Broker-Dealer: Explaining the Core Working Principles

Sep 09, 2024

Today, any financial market is not only a multifaceted system consisting of many interrelated infrastructure, service, and software solutions that ensure its stable and smooth operation but also a large number of agents, intermediaries, and other subjects whose work is associated with ensuring optimal conditions for trading in investment assets, their management, control, and storage. One of such important subjects of any capital market is a broker-dealer.

This article will shed light on what a broker-dealer is and what functions it performs. You will also learn what types of broker-dealers exist in the market today and their peculiarities.

Key Takeaways:

- Broker-dealers are financial entities that engage in trading activities within financial markets, representing their clients while carrying out trades for their accounts.

- These firms offer various brokerage services, from comprehensive full-service options to more limited discount brokerage focused solely on executing market orders.

- Full-service broker-dealers are the primary type used in practice within the financial markets.

What is a Broker-Dealer and How Does It Operate?

A broker-dealer refers to a financial institution or individual that participates in the buying and selling of securities, functioning in two capacities: as a broker, which involves executing transactions on behalf of clients, and as a dealer, which entails trading for its own benefit. This dual function is crucial for the effective operation of financial markets, as it offers valuable services to both retail and institutional investors.

A broker-dealer, a regulatory designation for what is commonly known as a brokerage, represents a significant level of expertise in the financial market. The individual who handles transactions — whether buying or selling — is a registered representative of a broker-dealer, a title that underscores their knowledge and experience, although clients often simply refer to this individual as their broker.

The world of broker-dealers is diverse, with various types existing. These include large wirehouses like Morgan Stanley and Wells Fargo, discount brokerages like Charles Schwab and TD Ameritrade, and independent firms like LPL Financial and Raymond James.

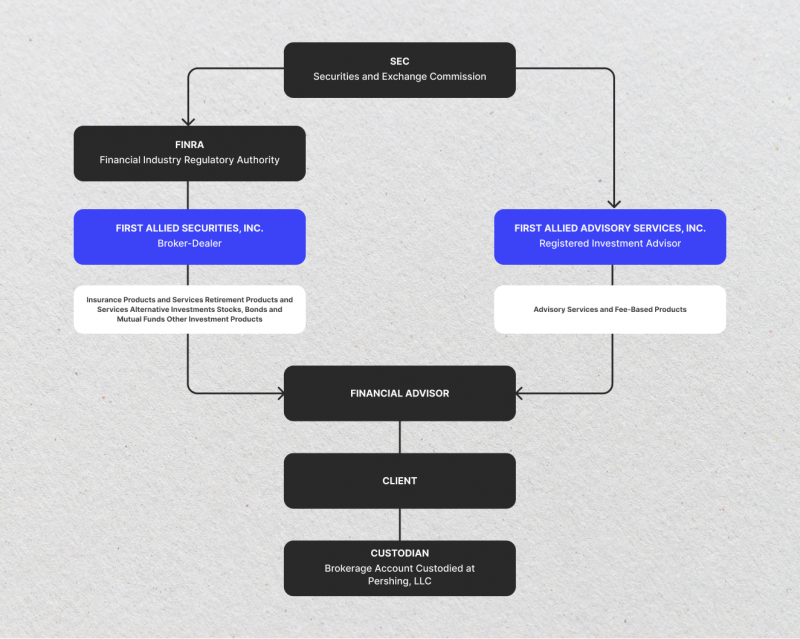

Even robo-advisors like Betterment and Sofi operate through affiliated broker-dealers, namely Betterment Securities and Sofi Securities. Large financial advisory and wealth management firms often hold dual registrations as investment advisors and broker-dealers or maintain affiliations with broker-dealers.

Broker Function

As a broker, the broker-dealer serves as a significant intermediary in the investment markets, alleviating operations between buyers and sellers of assets. They play a pivotal role in executing trades on behalf of their clients, who can range from individual retail investors to large institutional investors such as mutual funds, hedge funds, and pension funds.

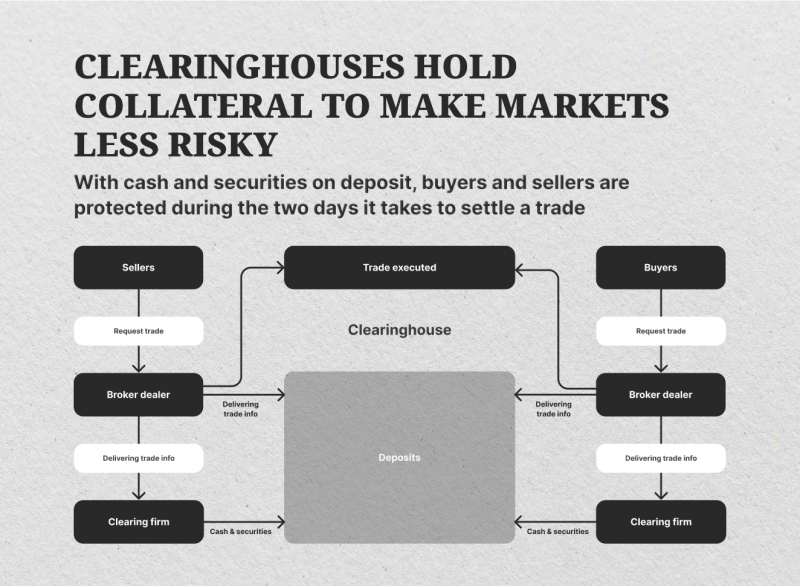

The broker-dealer is responsible for managing the entire process of executing the trade, which includes tasks such as order routing, settlement, and clearance. Additionally, brokers are compensated through commissions that are charged to their clients for the execution of these transactions. This compensation model ensures that brokers have a vested interest in securing favorable outcomes for their clients while also adhering to industry regulatory standards and best practices.

Dealer Function

As a dealer, a broker-dealer adopts a high profile in financial markets by purchasing and selling securities for its own account. This involves actively maintaining an inventory of securities and seeking to profit from the spread between the buying (bid) and selling (ask) prices.

One of the primary functions of dealers is to provide liquidity to the market. Dealers are willing to buy and sell securities, even without matching buy or sell orders from other parties. This willingness to engage in trade activities helps ensure constant liquidity in the market.

Dealer profits are derived from the bid-ask spread, which is the difference between the prices at which the broker-dealer is willing to buy and sell a particular security. Dealers can generate revenue from their trading activities by effectively managing the bid-ask spread.

Furthermore, the market-making activities of dealer firms are essential for assuring the smooth and efficient functioning of financial markets. Dealers facilitate price discovery, reduce trading costs, and help maintain orderly markets, thereby contributing to overall market liquidity and efficiency.

Fast Fact:

The primary type of commission at all broker-dealers is the difference between supply and demand, expressed in the absolute value of the price of a particular asset.

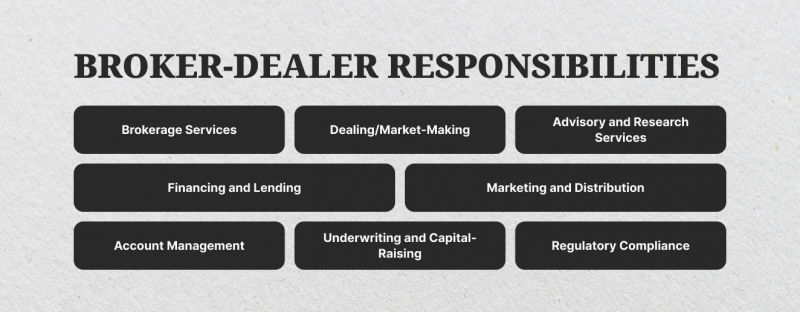

Key Functions and Responsibilities of a Broker-Dealer

Broker-dealer is a universal mechanism that ensures the optimum functioning of capital markets, giving advantages to their participants and optimizing the processes occurring in the interaction of different elements of the trading process.

At the same time, such market participants have several important factors that make achieving stability and security in the financial trading environment possible. Among the main ones are the following:

Brokerage Services

Brokers-dealers offer a variety of essential brokerage services to their clients, including the following:

Executing Securities Transactions

This involves buying and selling securities such as stocks, bonds, and other financial instruments on behalf of both retail and institutional investors. Brokers-dealers play a crucial role in ensuring that these transactions are carried out efficiently and following the client’s instructions.

Routing Orders

Brokers-dealers are responsible for directing client orders to the relevant exchanges or trading venues, ensuring that trades are executed promptly and at the best possible prices.

Providing Access to Investment Products

Brokers-dealers offer access to various investment products and securities, allowing clients to diversify their portfolios and make informed investment decisions based on their financial goals and risk tolerance.

Trade Settlement, Clearance, and Custody Services

Brokers-dealers handle the important process of settling trades, ensuring that securities and funds are exchanged correctly and efficiently. They also provide custody services, safeguarding clients’ assets and securing their storage.

Dealing/Market-Making

Brokers-dealers adopt a high profile in the financial markets by providing dealing/market-making services, which involve several key functions:

Maintaining an inventory of securities and engaging in trading activities using the firm’s own capital. This allows them to facilitate market transactions, provide liquidity, and support orderly market conditions.

Acting as a provider of liquidity in the market by being willing to buy and sell securities, even when there may not be an immediate matching order from another party. This helps ensure a continuous market for securities and reduces the impact of large buy or sell orders on market prices.

Profiting from the bid-ask spread refers to the difference between the price at which the broker-dealer is willing to buy a security (bid price) and the price at which they are willing to sell it (ask price). By capturing this spread, broker-dealers make a profit while facilitating trades for investors.

Advisory and Research Services

Brokers-dealers offer advisory and research services, including personalized investment advice and client recommendations based on their financial goals and risk tolerance.

Moreover, they conduct in-depth research and analysis on various financial instruments, economic conditions, and market trends to provide clients with valuable insights and information.

Such companies assist clients in developing and implementing tailored investment strategies that align with their long-term objectives and financial circumstances.

Financing and Lending

Brokers-dealers offer their clients various financing and lending services, including extending margin loans. These margin loans allow clients to engage in leveraged trading, amplifying their potential gains or losses.

Additionally, brokers-dealers lend securities to short-sellers, supporting short-selling activities and enhancing market liquidity. They also participate in securities lending and borrowing activities to support their own trading operations, facilitating the efficient functioning of financial markets.

Marketing and Distribution

Brokers-dealers market and distribute securities to potential investors using a range of channels, including direct sales, online platforms, and institutional networks. This process aims to attract investment in the securities being promoted.

Moreover, they encompass educational resources and materials to assist clients in comprehending market dynamics, investment strategies, and financial products. The objective is to empower investors with the knowledge and understanding they need to make informed investment decisions.

Account Management

Brokers-dealers provide custodial services involving the holding and managing of securities and funds on behalf of clients. This includes giving account maintenance and reporting services to ensure client’s assets are securely held and properly managed.

They also provide margin accounts that allow clients to borrow funds to purchase securities, effectively increasing their buying power. This type of account will enable investors to leverage their existing capital by using borrowed money to make additional investments. However, margin accounts also risk potential losses, as the borrowed funds must be repaid with interest.

Underwriting and Capital-Raising

Brokers-dealers provide underwriting and capital-raising services by acting as underwriters for new security offerings, such as initial public offerings (IPOs) and secondary offerings.

They also assist companies in raising capital by arranging and distributing these securities to potential investors. Doing so helps companies access the funds they need to grow and expand their businesses.

Regulatory Compliance

Brokers-dealers are responsible for ensuring regulatory compliance, which involves adhering to a comprehensive set of rules and regulations established by financial authorities such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

This includes maintaining adequate capital requirements, upholding rigorous reporting standards, and implementing measures to safeguard clients. In addition, broker-dealers are tasked with establishing robust internal controls and risk management procedures to uphold the integrity and stability of the firm.

Major Types of Brokers-Dealers

Brokers-dealers can be categorized into several types based on their functions, business models, and markets. Each type has its own advantages, disadvantages, and peculiarities in functioning in the market, but they are used to varying degrees depending on market needs and specifics.

Here’s an overview of the different types of broker-dealers:

Full-Service Broker-Dealers

Full-service broker-dealers provide a comprehensive range of services, including trade execution, investment advice, portfolio management, financial planning, and research.

They cater to individual investors, high-net-worth clients, and big-cap investors, offering personalized advice and extensive services. In exchange for these services, full-service broker-dealers charge higher fees and commissions.

Discount Broker-Dealers

Discount broker-dealers primarily focus on executing trades for clients, offering little to no advisory services. They are known for charging lower fees and commissions than full-service broker-dealers, making them an attractive option for cost-conscious investors.

These firms cater to self-directed investors who prefer to make their own investment decisions without relying on extensive advice or guidance from financial professionals.

Online Broker-Dealers

Online broker-dealers are financial firms that primarily operate through online platforms, providing a range of services, including trade execution, research tools, and market data. They are known for offering cost-effective trading options with little to no human interaction, making them an attractive choice for tech-savvy and self-directed investors who are comfortable managing their investments online.

These digital platforms typically cater to individuals who prefer to take control of their investment decisions and are adept at leveraging technology for financial management.

Independent Broker-Dealers

Independent broker-dealers are agents who operate autonomously, outside the scope of larger financial institutions. They are known for providing highly customized services and investment options tailored to clients’ needs. These professionals often emphasize financial planning and advisory services, ensuring their clients receive comprehensive and personalized financial guidance.

Proprietary Trading Firms

Proprietary trading firms engage in own account trading, meaning they trade securities for their own benefit rather than on behalf of clients. Their primary focus is on generating profits from market inefficiencies and trading strategies, using their expertise and resources to capitalize on opportunities in the equity markets.

These firms are profit-driven, and their trading activities aim to maximize their gains. They employ sophisticated risk management techniques to navigate the high risks of proprietary trading.

By leveraging innovative quantitative models, thorough research, and real-time market analysis, proprietary trading firms seek to minimize potential losses and optimize their trading performance. This requires a comprehensive understanding of market dynamics and swiftly adapting to changing conditions.

Institutional Broker-Dealers

Institutional broker-dealers play a crucial role in serving the needs of large institutional clients, including mutual funds, pension funds, insurance companies, and hedge funds. These broker-dealers specialize in handling large-volume transactions and offering highly specialized services tailored to the unique needs of institutional investors.

In addition to facilitating trades and transactions, institutional broker-dealers provide in-depth research, comprehensive market analysis, and customized investment solutions designed to meet their institutional clients’ specific objectives and risk profiles.

Introducing Broker-Dealers

Introducing Broker-Dealers (IBDs) is key in the financial services industry, focusing on client acquisition and acquiring and nurturing client relationships without directly handling trade execution or clearing.

These professionals often form partnerships with clearing broker-dealers responsible for the actual trade execution and settlement processes, allowing the IBDs to concentrate on client acquisition and relationship management.

IBDs typically earn commissions or fees by introducing clients to clearing firms, creating a mutually beneficial relationship that facilitates the smooth operation of the investment markets.

Clearing Broker-Dealers

Clearing broker-dealers play a crucial role in the financial markets by handling the back-end operations of trade execution, including clearing and settlement. This involves ensuring that trades are finalized and the securities and funds are delivered to the appropriate parties.

Clearing broker-dealers also provide custodial services by holding securities and funds for their clients, offering a secure and regulated environment for these assets. They are responsible for managing counterparty risk and ensuring the integrity of the settlement process, contributing to the stability and security of the overall financial system.

Prime Brokers

Prime brokers offer a comprehensive suite of services tailored to the specific needs of hedge funds and other institutional clients. These services include trade execution, clearing, custody, and financing.

Further, prime brokers provide advanced trading services such as leverage, short-selling facilities, and other sophisticated tools to support complex trading strategies. They also assist clients with risk monitoring and regulatory oversight, ensuring that their trading activities are conducted within the bounds of relevant legislation and best practices.

Market Makers

Market makers have an essential function in financial markets, serving as liquidity providers. They continually provide bids and ask prices for specific securities, which helps facilitate trading activity and assures sufficient liquidity in the market.

By buying securities at lower prices and selling them at higher prices, Market Makers can generate profits. Additionally, they engage in Inventory Management to maintain an inventory of securities to meet market demand and ensure they can promptly fulfill orders.

Conclusion

The significance of broker-dealers in the financial landscape cannot be exaggerated, as they facilitate a multitude of services for a wide range of investors. With the presence of full-service and discount brokers alongside proprietary trading firms and market makers, each broker-dealer type serves unique functions that cater to the diverse needs of its clients.

By familiarising themselves with the various categories of broker-dealers, investors can make deliberate decisions when choosing a service provider that best fits their investment strategies and goals.

FAQ:

What is a broker-dealer?

A broker-dealer is a financial entity or individual that participates in the trading of equities. They act as a broker when executing orders on the part of customers and as a dealer when trading for their own accounts.

How do broker-dealers make money?

Broker-dealers earn revenue through commissions on trades, fees for advisory support, spreads from market making, profits from proprietary trading, and interest on margin loans.

What regulations govern broker-dealers?

In the United States, broker-dealers are regulated by the SEC, the FINRA, and other regulatory bodies. They must comply with various rules and regulations to assure market integrity and protect investors.

Can a broker-dealer act as both a broker and a dealer in the same transaction?

No, a broker-dealer cannot act as both a broker and a dealer in the same transaction. They must either execute the trade on behalf of the client (broker) or trade for their own account (dealer).

What are some examples of well-known broker-dealers?

Examples include Goldman Sachs, Morgan Stanley, Charles Schwab, E*TRADE, and Interactive Brokers.