Why Is Bitcoin Spot ETF Approval Such a Big Deal?

Feb 23, 2023

January 2024 marked a milestone in the cryptocurrency world, with the U.S. Securities and Exchange Commission (SEC) giving the green light to Bitcoin spot ETFs, granting traditional investors a regulated and convenient means of investing in the biggest digital asset. This move has already begun to bear fruits – on February 12, Bitcoin reached $50,000 for the first time since December 2021.

In this article, we will examine what a spot ETF is, its benefits and limitations, and what the approval of Bitcoin ETF applications could mean for the financial world.

Key Takeaways:

- The approval of a Bitcoin spot ETF by the SEC contributes to legitimising Bitcoin as a mainstream asset.

- Bitcoin spot ETFs offer a straightforward on-ramp into cryptocurrency investment for those who are comfortable with stocks but cautious of the complexities of the crypto world.

- Spot and futures ETFs are two distinct forms of investments, with spot ETFs holding the physical asset, while Bitcoin futures ETFs are based on derivative contracts.

- Reputable custodians back Bitcoin spot ETFs, offering heightened security and regulatory clarity.

What is a Spot ETF?

A spot ETF is an investment fund that mirrors the real-time market price of an underlying asset. This asset can be stocks, bonds, commodities, or, in our case, cryptocurrencies like Bitcoin. ETF stands for Exchange-Traded Fund, indicating that these funds are traded on stock exchanges.

The idea of an ETF is particularly straightforward: instead of dealing with derivatives, it involves direct investment in actual assets, like Bitcoins, making it a tangible asset within an investor’s portfolio.

The mechanics of spot ETFs are simple yet profound in their implications for traditional stock exchange engagement:

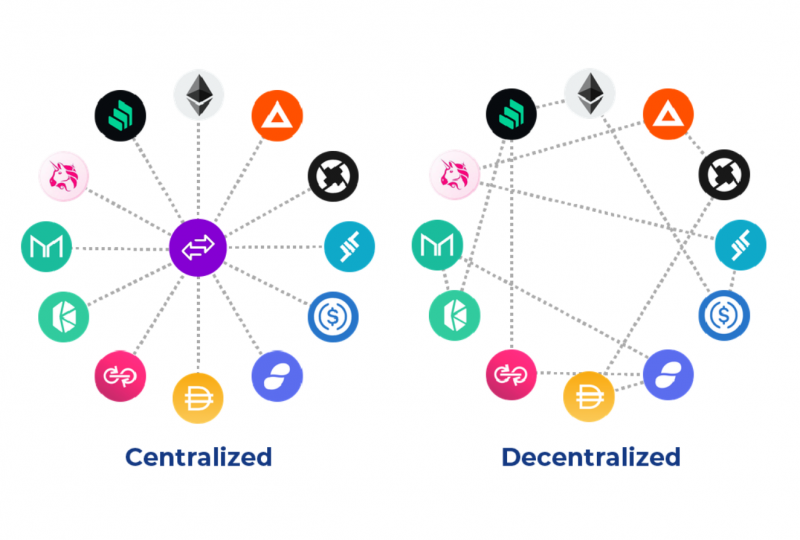

- Direct Exposure: Unlike futures ETFs, these funds hold the actual instrument, providing investors with the full brunt of the asset’s volatility and potential gains.

- Accessibility: Investment in a spot ETF is as accessible as buying shares on recognised platforms like Cboe, NASDAQ, or the NYSE and simplified further through traditional investment apps, such as Robinhood.

- Regulation: ETFs are regulated by the SEC, which gives investors assurance that their investments are protected and subject to transparent market practices.

What Is a Bitcoin Spot ETF?

A Bitcoin spot ETF is a type of spot ETF that specifically tracks the price of BTC. It allows investors to gain exposure to the world’s largest cryptocurrency without purchasing and storing the asset.

After the U.S. SEC sanctioned the launch of the first Bitcoin spot ETFs, marking a historic moment for digital asset investments, investors and traditional financial institutions were essentially given the chance to partake in Bitcoin’s market performance through a regulated and familiar investment structure.

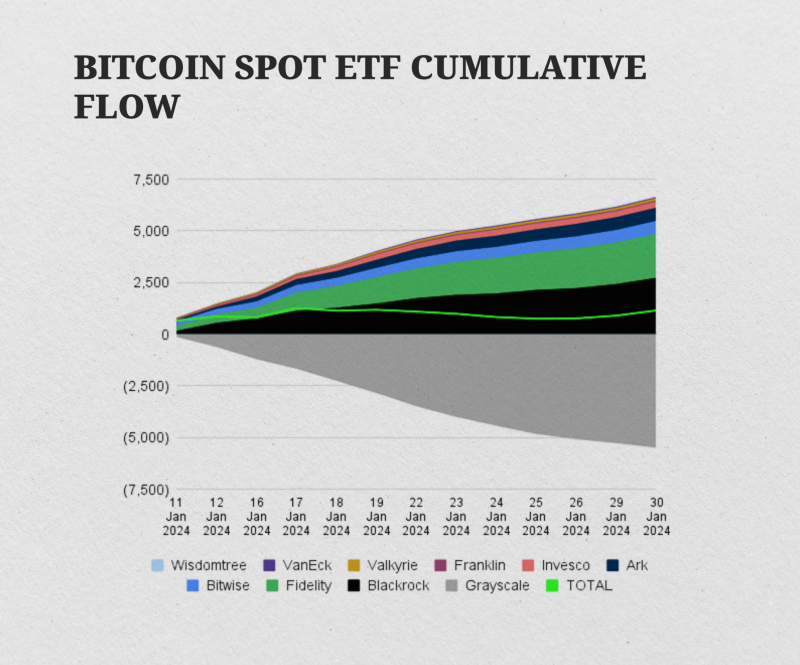

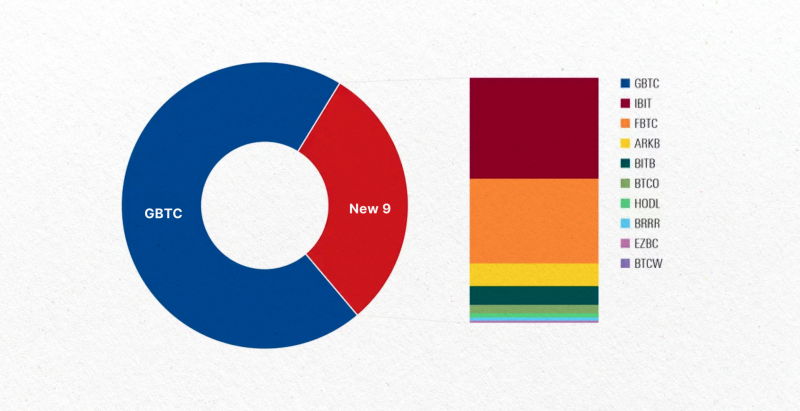

Notable firms such as BlackRock, Grayscale, and Hashdex, along with others, have rolled out their versions of the Bitcoin Spot ETF, each competing with attractive fee structures. For example, the top 10 ETFs offer competitive fees from as low as 0.19% up to 0.25%.

Reflecting the growing trend of integrating cryptocurrencies into traditional investment portfolios, these ETFs can be traded on a range of online brokerage and robo-advisor platforms and are even eligible for inclusion in various retirement accounts such as IRAs and solo 401(k) plans.

Fast Fact:

The ETF approval by the SEC contributes to legitimising Bitcoin as a mainstream asset and could pave the way for other crypto ETFs like Ether.

How Bitcoin Spot ETFs Work

The whole process of investing in these new instruments has its distinctive characteristics:

- Direct Investment: Institutions pool capital on behalf of investors to purchase actual Bitcoins, eliminating the need to deal with complex derivatives.

- Custodial Security: Bitcoins are securely stored in digital vaults by registered custodians, such as Coinbase, ensuring safety and compliance.

- Investment Access and Fees: Institutions charge investors for mediation services. A variety of ETFs from different issuers are available on the market at diverse prices.

About Bitcoin ETF Fees

Institutions that offer spot ETF services impose management fees and brokerage commissions for their services. These fees can vary amongst providers, for example:

- BlackRock (IBIT): 0.25%

- Grayscale (GBTC): 1.5%

- Bitwise (BITB): 0.2%

- Invesco (BTCO): 0.25%

- WisdomTree (BTCW): 0.3%

- Fidelity (FBTC): 0.25%

- Ark 21Shares (ARKB): 0.21%

The value of the ETF’s shares correlates with the CME CF Bitcoin Reference Rate – New York Variant, a benchmark that guarantees a valuation of Bitcoin that reflects the market.

What is the Best ETF for Bitcoin?

There are numerous ETFs available in the market for Bitcoin, but not all of them offer the same benefits or performance. According to experts, two ETFs stand out in terms of low fees and strong liquidity – IBIT and FBTC.

IBIT, or iShares Bitcoin Trust, is managed by BlackRock Inc., one of the world’s leading investment management firms. The fund offers a low expense ratio of 0.12%, making it an attractive option for investors looking to minimise costs.

On the other hand, FBTC, or Fidelity Wise Origin Bitcoin Fund, is managed by Fidelity Exchange Traded Products GmbH. While its expense ratio is slightly higher at 0.75%, it still offers a competitive fee of 0.25%.

Drawbacks and Benefits of Bitcoin Spot ETFs

As with any investment vehicle, there are both advantages and disadvantages to consider:

Advantages:

- Direct price tracking ensures that the performance of the ETF is closely aligned with the real-time price movements of Bitcoin.

- They offer a straightforward on-ramp into cryptocurrency investment without the need for self-custody, which can be a considerable technical barrier for some.

- Operating within a regulated environment provides a sense of security and legitimacy to the investment.

Disadvantages:

- Investors are exposed to Bitcoin’s price volatility, which can be considerable and lead to significant fluctuations in the value of their investment.

- Fees, although varying among providers, do represent an ongoing cost that affects overall returns.

- There is no actual ownership of Bitcoin, as investors hold shares in the ETF, not the cryptocurrency itself.

Why Does Bitcoin ETF Matter?

Exchange-traded funds focusing on Bitcoin provide investors with a crucial tool for engaging with the cryptocurrency market while bypassing the direct holding of the asset. This has several implications for both the investment landscape and the cryptocurrency ecosystem:

Simplified Accessibility

Bitcoin ETFs are traded on traditional stock exchanges, making them an attractive investment option for individuals comfortable with stocks but cautious of the complexities of the cryptocurrency world. Having these ETFs available through familiar platforms lowers the threshold for investment and brings a new demographic of investors into the crypto space.

It also means that Bitcoin will experience massive inflows of capital as these ETFs become more widely available, potentially leading to an increase in the asset’s value and overall market cap of the crypto market.

Enhanced Security and Regulatory Clarity

For those investors hesitant about the security and regulatory risks of direct cryptocurrency ownership, Bitcoin ETFs offer a sense of assurance. With Spot Bitcoin ETFs, reputable custodians securely hold the actual digital assets. These regulated vehicles alleviate investor concerns about hacking, loss of private keys, or other technological mishaps.

Increased Institutional Participation

The SEC’s approval of a Bitcoin spot ETF has opened up opportunities for institutional investors like hedge funds and pension funds to add exposure to Bitcoin in their portfolios. These institutions have been limited in their ability to invest directly in Bitcoin due to regulatory restrictions.

Increased Adoption and Mainstream Recognition

The acceptance of Bitcoin ETFs is a significant step towards wider adoption and recognition of cryptocurrencies as a legitimate asset class. It paves the way for other cryptocurrencies and their respective ETFs to be approved in the future, bringing more diversity and opportunities to investors.

Spot ETF vs Futures ETF

Spot ETFs and Futures ETFs are distinct forms of instruments, each with unique mechanisms and implications. The primary difference between the two is that spot ETFs hold the physical asset, while futures ETFs are based on derivative contracts.

Here are key points differentiating both types of instruments:

Spot ETFs:

- Aim to track the live market price of the asset, holding Bitcoin itself.

- Allow for direct engagement with the asset without the complexities of handling the cryptocurrency.

- Pose risks associated with the secure storage of digital assets and the volatility of Bitcoin prices.

Futures ETFs:

- Invest in Bitcoin futures contracts – agreements set for a future trade of the asset at a specified price.

- Facilitate speculation on the anticipated price direction without ownership of the actual asset.

- Hold risks such as contract expiry and rollovers that may lead to added costs and deviations in performance from the spot price.

The excitement surrounding the potential Bitcoin spot ETF approval caused a substantial upsurge in Bitcoin’s valuation, evidencing the market’s sensitivity to regulatory approvals in this emerging investment domain.

Yet, regulatory agencies like the SEC have been more comfortable approving futures ETFs over spot ETFs, owing to lingering concerns over market manipulation and security. This disparity in regulatory acceptance underscored the differing degrees of institutional trust in these instruments.

Considerations of Investing in Bitcoin Spot ETFs

Investing in spot Bitcoin ETFs presents investors with a set of considerations and potential challenges that require careful scrutiny. Key concerns include:

- Tracking Errors: The ETF’s ability to mirror the price of Bitcoin is not always perfect. Factors such as management fees, operational costs, and bid-ask spreads can cause discrepancies, known as tracking errors, between the ETF’s performance and the actual price of Bitcoin.

- Hefty Fees: ETFs charge management fees for their services, which can affect investors’ returns over time. Therefore, evaluating the cost of investing in a spot Bitcoin ETF is essential.

- Liquidity Risk: Investors may confront liquidity risks with spot ETFs. A scenario where the trading volume is low makes it difficult to execute large trades without impacting the market price. This could be particularly problematic during periods of market stress when liquidity is most needed.

- Custodial Risks: ETFs require reputable custodians to hold the underlying assets. If the custodian is not reliable or experiences unforeseen issues, it could affect the ETFs’ performance and, ultimately, investors’ returns.

- Tax Implications: The unique tax obligations resulting from Spot ETF investments necessitate understanding and planning to avoid unforeseen tax liabilities.

- Market Manipulation: The risk of market manipulation is an ever-present consideration, owing to the crypto market’s susceptibility to such practices.

How to Invest in a Bitcoin Spot ETF

Here is a step-by-step guide on how you can invest in this new asset:

Step 1: Select the Right Broker

Before venturing into Bitcoin ETFs, ensure you have an account capable of trading these assets. You can open such an account on a majority of online trading platforms. Ensure that the broker you select supports spot Bitcoin ETFs, as not every broker offers this option.

Step 2: Deposit Funds

Upon settling for a brokerage, the following course of action is to finance your account. Typically, this can be achieved by transferring money from another brokerage or a standard bank account. Ensure you have sufficient funds to cater to the cost of the ETF shares and any extra charges or commissions.

Step 3: Review Available Options

Currently, there are 11 Bitcoin ETFs approved by the Securities and Exchange Commission (SEC). As with any investment, it is crucial to research the available options thoroughly. Look for ETFs with a high trading volume and high assets under management (AUM).

Step 4: Decide on Your Investment

After conducting a comprehensive review, select your preferred Bitcoin ETF. Most brokers usually present two to three options, each with different fees.

Step 5: Make a Purchase

With your selected Bitcoin ETF in mind, placing an order is time. This process is similar to buying stocks, where you can choose between a market order or a limit order. A market order will execute the purchase immediately, while a limit order allows you to set a specific price at which the order will be executed.

Step 6: Keep Close Tabs on Market Events

Always stay updated about your ETF’s performance. Monitor crypto market actions through charts and news updates.

Closing Thoughts

In conclusion, the arrival of Bitcoin spot ETFs has significant implications for both individual investors and the broader market. Their introduction is expected to drive up the demand for Bitcoin, leading to potential price increases of tokens in the broader cryptocurrency sector.

If you decide to invest in these new instruments, be mindful of the charges associated with these ETFs. Do not forget to consider how these fees may impact financial benefits. Carefully assess all the challenges and effectively leverage the opportunities presented.

Disclaimer: The above information is not intended to be investment advice. Always consult with a financial advisor before making any investment decisions.

FAQs

Which is better: investing in Bitcoin ETFs or buying Bitcoin?

Bitcoin ETFs offer a more convenient way to invest in Bitcoin through your brokerage account but may incur higher fees, while buying actual bitcoins on an exchange or peer-to-peer platform gives you direct cryptocurrency ownership but requires more technical knowledge and security precautions.

Are BTC ETFs available at all brokerages?

No, not all brokerages allow their customers to purchase BTC ETFs. For example, Vanguard, one of the world’s largest asset managers, has announced that it will not offer BTC ETFs to its customers.

How do ETFs impact Bitcoin?

The introduction of a spot Bitcoin ETF is anticipated to boost Bitcoin demand, potentially causing a supply squeeze. PwC reports that global assets under management are around $115 trillion. Making Bitcoin more accessible through stock exchanges may result in significant market inflows.