A Brief Introduction to Scalping

Aug 07, 2023

Even if you are new to trading, you probably heard about scalping. Scalp trading, or scalping, is a widespread trading strategy known for a long time. This is an excellent way to earn extra money on intraday trades. In this article, we will discuss what scalping is in trading, which indicators and scalping trading strategies are used for it, and the advantages and drawbacks of this type of trading.

Key Takeaways

- Scalping is a trading strategy aimed at profiting from small price changes in the market.

- Scalping uses different indicators, such as RSI, Parabolic SAR, or MA, for implementing trading strategies.

- Scalping can be very profitable, but it has a lot of risks that should be considered before starting scalp trading.

The Definition of Scalping

Scalping is a trading type traders use to profit from small price changes in the financial market. Scalpers open and close their positions quickly, thus aggregating the profit from a large number of trades.

Scalping is one of the most common trading strategies among traders. It is especially popular among beginners, which is disturbing because this style of trading involves significant risks and a huge emotional burden on a trader resulting in losses in the case of novice traders.

Some experts claim that scalping is a mere trading strategy. However, it is more of a set of strategies aimed at quickly opening and closing trades.

To be specific, the idea of scalping is that smaller price movements occur more often, which is why it is easier to capture them.

It works best with significant amounts of funds since even small price movements would bring significant profit.

Also, scalping requires a strict trading strategy, determining when to enter and exit positions and how much assets should be placed on each.

This trading technique can be very profitable, but it is also extremely risky since one wrong decision can lead to losing all the assets you’ve earned during trading. That is why an exit strategy plays a crucial role in scalping.

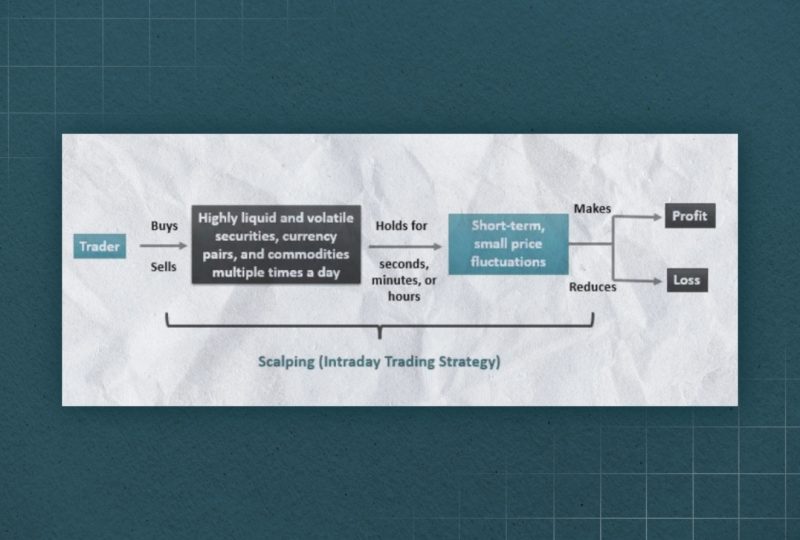

How Does Scalping Work?

Scalping is based on the assumption that most assets will complete the first stage of a movement in a short time frame.

Many traders recognize the scalping strategy as the most reliable, stable, profitable, and convenient. The main objective of scalp trading is to profit from small quote fluctuations — users of the trading platform open trades to receive a profit covering the brokerage company’s spread.

From the moment the trades open, the trader calculates the required number of steps, fixes the expected amount of income, and immediately closes the lot. Such a method is effective but takes a lot of effort. It is essential to make decisions quickly and follow the dynamics of quote changes to achieve the set goal.

Profitability from scalping derives from the rule of accumulation: each trade brings small profits, and several trades together give a considerable profit. Successful scalpers are guided by straightforward techniques and profound analysis to gain constant and considerable profit from trades.

Scalp traders purchase and sell large amounts of an asset and hold the position for a short period. So, it takes advantage of market volatility.

To profit from such small movements, scalpers enter hundreds of trades daily. This means they must dedicate much time to monitoring financial markets, so this trading style hardly suits beginners or part-time traders.

To say it simple, scalp traders purchase assets when the bid and ask spread is narrower than usual, with the ask lower and the bid higher than usual, and vice versa, assets are sold when the spread between the bid and the ask is wider than usual, with the ask higher and the bid lower than it should be.

Scalp traders also open a lot of trades during the trading session and close their positions within minutes. It is vital for traders to use platforms that allow open and close trades very quickly since any delay or slippage may lead to the loss of funds.

Indicators for Scalp Trading

In long-term trading, traders can use trending strategies and plan their trades without any hurry. But with scalping trading, the speed of trades opening plays a crucial role. The profit of one trade is relatively small, so scalp traders open many positions for short-term periods. In this case, the slightest delay can significantly influence the trade outcome.

To find the optimal entry points to trade, traders use technical indicators. Let’s discuss some of the most widespread scalp trading indicators in more detail.

Parabolic SAR Indicator

The Parabolic SAR (Stop and Reverse) indicator defines the stop and reverse points of market trends. In other words, it allows traders to define a future short-term trend and figure out where and when to place a stop-loss order.

This indicator is a parabolic curve formed out of points, each of which is calculated based on the value of the corresponding candlestick.

Simply put, the indicator is a series of dots above and below the price. A buy trade occurs when the indicator points are below the price line, and vice versa, a sell trade occurs when the price is below the parabolic points.

The Parabolic SAR offers scalpers the ability to spot multiple opposing trading opportunities throughout the day.

Parabolic SAR is ideal for placing stop-loss and take-profit orders. Its curve always moves with a delay relative to the price chart so that the stop-loss order can be placed at the level of the current value of the instrument. Take profit order is usually placed when the parabola is closest to the price or has already crossed it.

This indicator’s downside is that a significant trend does not appear on the market so often. Opening new positions any time the indicator signals can lead to severe losses. That is why experienced traders use Parabolic SAR as an addition to other analytical programs and not as a primary tool.

Stochastic Oscillator

This is a popular technical indicator that displays the percentage of the extreme closing price and extremes for the specified time frame. The Stochastic oscillator is used by the vast majority of modern traders.

This indicator can be used in scalping in several ways. For example, it can be used to determine overbought and oversold levels.

Like many other classic oscillators, the Stochastic indicator can detect discrepancies between the chart readings and the price line.

Many traders claim that the Stochastic Oscillator is the best modern indicator. However, it has the same downsides as the vast majority of classical indicators of this type: it quickly responds to all price fluctuations, resulting in a large number of false signals.

Moving average (MA)

This is a classic indicator that can be used to predict the direction and strength of price movements in a trending market and determine the most suitable entry and exit points. This tool is used today by the vast majority of traders for technical analysis.

There are several types of the moving average crossover indicator, among which are SMA (simple) and EMA (exponential).

SMA, or Simple Moving Averages, are elementary curved lines on a price chart. Their main task is to smooth or filter fluctuations in currency pairs to determine the vector of subsequent movement.

EMA, or Exponential Moving Averages, are used to reduce the delay typical for Moving Average.

Moving Average curves do not predict the future direction of the price; they predict the current price direction, though with some delay. Despite this, they effectively cope with such tasks as smoothing changes in the value of assets and filtering “noise”.

RSI

RSI, or Relative Strength Index, scans for extreme market conditions. RSI scalping works very well in more volatile market conditions, for example, when some news events occur.

When the RSI indicator reaches the oversold zone, scalpers close the position with a profit.

What are the Scalping Methods and Strategies?

Scalp trades come in a variety of shapes and sizes. Scalping methods and strategies are versatile. Most of the strategies are based on using combinations of scalping trading indicators and other technical analysis indicators.

Many scalping strategies exist depending on the asset amount, trading style, preferred market, etc.

However, there are three basic approaches to scalping:

- High-volume trading. Following this strategy, scalping traders buy large amounts of an asset to make a significant profit even out of the small price movements. This method works best on highly volatile and liquid markets with a tight spread. The profit is gained due to the frequent, though small, price movements and large asset amounts.

- Breakout trading. This scalping strategy is very popular due to the fact that it can be applied to different trading styles. The strategy implies that the traders wait for breakouts, position their entry to trade at the start of a breakout, and ride the market move until the first exit signal.

- Trading the spread. This strategy is also known as market making. It is one of the most difficult scalping strategies since traders must deal with large institutions and market makers, which is why it is suitable only for experienced scalping traders. The idea behind the strategy is to profit from the spread by simultaneously buying and selling an asset. It relies on a market being relatively stable but still popular enough to experience deep liquidity.

Pros and Cons of Scalping

Scalping is a complex yet potentially profitable type of trading. Let’s discuss some of the advantages scalp trading can offer.

- The main advantage of scalping is its quick result. Compared to long-term and medium-term trades, a scalp trader gets results from the very first trades.

- Scalp trade requires a limited amount of profound market knowledge. You don’t need to thoroughly investigate each asset and market in general to scalp trade. This advantage is especially beneficial for newcomers.

- Traders can make significant profits if they execute their trades precisely and have a solid exit strategy.

- Low entry threshold. Sometimes a few hundred dollars is enough for a scalper to profit.

- Low risks of total loss with one unsuccessful trade. Losing trades are covered by profitable ones, so even if you have many losing trades, the loss can still be covered with a successful trade.

- Lots of entry points. With scalp trading, you don’t need to wait for a profitable market movement; you can start trading at any time with tolerable asset volatility.

- Another benefit of scalping is that a trader does not need to know much about the asset. Unlike long-term traders who rely on fundamental information, scalpers focus more on technical analysis.

Despite all the advantages, scalping has a lot of drawbacks that should be considered. Here are some of the most common cons of scalp trading.

The need to open a large number of positions as well as invest large amounts of assets significantly increases the risks of loss.

- High speed of decision-making. Scalp trading requires quick decisions since any delay can lead to a loss. Traders need to be constantly focused on small details, which creates nervous tension that can be difficult for some traders.

- Scalping is also characterized by high transaction costs. This strategy involves hundreds of transactions daily, so transaction fees and broker commissions can result in enormous expenses.

- With scalp trading, it can be challenging to maintain a high risk/reward ratio. For example, at a 2:1 ratio, a profit of 10 points requires a stop loss at a distance of 5 points, which is too close to eliminate the risk of a stop loss order being triggered.

Conclusion

Scalping trade is a strategy widely used by many traders in the market since it decreases the exposure to losses and enables profitable trading even in relatively calm markets.

However, scalp trading is not a way to instantly achieve large gains. Scalpers must be ready to take small wins, make quick yet right decisions, and always consider the possibility of loss.

Scalping takes time and patience to master, but it’s a great skill that can make you a successful trader.

FAQs

How many trades do scalpers execute per day?

Usually, scalpers execute up to several hundreds of trades a day and capture small profits for some of them.

Is scalp trading legal?

Scalping is legal; however, some brokers do not allow it, opting for alternative short-term trading methods like day trading and swing trading. These methods are less fast-paced and high-pressured.

Is scalping suitable for beginners?

Scalping is commonly used by experienced traders. For beginners, trading on the buy side is more comfortable since handling the short side takes more confidence and expertise. However, scalpers must balance long and short trades for the best results.

How does a scalper work?

A scalper purchases an asset when the spread between the bid price and the ask price is narrower than usual; a scalper sells an asset when the spread is wider.