Energy Trading: What Is It And How To Get Started?

Jan 03, 2024

Energy trading is an extremely dynamic and profitable sector for growing your investment portfolio. This is not surprising, as oil, gas, and electricity are considered the most essential resources in today’s energy-driven global economy. According to the American Petroleum Institute, the oil and gas sector accounts for about 8% of the United States’ GDP.

In this article, we will look at the ins and outs of energy trading, including how it works, the various energy markets, and the strategies employed by successful traders.

Key Takeaways:

- Gas and oil continue to dominate as the top energy commodities in terms of consumption and revenue generation.

- Crude oil is a highly influential commodity in the global energy market, with OPEC being a major player in regulating its prices.

- Oil and gas stocks give exposure to the performance of the energy market, whereas renewable energy stocks provide opportunities for clean energy investment.

- Energy ETFs offer a diversified approach to investing in the energy sector, with sector ETFs focusing on specific segments of the industry and clean energy ETFs targeting renewable energy companies.

- Discipline, patience, and continuous learning are essential for successful energy trading.

What Is Energy Trading?

Energy trading is a vital aspect of the global financial system that involves exchanging energy commodities in financial markets for profit. The primary goal of energy trading is to take advantage of price fluctuations in the market and generate income from these transactions.

The energy industry is one of the most crucial sectors driving the world’s economy. It provides essential resources such as crude oil, natural gas, and electricity that power various industries and activities. The constant need for energy commodities makes energy trading a highly lucrative opportunity for different market players – from retail traders to big financial institutions.

Some of the key factors driving the demand for energy include population growth, industrial development, and technological advancements. As the world’s population continues to grow, there is an increasing need for energy to power homes, businesses, and transportation. Moreover, rapid industrialisation in developing countries has led to a surge in energy demand, while technological advancements have also increased the reliance on energy for various purposes.

An Overview of Energy Commodities

Let’s take a closer look at three of the most commonly traded energy commodities:

Crude Oil: The Lifeblood of the Energy Market

Crude oil stands as the most vital and heavily traded energy commodity globally, acting as the driving force behind the global energy market. This fossil fuel is extracted from underground reservoirs and undergoes refining processes to produce various products such as gasoline, diesel, jet fuel, and other petrochemicals.

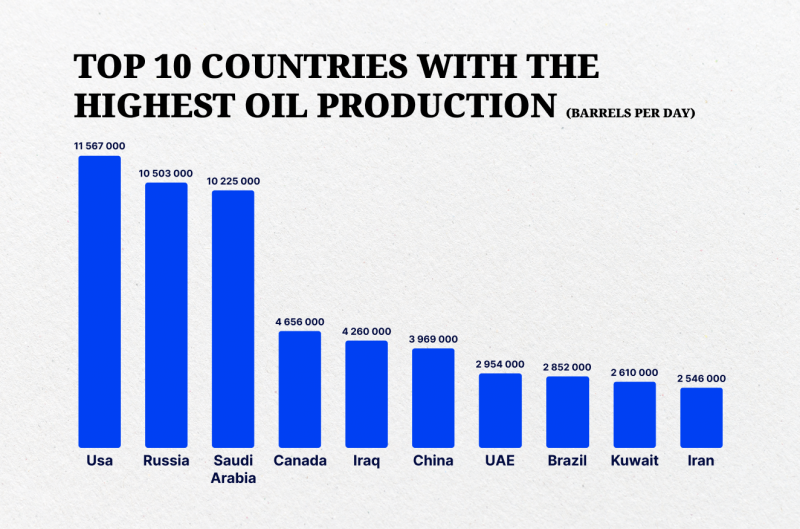

While many countries are involved in crude oil production, certain key players dominate the market, including the United States, Russia, and Saudi Arabia. The United States, despite joining the top producers relatively recently, currently holds the lead in crude oil production. For instance, Russia was the leading producer in 2009 and 2010, followed by Saudi Arabia from 2011 to 2013. Since then, the U.S. has maintained its position.

The majority of the oil produced by these countries is primarily used for domestic consumption, with any surplus being exported. Among the top exporters in 2022, Saudi Arabia holds the first position with revenues of $136.2 billion and a global market share of 20.1%. Russia follows closely behind with $73.7 billion in revenue and a market share of 10.9%, followed by Iraq with $46.3 billion in revenue and a market share of 6.8%.

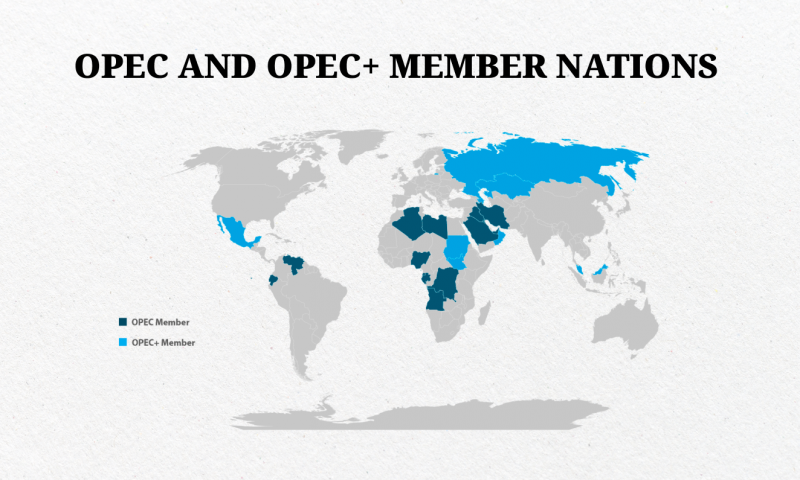

One of the most influential organisations in the crude oil market is OPEC (Organization of the Petroleum Exporting Countries). Currently, OPEC member countries produce approximately 34 million of oil barrels daily, which accounts for 35% of the world’s total oil production. This coalition allows for coordination among a large number of producers, giving them the ability to influence and regulate the market by managing production volumes. This includes implementing production cuts or increasing output to maintain stable oil prices.

In 2016, OPEC joined forces with non-OPEC countries such as Russia and Mexico to form a new coalition known as OPEC+. The alliance was formed to stabilise global oil prices, which had plummeted due to oversupply and increased competition from alternative energy sources.

Natural Gas: A Versatile and In-Demand Energy Source

Natural gas has been a vital source of energy for centuries, with its first commercial use dating back to 1825 in the United States. Since then, it has become a major player in the global energy market, used for various purposes, including heating, electricity generation, and industrial processes. With its high efficiency and relatively low environmental impact compared to other fossil fuels like oil and coal, natural gas has seen a steady increase in consumption over the years.

Like any other commodity, the price of natural gas is influenced by supply and demand dynamics. Strong demand for natural gas from industries and power plants can drive up its price, while an oversupply caused by increased production can lower it. Weather patterns also play a significant role in natural gas prices, as harsher cold winters can increase demand for heating and drive up prices. Geopolitical events such as conflicts or sanctions on major gas-producing countries can also have an impact on the market.

Moreover, natural gas is traded globally, with major hubs and exchanges facilitating the buying and selling of this commodity. This allows for competition among suppliers, resulting in more competitive pricing for consumers.

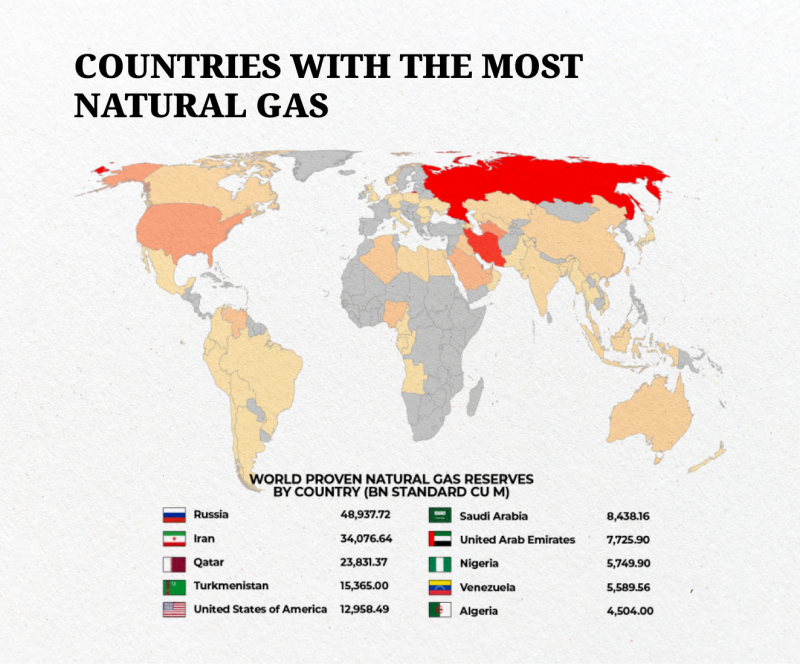

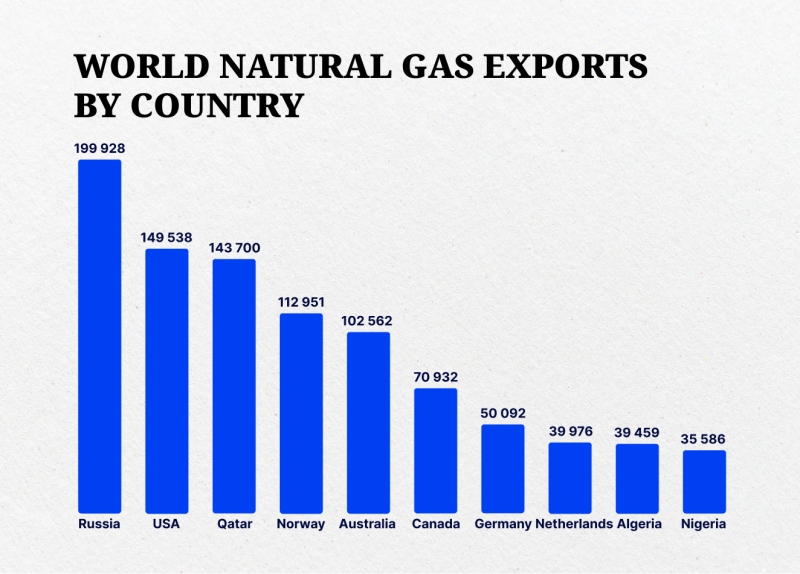

According to 2021 data, Russia was the world leader in natural gas exports, with 247.1 billion cubic metres exported. However, its share in global exports has been gradually decreasing over the years due to emerging competition from other countries. The United States has seen a significant increase in natural gas exports since 2000, making it the second-largest exporter with a 15% share of global exports. Middle Eastern countries like Iran, Qatar, and Saudi Arabia have also emerged as major players in the export market.

In 2023, due to sanctions and rebuilding markets, Russia dropped to 2nd place in export rankings after the US, according to different data and estimates.

There are two main types of natural gas that are exported:

- piped natural gas,

- liquefied natural gas (LNG).

Piped natural gas is delivered directly from the gas field to consumers through a network of pipelines. On the other hand, LNG is in liquid form, which is formed by cooling the gaseous fuel and reducing its volume by 600 times. This allows for easier transportation via tankers, making it possible to export gas from remote regions and essentially making the gas market global.

Electricity: Powering the Modern World

Electricity is an essential energy commodity that powers modern society. It is generated through various sources, including fossil fuels, nuclear power, and renewable energy sources. Electricity markets are complex and diverse, with different regions having their own pricing mechanisms and trading platforms.

The price of electricity depends on factors such as supply and demand dynamics, generation capacity, transmission constraints, and regulatory policies.

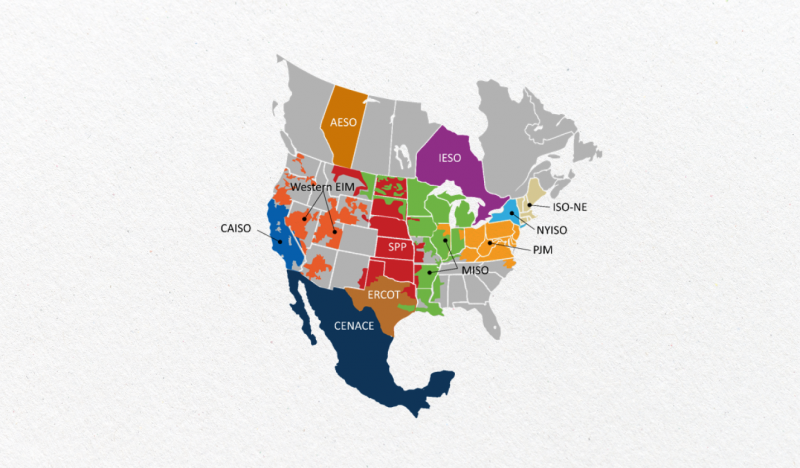

The management of energy markets is a highly specialised field, with many tasks falling under the responsibility of Independent System Operators (ISOs) in the US. These non-profit entities oversee the real-time markets, ensuring that electricity is delivered efficiently and reliably to consumers. ISOs also serve as exchanges and clearinghouses on the electricity markets.

While there are seven ISOs in the US, some regions still operate through bilateral markets, in which power producers trade directly with companies. However, even in these regions, grid operations are overseen by Regional Transmission Operators (RTOs) who ensure grid stability and balance.

What Factors Influence Energy Prices?

The prices of energy assets are not solely determined by market speculation. In fact, there are several key factors that can greatly influence the price of energy commodities and thus impact energy trading:

Supply and demand

One of the major drivers of energy asset prices is the balance between supply and demand. When there is high demand for a particular energy commodity but low supply, prices will tend to increase due to scarcity. Conversely, when there is an oversupply of a commodity and low demand, prices will typically decrease.

For example, during the COVID-19 pandemic, the decrease in global economic activity led to a significant drop in demand for oil by 2.5 million barrels per day, according to S&P Global Platts Analytics Future Energy Outlooks. This led to a sharp decline in oil prices worldwide.

Geopolitical events

Geopolitical events have profound effects on energy prices. Conflicts and tensions between countries can disrupt the supply of energy commodities, causing price fluctuations in the market. This was evident during the Russia-Ukraine War, where gas supply disruptions caused an increase in demand for alternative energy sources, leading to a rise in oil prices.

Macroeconomic conditions

Economic growth, industrial activity, and consumer spending all influence energy demand. A strong economy generally leads to increased energy consumption and higher prices, while a weak economy can result in decreased demand and lower prices.

Energy Trading in Different Markets

Energy trading encompasses various markets, each with its distinctive features and trading opportunities. Let’s explore the key characteristics of every market:

Crude Oil

Crude oil is the most widely traded energy commodity, and it has two primary benchmarks:

- West Texas Intermediate (WTI): WTI crude is primarily traded on the New York Mercantile Exchange (NYMEX). It reflects the price of oil produced in the United States.

- Brent crude: It is traded on the Intercontinental Exchange (ICE) and represents the price of oil produced in the North Sea. Crude oil trading offers traders significant volatility and liquidity, making it an attractive market for both short-term and long-term trading strategies.

- Dubai Crude: Classified as a medium-sour crude oil, Dubai oil is often used as a benchmark for pricing exports to Asia due to its immediate availability. With the rise of Asia as a major energy consumer, Dubai crude has become an essential benchmark in the global oil market.

Natural Gas

Natural gas is traded on various exchanges, including NYMEX and ICE. Natural gas trading is influenced by factors such as weather patterns, supply and demand dynamics, and storage levels, so traders often take advantage of seasonal demand fluctuations and short-term price movements in the natural gas market.

Electricity

Electricity trading involves the buying and selling of electricity contracts, typically in wholesale markets. Electricity markets vary by region, with different pricing mechanisms and trading platforms. Traders can participate in electricity markets through futures contracts, spot trading, and options contracts.

How Energy Is Traded

Energy trading involves the exchange of energy commodities through various financial instruments, which allow traders to speculate on their future price movements.

- Futures contracts: These are the foundation of energy trading. Futures are legally binding agreements to buy or sell a specified quantity of an energy commodity at a specified price and date in the future. Futures contracts are traded on organised exchanges, such as the NYMEX for crude oil and natural gas.

- Options contracts: These contracts offer traders the right, but not the obligation, to buy or sell an energy commodity at a specified price (strike price) within a specified period. Options provide traders with additional flexibility and risk management tools.

- Spot: Spot trading, on the other hand, involves the immediate trading of energy commodities at the current market price. Spot markets provide traders with the flexibility to take advantage of short-term price fluctuations and capitalise on immediate market conditions.

To trade energy commodities, traders employ a combination of successful trading strategies and analytical techniques:

- Fundamental analysis involves analysing supply and demand factors, geopolitical events, and economic indicators to assess the underlying value of energy commodities.

- Technical analysis utilises charts, indicators, and patterns to identify trends and potential trading opportunities.

- Sentiment analysis focuses on understanding market psychology and investor sentiment to gauge market direction and potential price movements.

- Risk management is a critical aspect of trading in every market. Establishing clear risk management strategies, including setting appropriate stop-loss levels, diversifying portfolios, and managing position sizes, will help you avert losses and preserve your capital.

Successful energy trading requires discipline, patience, and continuous learning. Traders should continuously monitor market conditions, stay informed about industry developments, and adapt their strategies as needed.

Energy Stocks: Investing in Energy Companies

Investing in energy stocks offers an alternative approach to participating in the energy sector. Energy stocks represent companies involved in the production, distribution, and sale of energy commodities. Let’s explore two categories of energy stocks: oil and gas companies and renewable energy stocks.

Oil and gas companies are major players in the energy industry, involved in the production, and distribution of crude oil and natural gas. These companies often have significant reserves and extensive infrastructure. Investing in oil and gas stocks allows traders to gain exposure to the overall performance of the energy sector. Some well-known oil and gas companies include:

- BP,

- Shell,

- ExxonMobil,

- Chevron.

Renewable energy stocks represent companies involved in generating and distributing energy from renewable sources such as wind, solar, and hydroelectric power. The renewable energy sector has experienced significant growth in recent years, driven by increasing environmental awareness and government support. Investing in renewable energy stocks allows traders to participate in the transition to clean energy and potentially benefit from the industry’s growth. Examples of renewable energy companies include:

- Tesla,

- NextEra Energy,

- First Solar,

- Vestas Wind Systems.

When investing in energy stocks, it is important to conduct thorough research, analyse financial statements, and consider the long-term prospects of the companies. Diversifying investments across different sectors and regions can help mitigate risks and optimise returns.

Energy ETFs: Diversifying Your Energy Investments

Exchange-traded funds (ETFs) provide another avenue for investing in the energy sector. Energy ETFs are investment funds that track the performance of energy-related assets, such as stocks, commodities, or indexes.

Let’s explore two types of energy ETFs:

Sector ETFs focus on specific energy industry segments, such as oil and gas development, oilfield services, or renewable energy. These ETFs offer broad exposure to the energy sector and allow traders to invest in a diversified portfolio of energy stocks. Examples of sector ETFs include:

- Energy Select Sector SPDR Fund, which tracks the performance of energy stocks in the S&P 500 index,

- iShares Global Clean Energy ETF focuses on clean energy companies worldwide.

Clean energy ETFs specialise in companies involved in renewable energy generation, energy efficiency, and sustainable technologies. These ETFs enable traders to invest specifically in the clean energy sector, which is expected to experience significant growth in the coming years. Examples of clean energy ETFs include:

- Invesco Solar ETF,

- First Trust Global Wind Energy ETF.

By investing in energy ETFs, traders can invest in the energy sector without having to select individual stocks or commodities. However, it is essential to conduct proper due diligence and consider the specific investment objectives and risk profiles associated with each ETF.

How to Start Trading Energy?

Getting started in energy trading requires careful planning, research, and selecting a reliable brokerage. Let’s explore the steps to embark on your energy trading journey.

- Educate Yourself: Familiarise yourself with the basics of energy trading. Take advantage of educational resources, such as online courses, books, and webinars, to enhance your knowledge.

- Choose a Reliable Brokerage: Select a reputable brokerage that offers robust trading platforms, competitive pricing, and a wide range of energy trading instruments. Consider factors such as regulatory compliance, customer support, and trading tools when choosing a brokerage.

- Open a Trading Account: Complete the account opening process with your chosen brokerage. This typically involves providing personal information, verifying your identity, and funding your trading account.

- Develop a Trading Plan: Create a comprehensive trading plan that outlines your trading goals, risk tolerance, and preferred trading strategies. Define your entry and exit criteria, position sizing, and risk management rules.

- Practice with a Demo Account: Before risking real capital, practise your trading strategies and techniques on a demo account provided by your brokerage. This allows you to gain experience and refine your skills without incurring any financial risk.

- Start Trading: Once you feel comfortable with your trading plan and have gained sufficient experience on the demo account, you can begin trading with real money. Start with small position sizes and gradually increase your exposure as you gain confidence.

Remember to stay disciplined, manage your risk effectively, and continuously evaluate and adjust your trading strategies as needed.

Closing Thoughts

Energy trading offers exciting opportunities for investors to profit from the dynamic energy markets. Whether you choose to trade energy commodities directly, invest in energy stocks, or utilise energy ETFs, it is essential to conduct thorough research, stay informed about market developments, and continuously refine your trading strategies.

Remember that energy markets can be volatile and influenced by various factors, including geopolitical events, economic indicators, and supply and demand dynamics.

Note: This article is for informational purposes only and does not constitute financial advice. Trading energy commodities carries risks, and individuals should carefully consider their financial situation and risk tolerance before engaging in energy trading activities.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

What makes a good energy trader?

A good energy trader possesses a combination of technical skills and personal qualities. These include financial analysis abilities, risk management expertise, market research proficiency, and a deep understanding of energy markets and commodities. In addition to these technical skills, a good energy trader should also have strong maths and statistical capabilities, as well as self-discipline.

Is energy trading profitable?

Yes, energy trading can be a lucrative field. In fact, it is estimated that energy accounts for up to 50% of total trading profits on Wall Street. However, like any type of trading, there are risks involved, so you need to have a solid understanding of the markets and their strategies before entering into trades.

What is P2P energy trading?

Peer-to-peer (P2P) energy trading is a business model that allows suppliers and consumers of electricity to trade directly with each other through an interconnected platform.