The S&P 500 Value of Chip Stocks Is Set to Fall. Take a Look at These Two Graphs.

Sep 26, 2023

The S&P 500 value of the S&P Semiconductors Select Industry Index is flat, which is bad news for the stock market as a whole.

The price and relative high of the index have been attained. And it has now broken the uptrend that began with its October low.

S&P Semiconductors is a market capitalization-weighted index. Unlike the major stock market indexes, its relative strength has barely regained half of its decline from its peak in 2000. Because the index is a leading indicator for the stock market, its inability to break past resistance suggests that the broad stock indexes may fall back in the coming weeks.

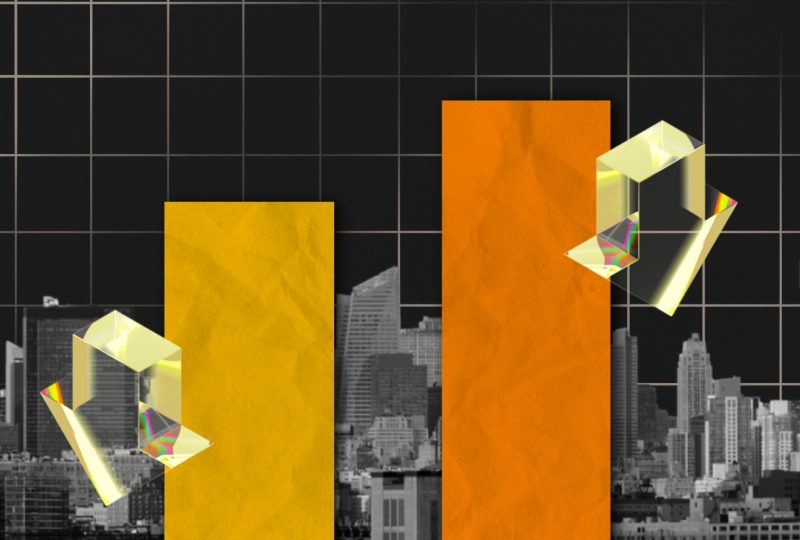

The Semiconductors Index weekly chart is displayed below. After the gains peaked, bearish reversals (indicated by red arrows) formed. Each reversal occurred when the Index challenged and breached its 11-week moving average, most recently in early August, when the index was rejected as it attempted to reclaim that level. The previous October bottom’s uptrend would be clearly broken.

The graph below shows the group’s decreasing relative strength. Semiconductors have produced a rounded top at a 23-year resistance level in contrast to the S&P 500 value of S&P 500 Equal Weight Index. While most indexes beat their 2000 highs by significant margins, semiconductors’ relative strength recovered just half of its 2000 low.

As a result, we continue to advise consumers to sell and profit from semiconductor equities, as well as the vast majority of other technological assets.