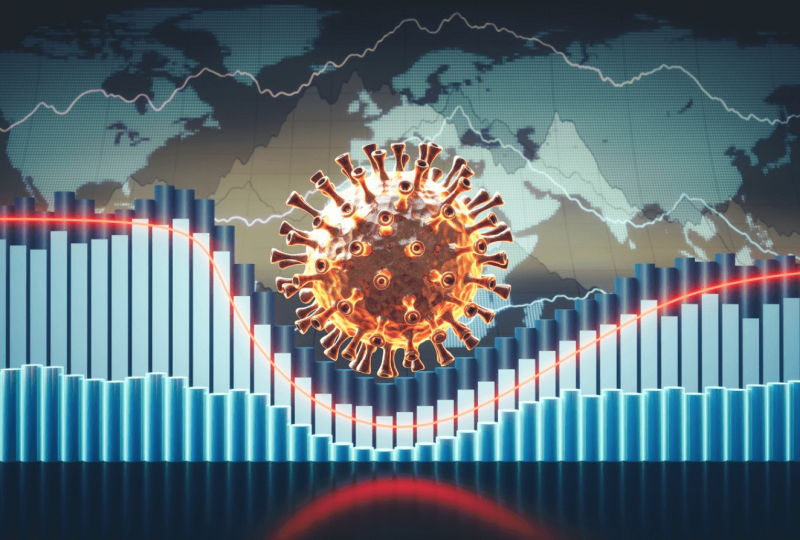

The Next Wave Of The Supply-Chain Crisis Is Building

Dec 27, 2021

Those hoping for a fast solution to supply problems will be terribly disappointed.

Port congestion, truck shortages, manufacturing shutdown, and raw material scarcities are all the biggest drivers of the latest wave of the crisis. However, a new wave is approaching. This wave will be more difficult to detect, and far too many businesses are concentrated only on the present crisis, failing to see the risk of what's to come.

Globally, governmental and private corporations minimized risks in the short term during the epidemic by putting money and adding debts to their balance sheets. Despite this move, many firms became in greater danger in the long run. What causes this to happen? In these circumstances, the core operations of corporations may recover while the cash is available, but if that doesn't occur, they must get additional liquidity to buy time. If a company is unable to manage its financial issues, it will either go bankrupt or start cutting costs, causing unanticipated consequences for its clients.

Financial collapse of suppliers is never nice, but it is usually obvious. A supplier's deterioration may be more subtle, resulting in dangers that are difficult to detect yet are expensive and possibly fatal to its clients.

The second wave of the supply chain crisis will come from suppliers that have been severely harmed by the struggles of the last 20 months, introducing operational, reputational, and financial challenges to their clients. It will occur when businesses are no longer able to hide issues with inexpensive and traditionally easy-to-access financing.

Here's how it'll go down.

Suppliers that cut savings on IT spending may put their clients in danger in cyberspace. Those who delay goods or cut R&D investment are less inventive and sensitive to the product development and dynamics of their customers. Suppliers that skimp on health, safety, or upgrades to production equipment updates bring sustainability, quality control, and delivery times, leading to reputational damage, business continuity, profit loss, inventory control, and working capital efficiency.

Since March 2020, the initial wave of the supply-chain crisis and the virus has been causing businesses to raise cash to avoid bankruptcy or mitigate losses. While governmental initiatives like the Paycheck Protection Program aided, the liquidity and low-rate environment maintained by the Fed since the 2007-2009 economic crisis has produced a market scenario in which practically all enterprises may obtain borrowings. As a consequence, pension funds and other asset managing organizations have spent the previous 12 years looking for yield in this low-rate climate, expanding the credit spectrum to purchase exposure to risky firms to meet their yield benchmarks. Simultaneously, new debt capital providers have arisen, resulting in a completely unregulated and untested asset class of alternative lending institutions. These two factors have supported businesses and supplied accessible financing to the tiniest private firms in a typical supply chain.

Businesses in many sectors, from automotive to entertainment to retail, have taken on more credit, increased cash flow over current liabilities, and overcome highly challenging operating conditions. Meanwhile, numerous subsegments within these businesses have grown riskier, although for a transient capital gain.

End result: There will come a time when many of these firms with a mountain of debt will demand financing (or refinancing, as the situation may be), and many will not be able to access liquidity at reasonable rates.

Cracks in the loan sector are already appearing. The plight of Chinese housing giant Evergrande is echoing across Asia. The Federal Reserve's intention to taper has investors in the bond market tense. These problems are in addition to a long list of others: The money for PPP has long ago run out. Inflation now looks to be persistent rather than transient. Risky assets are volatile, including capital withdrawals from the High Yield Bond Index, crypto movements, and fast moves in major stock markets. These factors, combined with concerns over the Omicron strain, might create a perfect storm for many companies that have been underperforming, if not collapsing outright.

Luckily, one of the most significant developments in supply-chain risk has been supplier cooperation. Private supplier firms embrace transparency, therefore they are more ready to provide financial, intellectual property, information security, environmental, social, and governance programs, and other sensitive information. Supply-chain risk professionals who connect with suppliers to understand their financial health can mitigate problems and build the most sustainable supply-chains possible, creating value for both customers and suppliers while facilitating communication of trustworthy narratives to investors and chief financial officers.

Despite this, there is still a lot of work that remains to be done. Many of these professionals may need additional assistance and resources. In the next year, investors will be watching closely those who oversee the presentation of their businesses' supply chain risk-management programs. That magnifying glass will also be focused on how they are ready for the following round of threats. While hazards themselves cannot be removed, they may be handled. Knowing what these hazards are, especially when a new wave comes, is critical. Clearly, the sky is not about to fall today. Nevertheless, supply chain risk managers must look up.