What’s The Difference Between Custodial vs. Non-Custodial Wallets

Mar 05, 2024

More people are willing to buy digital coins to diversify their portfolios and keep up with current trends. However, after purchasing a digital asset, it’s crucial to find secure storage for it. This is where cryptocurrency wallets come to the rescue. However, this might pose another difficulty for crypto enthusiasts since they must learn the ropes of different wallet types and their functions.

In this article, we will discuss the difference between custodial and non-custodial wallets and determine each type’s key advantages and drawbacks. Understanding cryptocurrency wallet types is crucial for keeping your digital funds safe and managing them according to your goals and preferences.

Key Takeaways:

- A crypto custodial account implies a trusted third party (such as a custodial exchange) with access to your funds and wallet’s private keys.

- Non-custodial wallets offer users total control over the assets, with no third-party intermediary.

- Custodial wallets are easy to use but offer less anonymity and control over the assets.

- Non-custodial options are secure but too sophisticated for beginner users.

Defining Custodial Wallets

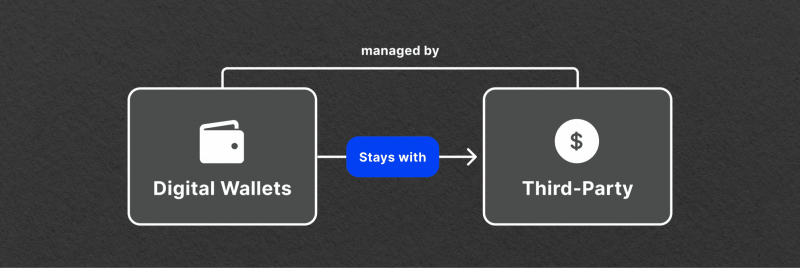

First, let’s discuss what is a custodial wallet. A custodial crypto wallet entrusts digital assets to a third party (for example, custodial exchanges) that takes custody of the user’s cryptocurrency without the user’s control over their private keys. This means the third party is responsible for securing and ensuring the user assets’ safety and protecting them from malicious attacks.

The wallet service provider handles all technical details, ensuring the security of digital assets. This type of wallet is ideal for newcomers who need a mild introduction to crypto security, as it allows for delegating the technical aspects to a trusted entity.

Key features of such wallets include third-party management, convenience, added features like buying, selling, and exchanging within the platform, and trust in the service provider’s ability to safeguard assets.

Trade-Offs of Utilising Digital Wallets

However, there is a risk of losing access to funds if the service is hacked, goes bankrupt, or restricts accounts. Some exchanges also provide backup keys, stored offline in cold wallets, as disaster recovery measures in case of theft. Transactions are initiated using the designated key, and the exchange generates a platform key, countersigns, and approves the transaction.

Additionally, custodial wallets may require personal information, such as identification, to comply with regulations. A custodial wallet provider generates a unique set of private and public keys for a user, securely stored by the provider. Users possess both public and private keys, with the public key being shared and the password remaining with the user.

These keys are used for sending and receiving cryptocurrency transactions, and users can access their funds by logging in and making transactions through the provider’s platform.

Custodial wallets, which encrypt and manage users’ private keys, are popular among crypto users, especially those who have just started their digital journey, due to their speed and convenience.

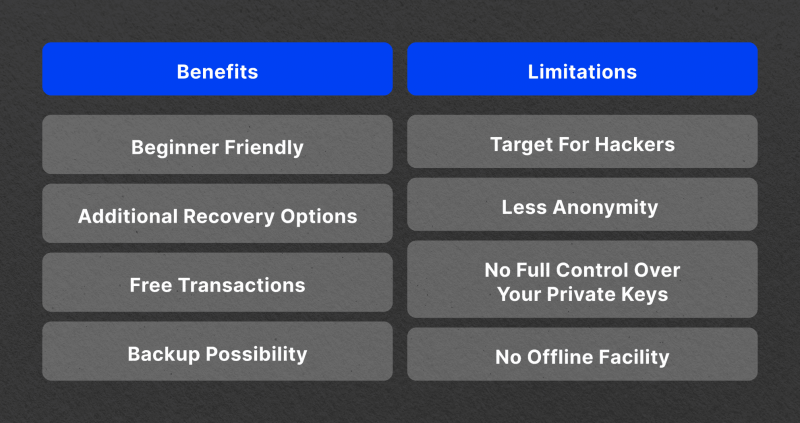

Benefits And Limitations of Custodial Wallets

Here are some advantages and limitations associated with a custodial wallet.

Benefits

first, let’s start by discussing the benefits of custodial wallets.

Beginner-friendly – Most custodial options are user-friendly, providing intuitive interfaces for beginners to manage and trade assets. Popular crypto exchanges act as custodians, offering a user-friendly way for their clients to fund accounts and start trading crypto.

Additional recovery options – If you lose or forget your password, you can request a new password from your custodian, as they can access your private keys, eliminating the need to store and protect your recovery phrase. This also wipes out the danger of permanently losing your assets if you lose or forget your password.

Free transactions – Custodial wallets don’t require a transaction fee, allowing customers to conduct transactions for free within the ecosystem.

Backup possibility – Custodial wallets offer backup facilities, allowing the central authority to undo transactions or restore previous versions, making it easier to manage and maintain.

Limitations

Despite significant advantages, custodial wallets also have some drawbacks. Here are some of the most notable limitations.

Target for hackers – Major centralised exchanges may be susceptible to security breaches, so transferring responsibility to a custodian doesn’t guarantee complete security.

Less anonymity – Most custodial platforms mandate KYC or AML verification to comply with regulations; they collect personal data to verify identity, monitor transactions, and report suspicious activity, similar to other financial platforms. This hinders the basic principle of anonymity in the crypto realm.

No full control over your private keys – Custodial services lack user autonomy over their wallet, as the custodian has complete control over funds and associated processes, including freezing stored amounts.

No offline facility – The internet connection is essential for logging in to custodial wallets and performing transactions, meaning that you don’t have access to your funds if you are offline.

Top Custodial Wallet Providers

Custodial wallets are very popular for transferring and storing digital funds. Here are some of the most liked options.

Coinbase

Coinbase is a secure and reliable crypto exchange with a wallet suitable for both beginners and experienced users. Available in over 130 countries, it offers a wide range of digital assets and educational resources.

Key wallet features include multiple asset management, DeFi liquidity pools, support for NFTs, token approval alerts, transaction previews, and affordable trade pricing.

Coinbase supports 240+ cryptocurrencies, including Ethereum, Polygon, Bitcoin, Dogecoin, Litecoin, Stellar Lumens, Ripple, and Solana networks.

BitGo

BitGo’s wallet is a secure and user-friendly solution for managing digital assets, offering features like cold storage, customisable policies, and insurance coverage up to $250M against theft and key loss.

It allows pairing custodial wallets with hot wallets, multi-signature security, and reliable asset movement. The wallet supports over 600 tokens across various blockchains and is regulated by NYDFS.

Gemini

Gemini is a popular digital asset wallet with a user-friendly interface, diverse buying and selling options, and the potential to earn interest on stored crypto coins.

It offers a vast array of digital assets, seamless fiat on-ramps, and insurance against certain types of losses.

The platform features 2FA, hardware security keys, address-allow listing, a multi-signature digital signature scheme, and rigorous background checks.

Gemini supports 80+ cryptocurrencies and is regulated by NYSDFS, MAS, and FCA.

Defining Non-Custodial Wallets

So, what is a non-custodial wallet? Decentralised or non-custodial wallets provide complete control over digital assets and allow users to store and manage their own private keys without a third-party intermediary. This eliminates the need for a central authority to manage funds or store private keys. Instead, users have the autonomy to protect their keys from unauthorised access.

This type of wallet offers greater autonomy, control, and flexibility in managing digital assets. It is suitable for users who prefer long-term holding and want full responsibility for their private keys.

Additionally, non-custodial wallets offer enhanced privacy without requiring personal information sharing. However, they may need more technical expertise to set up and use compared to custodial wallets, which is why this wallet type is more suitable for experienced traders and investors who know how to manage and protect their private keys.

There are two main types of non-custodial wallets: software wallets, which encrypt and store your keys on your computer’s hard drive, and hardware wallets, which store and sign your private keys on a separate hardware device. Also, some non-custodial wallets are browser-based.

The most secure type is a hardware wallet, which resembles a USB thumb drive and is only online when connected to a computer or mobile device. The signing of transactions using the private key occurs within the device itself and is only sent to be confirmed by the blockchain once it’s back online.

Non-custodial wallets offer users the freedom to be their own bankers, but they also come with more responsibility. If a custodial wallet provider forgets their account password, it can be reset through email and identity verification. However, losing the hardware wallet or its private key could leave users without access to their funds.

Fast Fact:

The reduced risk of a data breach for decentralised wallets results in 66.5% of crypto holders relying on non-custodial and mobile storage solutions.

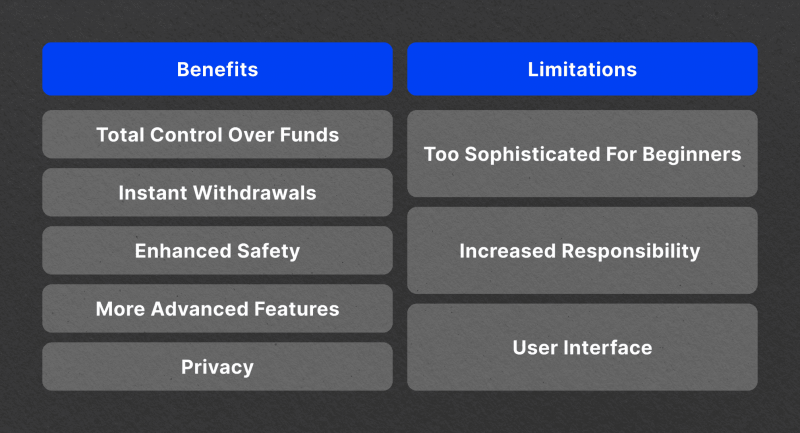

Benefits And Drawbacks

Like centralised wallets, non-custodial wallets have both advantages and weaknesses. Let’s discuss the perks of this wallet type.

Benefits

First, let’s start by going through the benefits of non-custodial wallets.

Total control over funds – Non-custodians are gaining popularity due to their individual access to users’ funds, eliminating the need for third-party management or related activities.

Instant withdrawals – Non-custodial wallets don’t require third-party transaction confirmation, simplifying the process and allowing instant withdrawals.

Enhanced safety – Non-custodial wallets provide enhanced security by preventing third-party access to private keys, eliminating risks of vulnerabilities, breaches, or mismanagement, and ensuring complete ownership and responsibility over crypto assets.

More advanced features – Decentralised wallets offer advanced features and opportunities for asset management, integrating with dApps on various blockchain networks, safeguarding private keys, and offering flexibility with customisable crypto transaction fees.

Privacy – Non-custodial wallets don’t require personal information or KYC/AML procedures for account creation. They can be created with just a phone number, making them an optimal solution for sending money anonymously.

Limitations

Now, let’s explore some limitations that may arise from using a non-custodial crypto wallet.

Too sophisticated for beginners – These options offer advanced features but require technical expertise, making them unsuitable for beginners.

Increased responsibility – The user is fully responsible for their private keys and recovery phrases. Failure to safely store these passwords will prevent access to your wallet or data, and you will lose access to your funds, as no backup or recovery option is available.

User interface – User interfaces of non-custodial wallets are more challenging than those of centralised wallets, which presents a problem for beginner users. Navigating non-custodial wallets requires some experience and expertise.

Top Non-Custodial Wallet Providers

Non-custodial wallets might seem challenging to use; however, they offer unconditional security options that make these wallets very popular among users. Here are some of the most widespread options.

MetaMask

MetaMask is one of the best non-custodial wallets. It is an Ethereum-based platform for storing, staking, and transferring crypto tokens. Its private keys are provided to wallet owners for safety and can be recovered using a 12-word seed phrase. Its browser extension allows seamless connections with multiple crypto platforms without leaving the web browser.

MetaMask’s key feature is its ability to buy and sell cryptos without providing personal information. To start trading on DeFi exchanges, users can install the app or browser extension and log in using a private seed phrase, promoting decentralisation.

Trust Wallet

Trust Wallet is a secure software wallet that supports over 70 blockchains and 4.5 million digital assets like Bitcoin, XRP, Solana, Cardano, Ethereum, and NFTs.

Managed by Binance, it is available as a mobile app for iOS and Android and a browser extension for Chrome. Users can secure their wallets using Touch ID, Face ID, or passwords. Trust Wallet is a non-custodial crypto wallet with WalletConnect via a QR code and an in-built staking tool.

Trezor Model T

The Trezor Model T is a sophisticated hardware wallet from Trezor, the creator of the world’s first crypto hardware wallet. It features a 1.54-inch colour LCD display and USB-C connectivity and supports over 1,000 crypto assets.

Users can set up a 50-digit PIN code and verify transactions independently. The Trezor Model can be managed on various devices using Trezor Suite. It offers multi-signature protection, Taproot support, and a Shamir backup system for added security.

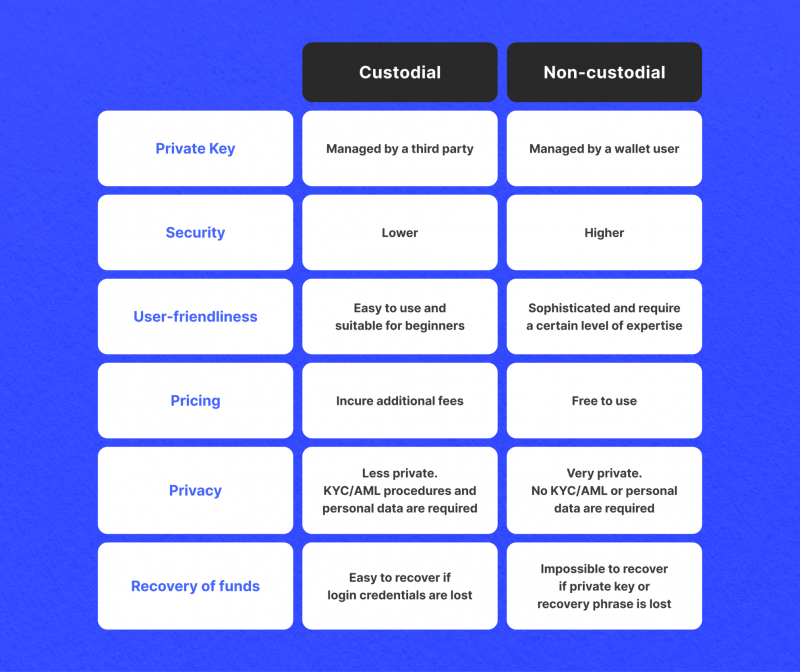

Comparing Custodial vs Non-Custodial Wallet

The choice between custodial and non-custodial wallet providers depends on crypto usage, security needs, and personal investing preferences.

The primary difference between custodial and non-custodial crypto wallets is the custodian of the private key.

In centralised wallets, a third party manages the private key, while in non-custodial wallets, all blockchain custodian services reside with users.

Non-custodial wallets are generally considered more secure than custodial wallets as they allow users to have complete control over their private keys. With custodial wallets, users entrust their private keys and personal data to a third party, thus sharing the control over their assets.

Custodial wallets are easier to manage as they don’t require technical expertise. Decentralised wallets, conversely, are more sophisticated and require some experience in the sphere.

Pricing is another notable difference between the two types of wallets: custodial wallets may incur additional fees, while non-custodial wallets are typically free to use.

Future trends suggest that non-custodial wallets will continue to gain an edge over custodial due to growing data breach cases and increased user awareness about data privacy and security.

Which Wallet Should You Choose?

The choice between custodial or non-custodial wallet providers depends on your crypto usage, security needs, and personal investing preferences.

Despite the wallet’s type, research the service provider’s history and ensure the provider follows stricter regulations, is properly registered with your local regulatory authority and has relevant licenses to operate in your country.

Custodial wallets are favoured by newcomers and those who prefer centralised management, while non-custodial wallets allow users to control access to their funds.

Both types have pros and cons, so it’s essential to weigh comfort with the most important features and consider perks like crypto debit or credit cards, supported coins, staking opportunities, and cashback rewards when choosing your best non-custodial wallet or a centralised option to store funds.

Most experienced traders and investors use a combination of both. Regardless of your choice, be sure to adhere to the best security measures, as this is the ultimate goal of any digital wallet.

Closing Thoughts

Custodial wallets are popular due to their increased third-party control over crypto wallets, whereas non-custodial wallets are well-liked due to users’ full control over their funds. Both wallet types have benefits and weaknesses, and choosing the one that suits you best depends on your preferences and needs. However, regardless of the wallet type, you should pay close attention to the wallet provider’s track records and offered functions and security features.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs:

What is a private key?

Private keys are alpha-numeric codes combined with a public key, providing secure access to blockchain wallets.

Are custodial wallets safe?

Custodial wallets are considered less safe than non-custodial ones. Nevertheless, this type can be a secure option for keeping your funds if all the safety measures are taken; plus, custodial wallets are convenient and require less responsibility from a user.

Do custodial wallets have private keys?

Yes. A custodial crypto account requires a private key. However, a third party manages this key, and a wallet user does not have complete control over the key and the assets in the wallet.

Is it possible to hack a non-custodial wallet?

Non-custodial wallets offer superior security due to their off-chain storage of keys, making it difficult for hackers to steal funds.