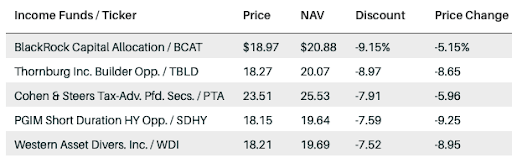

These Closed-End Funds Are on Sale for the Holidays

Dec 22, 2021

For bargain seekers, this is the most beautiful time of the year.

That is most certainly not the situation in shops, where supply-chain concerns in 2021 have made Christmas markdowns scarce. However, in a rather obscure financial industry sector known as closed-end funds, some substantial discounts have surfaced.

These low-cost CEFs were recommended to us by David Tepper, the eponym of Tepper Capital Management, which specializes in these funds, rather than by the same-named businessman who owns the NFL's Carolina Panthers.

He thinks that some of these CEFs' markdowns may be due to tax-loss selling. Investors are likely sitting on handsome gains with the main market indexes at or at all-time highs. Offsetting them with losses is a time-honored approach for reducing capital-gains tax payments, as is utilizing tax-loss carryforwards from the 2020 market catastrophe.

Additionally, Tepper notes that several of these CEFs launched in recent years, adding that many have traded lower in the months after their market debuts. (Several of them are also reappearing on Barron's screen from last month, which featured post-IPO CEF markdowns.) The stock market's recent rough performance is likely to have affected these CEFs as well, he says.

All of these funds are managed by reputable asset managers, including some of the a largest. Tepper cites three BlackRock funds, the most prominent of which being the BlackRock Capital Allocation Trust ( BCAT), which a team led by Rick Rieder manages. Additionally, they manage the open-end BlackRock Global Allocation Fund (MDLOX), rated four stars by fund tracker Morningstar.

Additionally, BlackRock announced buybacks of other discounted CEFs last month, including those included in the table after this post. Share repurchases tend to narrow CEF discounts when all other factors are equal.

Tepper also observes that the Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (PTA) is comparable to several of the firm's other closed-end funds, including the Limited Duration Preferred & Income Fund (LDP). However, the more recent Tax-Advantaged Preferred Securities & Income Fund trades at a discount of around 8%, while the older Limited Duration Preferred and Income Fund trade at a premium of approximately 4%. Thus, for individuals whose investment philosophy begins with the phrase "buy low," the option is self-evident.

(To summarize, CEFs issue a fixed number of shares that trade on an exchange, such as the New York Stock Exchange, at a price that may be lower or higher than the fund's net asset value. Often, in this inefficient market, those premiums or discounts look unconnected to values.)

Tepper offered two types of CEFs: those aimed primarily at income-oriented and those aimed at growth investors. The second category is more concerned with total returns. To be completely transparent, he is a buyer of several of these CEFs.

These CEFs provide some relative bargains for investors shopping in a highly expensive asset market.

Holiday Markdowns

While discounts are sparse in stores this year, a handful of freshly released closed-end funds are drastically reduced in the last months of the year. Once the tax-loss harvesting season is finished, the sales may not continue long.