Crypto Liquidity — What is it, and How to Measure It?

March 10, 2025

The liquidity of the virtual coins circulated in the crypto market is a central pillar of a well-structured and thriving crypto ecosystem. It reflects how efficiently a digital asset can be traded, irrespective of provoking massive price drops.

For traders, investors, and analysts, realizing liquidity is key to navigating the volatile world of crypto coins. But how do we quantify liquidity, and what challenges do fragmented markets pose?

This article dives deep into the methods, tools, and factors regulating crypto liquidity, offering actionable insights for anyone in the crypto space.

Key Takeaways

- Tools like the Amihud illiquidity ratio, bid-ask spreads, and turnover ratios offer research into market authenticity and price equilibrium.

- Volatility, market fragmentation, and regulatory ambiguities complicate liquidity measurement.

- Platforms such as CoinMarketCap, Glassnode, and DeFi Pulse provide robust data for analysing liquidity across centralised and DEXs.

What Is Crypto Liquidity Measurement?

Crypto liquidity measurement refers to the process of evaluating how efficiently and effectively a virtual currency can be traded in the market, yet avoid presenting momentous price declines. It provides critical research into market health, trading reliability, and asset longevity.

Liquidity assessment is decisive for shareholders, traders, and market specialists, giving them a base to make prudent determinations within the rapidly shifting arena of virtual assets.

Crypto liquidity analysis involves analysing several quantitative and qualitative factors that collectively indicate the ease with which crypto coins can be bought, sold, or exchanged without disrupting the market price. In financial terms, liquidity measurement bridges market activity with price uniformity, assuring traders and investors can initiate and close positions with minimal reimbursements and risks.

Unlike traditional assets, cryptocurrencies operate in highly fragmented and volatile markets, making liquidity measurement a complex yet indispensable practice.

Fast Fact

Over 70% of global crypto liquidity is concentrated on just a few major exchanges, underscoring the importance of exchange compatibility for market reliability.

Factors Influencing Crypto liquidity

Crypto liquidity is affected by a variety of factors, ranging from market activity to external regulatory frameworks. Being aware of these characteristics is crucial for evaluating how easily tokenised assets can be traded while not making consequential price alterations.

Trading Volume

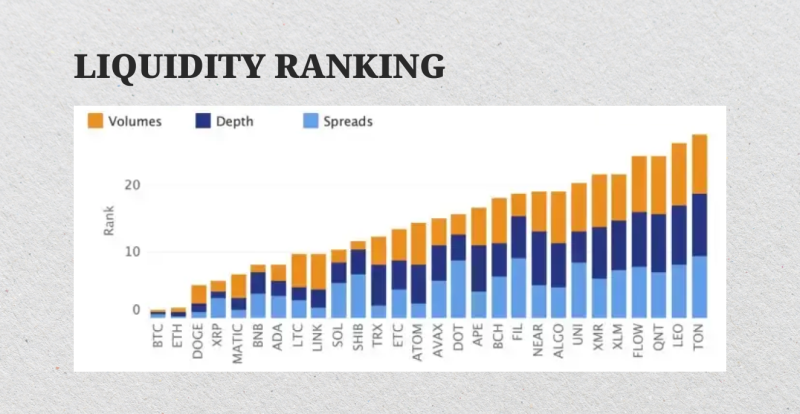

Trading volume is one of the most significant indicators of liquidity. Greater trading volumes reveal active market participation, with a steady flow of buy and sell orders.

Cryptos with excessive trading volumes, like Bitcoin and Ethereum, typically exhibit better liquidity because more counterparties are available to trade anytime. Conversely, low trading volumes suggest a lack of interest, making it harder to execute trades without negatively altering prices.

Exchange Listings

The number and reputation of exchanges listing a crypto asset play a critical role in its liquidity. A digital asset listed on multiple well-known exchanges has higher accessibility, attracting a broader pool of market players.

This wider exposure enhances liquidity by increasing trading activity across various platforms. Conversely, limited listings hamper accessibility and liquidity, particularly for newer or niche tokens.

Market Depth

Market depth indicates the presence of buy and sell orders at different price points within an exchange’s order book. A market characterised by depth features substantial order volumes near the prevailing market price, facilitating the execution of large trades with little slippage. Conversely, shallow markets exhibit expanded price dispersion, where even minor trades can result in considerable price changes.

Token Utility and Adoption

Cryptocurrencies with real-world use cases and extensive adoption tend to exhibit superior liquidity. For illustration, tokens that facilitate payments, smart contracts, or governance within a blockchain ecosystem attract more users, driving trading activity. The broader the utility and adoption of a crypto, the more liquid it becomes.

Regulatory Environment

The clarity and supportiveness of regulatory plans decisively influence liquidity. In jurisdictions where crypto trading is encouraged and regulated, participation by institutional and retail investors increases, boosting liquidity. At the same time, regulatory uncertainty or restrictive policies can deter market activity, reducing liquidity.

Market Outlook

Market trends and public perception heavily impact liquidity. Positive news, such as partnerships or technological achievements, can attract traders and boost liquidity.

Conversely, negative sentiment resulting from regulatory crackdowns, security breaches, or economic instability can dampen trading activity and lower liquidity.

Concentration of Token Ownership

The distribution of a cryptocurrency’s supply also influences liquidity. If a large percentage of tokens is concentrated in a few wallets, it can lead to illiquidity.

These large holders, often called “whales,” can impact the market drastically when they buy or sell, creating instability. A well-distributed token supply ensures more consistent and stable trading activity.

Technological Infrastructure

The quality and reliability of the trading platform’s architecture also impact liquidity. Exchanges with efficient order-matching systems, low latency, and high uptime attract more traders, facilitating higher liquidity. On the other hand, technical inefficiencies or frequent downtime can deter participants and cut down trading activity.

Global Time Zones and Activity Patterns

Crypto markets operate 24/7, but trading activity fluctuates based on global time zones. Liquidity is generally higher during periods of overlap between major markets, such as when U.S. and European markets are active. However, during off-peak hours, liquidity may decrease, making it harder to execute large trades efficiently.

Crypto Illiquidity Measurement Metrics and Estimators

Measuring crypto illiquidity is crucial for estimating the crypto ecosystem’s market performance, trading outcomes, and price consistency. This process involves evaluating how easily and cost-effectively cryptocurrencies can be traded amid severe price hikes.

Below are some key metrics and estimators used to assess illiquidity in the crypto market:

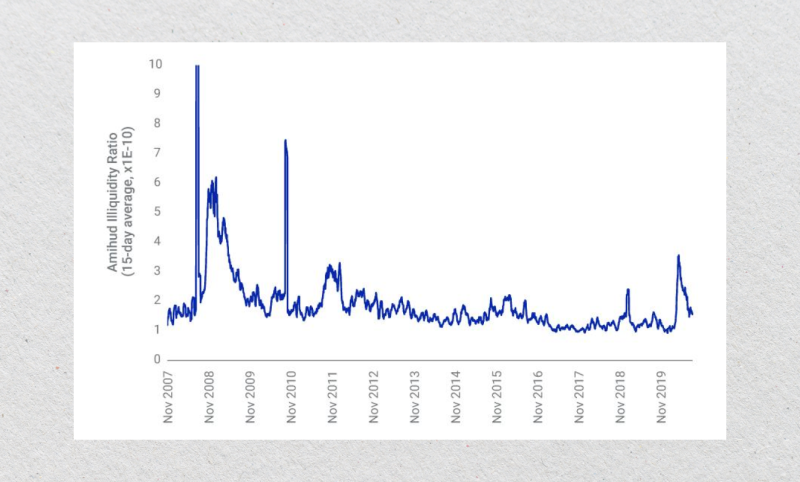

Amihud Illiquidity Ratio

The Amihud illiquidity ratio is a widely recognised metric that assesses the relationship associated with price movement and trading volume. It quantifies how much the price of a cryptocurrency changes in terms of the traded volume.

Amihud Ratio=Rt/Vt

Where:

- Rt — Absolute price return on day t.

- Vt — Trading volume on day t.

This ratio captures the sensitivity of price declines to trading volumes. A high Amihud Ratio points to profound price reductions with small trading volumes, signifying greater illiquidity.

Conversely, a lower ratio suggests better liquidity, where larger trading volumes have minimal impact on prices. This metric is particularly useful for comparing the liquidity of different cryptocurrencies or evaluating the efficiency of various exchanges.

Bid-Ask Spread

The bid-ask spread measures the gap that divides the highest price a buyer is eager to pay and the minimum price a seller is eager to accept.

Bid-Ask Spread=Ask Price−Bid PriceMidpoint Price

A diminutive bid-ask spread is a hallmark of a liquid market, indicating minimal costs for immediate execution. It reflects a well-balanced supply and demand dynamic.

On the other hand, a wide bid-ask spread points to illiquidity, where fewer participants are actively trading, resulting in higher transaction charges. This metric is a quick and effective way to analyze market quality in real-time.

Order Book Depth

This indicator evaluates the volume of buy and sell deals in a trading platform’s order book at multiple price levels.

Key Metrics:

Market Depth: Total volume of orders within a specified percentage of the current market price (e.g., ±1%).

Cumulative Depth: The aggregation of buy and sell orders across multiple price levels.

A deeper order book means the market can absorb multiple trades with no corresponding price changes, reflecting high liquidity. Meanwhile, shallow order books indicate fewer active orders, where even small trades can cause drastic price shifts. This metric is essential for assessing a market’s resilience to large trades.

Slippage

Slippage measures the deviation between the expected price of a trade and the actual executed price, especially for large transactions.

Slippage Level= Executed Price−Expected PriceExpected Price

Low slippage indicates a liquid market where prices remain stable even during large trades. High slippage suggests illiquidity, where trades radically affect the market price, increasing the execution cost. Slippage analysis is particularly important for institutional traders dealing with high-value transactions in volatile or low-volume markets.

Turnover Ratio

The turnover ratio compares the trading deal value of a crypto to its total supply or market capitalisation, providing details into trading activity levels.

Turnover Ratio= Trading VolumeMarket Capitalisation

A high turnover ratio reflects an active market with frequent trading, signifying good liquidity. On the other side, a low ratio indicates limited trading activity, suggesting potential illiquidity. This metric is particularly valuable for comparing the relative liquidity of cryptos with varying market sizes.

Volume-to-Volatility Ratio

This metric combines trading volume and price volatility to assess how effectively trading volume stabilises price fluctuations.

Volume-to-Volatility Ratio= Trading VolumePrice Volatility

A high ratio indicates strong liquidity, where substantial trading volumes can downgrade volatility and stabilise the market. Conversely, a low ratio reflects poor liquidity, where insufficient trading volume exacerbates price fluctuations. This metric helps assess the fairness and efficiency of a market.

Effective Spread

The effective spread measures the actual cost of executing a trade relative to the mid-market price. It captures both the spread and the price impact of the trade.

Effective Spread=2 x Executed Price−Midpoint PriceMidpoint Pirce

A smaller effective spread signifies high liquidity, as traders can fulfill orders with stripped-down costs. Larger spreads highlight illiquidity, where trading costs increase due to significant price differences during execution. This metric is beneficial for evaluating trading costs on specific exchanges or for particular cryptocurrencies.

Liquidity-Adjusted Price Impact (LAPI)

LAPI evaluates the price contact of a trade relative to its size, integrating order book depth and slippage testing.

LAPI=Price ImpactTrade Size

Lower LAPI values indicate that a market can handle large trades with minimal impact on prices, pointing to high liquidity. Higher values highlight illiquidity, where even moderate trades disrupt market prices. This metric is relevant for institutional traders evaluating the cost of large transactions.

Trading Volume as a Percentage of Market Cap

This metric evaluates liquidity by comparing the daily trading rate of a crypto to its total market capitalisation.

Volume-to-Market Cap=Daily Trading VolumeMarket Capitalisation

A high percentage suggests robust market activity and good liquidity, while a low percentage indicates limited activity and potential illiquidity. This is a simple yet effective metric that is widely used for quick market analysis.

Time-to-Execution

Time-to-execution measures the duration required to complete a trade of a specific size while not occasioning excessive price deviation.

Shorter execution times indicate higher liquidity, as orders are filled quickly without disrupting prices. Longer times point to illiquidity, where insufficient market activity delays trades and increases execution costs. This metric is particularly relevant for HFT strategies.

Challenges in Measuring Crypto Liquidity

Assessing crypto liquidity is a multifaceted challenge due to the distinctive features of the crypto market, including its decentralized structure, pronounced volatility, and fragmented trading landscape. The following provides an in-depth look at the primary obstacles encountered when measuring liquidity in the crypto sector:

Market Fragmentation

Cryptocurrencies are traded across various platforms, including centralized exchanges (CEXs) and decentralized exchanges (DEXs). This results in fragmented trading environments that create inconsistencies in liquidity variables such as trading terms and order book depth. Centralised exchanges often show variations in liquidity due to differences in user demographics, trading fees, and supported assets.

On the other hand, DEXs rely on automated market makers (AMMs) and liquidity pools, making their liquidity profiles challenging to compare with traditional order book-based exchanges. This fragmentation complicates data consolidation and leads to incomplete or misleading liquidity assessments.

Volatility and Price Deviations

Cryptocurrency markets are highly volatile, with sudden price swings driven by macroeconomic events, market news, or large trades. This volatility disrupts liquidity measurement by affecting key metrics.

For example, price surges can widen bid-ask spreads and cause imbalances in order books as traders swap their positions. These rapid changes make it challenging to derive stable and reliable liquidity measures over time.

Data Quality and Transparency

Data quality and transparency are critical to accurately measuring liquidity, but crypto markets face several obstacles. Practices such as wash trading, where volumes are artificially inflated, distort liquidity ratings and mislead market players.

Furthermore, exchanges employ inconsistent methods to calculate metrics like trading volumes and spreads, and DEXs often lack centralized oversight, leading to fragmented or incomplete data. These issues hinder the accuracy of liquidity examinations and make cross-platform comparisons difficult.

Lack of Regulatory Legislation

The absence of a standardised inspection mechanism for crypto creates inconsistencies in liquidity management and reporting. Some unregistered exchanges operate without adhering to standard practices, making their data unreliable.

Additionally, regulatory restrictions in certain jurisdictions reduce market participation, further impacting global liquidity. This lack of oversight exacerbates market fragmentation and diminishes confidence in the reliability of liquidity data.

The Function and Relevance of Liquidity Resources and Market Makers

Market makers and liquidity distributors are imperative for market equilibrium, but their activities complicate liquidity measurement. Market makers often create the appearance of higher liquidity by maintaining narrow bid-ask spreads.

However, their participation can be uneven, with liquidity providers withdrawing during periods of high volatility or regulatory uncertainty. These fluctuations make it difficult to interpret liquidity ratios, especially in turbulent market scenarios.

Illiquid Trading Pairs and Niche Assets

While leading cryptocurrencies like Bitcoin and Ethereum typically exhibit strong liquidity, smaller or niche assets often face significant challenges. Many altcoins suffer from low trading volumes, making it difficult to conduct large-scale trades and potentially drastically forcing prices upwards.

Additionally, concentrated ownership, where a few holders control a substantial supply, can lead to liquidity crises if large amounts are sold suddenly. These factors necessitate specialised metrics and a careful approach to evaluating illiquid assets.

Influence of Decentralised Finance (DeFi)

DeFi platforms add complexity to liquidity measurement through AMMs, liquidity pools, and staking. The availability of liquidity in DeFi often depends on incentives offered to liquidity providers, which can change rapidly.

Challenges like an impermanent loss — where liquidity providers lose value due to price fluctuations — impact the overall liquidity of these platforms. This makes DeFi liquidity difficult to compare with centralised exchange liquidity.

Time Zone and Global Market Activity

Markets of virtual assets operate continuously, but liquidity levels vary significantly based on time zones and global trading activity. Liquidity is typically higher during overlapping trading hours of major markets, such as the U.S. and Europe, but drops during off-peak times.

Reduced activity during these periods can increase the impact of trades on prices. Continuous monitoring and dynamic coefficients are invaluable for accurately analyzing liquidity across different time zones.

Tools and Software to Evaluate crypto liquidity

Evaluating crypto liquidity requires specialised tools and platforms to divulge revelations into market depth, trading circulation, price resilience, and order book activity. These tools help traders, investors, and analysts assess liquidity factors in order to make deliberate decisions.

Market Data Aggregators

Platforms like CoinMarketCap, CoinGecko, and CryptoCompare provide real-time stats on trading volumes, price developments, and market depth. Compiling data from CEXs and DEXs allows users to compare liquidity states across exchanges and identify markets with higher activity and narrower spreads.

Trading Platforms

Centralized exchanges (e.g., Binance, Coinbase, Kraken) and DEXs (e.g., Uniswap, PancakeSwap) offer tools to analyze order book depth, bid-ask gaps, and liquidity pool metrics. These features help assess how markets can handle bulk trades yet avoid major price impacts.

Blockchain Explorers

Etherscan, BSCScan, and Solscan track on-chain transactions, token transfers, and wallet activity. These data reveal trading patterns, ownership concentration, and the movement of large crypto volumes, which are critical for liquidity investigation.

Liquidity Assessment Solutions

Specialised platforms like DeBank, Zapper, Glassnode, and IntoTheBlock provide data on slippage, trading volume-to-market cap ratios, and liquidity pool developments. They offer in-depth analysis of token and network liquidity in real-time.

Algorithmic Trading Systems

Platforms like QuantConnect, 3Commas, and Coinrule allow traders to use liquidity ratings in automated strategies. These platforms provide APIs for accessing order book snapshots and real-time trading conditions.

On-Chain Liquidity Trackers

Uniswap Info, Sushi Analytics, and DeFi Pulse monitor liquidity pools, token swaps, and slippage rates on DeFi platforms. They help evaluate risks like impermanent loss and track liquidity in AMM-based exchanges.

Social Sentiment Platforms

Tools like LunarCrush and The TIE analyse social media trends, engagement, and crypto reviews. High social activity often correlates with enhanced trading flows and liquidity.

Advanced Analytics Tools

Institutional-grade platforms such as Kaiko, CryptoQuant, and Skew provide detailed reports on trading volume, open interest, and market depth. These tools cater to advanced users seeking granular perspectives into liquidity patterns and price outcomes.

Final Thoughts

Liquidity of crypto tokens is more than just a technical concept — it’s a vital predictor of market health and trading accuracy. While challenges like market fragmentation and data inconsistencies persist, advanced tools and variables facilitate valuable research into liquidity factors.

Assessing liquidity will remain crucial for making deliberate decisions as the crypto space evolves. Whether you’re a trader, investor, or liquidity provider, mastering liquidity cycles is paramount for success in the crypto scene.

FAQ

What is crypto liquidity?

Crypto liquidity equates to how easily and efficiently a digital asset can be acquired or exchanged in the market, avoiding decisively impacting its price.

Why is liquidity noteworthy in crypto markets?

Liquidity ensures smooth trading, cuts down price shocks, and fosters market viability, enabling traders to fill positions competently.

What are liquidity pools?

Liquidity pools are collections of tokens locked in smart contracts on DEXs, facilitating trading and providing liquidity for token swaps.

How can crypto liquidity be measured?

Liquidity can be measured using bid-ask spreads, the Amihud Illiquidity Ratio, trading volume, and order book depth.

What tools are available to analyze crypto liquidity?

Platforms like CoinMarketCap, Glassnode, DeFi Pulse, and blockchain explorers provide analyses into trading volumes, market depth, and liquidity trends.