Best Investment Strategies For Beginners

Apr 20, 2022

Reaching financial security right away can be tricky, especially when trying to cover everyday expenses and dealing with inflation. But once you’ve got a handle on your monthly bills and saved some money for emergencies, it’s time to start investing.

As a beginner, figuring out what to invest in and how to do it can be a bit confusing. Don’t worry; our easy-to-follow guide is here to help answer your questions.

Key Takeaways

- A well-defined investment strategy is crucial for managing risks and optimizing investment returns.

- There are numerous beginner-friendly and advanced investment strategies to choose from, catering to different risk tolerances and financial goals.

- When starting to trade, it’s essential to follow a few steps, including deciding how much to invest, opening an account, and selecting a suitable strategy.

- Every investment strategy and asset type carries inherent risks, and one should consider risk tolerance before making investment decisions.

Why Does Investment Strategy Matter?

Every action in this world requires some sort of strategy, and so do investments. You can’t just put all of your money into some asset, as the process of gaining financial profits is complex and needs some pre-thinking and planning.

Investment strategy matters because it provides a tailored roadmap for generating income through diverse sources, considering your unique financial goals, risk tolerance, and personal circumstances.

A well-optimized investment strategy can help you navigate various investment options, each requiring different levels of commitment and capital. In fact, a Pew Research Center study found that over half of Americans employ some form of investment strategy.

The motivations for investing differ for everyone, but ultimately, it’s about strengthening one’s financial position. A carefully designed investment plan can maximize your resources and offer financial stability.

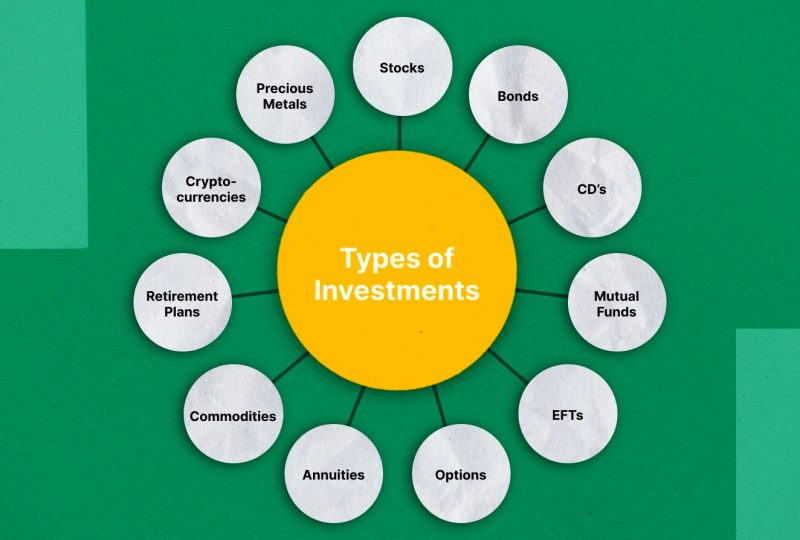

Main Types of Investments

Three main types of investments have historically shown promising results, making them excellent starting points for those new to investing. Remember that each investment option comes with its level of risk and involvement.

- Stocks

When you buy stocks, you’re essentially purchasing a share in a company you believe will perform well over time, growing your initial investment. Stock market investing comes with much fluctuation and some risk, but long-term strategy and professional portfolio management can help offset this.

- Bonds

If you prefer a low-risk, long-term approach, bonds may be the way to go. Whether issued by a company or the government, bonds provide returns through interest payments. While they may not offer high returns, they’re a solid choice for diversifying your investment portfolio.

- Mutual Funds

These professionally managed accounts pool your money with other investors’ capital, allocating it across various investments like stocks and bonds. With a predefined investment strategy, mutual funds may require higher minimum investments than alternatives, but they’re generally known to perform well. Understanding these basic investment types is crucial when building a foundation for your financial journey.

Top 10 Investment Strategies For Beginners

A solid investment strategy usually takes time to show results, so don’t expect to get rich overnight. It’s essential to start investing with a clear idea of what’s possible and what isn’t. Now, let’s explore ten popular investment strategies perfect for beginners.

1. Buy And Hold

A buy-and-hold investing strategy is a time-tested approach that has demonstrated its effectiveness repeatedly. As the name suggests, this method involves purchasing an investment and holding onto it for an extended period, ideally never selling it but keeping it for at least 3 to 5 years.

By focusing on long-term gains and thinking like an owner, this investment strategy steers clear of the pitfalls of active trading, which often hampers the returns of many investors. Success in the buy-and-hold approach relies on the performance of the underlying business over time, potentially allowing you to discover the market’s biggest winners and multiply your original investment considerably.

One of the attractive aspects of this strategy is its simplicity: once you commit to never selling, you don’t have to think about it constantly. This approach helps you avoid capital gains taxes, which can negatively impact returns. As a long-term investor, you’re not constantly monitoring the market like traders do, freeing you up to enjoy other activities instead of being glued to market fluctuations.

2. Buy Index Funds

The buy index funds strategy revolves around identifying a promising stock index and investing in an index fund based on it. Well-known indexes like the Standard & Poor’s 500 and the Nasdaq Composite consist of numerous top-performing stocks, providing you with a diversified array of investments even if it’s your sole holding.

Instead of attempting to outperform the market, this approach involves owning the market through the fund and reaping its returns. Combining the buy index funds strategy with a buy-and-hold mindset offers a straightforward path to potentially impressive results. Your return will reflect the weighted average of the index’s assets, and with a diversified portfolio, you’ll experience lower risk compared to owning just a handful of individual stocks.

Moreover, the buy index funds strategy simplifies the investment process, as you don’t need to scrutinize individual stocks. This low-maintenance approach allows you to enjoy other aspects of life more while your money continues to work for you.

3. Index And A Few

The “index and a few” strategy combines the benefits of index fund investing with a small selection of individual stocks. For instance, you could allocate 94 percent of your money to index funds and invest 3 percent in companies like Apple and Amazon, assuming you believe they have strong long-term prospects. This approach allows beginners to maintain a predominantly low-risk index strategy while gaining exposure to specific stocks they find appealing.

Blending the best aspects of the index fund strategy — reduced risk, minimal effort, and promising potential returns — this method caters to investors who want to dabble in individual stock positions. It serves as an introduction to analyzing and investing in stocks without the high stakes that come with more aggressive strategies. Even if these individual investments don’t pan out, the overall impact on your portfolio will be limited, making it a suitable option for beginners looking to dip their toes into stock investing.

4. Income Investing

Income investing involves holding assets that generate regular cash payouts, typically in stock dividends and interest from bonds. Rental properties are a common example of income investing, as you can earn monthly rental income. A portion of your return comes as cash, which you can spend however you like or reinvest into additional stocks and bonds. You could benefit from capital gains alongside cash income with income stocks.

Implementing an income investing strategy is straightforward, using index funds or other income-oriented funds, eliminating the need to choose individual stocks and bonds. These investments usually exhibit lower fluctuations compared to other asset classes and offer the security of consistent cash payouts. Additionally, high-quality dividend stocks often increase their payouts over time, boosting your income without any extra effort on your part.

5. Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves consistently investing a set amount of money at regular intervals, regardless of market conditions. For instance, you might choose to invest $1000 each month or $250 every week. This systematic approach allows you to spread out your buying points over time.

One of the main benefits of dollar-cost averaging is that it mitigates the risk of poor market timing or investing all your money at once. By averaging your purchase price over time, you ensure you’re not buying too high, which can be particularly advantageous in volatile markets. This method also helps establish a disciplined investing routine, which can lead to a more substantial portfolio in the long run.

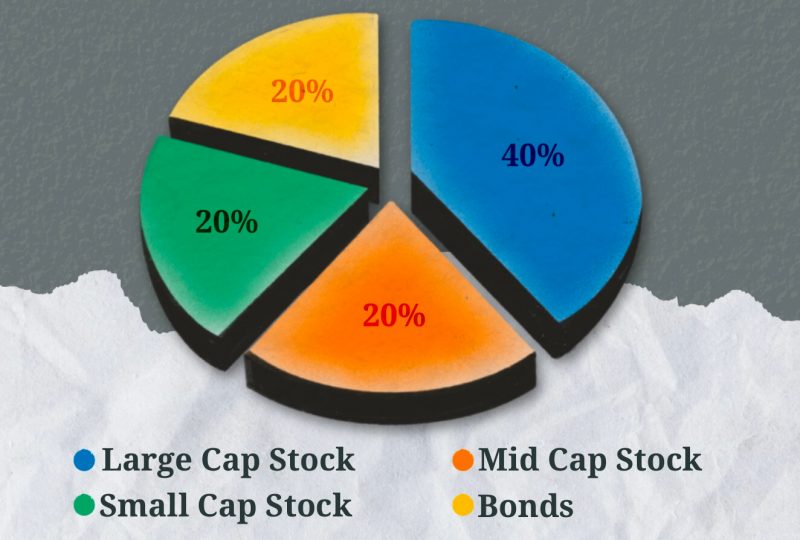

6. Tactical Asset Allocation

Tactical asset allocation is an active investment strategy that tracks market trends to identify opportunities for achieving optimal returns. The primary objective is to enhance your portfolio’s performance while maintaining a broader asset allocation, akin to the strategic asset allocation approach.

Strategic asset allocation involves selecting a target investment mix, such as 60% stocks and 40% bonds, and rebalancing periodically to align with these proportions. With tactical asset allocation, you establish your target allocation when creating your portfolio, but you may temporarily modify your allocations to capitalize on a thriving stock or sector.

After achieving your desired short-term returns and the momentum of a specific stock or sector wanes, you revert to your original baseline asset allocation. For example, if a particular tech stock is performing well, you might decide to invest while the prices are still rising but not overly expensive. This decision shifts your allocation from 60% stocks to 70%. Once the stock’s price stabilizes a few months later, you can sell it for a profit and adjust your allocation back to its initial parameters.

7. Robo-Advisor Investing

Robo-advisors are affordable online investment platforms that utilize software algorithms to build and manage investment portfolios. While financial professionals typically develop the strategies used by robo-advisors, computers handle the day-to-day management of these portfolios.

Traditional investment management firms and many financial advisors often require clients to maintain significant account balances and charge high annual management fees. In contrast, most robo-advisors have low or no minimum balance requirements and offer more cost-effective annual fees.

Services provided by robo-advisors include automatic asset allocation, portfolio rebalancing, and tax optimization. Many also grant access to human financial advisors for assistance with investment planning. Since robo-advisors operate automatically and are accessible online, they can expedite the investment process, usually taking just minutes to set up.

8. Momentum Investing

Momentum investing is a strategy that focuses on capitalizing on existing market trends by investing in assets already experiencing strong performance. The core principle behind this approach is that assets with a positive momentum will likely continue their upward trajectory, while those with negative momentum will continue to decline.

Unlike traditional investment management firms and financial advisors, which often require clients to maintain substantial account balances and charge high fees, individual investors can execute momentum investing at a lower cost. This approach enables them to identify and invest in emerging markets without too much risk.

The momentum investing strategy involves monitoring market trends and data, such as price movements and trading volumes, to pinpoint assets with promising momentum. Once identified, these assets are added to the investor’s portfolio, which is periodically reviewed and adjusted based on the latest market developments.

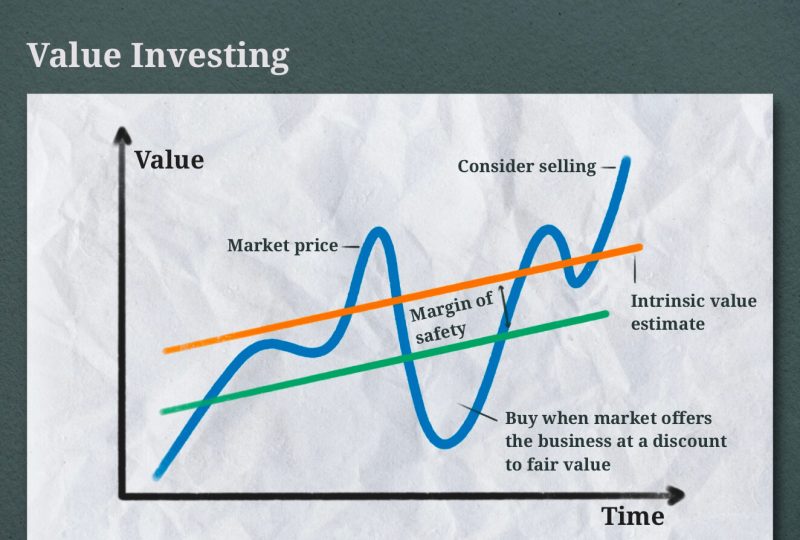

9. Value Investing

Value investing is a strategy that revolves around identifying and investing in stocks that are believed to be undervalued in the market. This approach is based on the premise that the market can sometimes be irrational, creating opportunities to purchase stocks at a discounted price and potentially profit from them.

Instead of sifting through vast amounts of financial data, value investors can choose from numerous value mutual funds that offer a diversified collection of stocks deemed to be undervalued.

For those who prefer a more straightforward method of identifying undervalued stocks, the price-earnings ratio (P/E) is a valuable tool. This ratio is calculated by dividing a stock’s share price by its earnings per share (EPS). A lower P/E ratio suggests an investor pays less for each dollar of current earnings, making it an attractive target for value investors.

10. Socially Responsible Investing (SRI)

Socially responsible investing (SRI) is an investment strategy that seeks to generate financial returns and positive social impact for investors. This approach involves investing in companies that contribute positively to society or the environment, such as solar energy providers, while avoiding those with negative impacts.

Various names, including values-based investing, sustainable investing, and ethical investing, know SRI. The acronym “SRI” is also used to represent sustainable, responsible, and impact investing. Some SRI approaches employ environmental, social, and governance (ESG) factors as a guiding framework.

Investors interested in SRI not only consider traditional metrics like performance and expenses but also evaluate whether a company’s revenue sources and business practices align with their values. As people have different values, the definition of SRI can vary among investors.

As awareness of climate change and its impacts continue to rise, the demand for green products and services is expected to grow, making investments in these areas potentially lucrative. By focusing on environmentally responsible companies, SRI investors can position themselves to benefit from this market segment’s anticipated expansion while supporting a sustainable future. In this way, SRI serves as a powerful tool for driving positive change and generating financial returns in the long term.

Getting Started: How To Make Your First Investment

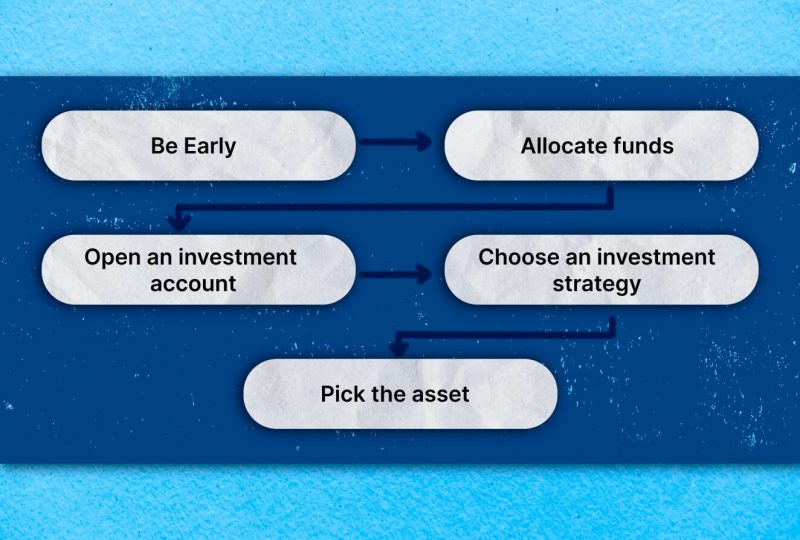

Getting started with investing may seem overwhelming, but taking the plunge can lead to long-term financial growth. Here are five essential steps to help you make your first investment:

- Start Investing As Early As Possible

Time is your greatest ally in investing. The sooner you begin, the more time your money has to grow and compound, making the most of market fluctuations and building a solid financial foundation.

- Decide How Much To Invest

Determine your initial investment and set aside a consistent monthly amount. Even small amounts can accumulate over time, so don’t be discouraged if you can’t invest a large sum at first.

- Open An Investment Account

Choose a reliable brokerage firm or robo-advisor to open an account with. Consider factors like fees, account minimums, and available investment options to make an informed decision.

- Pick An Investment Strategy

Based on your financial goals, risk tolerance, and time horizon, select a strategy that suits your needs. This could include passive or active investing, diversified portfolios, or focusing on specific sectors.

- Understand Your Investment Options

Familiarize yourself with various investment vehicles like stocks, bonds, exchange-traded funds (ETFs). This knowledge will help you make informed decisions and confidently navigate the investment landscape.

FAQs

- What is the best investment strategy for a beginner?

There’s no one-size-fits-all answer, as the best strategy depends on your personal financial goals, risk tolerance, and time horizon. However, popular beginner-friendly strategies include buy-and-hold, index funds, and robo-advisors.

- How can I minimize risk when investing?

Diversification is critical to minimizing risk. Invest in a mix of assets such as stocks, bonds, and real estate, to spread out your risk and reduce the impact of market fluctuations.

- Can I invest in individual stocks as a beginner?

Yes, you can invest in individual stocks as a beginner, but it’s essential to research and analyze the companies before investing. Diversify your portfolio to minimize risk and consider incorporating other investment vehicles like index funds or ETFs.

- What is the difference between active and passive investing?

Active investing involves picking individual stocks or bonds and frequently trading to outperform the market. Passive investing focuses on long-term growth by tracking a market index, such as the S&P 500, with minimal trading and lower costs.

- How do I open an investment account?

To open an investment account, choose a reputable brokerage firm or robo-advisor and follow their account opening process. You’ll need to provide personal information, such as your name, address, and Social Security number, and fund the account with an initial deposit.

Wrapping Up

To wrap things up, jumping into the investing world can be a smart move for your financial future. Every investment strategy has its own style and way of handling risks, so make sure you pick the one that fits you best. And don’t worry about being late to the game – it’s never too late to start investing.

Just stick with your chosen investment strategy, determine how much risk you can take, and you’ll be on your way to making the most out of the opportunities the market has to offer, setting yourself up for a bright financial future.