After-Hours Trading: Can You Trade After Financial Markets Close?

Apr 15, 2025

Timing your investment is one of the most crucial choices in the financial markets. You might wait for news, follow market speculation, or simply go with the trend. But there is also the option to trade when a few participants are active.

After-hours trading refers to buying and selling stocks outside regular exchange hours—after the market closes and before it reopens. This period comes with its own distinct features, benefits, and risks, which we will explore in this article.

Key Takeaways:

- After-hours trading means investing at major stock exchanges after the closing bell.

- Investing outside of regular exchange hours is made possible with ECN technology via online brokerage firms.

- Post-hours markets are more volatile, less liquid, and highly unpredictable due to low trading activity.

- NYSE and NASDAQ allow trading outside normal session times, while LSE only supports auction-like orders for 1-hour post-market activity.

Overview: What is After-Hours Trading?

The after-hours market refers to buying and selling financial instruments after the end of the regular trading session at key stock exchanges, such as the NYSE and NASDAQ. While the futures market trading hours last 24 hours, equities are traded within specified timeframes in different marketplaces.

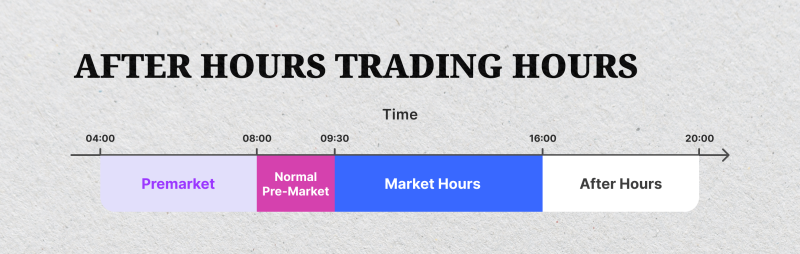

Typically, NYSE and NASDAQ work from 09:30 to 16:00 (ET). However, after-market trading starts at 16:00 and lasts until 20:00. Buying and selling within this window is done using electronic communication networks (ECNs) provided by online brokerage firms. As such, brokers will not physically be located inside stock exchange floors.

These times provide significant opportunities, especially since most companies announce important news and reports when the market is closed. At the same time, you must expect more challenging liquidity status, unexpected price movements, and delayed trade execution.

Who Can Trade After-Hours?

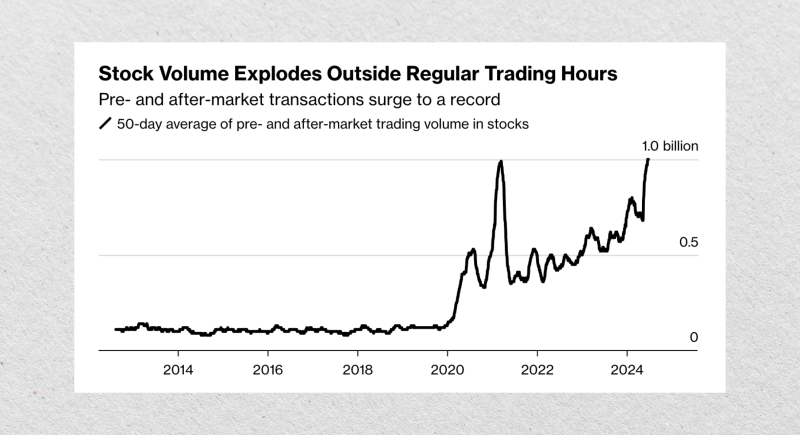

Previously, after-market sessions were exclusive to top executives and corporations who wanted to avoid secondary market impact. However, this is not the case anymore. Thanks to technology, almost anyone with a supported brokerage account can trade after the stock exchanges close.

- Individual Investors: Retail traders can place orders through online brokers that offer extended access. However, limited liquidity might affect your ability to get favorable prices and react quickly to news.

- Institutional Investors: Mutual funds, hedge funds, and pension funds enjoy exclusive insider markets. They often dominate after-market trading due to their large order sizes and access to better execution technologies, causing prominent market changes.

- Market Makers: These firms help maintain liquidity by actively buying and selling securities at publicly quoted prices. In extended sessions, they may reduce their activity to widen bid-ask spreads and gain a price advantage.

After-Market Trading Hours

Post-market time starts immediately after the regular session ends. Therefore, you must carefully track the local time of the exchange, brokerage, and your timezone to accurately trade in the extended time.

- NASDAQ: Regular session from 09:30 to 16:00 (ET) and after-market from 16:00 to 20:00.

- New York Stock Exchange: Regular session from 09:30 to 16:00 (ET) and after-market from 16:00 to 20:00.

- Toronto Stock Exchange: Regular session from 09:30 to 16:00 (ET) and after-market from 16:00 to ~17:00.

- London Stock Exchange: Regular session from 08:00 to 16:30 (GMT) and after-market from 16:40 to 17:15 for auctions only.

It is worth noting that most equity marketplaces in Asia and Europe restrict extended trading sessions. For example, Shanghai and Tokyo Stock Exchanges do not allow continuous investing after the closing bell.

However, Euronext allows after-hours for block trading and not retail, the Hong Kong Exchange allows it for Futures only, and the Australian markets extend it only for derivatives.

Fast Fact:

NASDAQ’s president announced a plan to move to 24/5 regular sessions, eliminating the concept of after-hours trading. The exchange would operate from Sunday 20:00 ET to Friday 20:00 ET, probably from the second half of 2026.

Key Considerations

During these extended investing windows, it is vital to understand the market’s unique dynamics. You can expect lower activity, reduced participation, and volatile price movements, leading to unpredictable consequences. Let’s review the four key factors to capitalize on your activity outside regular market sessions.

Volume

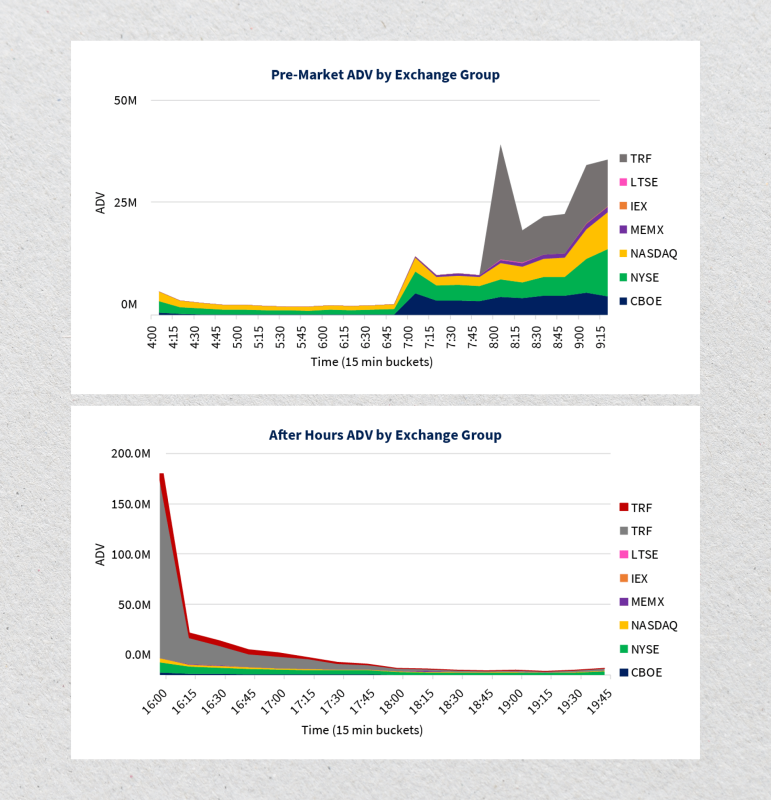

The trading volume drops significantly after the market closes as more participants leave and only a few buyers and sellers remain. This makes trade execution more difficult, and orders might not be filled completely or at your desired price.

The limited market action makes it harder to gauge true investor sentiment and can lead to sudden price swings with a few transactions.

Price

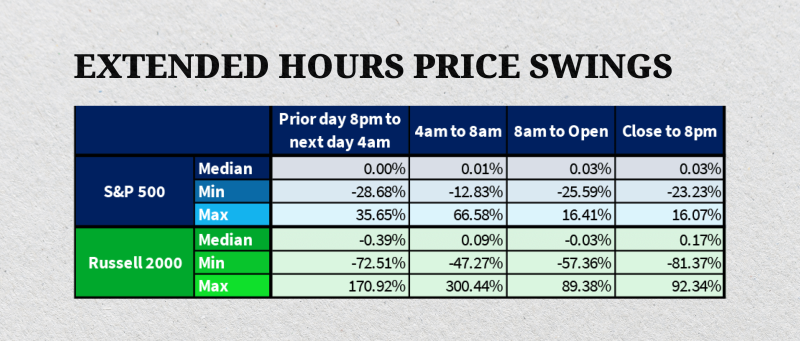

Due to the limited volumes, the markets become more sensitive to news. A single trade can move prices more dramatically than during regular working times.

Therefore, you must closely watch the market and use risk-management tools to avoid overpaying or underselling in unpredictable environments.

Participants

Most casual traders and newbies cease activity as the closing bell rings. The after-hours market attracts a different crowd, mostly experienced traders, institutional investors, and HFT brokerages.

These players often have better tools and information, giving them a competitive edge to execute successful trades. This puts retail traders in a challenging space where others can act faster and more strategically.

Liquidity

Due to the massive participant outflow, liquidity dries up during extended trading, meaning that only a few shares are available to buy or sell.

This makes the bid-ask spread broader and delays trade executions. Therefore, your processed orders may be settled at a slightly different price.

Extended Trading Hours: Pre-Market vs After-Hours

After-hours and pre-market trading are two types of extended-hours sessions. They work differently, have distinct characteristics, and attract different participants.

The pre-market takes place before the typical working hours. For example, pre-session trading in the NYSE happens from 04:00 to 09:30 (ET) — five and a half hours before the opening bell starts.

Both sessions give you exclusive access to act on important news and announcements in different ways.

Motives: After-hours traders often react to earnings reports and press releases published after the close. On the other hand, before-market trading responds to overnight developments, global events, and early morning economic data.

Liquidity and volatility: After-hours sessions usually see sufficient activity due to scheduled earnings reports and end-of-day portfolio adjustments. However, placing orders before markets open can be more erratic, driven by overnight sentiment and start-of-day speculations.

Order types: Institutional investors and high-frequency traders dominate both. Retail traders are slightly more active in the early hours as they set their strategies and prepare for regular hours.

Advantages and Disadvantages

Trading after the market closes opens the door for more opportunities that would not be typically available during regular working times. This becomes very critical if economic announcements or financial news are anticipated. At the same time, there are some challenges that you must prepare for.

Pros

- Act on Late News: You can respond immediately to earnings reports, analyst predictions, or geopolitical news that breaks after the market closes without having to wait until the next working day.

- More Flexibility: After-hours trading allows you to place trades on your schedule, offering flexibility if you live in a different time zone.

- Arbitrage Opportunities: Due to price inefficiencies that are hard to find during regular sessions, traders can gain vital price advantages using advanced arbitrage techniques.

- Hedge Positions: You can adjust your positions in reaction to sudden market changes outside normal hours to manage your risks and avoid significant price swings overnight.

- Test Reactions: The after-hours session gives a preview of how the market might react the next day, which can help you prepare more effectively for open trades.

Cons

- Lower Liquidity: Due to limited participation, opening or closing new positions can cause massive price changes and slippage.

- Wider Spreads: The difference between bidding and asking prices tends to widen during these hours. This leads to wider spreads and higher trading costs, offsetting any potential profits.

- Higher Volatility: Due to market inefficiency and the lack of liquidity, markets become highly sensitive. News and speculations can cause large price swings, making it risky to manage orders.

- Limited Access: Not all brokerage firms support ECNs to facilitate full access to extended-hours trading. Some may limit trading times or available financial instruments.

- Limited Order Options: Some brokers limit order types, making limit orders and time-in-force order options unavailable.

Impact on Overall Market

While after-hours trading occurs outside regular market hours, its influence can ripple into the next day’s session. Here’s how this extended trading window can affect broader market dynamics:

On Standard Trading

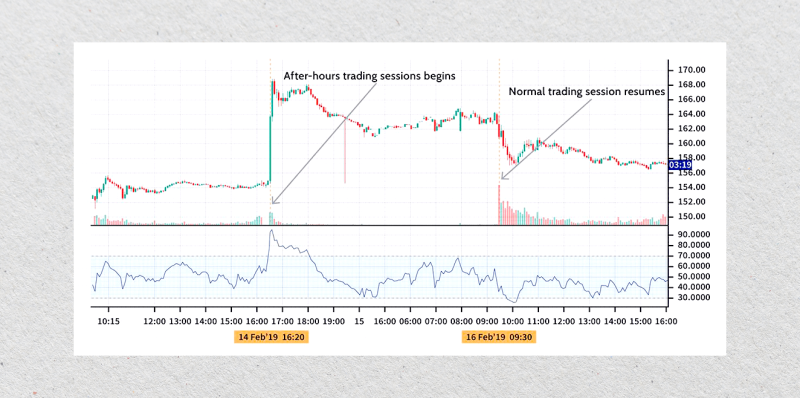

After-hours price action sets the tone for the opening price of the next trading session. Traders usually use the late-hour trends to gauge market sentiment and adjust their strategies.

However, most overnight changes are corrected as soon as secondary markets reopen and trader inflow increases, fixing any inefficiencies and increasing liquidity.

On Stock Price

After-hours orders can massively impact a stock’s value. When a company announces positive earnings, more participants rush to buy its stocks, raising its price.

During after-market sessions, prices can spike dramatically when the liquidity is low. However, these shifts revert and smooth out quickly the next day due to weaker volumes and a lack of counterpart availability.

On Market Trends

Increasing activity in one direction can trigger an overall market trend, especially in illiquid market conditions and low volumes, sending strong trading signals. However, not all these sentiments are reliable because they were born in extraordinary circumstances and can revert during normal trading patterns.

Best Stocks for After-Hours Trading

To capitalize on your after-hours trading strategy, look for stocks with high liquidity and volume outside regular sessions. Blue-chip companies have consistent activity levels due to high institutional interest and frequent events. These include Apple, Microsoft, Amazon, and Tesla.

Small-cap or less-known stocks are not ideal to trade because they have wider spreads and limited liquidity, causing striking unpredictability and volatility. Here’s how you can find the best stocks for after-hours trading:

- Look for companies reporting earnings after the market closes. Strong hits or misses cause major moves during extended hours.

- Use platforms like Benzinga Pro, MarketWatch, or Seeking Alpha to track breaking news, economic calendars, or product launches.

- Monitor trading volumes with trading platforms (like TradingView) to scan stocks with high volume and price volatility after the close.

- Monitor listings from brokerage platforms that show top gainers/losers outside standard hours.

- Check institutional filings or moves (like 13D or Form 4), signaling possible mergers or acquisitions after normal market hours.

How to Start Trading After-Hours: Step-By-Step

Extended trading markets have become more accessible thanks to electronic market capabilities, enabling brokerage firms to connect users with financial markets. This technology routes orders through various instances and order books to find matching buy/sell orders. Here’s a detailed after-hours trading guide.

- Choose a Broker: Not all brokers offer extended-hours trading. Pick a provider that facilitates continuous trading access via ECNs, such as TD Ameritrade, Fidelity, or E*TRADE.

- Check Permissions: Some brokerage platforms require additional permissions or special verifications to gain after-hours access. Log in to your account settings and enable extended-hours trading to continue trading after regular working hours finish.

- Review the Hours: Some brokers have limited access to markets outside official working times. For example, a broker may support NASDAQ after-hours for two hours out of four.

- Use Limit Orders Only: Ensure advanced trading options, such as limit and stop orders, remain available after the market closes. Set your minimum and maximum price limits because markets can move unpredictably.

- Watch News Closely: Monitor earnings releases, economic updates, and major financial events that can influence after-hours sentiment. Then, make decisions in a timely and accurate manner.

After-Hours Trading Strategies

Success in these instances requires a solid plan to navigate the market’s unique characteristics. You must read price actions, track news, and make accurate decisions to capitalize on lucrative events. Here are three reliable strategies to help you earn from post-market moves.

Earnings Reaction

Companies often report earnings after the closing bell. This approach minimizes the impact on secondary markets during public trading.

You can track a company’s earnings results and trade based on its initial stock reaction. For example, if earnings beat expectations and the stock spikes on volume, you might buy early to ride the momentum.

However, the initial reaction may not translate into a complete trend, and prices can reverse sharply by morning as more participants join on both sides of the market.

Gap Fill Strategy

This strategy looks for a stock that moves significantly after hours but may “fill the gap” during the next regular session. This often happens when the initial move is seen as overdone or lacks strong support from volume or news.

For instance, a stock that jumps 10% on light volume may retrace part of that move once normal volume returns. You can take a counter-position, expecting a pullback to previous levels, and earn as the price reverses.

News-Based Trading

Economic news like mergers, macroeconomic reports, and FDA approvals can move stocks fast in post-market sessions. You can assess the reactions to these updates, analyze their magnitude, speculate on their long-term impact, and place positions accordingly.

However, you must also assess volume, liquidity, and sentiment changes. If volume supports the move, entering early could yield gains before the wider market reacts. Also, you must verify the news source to avoid chasing false or overhyped stories.

Final Notes

After-hours trading allows you to capitalize on crucial economic news when the market is closed. Many stock exchanges enable extended sessions before and after official working hours.

However, these sessions have lower volume, increased volatility, and fewer participants, rendering prices highly unpredictable. While most post-market hours trends are smoothed out in the next regular trading session, strong movements can impact stock price and market trends.

FAQ:

What’s the meaning of after-hours?

After-hours refers to the time period after the official stock market closes, typically from 16:00 to 20:00 ET for NASDAQ and NYSE. During this session, investors can trade stocks through ECNs, reacting to late-hour news or earnings announcements outside regular trading hours.

Can you trade CFD during after-hours trading?

Yes. Some brokers offer CFD after-market trading, especially for major stocks and indices. However, availability depends on the broker, and spreads may widen due to low liquidity.

How does after-market trading work?

After-hours trading uses electronic communication networks (ECNs) to match buy and sell orders without a traditional broker-dealer. Investors place orders during this session, which are matched to available counterparts. However, trade execution can be delayed due to a limited number of participants and low liquidity.

What markets allow after-hours trading?

US stock exchanges like NASDAQ and NYSE support post-market trading through ECNs. Some Asian and European exchanges offer extended sessions with restrictions, such as Futures only, block orders, or auctions.