5 Infinite Banking Mistakes That Could Cost You Thousands

May 13, 2025

The idea of being your own bank – building wealth and having access to cash completely outside the traditional banking system – sounds incredibly appealing, especially if you’re an entrepreneur, business owner, or investor who values control and financial flexibility. That’s the core promise behind the Infinite Banking Concept (IBC).

Using a specially designed life insurance policy, IBC suggests you can achieve control, liquidity, and steady long-term growth. However, there’s a big “if.” It only works if you understand it thoroughly and set it up correctly.

The truth is, many people jump in based on misunderstandings, get swayed by overly optimistic projections, or structure their policies the wrong way from the start. These slip-ups can quickly turn what seemed like a smart financial strategy into an expensive lesson learned.

That’s exactly why we’re digging into the top 5 infinite banking mistakes in this article.

Key Takeaways:

- Choosing the wrong insurance product can sabotage your infinite banking strategy before it even starts.

- Mismanaging policy loans quickly undermines the benefits of cash value growth and financial control.

- Overtrusting policy illustrations leads to unrealistic expectations and potential financial setbacks.

- Infinite banking fails without proper financial planning and a long-term commitment to premium payments.

- Working with inexperienced advisors is one of the fastest ways to make costly Infinite Banking Mistakes.

What is Infinite Banking?

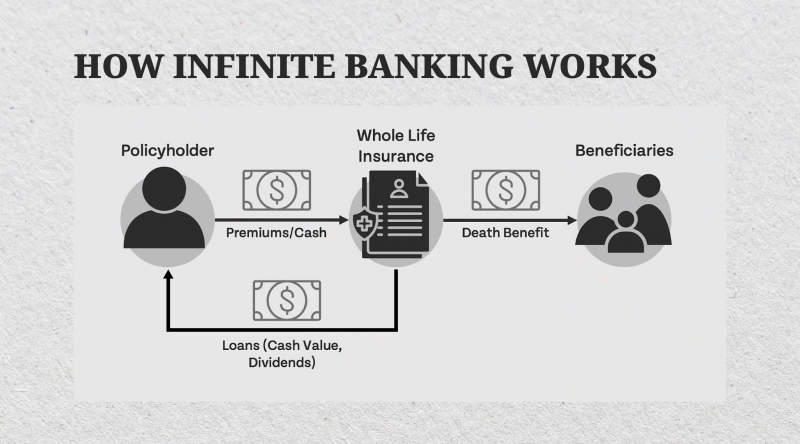

Infinite Banking is a concept, largely popularized by R. Nelson Nash in his book “Becoming Your Own Banker.” The core idea is using a specific type of life insurance – dividend-paying whole life insurance, typically from a mutual insurance company – as your own private financing system.

Instead of automatically turning to a bank when you need a loan for an investment, a business expense, or a major purchase, you tap into the cash value that accumulates inside your own policy.

Is Infinite Banking a Good Idea?

It’s easy to see the attraction of the concept. The core promises of IBC directly address common frustrations investors face with traditional finance:

- Getting access to capital without relying solely on banks and their strict lending criteria.

- Having a ready source of funds to seize opportunities (like investments or business expansion) or handle emergencies without disrupting long-term investment plans.

- Adding an element of predictable, guaranteed growth to their financial picture, separate from market volatility.

- Enjoying tax efficiencies on growth and access.

- Plus, the life insurance component provides a legacy benefit.

This blend makes IBC seem like a powerful tool for building wealth while maintaining maximum control.

The Problem with Infinite Banking Concept

While the potential benefits are real, the marketing hype around IBC can sometimes gloss over the crucial details. Most infinite banking mistakes come from thinking this approach is a “get-rich-quick” scheme. Success hinges entirely on proper policy design, consistent funding, disciplined loan management, and understanding the long-term nature of the strategy.

Get the setup wrong, misunderstand the costs, or fail to manage it actively, and you risk falling into common traps. Understanding these potential infinite banking mistakes before you commit is vital. And that’s exactly where we’re headed next.

Mistake #1: Starting with the Wrong Foundation – The Policy Itself

This is probably one of the most fundamental infinite banking mistakes, and it happens right at the beginning. The entire concept hinges on using a very specific type of policy: a dividend-paying whole life insurance policy, issued by a mutual insurance company, and structured in a particular way to maximize cash value growth.

Why Product Choice Matters?

IBC works because your policy builds cash value – a pool of money you can borrow against and use. A properly designed IBC policy is engineered to build this cash value as quickly and efficiently as possible, especially in the early years. The problem? Many people end up buying policies that simply aren’t built for this purpose, often sold by advisors who aren’t specialists in IBC design.

Common infinite banking mistakes and misunderstandings include:

- Standard whole life policies focused mostly on the death benefit, not rapid cash accumulation.

- Universal or variable life policies, which often have fluctuating returns tied to markets, higher internal costs, and less predictability, undermine the stability IBC aims for.

- Even whole life policies can be structured poorly, loaded with high commissions or riders that drain cash value.

Using the wrong policy structure basically sabotages your plan from the start. You’ll likely experience painfully slow cash value growth, meaning it could take many, many years to build up a meaningful amount to borrow against.

High internal costs might eat away at your premiums, leaving less to build your cash value ‘bank’. It’s no wonder people get frustrated and think IBC “doesn’t work” or is some kind of “scam” – often, the real issue was simply using the wrong financial tool for this specific job.

How to Avoid This Mistake?

You need to find an advisor who genuinely understands how to structure policies specifically for high early cash value (the goal of IBC), not just for the death benefit. Insist on looking only at dividend-paying whole life policies from well-regarded mutual insurance companies (where policyholders effectively share in the profits via dividends).

The policy design should heavily emphasize cash accumulation, often achieved through a Paid-Up Additions Rider (PUAR). This might mean the initial death benefit is lower than a traditional policy for the same premium, but that’s okay – the primary goal here is building your accessible cash value.

Mistake #2: Misunderstanding How Policy Loans Really Work

A huge appeal of IBC is the easy access to capital via policy loans. No lengthy bank applications, no credit checks, just straightforward access to funds using your cash value as collateral. However, and this is a significant caveat, infinite banking mistakes happen from misunderstanding how these loans function.

Here’s the key: when you take a policy loan, you aren’t actually withdrawing your cash value. Instead, you’re borrowing directly from the insurance company, and your cash value simply acts as security for that loan.

The great part is that your full cash value amount typically continues to earn its guaranteed interest, and potentially dividends, even while the loan is outstanding. You pay interest on the loan (back to the insurer, not yourself), and repayment terms are usually very flexible, giving you control.

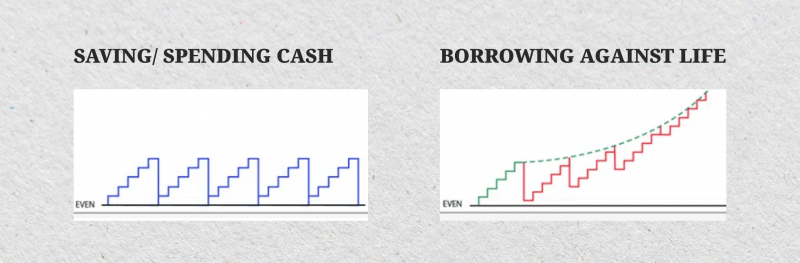

The danger zone comes with that flexibility. Because you can defer payments, some people treat policy loans like a free-for-all and don’t bother paying them back systematically. This is where infinite banking mistakes happen:

- Loan Interest Mounts: The interest you owe on the loan compounds over time. If you aren’t paying it down, the loan balance grows, steadily eating into your net available cash value (which is your total cash value minus the outstanding loan).

- Your Death Benefit Shrinks: Any outstanding loan balance (plus accrued interest) at the time of your death is deducted from the death benefit payout. Your beneficiaries get less.

- The Risk of Policy Collapse: This is the worst-case scenario. If the total loan balance ever grows larger than the policy’s cash value, the policy can lapse – it essentially implodes. If this happens, you could face a significant tax bill on any gains within the policy, and you would lose both the cash value and the death benefit coverage.

How to Avoid This Mistake?

Simple: treat policy loans with respect. Think of them like any other loan, even with the flexibility. Have a clear plan for repayment before you borrow. Don’t take loans impulsively. Keep track of the outstanding balance and the interest accumulating to ensure it doesn’t get out of hand. IBC gives you control, but that control comes with responsibility.

Mistake #3: Putting Too Much Faith in Policy Illustrations

When you first look into getting an IBC policy, you’ll undoubtedly be shown policy illustrations.

These are printouts, often running for decades into the future, showing impressive projections of how your cash value might grow, the potential dividends you could receive, and how much you might be able to borrow down the line. They can look very attractive, but treating these illustrations as guarantees is one of the most common infinite banking mistakes.

What are illustrations, really? They are projections, nothing more. They’re based on the insurance company’s current dividend scale, interest rate assumptions, and estimated future expenses. They show a potential outcome if today’s conditions continue perfectly for the next 30, 40, or 50 years.

Why Overreliance on Illustrations is a Problem

The key issue here is the word “assumptions.” Dividends, in particular, are not guaranteed. They depend entirely on the insurance company’s future financial performance – factors like their investment returns, how many claims they pay out (mortality experience), and their operating expenses. These factors will change over the decades-long life of your policy. Interest rates will fluctuate. Company performance will vary.

If future dividends aren’t as high as what’s illustrated today, your actual cash value growth and your future loan capacity will be lower than those rosy projections. Relying too heavily on non-guaranteed numbers for your financial planning can lead to frustration when reality doesn’t match the initial picture.

How to Avoid This Mistake?

Focus primarily on the guaranteed elements of the policy illustration – the guaranteed minimum cash value growth and the guaranteed death benefit. These form the bedrock of the policy. View the non-guaranteed dividend projections as potential upside, a possible bonus, not a certainty.

It’s often wise to ask for illustrations that show performance using lower, more conservative dividend assumptions. A well-designed IBC policy should still perform its function reasonably well even if dividends aren’t spectacular. Use the illustrations as a guide to understand how the policy could perform, but base your concrete financial plans more on the guaranteed values.

Mistake #4: Ignoring Your Overall Financial Picture

ICB can be a great component within a larger financial strategy, but it’s crucial to remember it’s just one piece of the puzzle, not the entire solution. Frequent infinite banking mistakes are rushing into an IBC policy and not having a clear and realistic understanding of your complete financial situation and long-term goals.

Why does the bigger picture matter so much? Making IBC work effectively requires several things from you:

- Consistent Premium Payments: These policies often involve significant premiums, and you need the reliable cash flow to pay them, potentially for many years, without undue strain.

- Patience: Especially in the early years, cash value growth is typically slow. IBC is a long-term strategy; you can’t expect to have huge borrowing capacity overnight.

- A Plan for Loan Repayments: As discussed, you need the means and the discipline to repay policy loans eventually, without crippling your budget.

If you haven’t assessed your overall finances first, you risk running into problems.

- You may commit to premiums that become unaffordable in the future.

- You could find yourself forced to borrow from the policy just to cover living expenses, especially early on, which severely hinders its growth potential.

- You may become frustrated when the policy doesn’t immediately resolve unrelated cash flow issues.

- In the worst case, if you cannot keep up with the premiums, you may have to surrender the policy, potentially losing a significant portion of your investment and the insurance coverage.

How to Avoid This Mistake?

Before committing to potentially large IBC policy premiums, get brutally honest about your income, expenses, debts, savings rate, and other investments. To avoid these infinite banking mistakes, you must clearly define what role you want this specific policy to play in your financial life. Is it primarily for retirement income? Funding business ventures? Financing real estate? Acting as a supercharged emergency fund? Knowing its job helps determine the right size and structure.

Ideally, discuss IBC with a financial advisor who understands the concept deeply and can help integrate it sensibly into your overall financial plan, rather than just selling it in isolation. IBC should support your financial goals, not be your entire financial strategy.

Mistake #5: Working with the Wrong Advisor

Getting the policy designed correctly from the outset is absolutely make-or-break for the infinite banking plan to function as intended.

Unfortunately, many people are introduced to IBC by insurance agents who, while perhaps well-meaning, might lack the specialized knowledge needed for proper IBC policy construction. Sometimes, the focus might lean more towards maximizing sales commissions rather than optimizing the policy specifically for your banking needs.

Why does specialist advice matter so much here? Designing a policy for high cash value is a specific skill. A knowledgeable IBC specialist understands:

- How to structure the policy using tools like PUARs to turbo-charge early cash value growth.

- How to balance premium levels for both affordability over the long haul and effective policy growth.

- Crucially, how to educate you on using the policy correctly – managing loans, repayments, and understanding its behaviour over decades.

What happens if your advisor isn’t experienced in IBC design?

They might sell you the wrong type of policy entirely (term life, universal life, variable life – none are suitable for true IBC). They could set up a whole life policy, but do it inefficiently, saddling it with high internal costs that dramatically slow cash value growth.

They might simply fail to explain properly how to manage the policy loans and repayments effectively, setting you up for future problems. The end result is often an underperforming policy and a feeling that IBC itself is flawed, or that you were somehow misled.

What are some warning signs when talking to an advisor? Be cautious if they:

- Struggle to clearly explain the mechanics of IBC, policy loans, and dividends in simple, understandable terms.

- Focus almost exclusively on the death benefit amount or seem primarily interested in just selling an insurance policy, rather than meticulously structuring it for your banking goals.

- Pressure you to make a quick decision or buy a larger policy than you feel comfortable affording long-term.

- Can’t provide clear examples or anonymized case studies showing how they’ve successfully helped other clients implement IBC over time.

How to Avoid This Mistake?

Don’t just talk to the first person who mentions IBC. Seek out advisors who explicitly state they specialize in the Infinite Banking Concept and designing policies for cash value accumulation. Ask detailed, probing questions about policy structure, PUARs, internal costs, loan features, dividend history (of the insurer), and how they provide ongoing service.

Look for someone who acts like an educator, prioritizing your understanding of the strategy, its risks, and your responsibilities. Transparency and trust are paramount for this long-term relationship and avoiding infinite banking mistakes.

Conclusion: Making Infinite Banking Work For You

Infinite Banking is a disciplined, long-term financial strategy that absolutely requires careful planning, the right financial tool (the policy), consistent management, and realistic expectations about how cash value grows over time.

When it’s set up correctly with the right kind of policy and managed with discipline over the long haul, Infinite Banking can offer a remarkable way to build and access capital within your own private system, reducing reliance on traditional banks.

But success hinges on doing your homework upfront and avoiding these common, costly infinite banking mistakes. Take the time to educate yourself thoroughly before committing – a well-informed start is your best defence.

Disclaimer: This article is for informational purposes only and should not be considered financial, insurance, or investment advice.

FAQs

What is an infinite bank really?

An “Infinite Bank” isn’t a real financial institution. It refers to using a specially designed whole life insurance policy to create a personal system for saving, borrowing, and building wealth without relying on traditional banks.

Why doesn’t infinite banking work for everyone?

Infinite banking doesn’t work for everyone because it demands a strong financial commitment, patience, and disciplined management. Many people struggle with the long-term nature of the strategy, which explains why infinite banking doesn’t work for everyone in practice.

Is infinite banking scam?

Infinite banking itself is not a scam, but common infinite banking mistakes and poor implementation can make it seem like one. Working with inexperienced advisors or misunderstanding how policy loans work can create problems that fuel the perception of an “infinite banking scam.”